🔮 How ‘Political Kiwi’ Scored $300k Fading Nate Silver Fanboys

Reclusive Polymarket election night specialist shares his game plan for the Dutch and NYC Mayoral races

Jesse Richardson is a full time prediction market trader who got his start before anyone considered political betting as a potential career. The 20-something New Zealander got hooked following the rise and fall of the Bernie Sanders campaign, and quickly lost two-thirds of his $75 bankroll trading polling releases.

But something clicked on election night 2016 when he watched Trump's win unfold in real-time, and realized most traders couldn't properly interpret live vote counts. Richardson prefers to keep his Polymarket account anonymous, but amassed over $800k in profits as @Rabs. He now writes on X and Substack under the handle "Political Kiwi."

The Oracle spoke to Richardson on how he developed his election night edge, his $300,000 profit betting against Nate Silver, and how he’s approaching several upcoming elections.

This interview has been edited for length. All answers are Jesse’s own.

How did you get started with prediction markets?

I jumped in around 2016 after becoming a huge fan of Bernie Sanders. I would come home from school every week when there was a primary and watch CNN results with my parents. I got really interested in why Bernie was winning some states and not others.

I started googling endlessly about that and found PredictIt had a market on whether Bernie would win Oregon or something. I was instantly hooked. I was like, these people are wrong, they don't know what they're talking about, I want to do this.

Were you profitable from the start?

Not at all. When I first started trading, I was almost exclusively trading polls leading up to the 2016 election, and I consistently lost money for several months. There's a lot of inside knowledge and experience that some people had about what polls would be released and what polls are likely to have certain results. I ended up losing probably two-thirds of my bankroll, which was like $75 at the time. I got down to about $30 in my account.

What changed?

The turning point was election night 2016. I made my first sizable win, doubled my money, from the fact that people were slow to realize Trump was winning. I wasn't doing any advanced analysis, it was partially blind luck, but they'd count more and more votes in Wisconsin and CNN commentators would be like "Trump can't win Wisconsin" and it's like, well, he's winning and there's not many votes left to count.

Then once it became clear Trump was likely to win the electoral college, the markets went crazy in the other direction, like Trump's going to win Virginia, Colorado, all these other states he actually wasn't. So I faded both ends of that spectrum on election night. That got me hooked on live election trading, which is the thing I do most now.

Now I normally trade several times more volume on the night than leading up to it. Many elections I'll trade literally nothing beforehand, sometimes I'll come into an election having looked up nothing before the day of and still trade the live results.

Walk me through your $300,000 bet against Nate Silver.

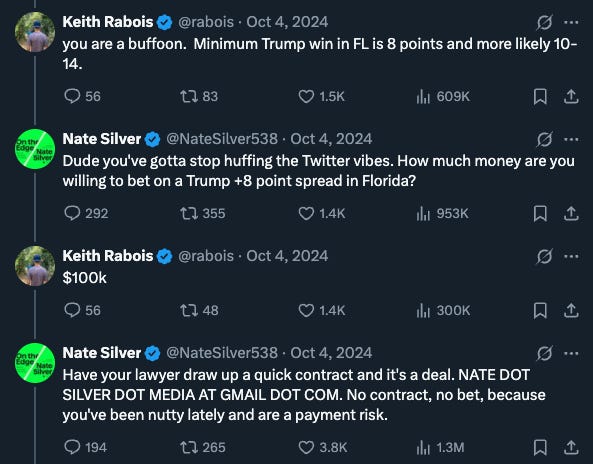

This was my biggest win and probably the most insane thing I'd ever seen. There was a Twitter feud between Nate Silver and Keith Rabois, some crypto Trump guy, about Trump's Florida margin. Silver's model showed Trump winning by like 4-5%, and Rabois was saying Trump would win by a lot more.

Nate Silver, to his credit, said "instead of calling each other names, let's bet on it." The bet was whether Trump would win Florida by more than 8%. Polymarket put up the market and it was trading at like 20 cents because people saw Nate Silver wanted the under and blindly followed.

