🔮 RISK OFF

“Scottilicious” won so much money on Polymarket he had to hire a personal risk manager

Scottilicious is a Polymarket whale with over $1.3 million in lifetime trading profits, mostly accumulated since mid 2024. A political science PhD dropout, he developed his edge by applying psychology to politics trading. The Oracle spoke with him to discuss his unconventional Fiverr method for researching overseas elections, and why he hired someone to stop him from betting his entire bankroll on rules disputes.

This interview has been edited for length. All answers are his own.

What’s the back story of Scottilicious?

I bought Bitcoin in 2011 and kept up with the crypto space. Bought some ether, bought some Aave, did some other stuff in crypto. In 2020 I noticed Polymarket, tested it a little bit, made $30 or 40k, then left it alone.

Then in 2024 I was taking care of my dad in Europe. My dad was a very kind man but also had a great intuition and knack for predicting things, and oddly enough was a lifetime horse gambler. He was in his last days, 90 years old, and I found myself with a lot more time than usual.

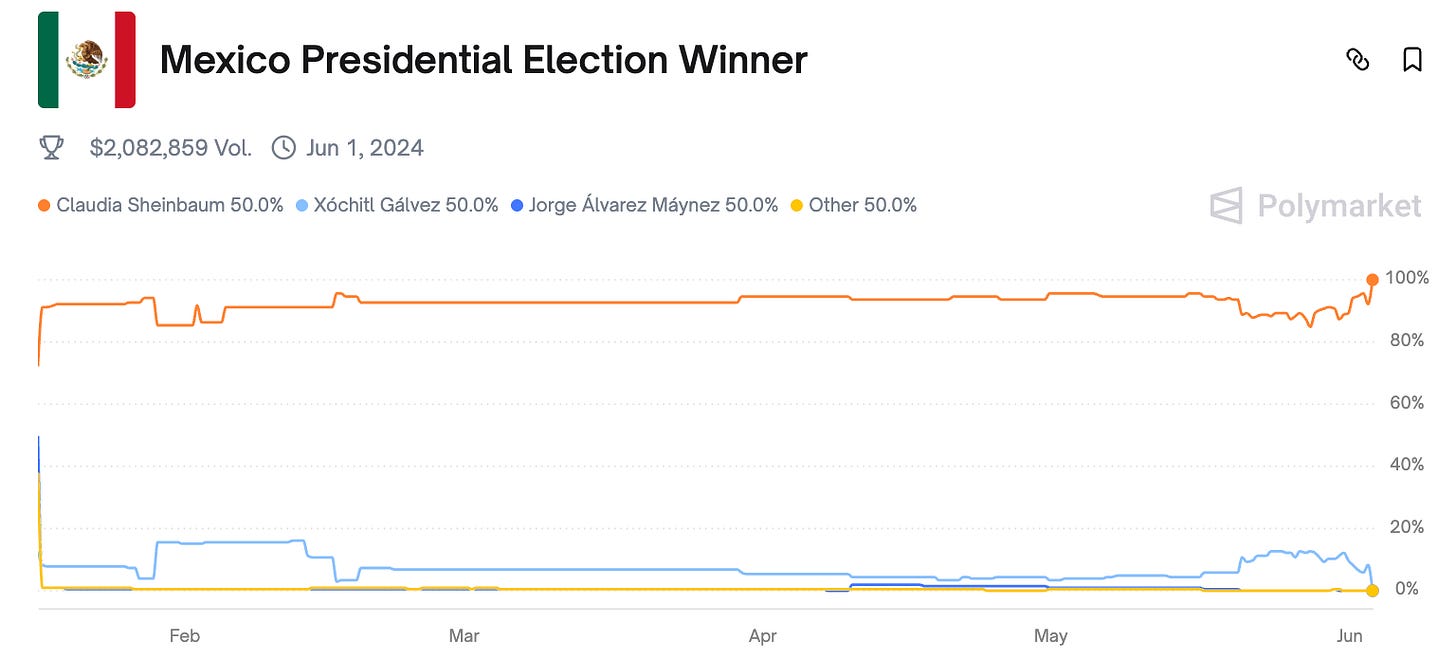

I placed a decent sized bet on the 2024 Mexican election, which was more of a coronation than an election. It was Claudia Sheinbaum who had been pretty much chosen by the prior leader. It was evident to me she was going to win. That was the start of my really successful year. It kept me busy while taking care of my dad and turned into a whole new business.

