🔮Choose Your Fighter

Trump sets his sights on China in the trade war

🔮NEW: Oracle on YouTube. We’re now distributing the podcast and show clips on YouTube. When you subscribe to our new channel, like, and comment, it will really help us get rolling.

👉 Subscribe to The Oracle on YouTube

Trump Caved / Art of the Deal’d

You have probably heard by now that Trump has issued a 90-day pause on most of his non-China tariffs.

Libs are saying Trump got spanked by the bond market.

MAGA thinks it was an Art of the Deal masterstroke.

All we care about is that Polymarket was right.

If you read this newsletter on Tuesday, you would have known that Polymarket was pricing this exact scenario as most likely: escalation with China and a cooling elsewhere.

Not Out of the Woods

But hang on.

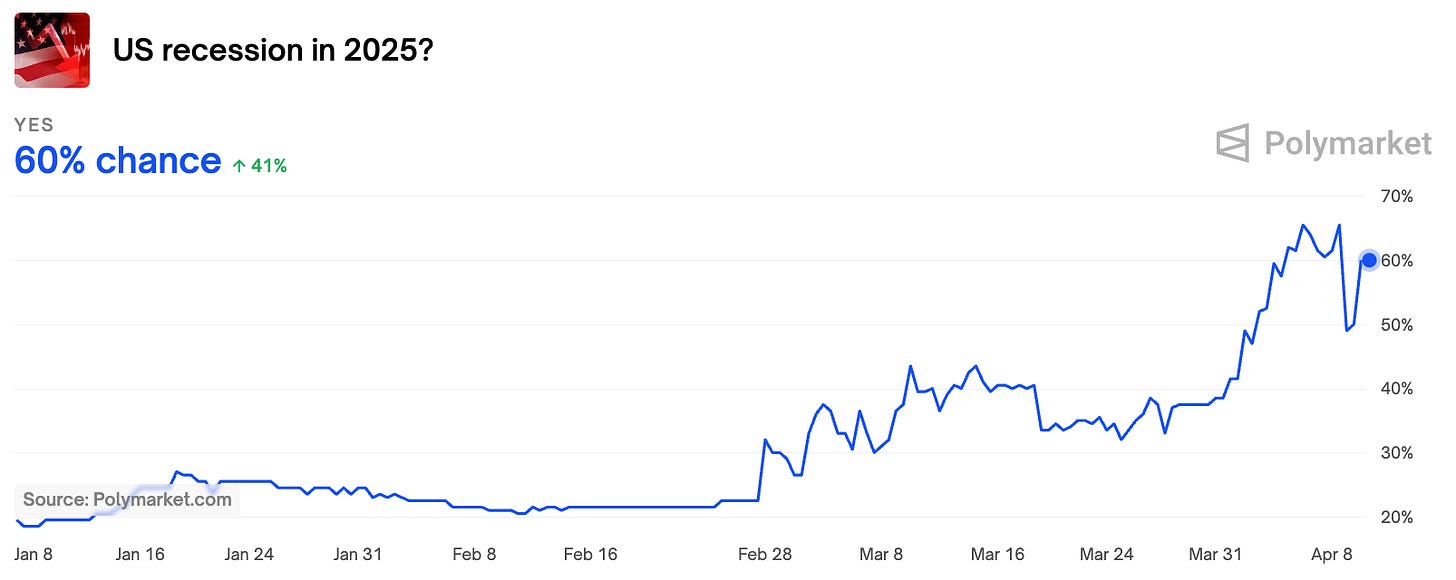

Odds are still elevated for a stock market crash this year.

The base rate for a NYSE circuit breaker (triggered by a 7% intraday drop in the stock market) is ~18% in any year. So the current 41% odds for a circuit breaker over the next 3 quarters is a big increase off this baseline.

Odds of a recession this year remain high at 60%, almost 3x the ~20% average risk of a recession in any given year.

Tariffs still BIG

What explains the elevated market risk and 10-year rates that are staying well above 4%?

The market thinks that tariffs are still going much higher, even after Trump’s 90-day pause.

This is confirmed in Polymarket’s “large tariffs in first six months” market. This market resolves according to the weighted tariff average, and thus gives a big picture of the full tariff load on the economy.

According to this, we’re still 77% to see at least a doubling of overall tariffs this year.