The problem was Nate Silver was viewing his model as canonical or unbeatable. But there was a bunch of data showing Trump would likely win Florida by a lot that you just can't put in a rigorous empirical model: party registration data, how much DeSantis won by in 2022, the million Republican boomers who'd moved to Florida from every other state in the last four years.

I thought Trump would win by about 12 points. Florida had trended 3-4% to the right, which is extremely normal variance. I bought hundreds of thousands of shares in the 20s and low 30s for something I thought was worth 80 cents. Trump ended up winning by exactly 13 points.

What makes a good or bad election for live trading?

US elections are just unbelievably good because every state has a slightly different way of counting votes. The system is labyrinthine and confusing, you have to know all the ins and outs. You have this inconsistent drip from different places at different times with different types of votes. It also helps that US elections don't have good quality exit polls.

European elections often disappoint because you get accurate exit polls and efficient counting. If it's just like, okay, there's an exit poll, the exit poll is mostly right, and then we get results quickly from all parts of the country at once, there's not a lot you can do with that.

Let’s look through the list of upcoming elections. Can you pick one you haven’t looked into and talk about how you’d approach it?

Ok [browsing list] how about the Dutch parliamentary election? I gravitate toward countries with easily comprehensible election systems, which most of Europe has.

The Netherlands is like the epitome of the generic European country in terms of politics. All European countries have the same parties, right? There’s that famous meme, like here's the far-right party, the social democrat party, the Christian democrat party with a safe pair of hands, some weird alt-center party called like "Wow" or something.

They're all just the same parties from different countries, so I instantly know what a lot of the Dutch parties are about even if I've never heard of them.

What specific polymarkets are most interesting for the Dutch election?

The largest market is "greatest number of seats" with several million dollars in volume. But that's inherently going to have less edge because it's just a question of who gets the most votes in two months, basically polling plus random walk.

But the more interesting question is the prime minister market. I saw that Geert Wilders, the far-right leader, was at 8% to become prime minister. That instantly seems like a fade. Without even looking deeply, I'm guessing there are other parties necessary for him to form a coalition that won't accept him as prime minister.

Looking at Wikipedia, I see that Wilders' party was part of the current government until June 3rd, when they left over some immigration proposal that was too much for other parties to stomach. The leading candidate, Henri from the CDA Christian Democrats (🔮42% odds), seems like a natural to end up as prime minister.

It's probably going to be a repeat of the German election: the right party does well in vote share, but no one else wants to coalition with them, so all the others team up against them. The center-right will probably coalition with Wilders but not let him be prime minister, maybe not even in cabinet, just relying on them for votes.

What upcoming election are you most excited for?

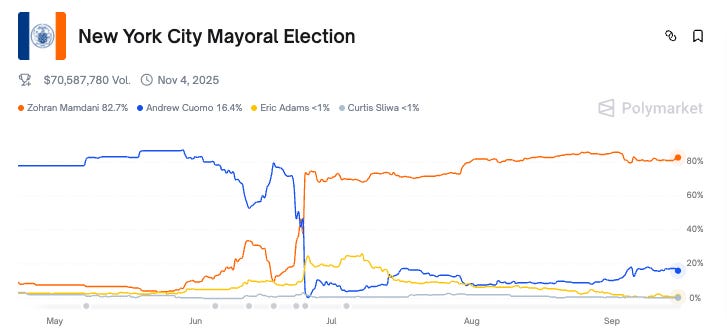

The NYC Mayoral could be an all-time great election if it ends up being close. Mamdani completely remade the electorate in the primary. I've never seen anyone successfully pull off the socialist dream of remaking the electorate with a huge surge of young socialist voters. Bernie always predicated his campaigns on "I'm not going to win moderates, I'm going to activate young people," and then he didn't. Mamdani actually did it.

Are you more interested in the election because of Mamdani? Or for trading?