I made like 8% for something that had a 99.8% chance of happening. I look for those discrepancies. There’s a lot of meat in bets that are from 70 to 90 cents. Those are some of my favorites. I do like to bond, but the best is when you have something at 80 or 85 cents where the fair value should really be 99.

When you say it was 99.8%, where did that number come from?

It’s qualitative, not quantitative. I am somewhat familiar with the history of Mexico. Mexico for many decades was ruled by the PRI, the Revolutionary Party. Even though the PRI no longer rules things in Mexico, there’s sort of an institutional mentality where once someone is designated by the ruling party and they have decent political support, there’s a good chance that person is going to win.

On Biden, you were on “not resign,” but not the dropout question?

This was one of my biggest wins, was when there was a lot of noise on right wing media about Biden resigning the presidency. He had decided not to run, but he had fought like hell to continue running despite everybody telling him he shouldn’t. How on earth is a guy who fought like hell to continue running going to just give up the presidency? The chances were, in my opinion, less than 1%, but it was a 16 or 17% return in less than a week.

You’re doing a lot of politics polymarkets. Do you have a background in politics?

I’m a dropout from a PhD program in political science. I learned pretty quickly that I had to really kiss ass to the professors to get someone to sponsor my thesis. I thought, okay, I’m making 15 grand a year as a TA. This was back in the mid-2000s. The level of ass kissing I was going to have to do, I realized, would be like working on Wall Street for Goldman Sachs. I figured if I’m going to have to do that level of ass kissing, I might as well go make some real money and not be stuck at the library 10 hours a day.

What’s your research process? Are you just reading Google News and the papers? Or are you developing sources and doing research in off the beaten track areas?

I would say all of the above. I’ve been reading the newspaper since I was six. For international predictions like Korea, Chile, and a few others, I went sort of off the beaten path and started interviewing people from those countries. I didn’t interview them to figure out who was going to win. I interviewed them to figure out which prediction was the safest.

But when you get across the board, regardless of political affiliation, age, gender, type of business, income, and they all tell you there’s no way this guy will make it, that’s my edge. That’s not a news source or a quantitative source. It’s just narrative research.

How do you find ten South Koreans from different walks of life to speak with?

I have a pretty extensive network. I knew like five Korean expats. Chile, same thing. I knew five Chileans that were expats. Then it’s like, okay, who else do you know from that community? Can I talk to them?

