🔮Will Trump Pick a BTC Bull for Treasury Secretary?

And what it means for the Strategic Bitcoin Reserve

So far, most of Trump’s transition picks have seen little drama prior to their announcement. One exception has been Secretary of the Treasury - a job that will be instrumental in managing US debt markets and play a role in Trump’s promised Strategic Bitcoin Stockpile.

On Polymarket, Treasury has been one of the most volatile cabinet markets, with four contenders breaking 50% in the odds, and new players entering late in the game. Let’s look at some of the key moments in the race and what the implications might be for Trump’s Strategic BTC Reserve (🔮42% odds before April 29, 2025).

Scott Bessent: The Early Favorite

The market for Treasury Secretary was launched on Polymarket on November 6, and Bessent, the former CIO of Soros Fund Management jumped out to a heavy favorite, touching a high of 89% on November 12.

Bessent has been a backer of Trump’s political career since 2016 and is in sync with his tax cuts and deregulation agenda. However, some comments Bessent made about Tariffs - that they are more useful as a threat than actually implemented - led to backlash from some who see tariffs as key to stimulating domestic manufacturing.

While he doesn’t have as long a history with crypto as other candidates, Bessent has said “everything is on the table with Bitcoin" and expressed excitement about Trump’s crypto agenda.

For the first week post-election, Bessent seemed like a lock, with the Financial Times and others citing him as a top contender. On November 12, however, his odds began to nosedive at the same time as a spike in Google searches on Bessent’s years of work as a “protege” of liberal mega-donor George Soros.

Many on the right, including Steve Bannon, defended Bessent’s MAGA credentials, but it appears that the smears may have had some effect, as his Polymarket odds declined from a high of 89% to a low of 12% before recovering to their current level of 42%.

Howard Lutnick: The Bitcoin Pitbull

As Bessent’s star was falling Howard Lutnick’s was rising. Lutnick, the long-time Cantor Fitzgerald, CEO who rebuilt the firm after 658 of its employees were killed on 9/11, was already advising Trump’s transition team before his name started being mentioned for Treasury.

Lutnick saw his biggest one-day jump in the odds from 18% to almost 50% on November 16 after he was endorsed by Elon Musk and RFK Jr. on the same day.

Lutnick is a favorite of crypto advocates due to his strong support of Bitcoin, and because Cantor Fitzgerald manages the reserves for Tether, the largest stablecoin.

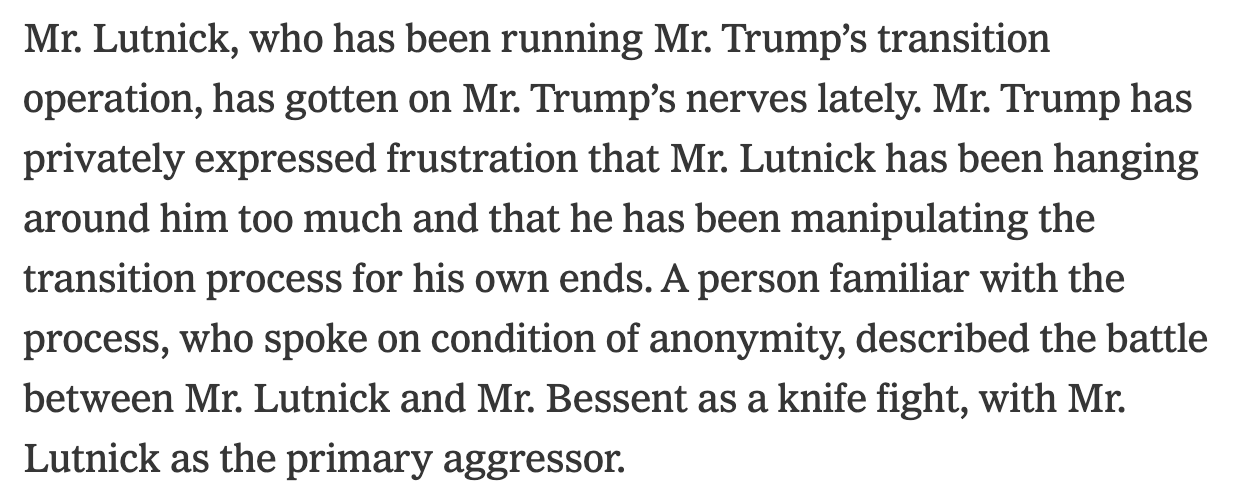

The Lutnick surge, however, was short lived; his odds were down-only from the day of the Elon / RFK endorsements until he was announced as Commerce Secretary on November 19, thus removed from Treasury consideration. What happened? It’s possible his sharp elbows and high profile lobbying by Elon and RFK backfired, as was suggested in the Times.

Kevin Warsh - the Crypto Skeptic

With Lutnick out and Bessent on the back burner, a new group of candidates was on the rise. The current second-place candidate is former Federal Reserve Governor, Kevin Warsh (🔮 31%). Warsh served on the Federal Reserve during the 2007-8 financial crisis, and is known for hawkish views on inflation.

In crypto circles, Warsh has been criticized for supporting a Central Bank Digital Currency (CBDC), which Trump pledged never to launch as president.

Some macro commentators, however, have noted that US treasury markets rallied when Warsh’s Polymarket odds began to rise, implying a positive market reaction to his candidacy.

Marc Rowan: Private Equity Guy

Another new name in the mix is private equity CEO Marc Rowan (🔮 15% odds). The founder of Apollo Global Management, Rowan’s signature issue is letting Americans add non-traditional financial assets like private equity to retirement accounts.

On Bitcoin, Rowan has pleaded ignorance, which has led to suspicion of his crypto support. As Ryan Selkis, founder of Messari Crypto wrote on X, Rowan “could be a prickly ‘Mnuchin-esque’ blocker on Trump’s crypto agenda.”

Rowan has also been attacked from the right as ‘Open Borders Marc Rowan’ for donating to James Lankford, a Republican senator from Oklahoma who broke with the party’s hawkish immigration policies.

“Bitcoin” Bill Hagerty

The most recent addition to the candidate pool is the junior senator from Tennessee, Bill Hagerty (🔮 11% odds), who has recently been photographed with Trump at Mar-a-Lago and with Musk at a SpaceX launch.

In addition to a private equity background, Hagerty served as ambassador to Japan during the first Trump term and has held other roles as a DC economic advisor. Of all the remaining candidates, Hagerty is the strongest crypto bull, with multiple industry insiders expressing their support.

Hagerty is a sponsor of the Clarity for Payment Stablecoins Act and has sought to promote his home state of Tennessee as a hub for Bitcoin mining. Despite the enthusiasm in crypto circles, Hagerty remains a longshot, never exceeding 11% in the odds.

Will the USG Hodl BTC?

One market to watch in the coming days is “Will Trump create a national Bitcoin reserve.” This market, which resolves to “yes” if the US announces it holds Bitcoin as part of its reserves before April 29 has been trending up since November 16th, but could re-rate sharply in either direction depending on who is chosen.

This selection process is culminating as BTC hits a new all-time-high of 98k this morning, with an 81% chance that it cracks $100k by the end of November. Put together, it seems like markets are increasingly bullish on the chances that Trump and his ultimate Treasury pick will deliver for the BTC maxis that supported him.

Disclaimer

Nothing in The Oracle is financial, investment, legal or any other type of professional advice. Anything provided in any newsletter is for informational purposes only and is not meant to be an endorsement of any type of activity or any particular market or product. Terms of Service on polymarket.com prohibit US persons and persons from certain other jurisdictions from using Polymarket to trade, although data and information is viewable globally.