🔮 He’s Betting $250k that Trump won't Fire Powell

A trader with a nearly $1m lifetime Polymarket PnL on why he’s going heavy on the TACO trade

Polymarket is Coming Home. 🇺🇸

Polymarket will soon be available for US traders. We're working hard to get the US platform ready for launch. In the meantime, sign up here to receive updates:

Trading under the handle @BuckmySalls, the German political bettor who goes by IvanCryptoSlav on X has applied knowledge from his political science degrees to rack up lifetime Polymarket gains of $841,770.

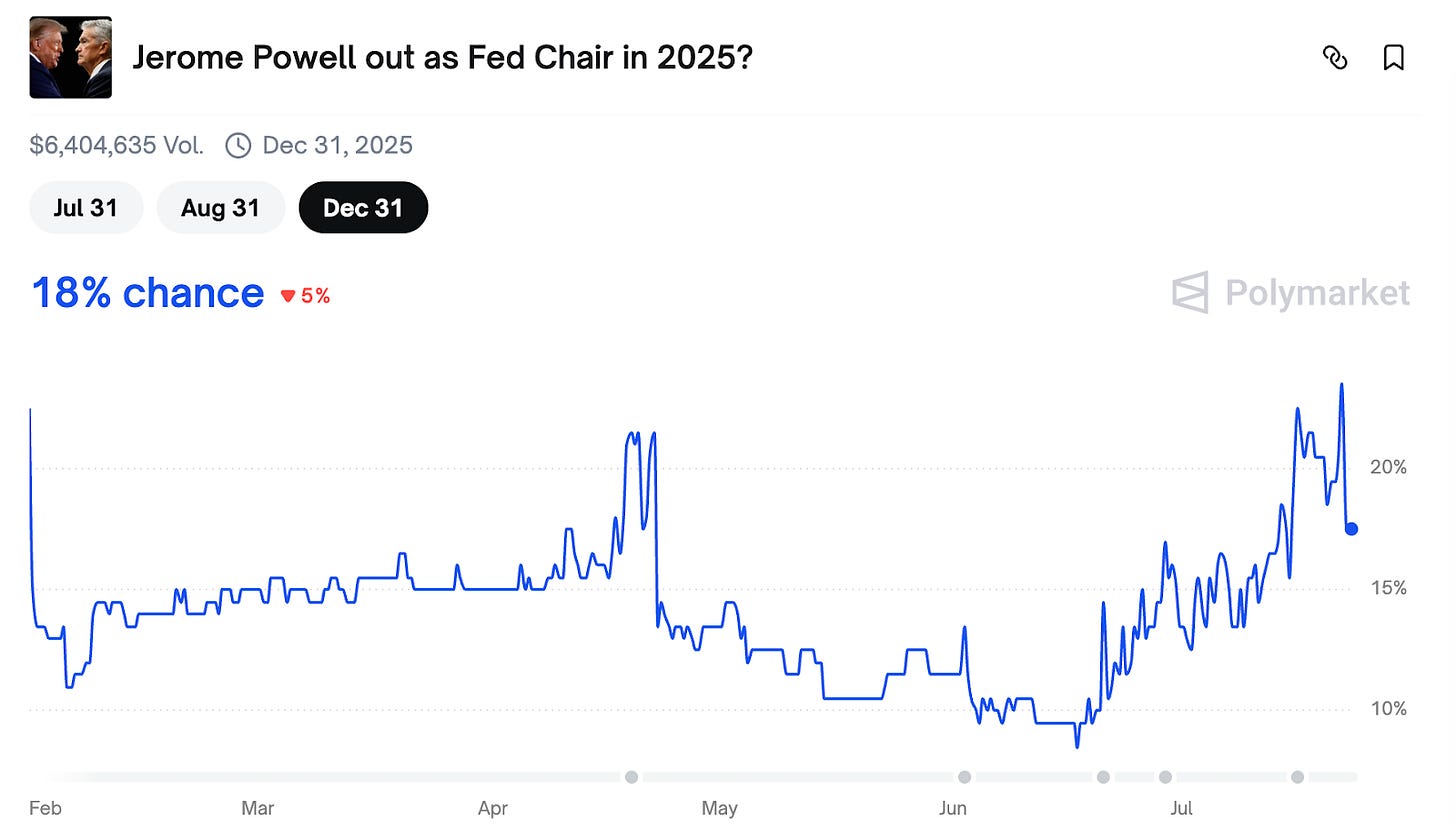

Ivan, who also writes about his trades on Substack, approaches American politics through the lens of spectacle and psychology. His latest conviction trade is a $250,000 bet that Jerome Powell will survive as Fed Chair through the end of the year despite increasing pressure from Trumpworld to resign. The Oracle caught up with Ivan to discuss why he’s betting so heavy on the TACO (‘Trump always chickens out’) trade.

This interview has been edited for length. All answers are his own.

You announced a big position that Trump won't fire Jerome Powell. Walk me through your thinking.

I have about $250,000 spread across various Powell markets. The largest one is that Powell will stay Fed chair through end-of-year because that was the most liquid one. I'm also in the market for whether Trump will fire him by the end of August.

My framework is simple: Trump gets his way on issues where there's no real-world resistance. Look at the Big Beautiful Bill, I was betting it would pass by July 4th because even with a few dissenters, Trump just twists their arms and they fall in line. He's the boss.

But where there's real-world resistance, he doesn't get his way. That's where the "TACO theory" comes in. You saw it with the Ukraine ceasefire. He said he'd get it done easily, but I knew he wouldn't. I made a lot of money on that market, though I fumbled my position a bit.

