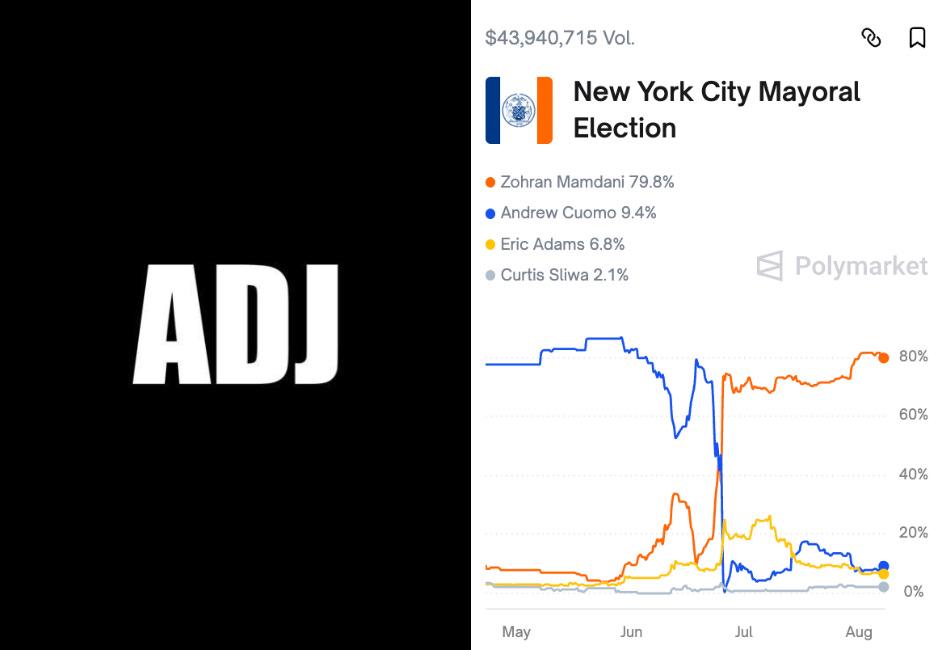

🔮 ZOHRAN OVERVALUED?

Can prediction market indexes uncover overlooked value?