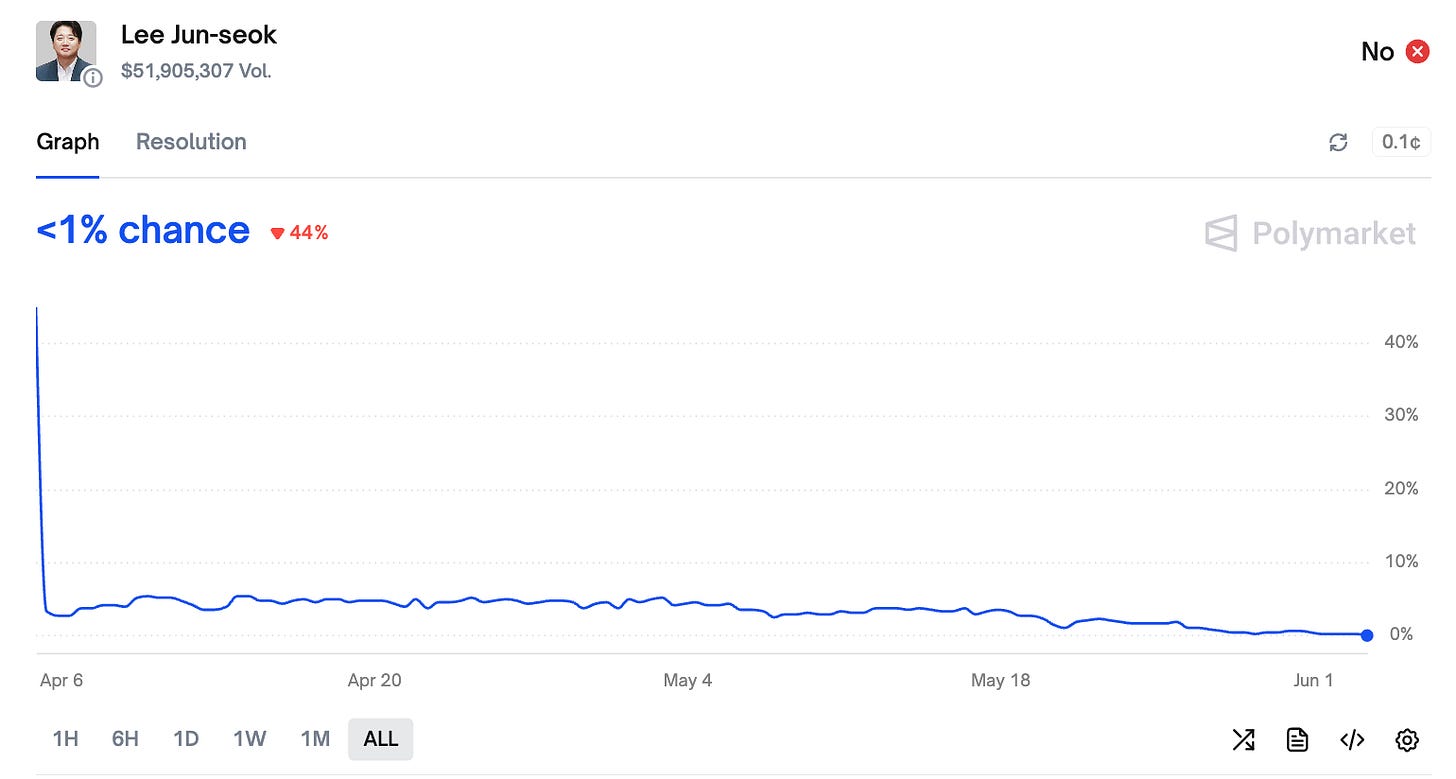

For Korea, I went as far as to go online and find people. I put a really huge amount on that, maybe 600k on the “No” for that guy. So I wanted to be damn sure. I went to Fiverr or one of those online worker platforms and just paid people to give me their opinion.

Can you walk me through that Korean election trade in detail? What questions did you ask?

I think his name was Lee Jun-Seok. First I did the research on him online. There was a lot of negative sentiment online about this guy. Korea’s kind of a conservative society, and he had been accused of being with a prostitute or something. He was young and very arrogant.

I asked one guy I knew, and he said this guy will never make it. That prompted me to ask four or five other people. They all said there’s no way. He’s arrogant.

It wasn’t like with Trump, where you ask 10 people across the United States and three or four are going to be supporters. With this guy, there was not one supporter. So after digging through the initial five people firsthand, I went online on Fiverr, and said ‘I’ll pay you X amount of money for an interview.’

It’s interesting because everybody had a different take on who was going to win the election. Different takes on Chinese influence on Korean politics. You could sort of get an idea of where they were coming from. But across the board, they were in agreement that there was no way this guy could be elected.

Do you feel like there’s more juice on Polymarket today in other countries versus US politics?

No, it’s case by case. There’s also a huge component where I feel I have really good intuition about human behavior.

