🔮 RED TILT?

Polymarket Bros Overweight Republicans, Right?

A common critique of prediction markets is that traders fall into the “crypto bro” stereotype, ie male and right leaning.

This has called into question the veracity of Polymarket’s election markets, with some believing that partisan traders implies flawed forecasts.

But does the data reflect this bias? The short answer is no. In fact, Polymarket traders slightly overvalued Democrats in the most recent electoral cycle.

Findings and Analysis

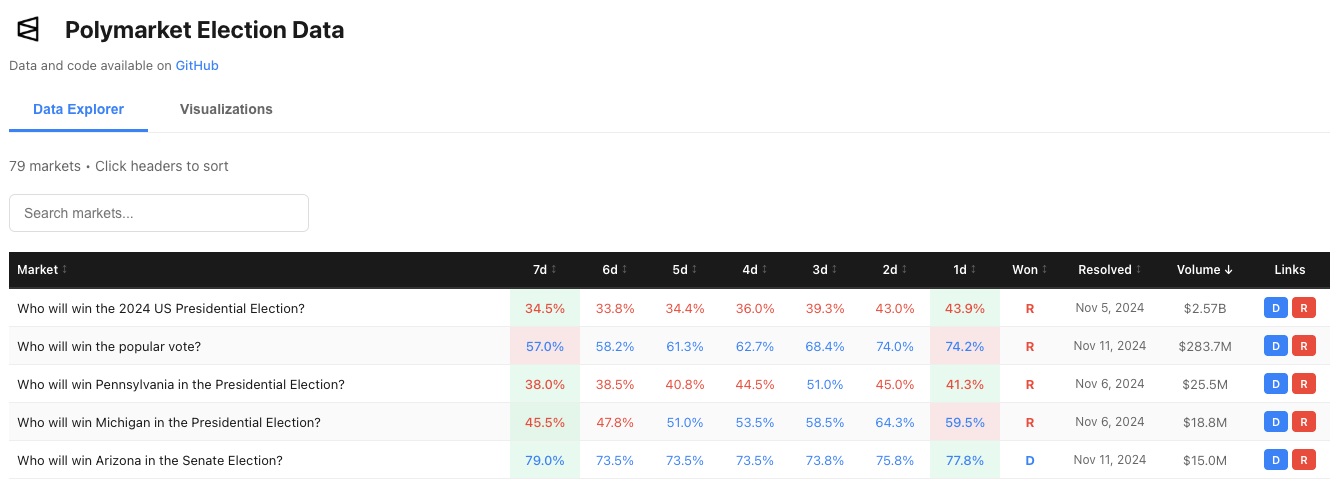

We analyzed 79 events from the November 2024 election, looking at only elections primarily contested between a Democrat and a Republican (more details + dataset + code snippets at end of article).