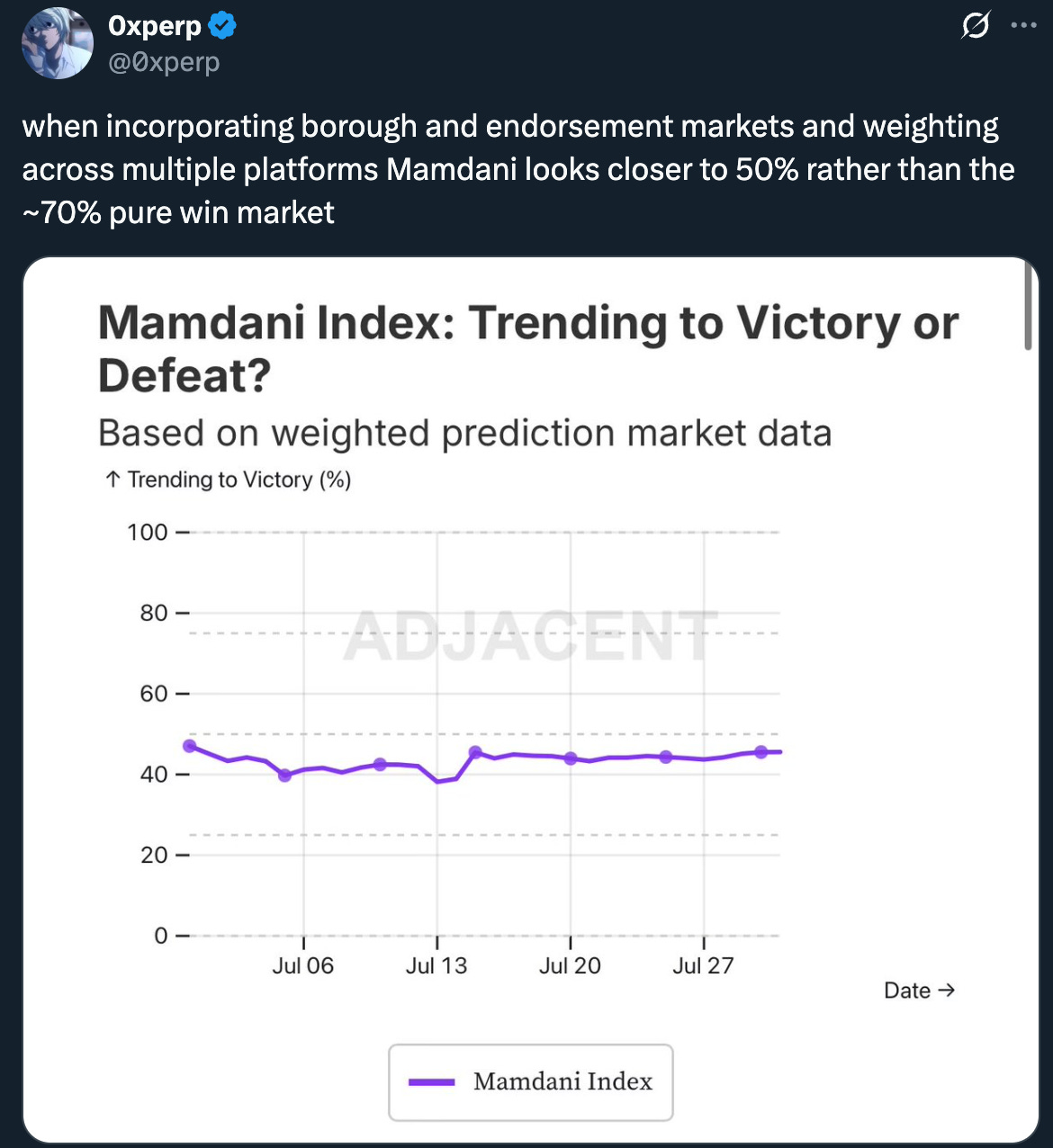

The following is an interview with @DougieBuckets and @0xperp who are building Adjacent News, a prediction market aggregator and data service. The Oracle caught up with them to discuss their new Mamdani Index, which suggests that Zohran could be up to 30% overvalued. We also discussed AI prediction bots and how their platform helped predict the India-Pakistan conflict six days before it happened.

Adjacent received a grant as part of Polymarket’s Open Builders Program. This interview has been edited for length. All answers are their own.

What is Adjacent?

Adjacent is building the data infrastructure and forecasting ecosystem to make prediction market insights more accessible and actionable. Our platform aggregates market data across Polymarket and other prediction markets so you don't have to build separate integrations for each one.

Lucas, my co-founder and the brains behind the idea, realized that prediction markets had this accessibility problem. The data was scattered across different platforms, each with their own APIs and formats, making it difficult to actually use the information. So we built the data layer and tooling that sits adjacent to prediction markets to advance the space.

Is it more of a news tool? Or a tool for traders? How do people use it to trade on Polymarket?

It's both. We serve news consumers who want market context on current events, and traders who need data to make better decisions. Our API aggregates odds across platforms to spot arb opportunities, and our newsletters highlight long-tail markets that need more liquidity. For instance, we’ve had success identifying spreads between forecasting platforms like Metaculus and real money prediction markets.

Earlier this year we identified one market, “Bird flu declared public health emergency this year?” that was trading at 38%, while forecasters on Metaculus had a similar question between 15-18%. We were able to place a couple trades and take advantage of this spread which was likely the result of low volume.

Other entities use our platform as more of a news tool that they integrate within their applications. For instance Polymarket Analytics uses our news API to add news context to their corresponding markets.

Can you think of any big trades or stories that ‘broke' on Adjacent?

