🔮 WHO’S NEXT?

Fed Insider on Why the Bond Market is Nervous about Trump's Top Pick to Replace Powell

A career bank regulator and now digital asset technology co-founder, Robert Bench spent four years inside the Federal Reserve building digital currency infrastructure after helping design USDC at Circle. Now he’s watching the Fed Chair race from the outside, and he sees a market that’s mispriced.

Hints Trump dropped in his December 2 cabinet meeting sent Kevin Hassett’s odds soaring to 85%. But within 48 hours, the Financial Times ran a front page story suggesting the bond market is nervous about the Hassett trial balloon.

Bench walks us through how to read the Fed chair tea leaves: why Hassett may be overvalued at 72%, and some surprising long shots worth a look.

This interview has been edited for length. All answers are his own.

What’s your background that informs your perspective on these markets?

I’ve been in bank regulation since 2005. I pivoted to stablecoins and crypto in 2017 when Circle brought me in to run regulatory and policy for them. That’s when I started thinking about the larger questions: how does money work, what is a dollar, how do dollars move, who are the participants?

I left Circle in 2019 to help catch the US up with China on digital dollar research. China had made a considerable strategic investment in moving towards a digital yuan. I was fortunate enough to meet with the Federal Reserve and build a team of technology experts, largely from Circle and MIT, researching how digital currencies work and how to make them extremely safe. Our focus wasn’t necessarily moving money faster, but making sure that if Congress ever called upon us to build a digital currency, it’s secure and can’t be double spent.

I did four years at the Federal Reserve. In the Fed, that makes one barely an intern. Most people spend their entire careers there, upwards of 35 years. But I got a really interesting experience seeing all sides of it because it was such a critical project. I’ve also been a student of Federal Reserve history for 30 years. I was reading BIS annual reports in middle school. I was really obsessed about this stuff.

How do you see the Trump-Powell relationship? Is this a real threat to Fed independence?

For those who don’t spend a lot of time geeking out on this stuff, it seems pretty severe. But the Federal Reserve independence question has been very cyclical historically. In 1951, the Federal Reserve was still trying to gain independence from the Treasury Department post World War Two. It took almost a decade after the war.

Our president has a unique communication style. But we had Lyndon Johnson physically assaulting a prior Federal Reserve Chair. I’m not aware that Donald Trump has done that to Jay Powell, nor do I think Jay Powell would stand for it. These things come in waves. I think Powell is handling it in an excellent manner.

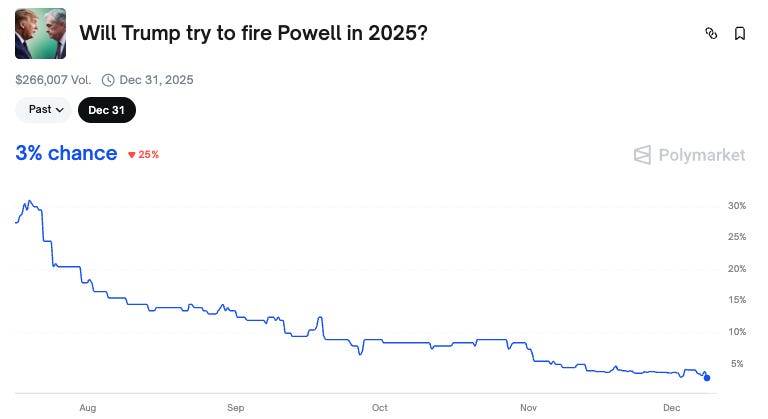

The polymarket on “Will Trump fire Powell in 2025“ was decently high a few months ago but has collapsed. What happened?

I think it was never really on the table. I’ve met Chairman Powell. If you’re looking for anything remotely “for cause” to terminate him, I just don’t imagine there’s any way. He’s an exemplary leader, an exemplary public servant. And whether the President has unilateral power to fire him is very questionable legally.