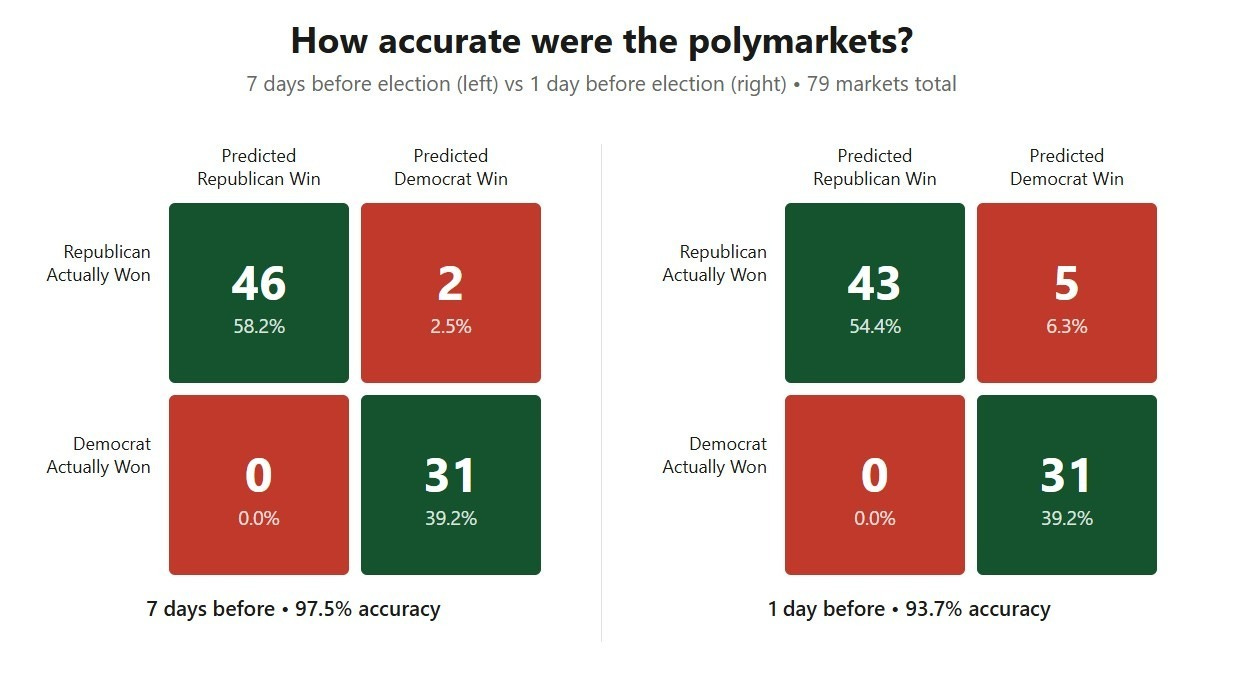

Polymarket traders were correct for 77 (97.5%) of them 7 days before closing, and 74 (93.7%) of them 1 day before closing. Among these 79 events, Republicans won 48 while Democrats won 31.

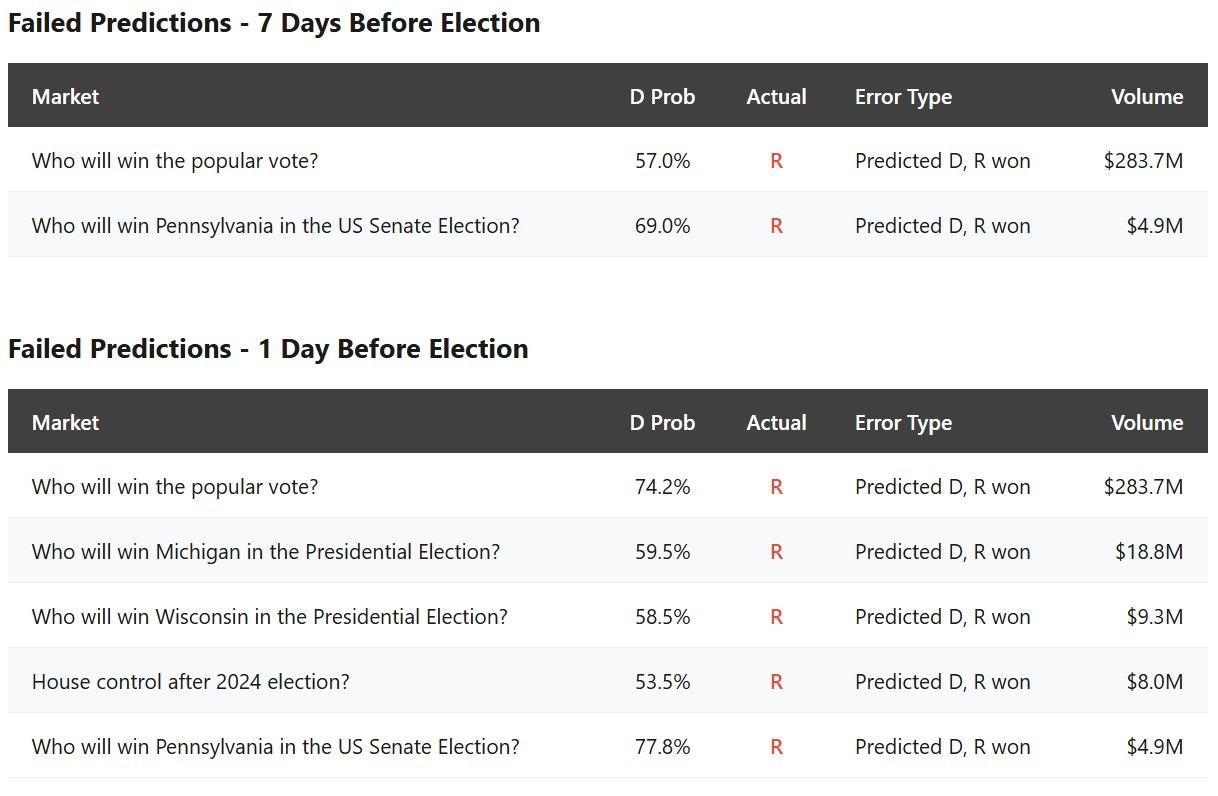

Looking at where the inaccuracies fall, we see that they actually display a tendency to be overconfident in Democrats.