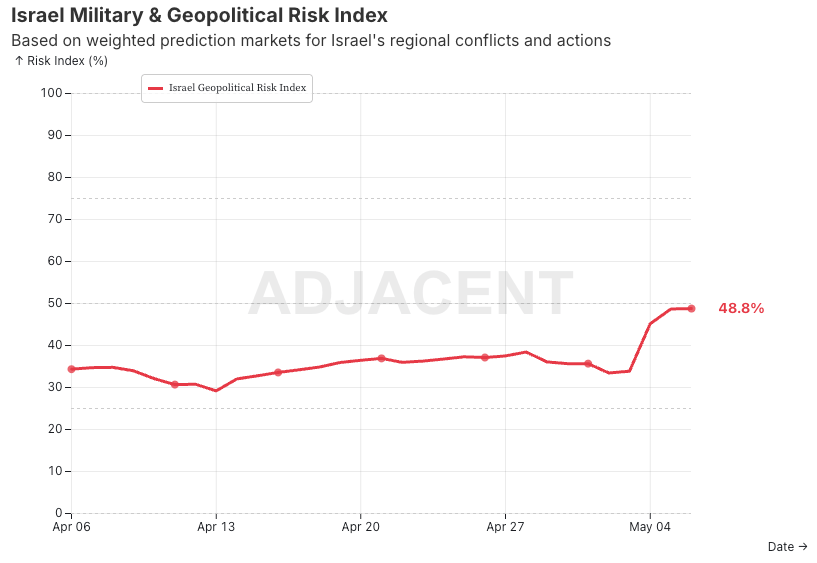

We've had instances where Adjacent spotted major developments before they hit mainstream coverage. Our biggest win was with the India-Pakistan conflict. On May 1st, we published “India on Brink of Military Conflict?” highlighting how tensions were escalating. Six days later, India launched missile strikes on Pakistan. We caught that story through our AI-powered news analysis detecting escalating rhetoric and military positioning that traditional media was missing.

We have also explored tools using the API to sort by highest moving markets (based on various volume thresholds) that have news that is semantically related. For instance seeing a large market move on no news it is usually not relevant. However if there are a few articles from some fringe news sites then the odds movement can be more interesting. Ultimately we use the news and data API to build a screener for markets which are then identified for a deeper look.

