🔮 STABLE?

Here are the 5 riskiest stablecoins, according to Polymarket traders

By Flyu

While stablecoins are just under 10% of the total crypto market, their failure can cause cascading risks, as we saw with the $45b collapse of Terra (UST) that ultimately took out FTX in 2022.

New stablecoin polymarkets let traders forecast which stables will depeg, or lose their 1:1 correlation with the dollar, by a given date.

Looking at polymarket depeg odds side-by-side gives us a market-driven stablecoin risk rating that can be useful for builders choosing which coins to integrate into their apps and users looking for the safest place to park funds.

Stablecoin Risk 101

The polymarkets mentioned in this article use Pyth (a price oracle service) as the resolution source.

The rules for these markets specify that if a 1-minute Pyth candle closes under 98 cents before the deadline, the market will resolve to “Yes,” indicating a depeg.

This is a fairly strict standard. Just because a stablecoin depegs for a minute doesn’t mean it will necessarily enter a Terra-like death spiral. And stablecoins often fluctuate around the $1 mark due to temporary market conditions.

With those caveats aside, let’s take a ride through the stablecoin danger zone:

USD0 (Usual)

Depeg Risk: 9% by end 2025

Market Cap: $540m

Backed By: T-bills

USD0 by Usual is an Real World Asset (RWA) backed USD stablecoin, a tokenized basket of US treasury bills. At the moment, USD0 is 101.29% collateralized.

While USD0 has not depegged before, the staked version (USD0++) has. The staked token used to be redeemable at a 1-to-1 ratio for the stablecoin, but the team suddenly set a price floor for redemption of $0.87, causing mass panic and a repricing of the USD0++ coin.

While the staked token depeg did not have an effect on the stablecoin itself, it does highlight risks with staked versions of stables transmitting risk to the underlying stablecoin, especially if they are redeemable at a fixed rate (usually 1:1).

2. USR (Resolv)

Depeg Risk: 7% by end 2025

Market Cap: $216m

Backed By: Delta-neutral hedging strategy with token insurance layer

USR’s design is similar to Ethena’s USDe (see #3 below) but adds an insurance token RLP as first defense against losses. While the RLP may help initial depeg scares, it carries the same unique risks that USDe has, and large losses may bleed into the underlying stablecoin price, if the RLP cannot manage to offset the potential losses incurred.

3. USDe (Ethena)

Depeg Risk: 5% by end 2025

Market Cap: $7.8b

Backed By: Delta-neutral hedging strategy

USDe is a crypto collateral backed stablecoin created by Ethena Labs. Rather than being backed by dollars or cash equivalents, it is backed by crypto tokens that are hedged delta-neutral to generate yield.

Besides the general risks of stablecoins, Ethena’s USDe has multiple additional risks given their collateralization strategy. Some notable ones are smart contract risk from their crypto collateral tokens (such as stETH,) depegging, the possibility of long term negative funding rates, which would force them to pay funding instead of earning funding in order to remain delta-neutral, the exchange custodial risk of their short positions, and the auto-deleveraging of their short positions, which would leave them in a directional position instead of being hedged.

Some of these risks played out, if only for a brief moment. On October 10th, panic regarding potential auto deleveraging of Ethena’s shorts caused the USDe stablecoin to wick as low as $0.65 on Binance.

Ethena has also seen high redemptions recently, causing its market cap to shrink from its October high of nearly $15b. While market cap does not say anything on its own, it can be indicative of consumer sentiment and confidence in a stablecoin.

4. USD1 (World Liberty Financial)

Depeg Risk: 4% by end 2025

Market Cap: $2.8b

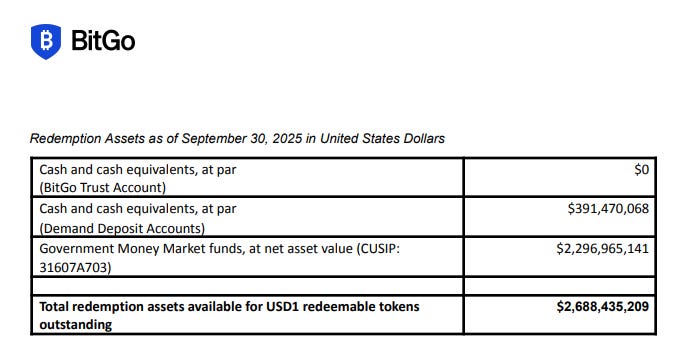

Backed By: Bank deposits and money market funds

USD1 by Trump-family connected World Liberty Financial is a pretty standard USD-backed stablecoin. The coin’s relatively high risk rating seems related to the fact that USD1’s reserve statements are less transparent than other large USD-backed stablecoins.

It is quiet about where exactly the money is held and what form it’s in. The money market funds detailed in the reserve don’t break down what exactly the money market fund is investing in, as well as how much cash is actually in cash versus cash equivalents.

5. USDTb (Ethena)

Depeg Risk: 4% by end 2025

Market Cap: $1.3b

Backed By: Tokenized money market fund

USDTb is Ethena’s take on a USD pegged stablecoin. Rather than relying on collateralized tokens such as ETH, it’s managed by Blackrock’s tokenized money market fund, BUIDL. Most of the additional risk will fall onto Blackrock’s shoulders and how well they manage to secure the reserves.

While Blackrock is an extremely large and trusted asset manager in traditional finance, they are not known for custodial services for cryptocurrency. The reserves being difficult to find and the smaller size of this stablecoin also do not inspire confidence.

Good News, Bad News

The good news here is that the riskiest stablecoins, according to Polymarket traders, are all quite small compared to the $45b UST, whose collapse kicked off the 2022 crypto winter.

Yet it’s important to note that even the safest coins are not immune to temporary depegs. For example, USDC by Circle (2% depeg risk this year) is the second-largest and most widely used stablecoin, second only to the giant USDT. It has undergone deep regulatory scrutiny, and frequent audits.

Still, USDC depegged temporarily in 2023 due to concerns that 8% of its reserves were held in Silicon Valley Bank, which filed for bankruptcy that year amid US government pressure. The US government stepped in, however, and ensured the funds held in SVB would be returned, which caused USDC to return to peg within about 48 hours.

PYUSD, backed by Paypal, also illustrated the perils of centralization risk, when $300 trillion was minted in October this year due to a typo. While the excess coins were quickly burned, the incident highlights the potential for bad actors to do the same thing if there was ever a security breach.

The recent turbulence in crypto markets have led some to worry that lower volume, orderbook illiquidity, and negative funding rates could see stablecoin risks spike. These worries, however, have not translated to higher odds for large stablecoin depegs, at least by end-of-year.

Disclaimer

Nothing in The Oracle is financial, investment, legal or any other type of professional advice. Odds are time sensitive and subject to change. Anything provided in any newsletter is for informational purposes only and is not meant to be an endorsement of any type of activity or any particular market or product. Terms of Service on polymarket.com prohibit US persons and persons from certain other jurisdictions from using Polymarket to trade, although data and information is viewable globally.

Either collateralized by treasuries or just a crypto speculation. If T’s then fine. But stupid to give up yield eg tether.

A london polymarket addict https://youtu.be/1vj7jnA2Pyg