But more importantly, remember that American debt has two sides: the Treasury Department and the Federal Reserve System. Removing the chair would send a very difficult signal to the buyers and holders of our debt. We can only fund our government through taxes or debt. The market would speak up.

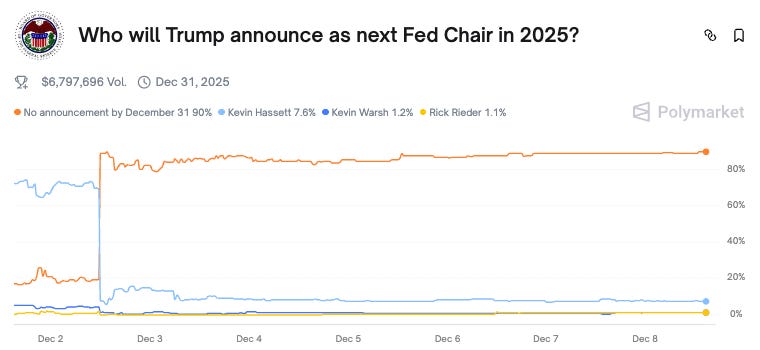

There was talk about Trump announcing a “shadow Fed Chair“ while Powell was still in office to pressure Powell to cut more. We see the odds for that collapse on December 2. What happened there?

On Dec 2 there was a significant cabinet meeting where Trump essentially said two things: that he would wait until early 2026 to announce the next Fed chair, and strongly hinted at Hassett as the choice:

But to say this will be firmed up by a statement in an interview six months ahead of time may not be accurate. I think there is going to be considerable input into this decision. This is arguably the President’s single most important policy decision.

An early announcement may not necessarily be a negative thing. There’s a world where that could provide continuity for the market. But remember, the Federal Reserve is really three separate legal organizations. The Open Market Committee is just that: a committee. While we’ve had fairly consistent voting along the lines of the chair over the last 20 years, that’s no guarantee.

When Congress designed the FOMC, they wanted someone representing farmers in Iowa to have a slightly different take on interest rate policy than someone representing bankers in New York City. So even if you have a chair more aligned with a president, that does not guarantee rate changes. The Chair is one vote. That always needs to be considered.

On December 2, Hassett spiked to 85% after the meeting with Trump, but have cooled a bit since. What’s going on there?

A few days after the Trump meeting, there was a very important article on the front page of the FT that some bond market insiders were warning against the Hassett selection. That article was not randomly written. The FT doesn’t just decide to write an article like that. Serious people in the bond market probably raised this to be on the front page.

It referenced the Treasury Borrowing Advisory Committee, and the reporting was that the bulk of the conversation was around political matters, not around the yield curve. The question is: does Hassett have the confidence of the bond market? My hunch is this remains an open question.

Big picture, how do you think about handicapping Fed candidates?

There are three boxes to check. One: do they know the Federal Reserve System? It’s a really complex organism. Two: does the bond market trust them? Three: do they have the confidence of the nominating President and their political party to get through the Senate?

Hassett checks boxes one and three. He has the economic chops, decades of policy experience, and he worked as an economist at the Federal Reserve. He clearly has confidence of the party in power. But box two, the bond market, that’s the yellow light flashing.

