🔮 What’s Happening on April 2?

A Day of Destiny in Trump’s Trade War

This weekend, the timeline was filled with chatter about an auspicious date in Trump’s trade war:

Why is April 2nd so important?

The first mention of the date came on February 14 at an Oval Office signing ceremony. Since then, Trump has been turning up the hype about the day after April Fools, calling it “a liberation day for our country.”

So what exactly is coming on April 2? And is it bullish or bearish?

No one knows for sure, but the elevated odds for a US recession in 2025 may contain some clues:

On Polymarket, traders shrugged off early chatter about the trade war, which was seen as more of a negotiating tactic than a real policy.

But odds of a recession this year spiked after Trump expanded his tariff plans to include the EU and other close US trade partners.

Recession odds cooled slightly on dovish language at the Fed’s March 18 meeting, but remain above the baseline of around 22% odds for a recession in any year.

The “Dirty 15”

On March 23, we saw the first pre-rollback of the plan, with a report that the White House was narrowing the April 2 action to exclude specific sectors such as cars and chips, but that Trump is still planning to hit close trading partners with blanket tariffs.

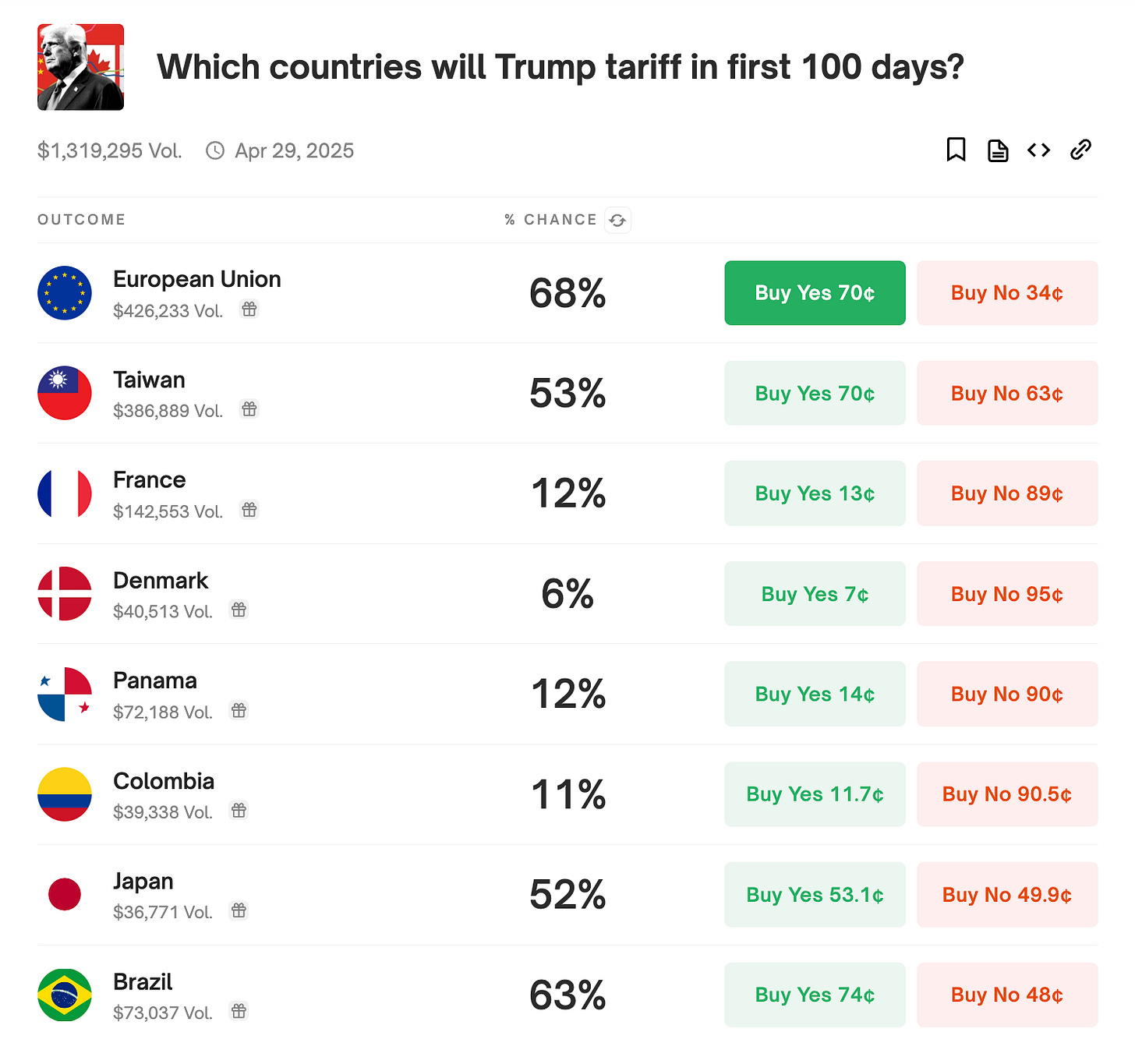

Who will get hit? The Trump Administration has coined a term the “Dirty 15” which refers to countries with the highest tariffs and non-tariff barriers on trade with the US.

