🔮 REVERSE TARIFF TACO

5 Polymarkets on the Trump Trade Deals

Last week, we heard from one trader who is deep in the TACO trade, betting that Trump won’t follow through on his aggressive economic policies. This week, attention is back on trade negotiations ahead of Trump’s August 1 tariff deadline.

But contrary to the TACO narrative, the EU deal announced Sunday keeps US tariffs at an elevated rate of 15%, and Polymarket traders are betting that elevated tariff levels will continue on several fronts.

Here are 5 Polymarkets showing where traders think the tariff talks are headed.

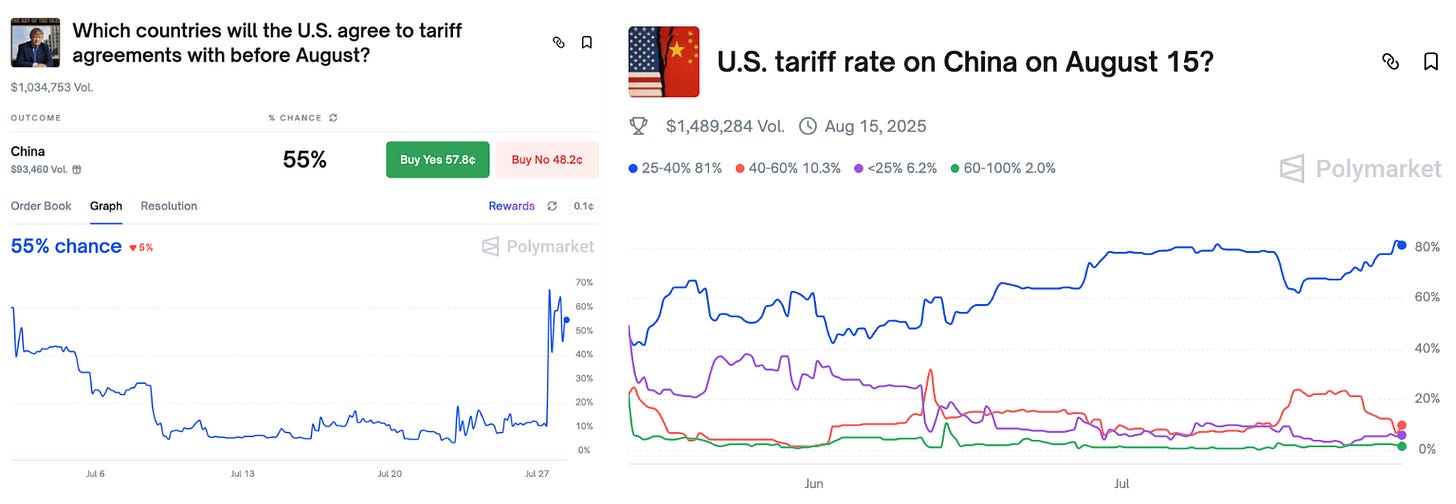

1. China Deal Back from the Dead?

With US-China talks in progress, odds for a deal with Beijing before August have surged to over 50%, up from just 15% in early July.

Deal / no-deal polymarkets have been volatile but those on the eventual tariff rate have been more steady:

Since mid-June, traders have grown more confident that the eventual tariff rate on China will land at 25 - 40%, rather than the threatened 100%, or even 200% levels envisioned following “Liberation Day.”

2. Tariff-Driven Inflation?

The Trump-Powell standoff centers on how tariffs will impact inflation.

The Trump team is arguing that foreigners and companies will eat most of the cost, while Powell argues for a pause on rate cuts to evaluate the impact of tariffs on price levels. Who’s right?

The 2025 inflation polymarket contains hints on how traders see the tariff-inflation relationship.

2025 inflation expectations spiked on the ‘Liberation Day’ tariff rollout on April 1, then cooled as extensions and pauses were announced.

But as the August deadline approached with just a handful of deals done, the odds for inflation this year to exceed 3% have increased, and now sit at 60%.