The figures below, known as “confusion matrices” display predictions vs reality. Here is how to interpret the chart below:

Top left box: how many elections traders predicted would be won by the Republican AND were actually won by the Republican

Bottom right box: how many elections traders predicted would be won by the Democrat AND were actually won by the Democrat

Top right box: how many elections traders predicted would be won by the Democrat BUT were actually won by the Republican

Bottom left box: how many elections traders predicted would be won by the Republican BUT were actually won by the Democrat

At both the 7 day and 1 day time horizons, there are several markets where traders predicted a Democrat win, but in reality a Republican won (top right), while there are no cases where the opposite was true (bottom left)

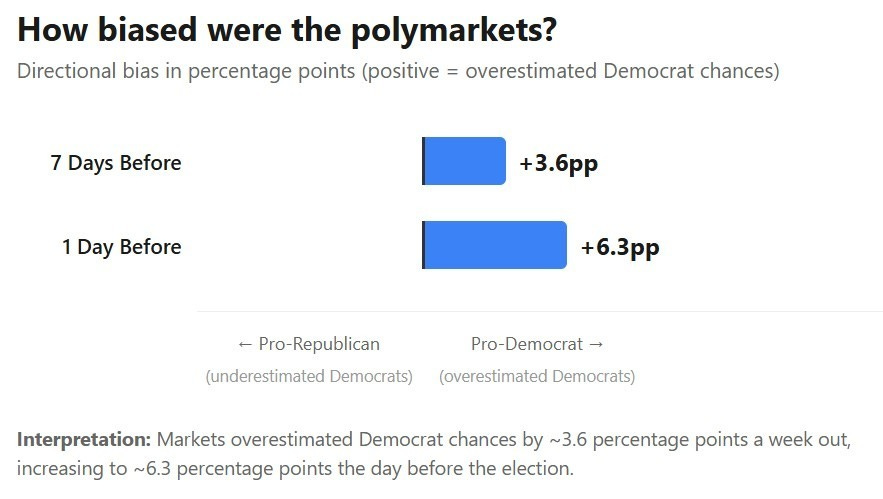

Going one step further, we can also look at the raw probabilities to compare confidence in predictions by measuring a quantity called directional bias.

Imagine if, in 100 coin flips, you guess a coin flip to be heads 60% of the time, but heads only comes up 50% of the time; you have a clear bias toward heads - you kept thinking heads was more likely than it actually was. In this case, your directional bias would be 60% - 50% = 10%.

Our dataset showed a pro-Democrat directional bias of ~3.6% at a 7 day time horizon and ~6.3% at a 1 day time horizon.

Takeaways and Caveats

So does this mean that traders on Polymarket are predominantly liberals with outsized belief in the Democratic party? NO.

Election markets are not perfect, in fact, accuracy slightly decreased approaching the election date. Late money is not always smart money. It’s quite possible that platforms like Polymarket may see an influx of momentum and/ or purely speculative traders as markets near resolution. While we didn’t examine the direct correlation between polls and Polymarket forecasts, it’s notable that Nate Silver’s Silver Bulletin, also found a slight Democratic lean in polling in 2024.

Due to changes in Polymarket’s API, pre-2024 election data is incomplete. We were able to source a limited dataset from the November 15th, 2022 election, which showed a different pattern: 11 markets predicted correctly and 3 markets such that, at a 7 day time horizon, traders predicted Republican but the Democrat went on to win. The logical next step in this research is to assemble a full dataset of all D vs R election events on Polymarket to understand how traders’ partisan betting patterns are changing over time and compare with polls.

This experiment (and the difference between prediction markets and polls in general) also only assesses the trading sentiment of users; their political preferences may vary from how they choose to trade.

Our final takeaway is that, while the signal might not always be perfect, the trading patterns from the 2024 election, Polymarket’s highest volume US national election so far, does not support the “conservative crypto bro” stereotype.

As more diverse traders enter prediction markets, we’re eager to see how these dynamics evolve, and the 2026 midterms will be the next major test.

Data Collection

We used Polymarket’s Gamma API and tag system to find all markets that fulfilled the following criteria:

Already resolved

American election primarily contested between a Democrat and a Republican or pertaining to the Democrat party and Republican Party (i.e. no Zohran vs Cuomo, no Seattle mayor, no primaries)

Focus on the 2024 election for data availability (as opposed to 2022) and adherence to Democrat vs Republican (as opposed to 2025)

While this does constrict our analysis pool, it allows us to prioritize only markets that directly signal towards the validity of our question.

Our dataset + all code used to collect it are available here, and we encourage users to revisit this question after the midterms, when more data will be available.

Disclaimer

Nothing in The Oracle is financial, investment, legal or any other type of professional advice. All odds are time sensitive and subject to change. Anything provided is for informational purposes only and is not meant to be an endorsement of any activity or market. Terms of Service on polymarket.com prohibit US persons and certain other jurisdictions from using Polymarket to trade, although data and information is viewable globally.

there was an example of predicted GOP victory for Senate in midterms 2022, won by Dem?