🔮 TARIFF ON, TARIFF OFF

24 Hours in the Trump Trade War PLUS: BBB Senate trouble? Trump vs Apple, India-Pakistan Flareup?

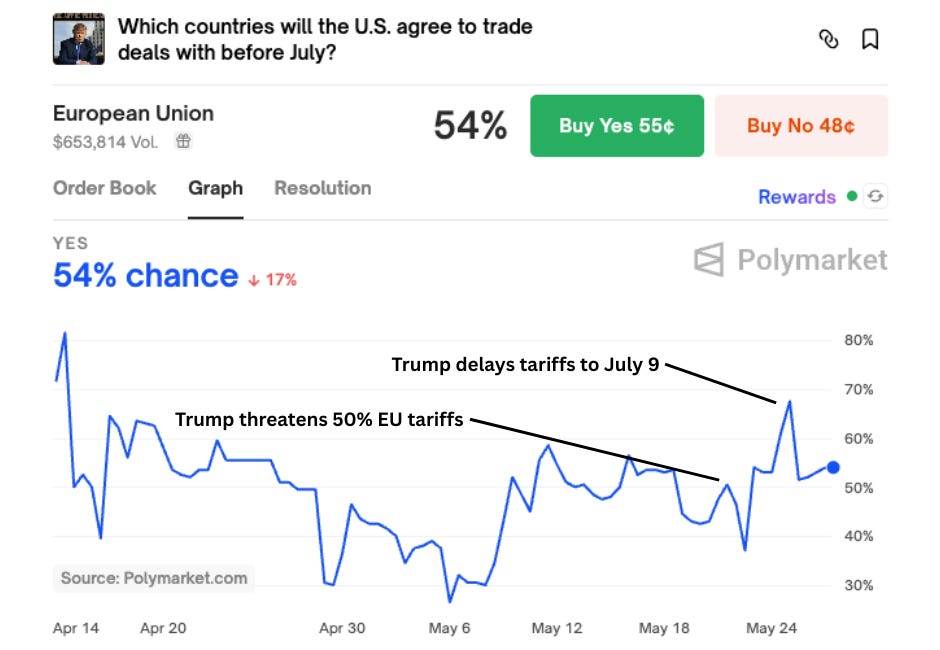

EU Tariffs

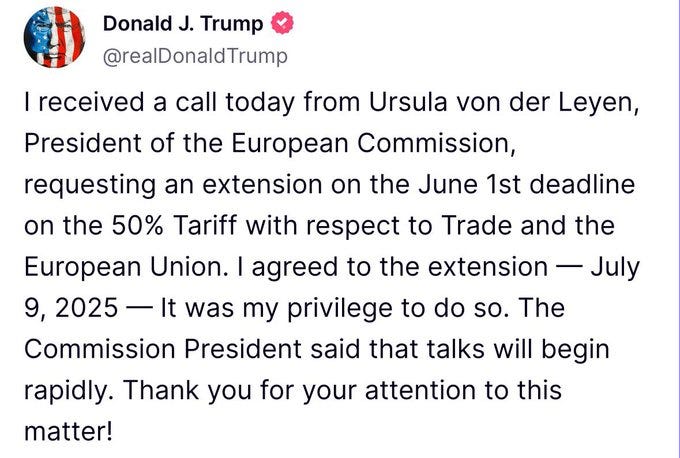

On Friday morning, Trump was “recommending” 50% tariffs on the EU. But by Saturday, the Europeans had been given a reprieve until July 9.

On Polymarket, swings in tariff markets have been getting more subdued as traders put less faith in each individual announcement.

Looking at Trump’s recent tariff announcements, there is a 5/7 rate of announcements converting to reality:

Made in the USA iPhone?

Also on Friday, Trump took aim at Tim Cook and Apple:

Moving iPhone production out of China wasn’t enough. We need those phones made in the USA.

Will it happen?

Here’s where the markets are shaking out:

Will Apple assemble iPhones in the USA? 🔮 Don’t count on it.

Rising iPhone 17 prices? 🔮 Probably

Apple Largest Company end 2025? 🔮 The tariffs have hurt Apple’s odds

BBB Senate Trouble?

Mainstream media outlets want you to think that Trump’s big economic bill is facing hurdles in the Senate after passing in the House last week in a 215-214 vote:

GOP fears Trump’s ‘big, beautiful bill’ is ‘debt bomb’ (The Hill)

Republican Senators Rebuke 'Immoral' Trump Bill—'Emperor Has No Clothes' (Newsweek)

GOP senator says resistance to Trump's 'Big, Beautiful Bill' could stop it in the Senate (ABC News)

But Polymarket traders are calling BS, giving overwhelming odds that the bill is passed over the summer, and that it will contain most of what Trump wants.

👉 What will be in the Reconciliation Bill?

BTC Lookin’ Good Here

Everyone and their mother, cousin, sister, and barber is now launching a Microstrategy-esque BTC accumulation vehicle:

Trump’s Media Company to Raise $2.5 Billion to Buy Bitcoin (WSJ)

GameStop Announces Update to its Investment Policy to Add Bitcoin as a Treasury Reserve Asset (Gamestop)

David Bailey's Nakamoto Holdings Going Public Via Merger With KindlyMD; Shares Soar 650% (Coindesk)

And while some are warning of leverage building up in the system, the price forecasts on Polymarket look good for now.

Odds of BTC hitting $130k this year have soared since mid-April.

India-Pakistan Flareup?

For a moment last month, it looked like a full blown war could erupt between India and Pakistan following a terror attack in Kashmir.

But the market believes that the ceasefire is likely to hold through much of the summer.

🔮 13% odds of an India strike on Pakistan before August

🔮 13% odds of a Pakistan strike on India before August

Disclaimer

Nothing in The Oracle is financial, investment, legal or any other type of professional advice. Anything provided in any newsletter is for informational purposes only and is not meant to be an endorsement of any type of activity or any particular market or product. Terms of Service on polymarket.com prohibit US persons and persons from certain other jurisdictions from using Polymarket to trade, although data and information is viewable globally.

Yes. The mkts have been news driven.