Walk me through the construction of your prediction market indexes

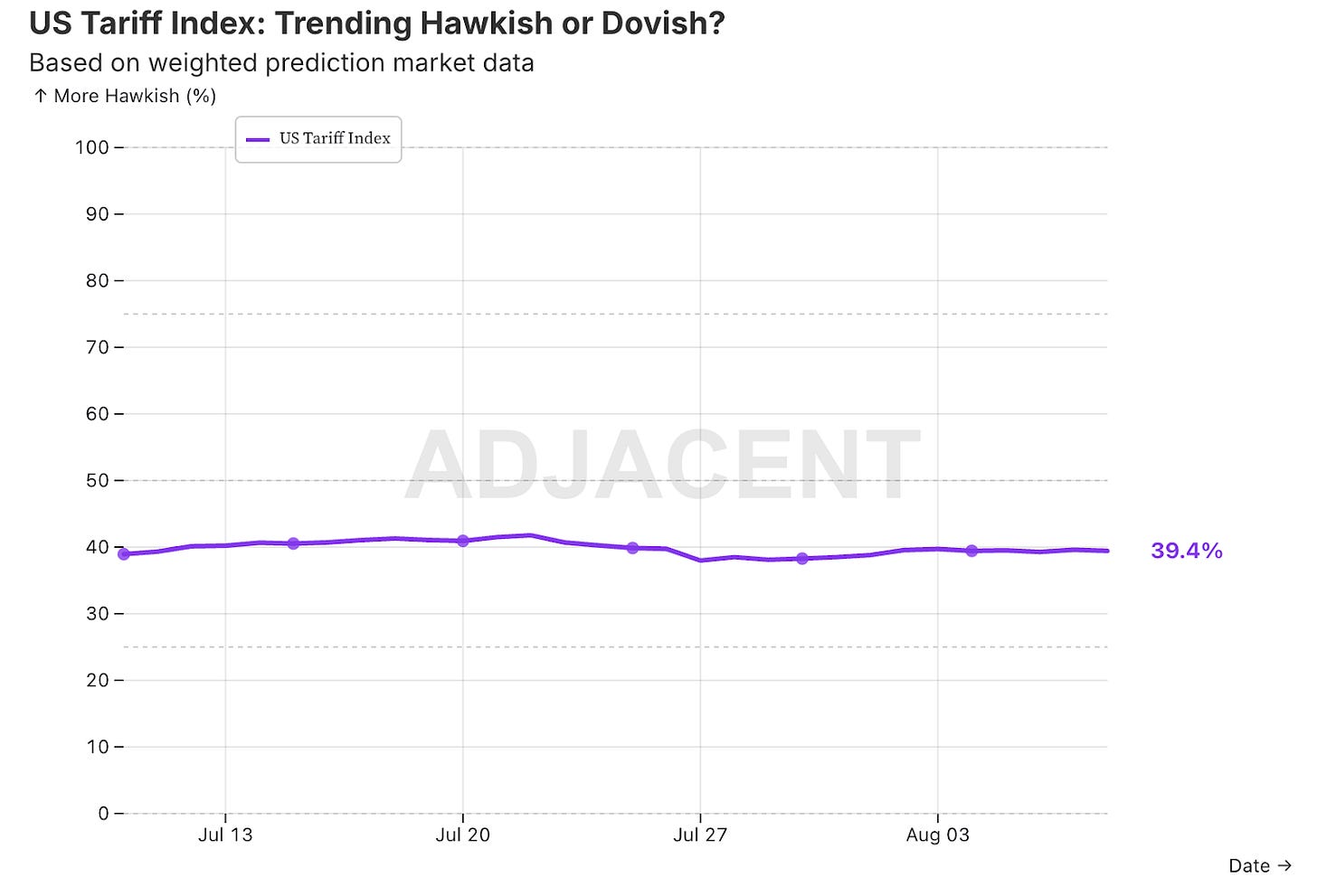

We started building weighted prediction market indexes a few months ago because we realized that individual event contracts, while valuable, often miss the bigger directional signals that investors really need. These indexes aggregate related markets to capture trends that might otherwise be lost in the noise.

Our indexes weight markets based on liquidity, time horizon, and the impact or severity of probabilistic outcomes so that high-volume, near-term markets with significant consequences carry more weight than distant events.

A good example is our US Tariff Index. It tracks whether US tariff policy is trending hawkish or dovish by aggregating multiple related prediction market contracts. When the index increases, it signals more protectionist policy direction; when it decreases, it suggests a more free-trade oriented approach.

We're aware of investors using this index as a portfolio trigger, adjusting their positions in equities based on the signal. The interesting thing about the tariff index now is that, despite all the crazy headlines that come out each day the overall index has been pretty steady, indicating a less volatile overall policy picture.

You also have a Mamdani index, which is closer to 50% than to the market rate of 70-80%. How does this work?

Our weighted Mamdani Index, fueled by 17 prediction markets across various platforms, has gained a bit of attention given the disparity between the index’s value of around 50%, compared to the around 80% that Will Mamdani win the NYC mayoral election is trading on Polymarket and others. There’s a few reasons for this disparity:

Outcome Diversity: Our index includes 17 different markets, many with lower probabilities than the direct victory market. For example, endorsement markets and "winning all 5 boroughs" have much lower probabilities even if overall victory is likely.

Weighting Effect: Currently, lower-probability outcomes (like specific endorsements) are pulling down the index despite Mamdani's strong position in the victory market. We might consider modifying how we weight time horizon vs liquidity vs impact.

Correlation vs. Independence: The index treats correlated events (winning overall vs. winning 3+ boroughs) as separate signals, which can dilute the core victory signal. The current methodology provides a more conservative, multi-dimensional view of Mamdani's prospects, while the direct market reflects pure win probability.

We encourage others to fork the index’s Notebook and play around with the weights, the markets included in the index, and perhaps even use a composite method in which separate sup-indexes are created and weighted (e.g., 70% core victory, 20% borough performance, 10% endorsements).