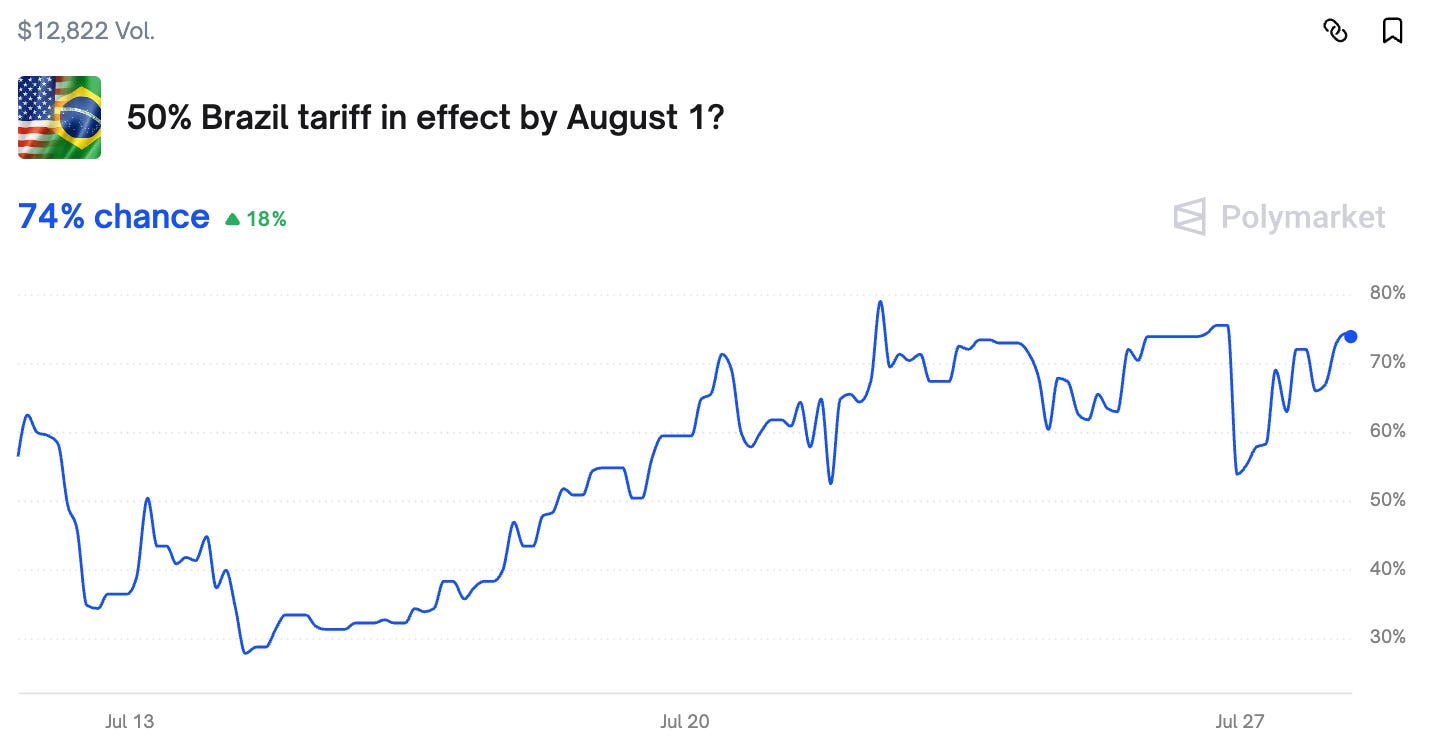

3. Bolsonaro Blowback

On July 9, Trump lobbed a threat of 50% tariffs at Brazil over their “witch hunt” prosecution of former president and Trump-ally Jair Bolsonaro.

Brazil exports only 1.7% of its GDP to the United States, giving it substantial leverage to resist Trump's pressure.

Polymarket traders think a near-term offramp is unlikely, with a 74% chance that Brazil will get hit with 50% tariffs by August.