The Powell situation is similar but riskier. Trump could technically do it, but the market reaction would be so severe that it keeps him restrained. All his advisors - Bessent, Lutnick, the CEOs, they're keeping him on a leash.

So you think the financial market reaction is the key constraint here?

Exactly. When they floated that trial balloon last Tuesday about firing Powell, the S&P dropped 50 points in 30 minutes. That's how they do policy now - put out a headline, see how the market reacts, then decide. They walked it back within half an hour because the market dumped.

The risk is that Trump might think, "Oh, 50 points isn't that bad." But if he actually did it, we'd see maybe a 150-point drop. The unknown market reaction is scary enough to keep him from pulling the trigger.

Tell me about the timeline. When did you enter this trade?

Initially, I bought it as a bond a couple months ago when “No” was between 85-90%. I thought Trump wouldn't be crazy enough to tank the markets. My position was small then.

Then this guy Pulte – he's director of federal housing or something – started tweeting constantly about how Powell needs to be fired. The market ticked down a couple cents. I didn't react.

Friday or Saturday, Anna Paulina Luna came out saying Powell's gonna get fired. I thought it was bullshit - she doesn't know anything, she's just another MAGA talking head. But apparently Trump was waving around a draft letter and asking House members if he should fire Powell. Of course they all said yes. There are no normal Republicans left in the House.

That's when I started buying more heavily. It dropped to around 80%.

And then came the real test on Tuesday?

Yeah, Tuesday shit hit the fan. The White House put out that they were "considering" firing Powell, a classic Trump trial balloon. I stepped in hard, buying more and hoping it was just a test. I didn't expect them to walk it back so quickly, but they did.

Now I'm in quite heavy. I wouldn't mind reducing size if it floats back to the 90s, but the market's not where I'd like it to be yet.

Do you think Polymarket traders are becoming more aware of the "TACO trade," the pattern of Trump backing down?

Definitely. You see it in traditional markets too: SPX just goes up no matter what, even though the situation is worse than in April with tariffs basically assured.

The thing is, Trump does the same thing again and again. For me, the key is hoping Bessent and others keep telling him the juice isn't worth the squeeze. He'll get his way on rates eventually anyway, so why crash the market?

But at some point, something will go wrong. Trump feels so emboldened that he thinks he can get away with anything. Everyone's figured out his game and no one takes his headlines seriously anymore, but they still back down. Only Putin and Xi are willing to stand up to him.

It sounds like you think there’s still some chance he could get fired. What would you consider fair odds it happens? Would you sell before the market resolves?

If it got back to the 90s, I'd probably reduce size. But that depends on timing. If we're in October with only one FOMC meeting left and it's quiet, I might not sell. But if it drops to the 90s fairly quickly in August and this investigation blows over, I might sell.

The FOMC meetings are key because rate decisions could trigger Trump more than anything else. The whole Epstein files thing was pissing him off last week too. So the Powell firing thing was partly a diversion tactic, but he was genuinely angry.

Despite all the threats of firing, the rate cut polymarkets have been pretty steady. Are you looking at these or others to inform the position?

The rate cut polymarkets have a fairly reliable inefficiency. You can pick up money by selling volatility because Powell is actually quite easy to read. He just does what he says. He's been saying they're data dependent, taking it day by day.

I'm 100% certain of two things: Powell will not do a political cut, and he will not step down. He'll only leave if he's fired, and then he'll fight it in court. But he won't resign.

What about Powell's psychology? After the trial balloon didn’t work, the Trump allies are pressuring him with criminal referrals for lying about the new Fed building. Any chance he just gets tired of the pressure?

After reading Nick Timiraos's book about Powell, I have a much better read on his psychology, and I have zero doubts about this: Powell will not step down under any circumstances. They'd have to force him out. Resigning would be admitting guilt, and he's mission-driven. There's a quote that he wants his legacy to be like Volcker, standing up to political pressure and not yielding.

This pisses Trump off so much, that there's one person in the US he can't bend to his will. Powell isn't saying anything publicly, but through his actions he's standing up to Trump.

If Trump tweets today "I'm firing Powell," would you try to dump? Or keep holding and hope Powell can survive somehow?

I probably couldn't dump. I'm too big in the market. I might look to buy more cheap shares if I thought there's still a way for the bet to win. A decent strategy on Polymarket is providing liquidity when no one else wants to.

Markets often spike on headlines then retrace. Few headlines actually turn out to be immediately the thing. More likely than not, I'd just hope he doesn't do it. If he does, it would take my yearly P&L and put a big red candle down. But I've had a good year, so I don't mind putting on size.

Any final thoughts on the risk here?

This is the most dangerous of all the Trump trades because he has a personal dislike of Powell and it's so easy to do. He's not going to annex Greenland or occupy Gaza, but firing Powell is potentially just one tweet away.

The worst thing that can happen is the market just holds here: the yes side stays elevated because it goes through Congress, they question Powell, Trump talks shit, and there's no catalyst for it to float back up. I'm in a bit of a bind. That's why I wouldn't mind having less size. But for now, I'm just going to ride it out.

Disclaimer

Nothing in The Oracle is financial, investment, legal or any other type of professional advice. Anything provided in any newsletter is for informational purposes only and is not meant to be an endorsement of any type of activity or any particular market or product. Terms of Service on polymarket.com prohibit US persons and persons from certain other jurisdictions from using Polymarket to trade, although data and information is viewable globally.

Very interesting read.

He seems very experienced with polymarket order-flow/micro struture and then adds the psyvhology of Trump/Powel to the point a martingale strategy makes rational sense

So can Trump actually fire Powell or not? I was certain that he simply can't do that and I am a bit perplexed after reading this post. Perhaps it is the exact impression the trader intends to create with this piece.