So based on your index, would you be short Mamdani here?

@0xperp: I have thought a lot about this. Really all that matters is the popular vote. Although things like boroughs and endorsements, less so, are indicative in some regard of the popular vote. It’s hard to quantify. Endorsement markets are interesting but also are just a tiny piece of information. There are also only a few endorsement markets (although they have decent volume!). I think what I am really looking for is a way to capture the clear pro-Mamdani culture across social media, in part due to him having a really good social media team and presence but also in part due to there being significant positive sentiment for him, which was apparent in the huge swing in the primaries.

I would not short him right now, but will be watching this index as the election gets closer and would like to see Polymarket list more markets that can represent his favor on socials (tweet impression volume, endorsements from influencer/celebrities, etc.)

@DougieBuckets: The index suggests more caution than the direct market, but I'm not ready to short yet. It could mean: (1) the direct market is overconfident, (2) our weighting needs adjustment, (3) correlated events are naturally creating drag, or (4) all of the above. One could make the case that the disparity highlights how the index is measuring “How confident should one be in a *comprehensive* Mamdani victory across multiple dimensions,” rather than the direct “Will he just win?” I'd want to see the index trend or the gap widen before taking a position. One could make the case that the index is currently more valuable as a signal of market structure than a trading recommendation.

Who is building on Adjacent now and how are they using it?

We're seeing three main categories: quant hedge funds are using our APIs to build systematic trading strategies, fintech startups are embedding our market data for prediction market context, and media companies are adding real-time market insights to their coverage.

The real alpha comes from our Semantic Search and News API tools. Unlike basic keyword search, our semantic search uses vector embeddings to find related markets you'd never discover otherwise. Search 'economic downturn' and it surfaces markets about 'recession,' 'GDP decline,' 'unemployment rise' - helping traders find mispriced opportunities across platforms.

Our News API provides early signal detection by using neural search to connect news articles to relevant markets before other traders make the connection. When Fed policy news breaks, it surfaces related articles about monetary tightening that might impact rate markets before they're fully priced in.

We've seen traders identify mispricings worth 10-20% using this approach, particularly in lower liquidity markets where information inefficiencies persist longer. Developers are also building portfolio management tools and custom indexes on our platform.

We're also launching an Adjacent Fund that will trade these opportunities as an uncorrelated hedge against traditional finance.

I understand you launched an AI trading bot based on your tech. Can you describe how it works and how it performed?