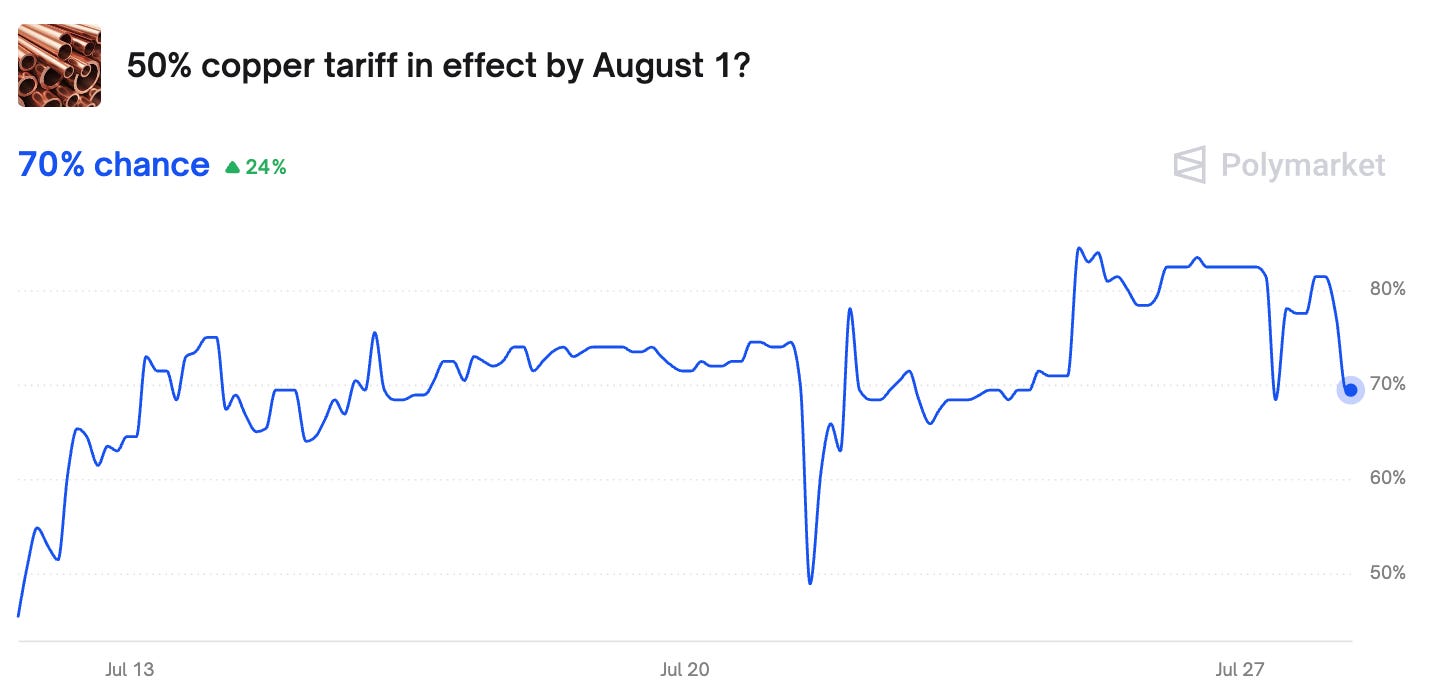

4. Copper Chaos

After a Commerce Department investigation deemed copper imports a national security risk, Trump announced a 50% tariff on copper on July 9. The announcement sent copper prices spiking 13%, the biggest single-day jump since 1989.

The US imports around half of its annual copper consumption, and Freeport-McMoran, the largest domestic copper miner, has been on fire since Liberation Day.

Polymarket traders see a 70% chance that Trump will allow the copper tariffs to go into effect as planned on August 1.