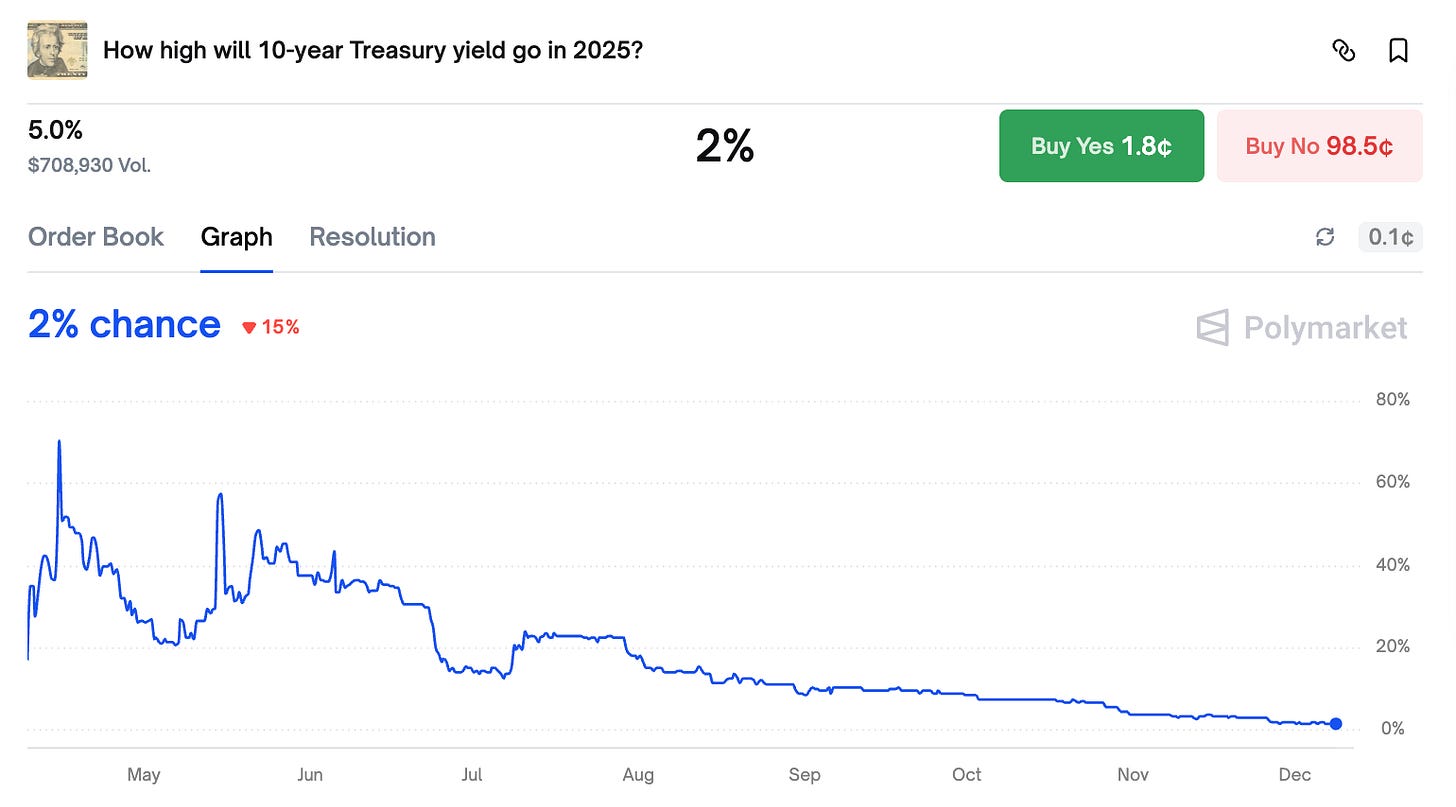

You can also see this reflected in treasury spreads. There’s been a spike from 51 basis points to 58 basis points from November 28 to today. I’m not saying it’s definitive, but it’s interesting. The market determines the 10 year and longer. That market is institutions, but also foreign governments like Japan and China, the big buyers. Do they want to put their national treasuries somewhere they’re uncertain about the Fed Chair?

So at 72%, you think Hassett is overvalued?

Way too high. There are too many people that the bond market would find credible who can also check the other two boxes. We have seven months until Powell’s term ends, and a lot can happen in seven months in Trump White Houses and bond markets. I wouldn’t touch it at 72%.

Let’s talk about the other leading candidates. What do we know about Kevin Warsh?

Warsh was a prior Fed Governor, so he checks that box. He’s been doing monetary policy and markets for the last 10 years. He’s not a PhD economist, but that’s not fatal thanks to Jay Powell’s exemplary performance.