What Markets Say

Trump’s tariff moves have coincided with a 10% drop in the S&P and a doubling in recession odds on Polymarket.

While we wait for the big day, a number of markets give us a picture of what is likely to go down in the coming weeks.

Mexico: 🔮 26% chance tariffs removed by May

Canada: 🔮21% chance tariffs removed by May

Who’s Next?: The EU, Taiwan, Brazil, and Japan, all on the “Dirty 15” list, are at elevated risk of getting hit with some additional tariffs, but there’s still a better than 30% chance they are spared.

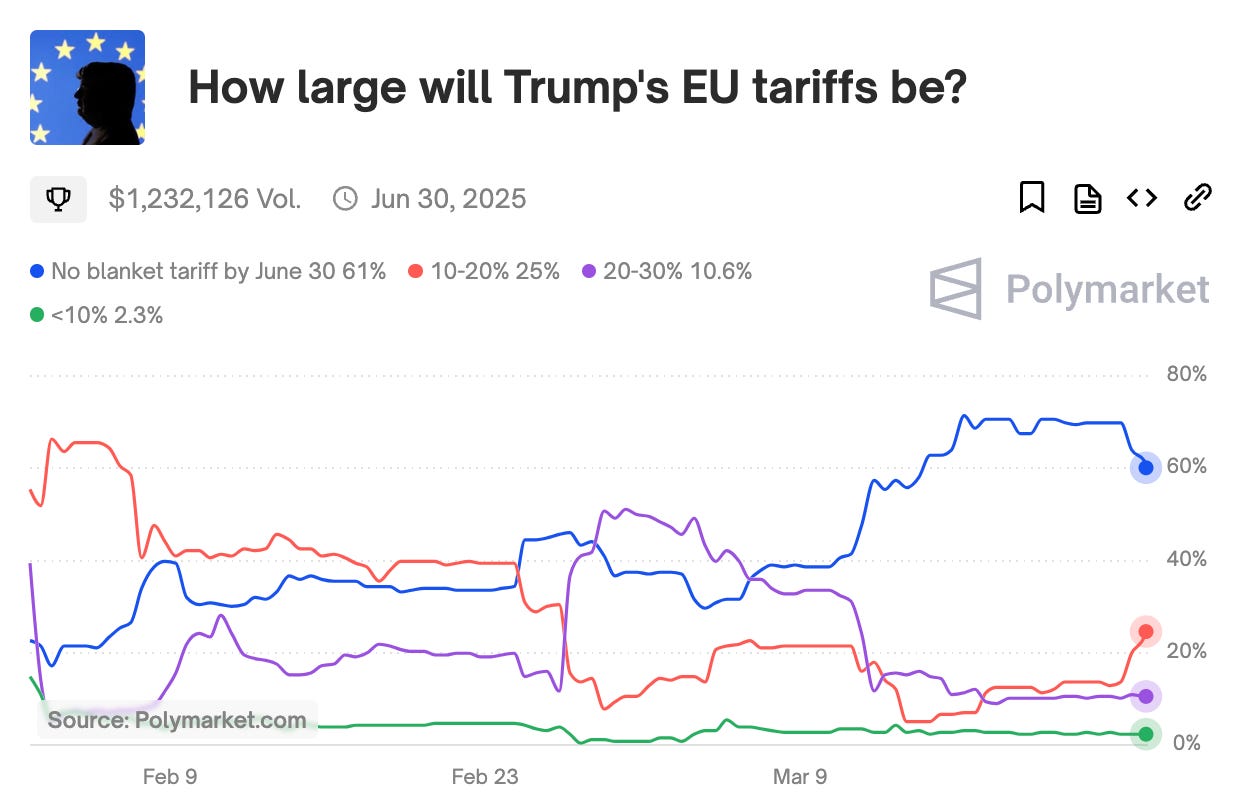

Size? The market on the size of Trump’s EU tariffs gives more clues, with a 61% chance for no blanket tariffs on the EU, and ~36% odds for the tariffs to be between 10-30%. The market seems to be telling us that further reductions in scope are likely.