Big Uncertainty: China

After Canada and Mexico, China is the US’ third largest trading partner. But the US is China’s top export destination.

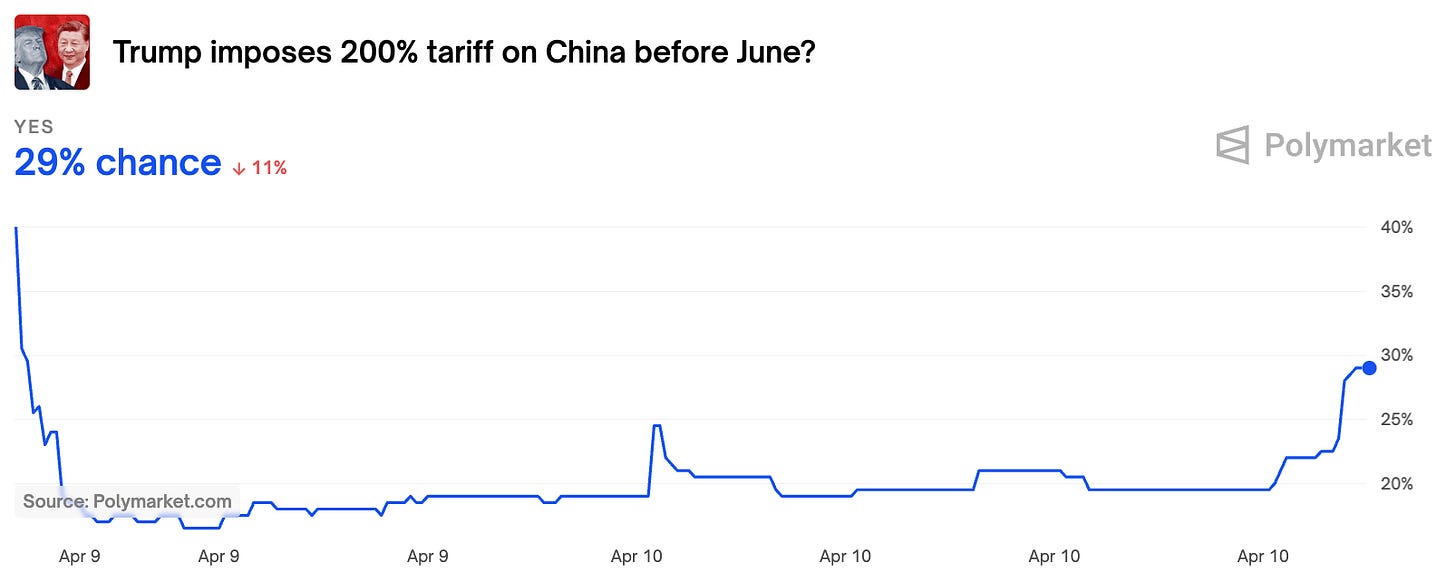

Does Trump want to crush their economy or cut a better deal? The market thinks it’s basically a coin flip as to whether a deal is reached in the next couple of months.

At the start of Trump’s first term, China tariffs were ~3.8%.

At the start of his second term they were ~42%, and now, after two more rounds of escalation, the China tariff level now sits at 125%.

Why stop there? Let’s make it an even 200%? There’s almost a 1 in 3 chance it happens, and rising.

Treasury Turbulence

Recent reporting suggests that Treasury Secretary Scott Bessent has emerged as an internal voice against the tariff program. He is reported to have travelled to Mar-a-Lago to lobby Trump personally on the issue on Sunday, April 6.

A few days earlier, on April 4, Stephanie Ruhle reported on Morning Joe that Bessent was already looking to exit the administration.

Both events are clearly visible in the chart and hint at some serious volatility in Bessent’s position. However tariff architect Howard Lutnick is still in the lead as most likely to exit this year.

Connect With The Oracle

Tips? Feedback? Story ideas? Write oracle@polymarket.com or @wasabiboat on X

Write for The Oracle: We’re expanding our coverage and looking to hire more writers and investigators. Details Here.

Disclaimer

Nothing in The Oracle is financial, investment, legal or any other type of professional advice. Anything provided in any newsletter is for informational purposes only and is not meant to be an endorsement of any type of activity or any particular market or product. Terms of Service on polymarket.com prohibit US persons and persons from certain other jurisdictions from using Polymarket to trade, although data and information is viewable globally.