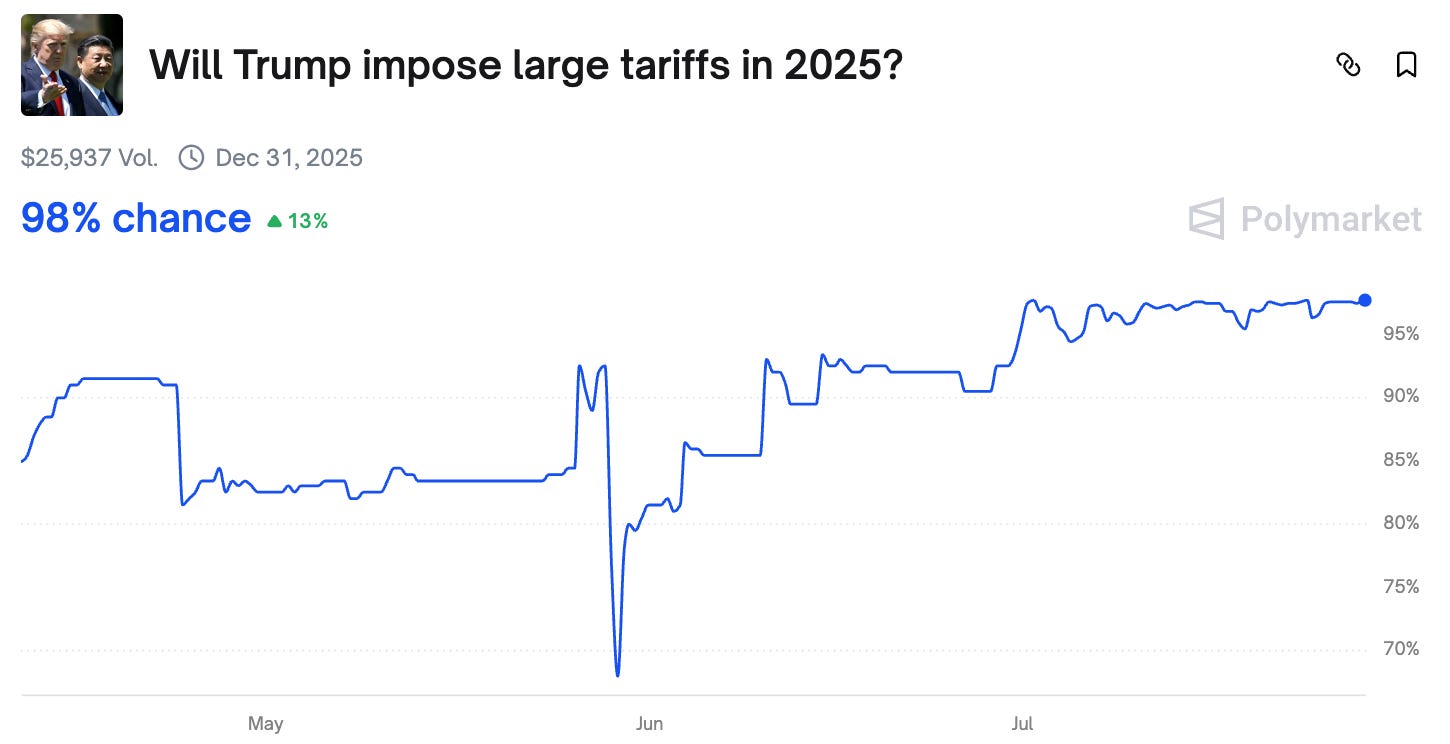

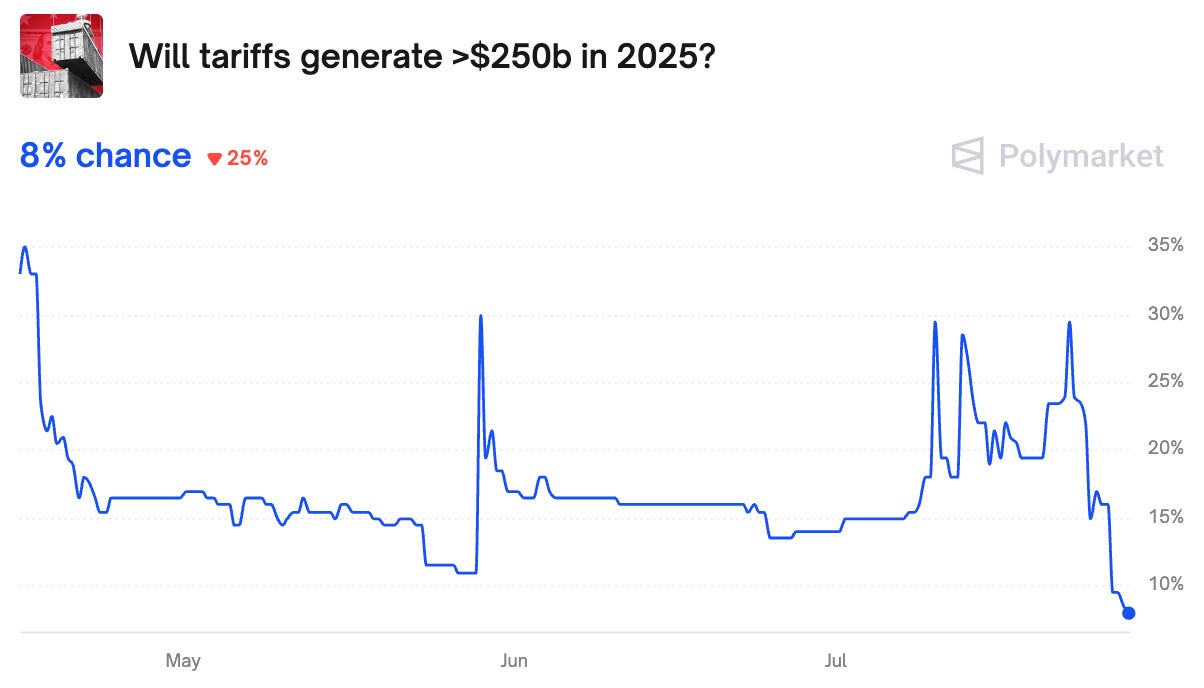

5. Revenue Reality Check

The bottom line is that Trump has far from chickened out when it comes to raising tariffs.

Polymarket traders see a 98% probability that the global weighted tariff level will double to 5% this year.

But when it comes to putting a meaningful debt in the budget deficit, they are more skeptical.

So far in 2025, Trump’s tariffs have brought in over $100b, but there’s just an 8% chance that the tariffs will raise more than $250b in income.

Compared to the $4.9 trillion the government collected from taxes in 2024, tariffs remain modest compared to other forms of taxation for now.

Disclaimer

Nothing in The Oracle is financial, investment, legal or any other type of professional advice. Anything provided in any newsletter is for informational purposes only and is not meant to be an endorsement of any type of activity or any particular market or product. Terms of Service on polymarket.com prohibit US persons and persons from certain other jurisdictions from using Polymarket to trade, although data and information is viewable globally.

TACO = Trump Always Confuses Opponents