Likely Fallout

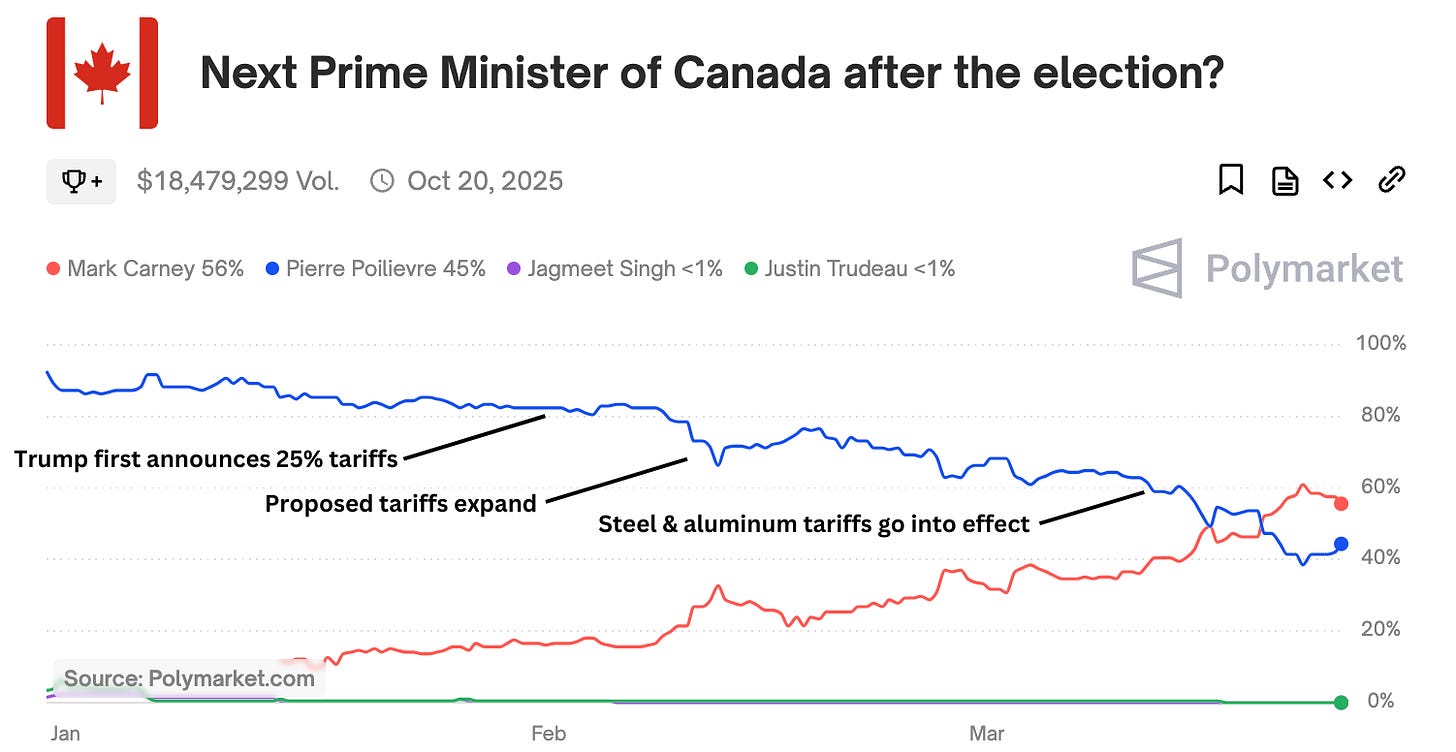

Canada. The biggest political impact of the trade war has been the flipping in the Canadian Prime Minister race. Since Trump was inaugurated, there has been a rapid 100 percentage point swing away from the Conservatives, with large moves coinciding with news developments in the trade war.

Expanding Trade War. There are also strong signals that the trade war will begin to widen as countries react. There’s now a 🔮 73% chance Mexico imposes tariffs on China by July (a condition requested by Trump in negotiations) and a 🔮72% chance the EU imposes tariffs on the US by May.

As with all Trump policies, the trade war is a moving target, and we’ve already seen at least one major change to the policy before its rollout.

Markets continue to price a wide range of outcomes as countries scramble to cut deals and jockey for position. But perhaps the most important market to keep an eye on is “Will Trump Impose Large Tariffs in the first Six Months.”

This market looks at the aggregate tariff level across all US international trade, and is pricing just slightly better than even odds for tariffs to exceed 5% - a doubling from current levels.

If it happens, that would put tariffs back to levels not seen since Gerald Ford slapped taxes on imported oil in response to the oil shocks of the early 1970s. This policy lasted about 7 months before being rolled back.

Connect With The Oracle

Tips? Feedback? Story ideas? Write oracle@polymarket.com or @wasabiboat on X

NEW: We’re On X: Follow The Oracle for updates

Write for The Oracle: We’re expanding our coverage and looking to hire more writers and investigators. Details Here.

Disclaimer

Nothing in The Oracle is financial, investment, legal or any other type of professional advice. Anything provided in any newsletter is for informational purposes only and is not meant to be an endorsement of any type of activity or any particular market or product. Terms of Service on polymarket.com prohibit US persons and persons from certain other jurisdictions from using Polymarket to trade, although data and information is viewable globally.