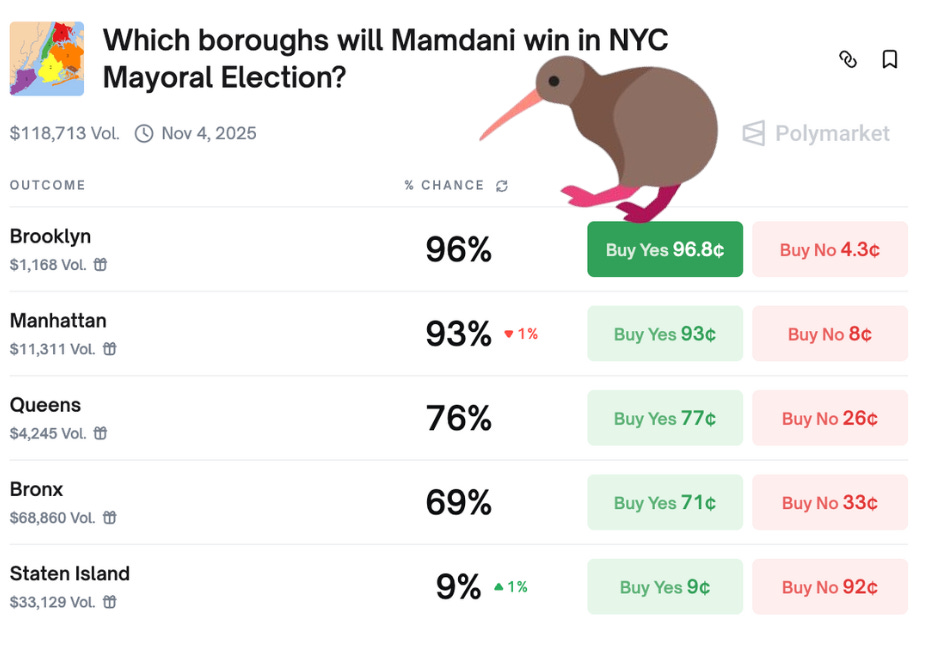

Both really. It's a four-way race, which is really unusual in the US, with real characters like Mamdani and Adams that gather a lot of interest. New York is like a mini-US with different boroughs counting at different times, and they'll spend weeks counting late votes after the election.

There are also interesting ancillary markets like who will win the Bronx or Queens. The Bronx is particularly compelling because it was Cuomo's best area in the primary, but it has a lot of black and Hispanic voters who you might expect will back the Democratic candidate. That's probably where the dynamic of black voters switching from Cuomo to Mamdani matters most.

The uncertainty around whether Mamdani can replicate his primary coalition makes it even more interesting. Every poll assumes the general electorate will be older than the primary electorate, but if he pulls off the same youth turnout magic, he'll outperform those polls. That creates the kind of uncertainty that can make election night really profitable.

Any final words of wisdom?

I like to focus on fewer, bigger, highly researched bets. When you have real conviction based on deep research, size up.

For live election trading specifically, start manually to understand the mechanics. My edge comes from going deeper than anyone else, I'll spend dozens of hours researching until I find a key piece of information everyone else missed. Most people just look at topline numbers. I dig into methodology, crosstabs, sampling of the polls.

When I do go outside of elections, it's a big random mess of shit that I find. I do a lot of what Peter Wildeford talks about, betting ‘No’ on things people think will happen, particularly within short time frames. People have a good understanding of whether something will happen in the next five years, but when they try to compress that distribution down to the next four months, they often put too much probability on it.

China invading Taiwan is a perfect one. I'm not particularly bearish on China invading Taiwan. Sure, it could happen in the next several years. But to estimate the short term, you should figure out what the probability is over several years first, then work backwards to what that means for the next four months, rather than just saying "5% in four months, sure, why not?"

The same logic applies to markets like whether Trump will strike Venezuela by the end of October at 27%. If that's accurate, unless there’s some immediate catalyst, then he’s almost certainly doing it by end-2026. Do you believe that too? Unless you think the distribution is really spiky around current events, these shorter timeframe markets are often overpriced.

Disclaimer: Nothing in The Oracle is financial, investment, legal or any other type of professional advice. Anything provided is for informational purposes only and is not meant to be an endorsement of any activity or market. Terms of Service on polymarket.com prohibit US persons and certain other jurisdictions from using Polymarket to trade, although data and information is viewable globally.