Here’s what’s interesting: there’s a publication called Grants Interest Rate Observer. It’s been worrying about the money market for 40 years. They do one conference a year, really nerdy stuff for people who care about the cost of money. Last year they had Scott Bessent as the keynote speaker before anyone was really talking about him for Treasury Secretary. This year it was Kevin Warsh.

Someone said Kevin Warsh needs to speak at this thing. They showed him to the bond market like they showed Bessent last year. That’s a signal.

What about Chris Waller?

Waller is fascinating, and my favorite amongst the “favorites”. He’s a Federal Reserve lifer who came up through Midwest academia, not from the traditional pipeline. Right now, two Supreme Court Justices went to the same high school (the same school as Jay Powell). You very rarely get Supreme Court justices and Fed Governors from anywhere but New York, DC, Boston, San Francisco, Chicago.

Waller went to Bemidji State, then Notre Dame, then spent his entire career as an economist in the Midwest. Chairman Powell has put him in some of the most critical committee leadership roles. He runs the Committee on Reserve Bank Affairs and the Committee on Payments, Clearing, and Settlement. If you’re trying to train someone to run the whole system, which has about 25,000 people, that’s the role. It looks like he’s Powell’s selected replacement.

But you’d see that as a negative since Trump is angry at Powell?

Not necessarily. I would find more telling Waller’s September vote. Waller went with Powell and the majority of the FOMC against Stephen Miran’s 50 basis point cut preference. If you presume Miran represents the White House’s views, Waller did not go along. That may mean he has the appearance of independence, which would make the bond market happy. But does he have full faith and confidence of the White House? Open question.

He’s also the only one in this group who has put himself forward on the technology side. He’s been really forward on stablecoins, digital assets, all those matters. If that’s a bigger question for these folks, how to approach technology in central banking and monetary policy, Waller is getting the sharpest on it.

Any longshots worth looking at?

Jay Powell at 0.4 cents. He hasn’t said he wouldn’t serve again. He’s a historic public servant who sees the role as fully independent. If the President asked him to serve, Federal Reserve staff and the bond market would be over the moon. There’s a non-zero chance. That’s a great bet.

Rick Reider at 3.3 cents. The bond market would be doing backflips. He’s been managing BlackRock’s fixed income books. As far as who knows the bond market best, you’re not going to get better than Reider.

Imagine your full time job for the next seven months is to do nothing but trade this Fed chair polymarket, what would you do?

I’d read Grant’s Interest Rate Observer. I’d watch the 10 year to 2 year spread. I’d watch Treasury auctions. I’d run statements from the White House through Claude or Gemini and model them against the spread movements. Watch who’s talking publicly and who’s not talking publicly on matters of interest rates.

And honestly? I’d go see Matt behind the bar at the Old Ebbitt, get some crabcakes, and ask what he’s hearing. He’s going to have better sources than anyone at the WSJ or the FT. That’s really what I’d do.

The 10 year yield almost hit 4.8% in January. Do you have a view on overall bond market health?

If I had a strong view on that, I wouldn’t be running a startup right now. I’d be retired.

The thing I find most interesting is Japan. There’s new leadership, a new tone. They’re in a funny spot with their macro and demographic scenarios. As the marginal buyer of US Treasuries for the last 30 to 40 years, are they going to change their behaviors? Will this impact the carry trade?

If the Bank of Japan gets more hawkish and Japanese short term rates start getting closer to US yields, that unwinds a bunch of stuff. It underpins a considerable amount of market liquidity. Every day I try to read and get smart on Japanese macro.

Disclaimer

Nothing in The Oracle is financial, investment, legal or any other type of professional advice. All odds are time sensitive. Anything provided is for informational purposes only and is not meant to be an endorsement of any activity or market. Terms of Service on polymarket.com prohibit US persons and certain other jurisdictions from using Polymarket to trade, although data and information is viewable globally.