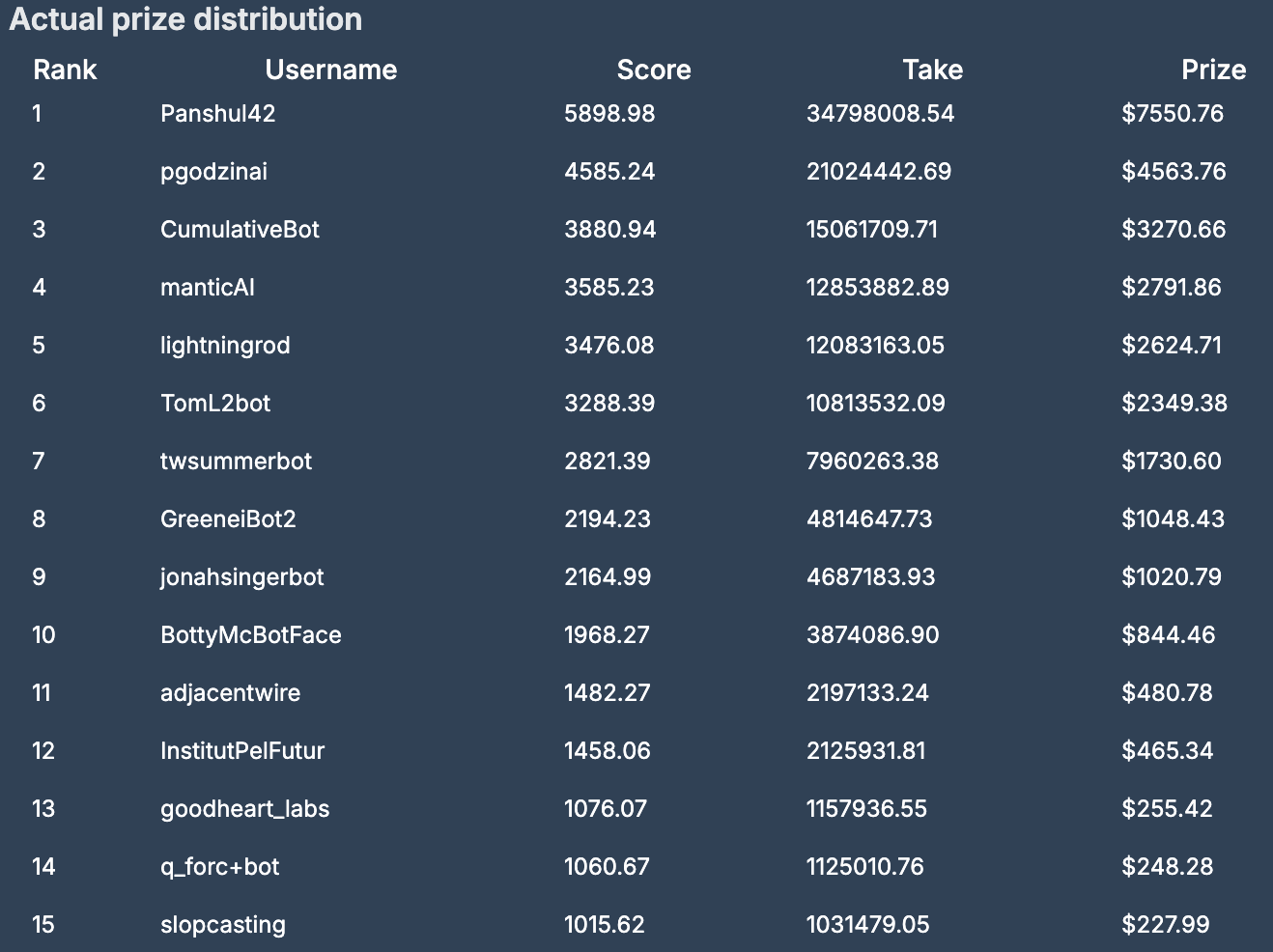

Metaculus has been running LLM based forecasting tournaments for a few quarters. In Q2, 2025 Adjacent participated with an extremely minimal implementation of the bot. In fact all we did was give the base forecasting bot access to using the Adjacent API for news, semantic markets, and price history. You can find the implementation here. Adjacent placed 11th in this competition.

The bot does not yet trade on real-money markets, we have only been trialing it across the various competitions. Forecasts that the bot has made and its reasoning can be found in the comments section here. Right now the bot’s forecast help to inform some of our real-money positions but it is not trading live money at the moment. I can easily see it expanding to that in the future.

Since then, multiple top 10 finishers have reached out around using our API to improve their bots in future rounds and we plan on spending significantly more time improving the quality of our LLM based forecasts.

What polymarkets would you like to see launched?

There's a huge opportunity when it comes to markets associated with private company valuations and using post-money valuations after raises as the resolution criteria. We also think it'd be super interesting to have indices associated with these, for example, "AI Private Company Valuation Index," etc.

We're also excited about the future of perps with prediction markets. we think there's a real opportunity to use perps and binaries (e.g., daily, monthly, quarterly, yearly, etc) to trade prediction market-driven indices.

How can people contact you?

Follow us on X @AdjacentNews for real-time market takes, and explore adj.news for all our articles. If you are interested in the API, email lucas@adj.news for a key.

Disclaimer

Nothing in The Oracle is financial, investment, legal or any other type of professional advice. Anything provided in any newsletter is for informational purposes only and is not meant to be an endorsement of any type of activity or any particular market or product. Terms of Service on polymarket.com prohibit US persons and persons from certain other jurisdictions from using Polymarket to trade, although data and information is viewable globally.

Great interview, Adjacent does a great job with market data!