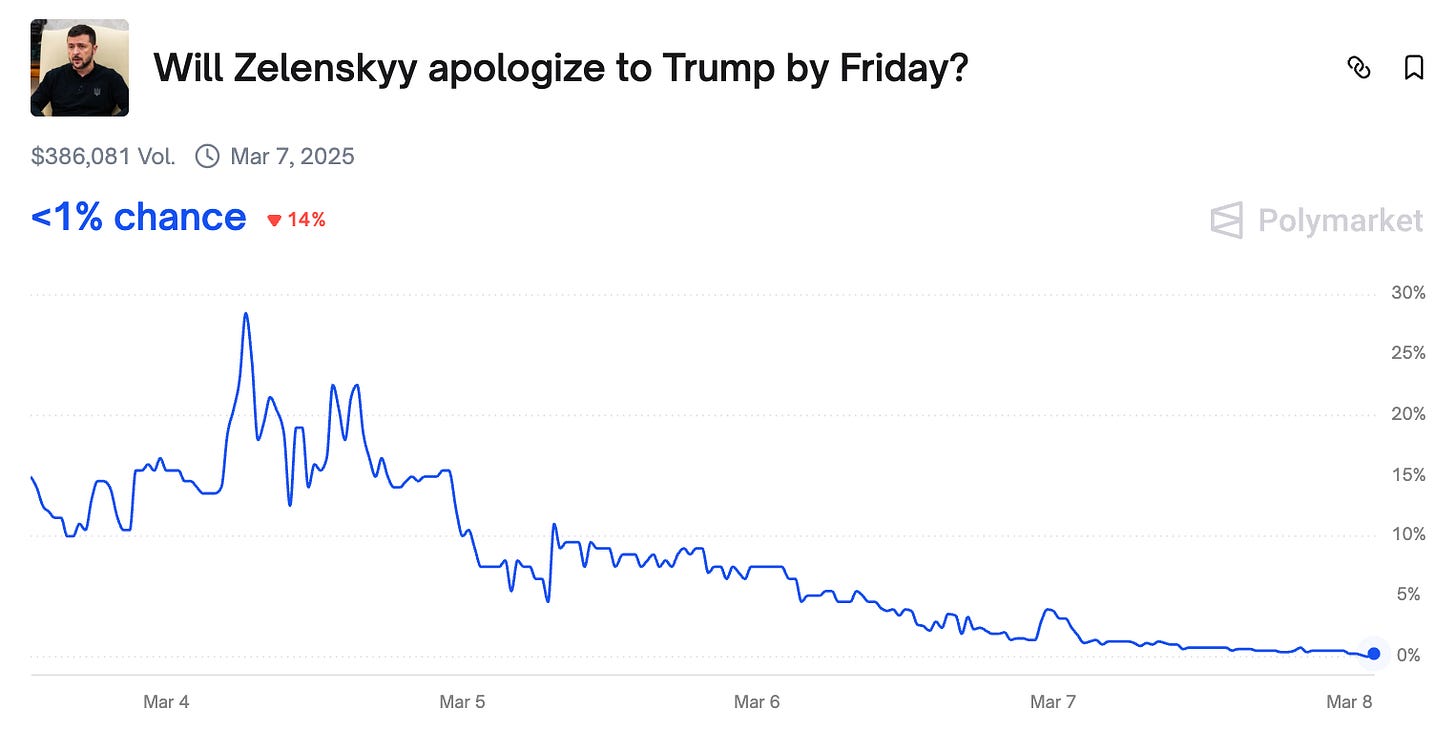

There was a Zelensky market where people were hypothesizing he might apologize after that crazy press conference at the White House. You remember, when he was yelling at Trump and Vance?

My take was Zelensky is not a guy who follows standard diplomatic protocol. He’s a fighter. His country’s been at war. He hasn’t worn a suit in a long time. There was also a certain dynamic where I felt Trump and Vance were bullying him a little bit. You’ve got this skinny, scrawny Jewish guy, who’s leading a country at war, and you got these two tall white guys talking smack to him.

Then there’s a question about whether he’s going to apologize. I’ve been that guy. I mean, I’ve never led a country at war, I don’t want to seem like an egomaniac, but I’ve been that guy in a room with bigger guys trying to bully me, and there’s no fucking way I’ll apologize. So the human behavior was: this guy’s not going to apologize. That resulted in 15% in three days.

A recurring theme is that human behavior transcends political parties. Alfred Adler, the famous psychologist from the Vienna school, one of the big three with Jung and Freud, one of his main contentions was that conflict is a natural part of being in a community. He urged people to embrace the conflict, let it play itself out.

Are there any other books or psychology concepts that have been helpful?

I’ve traveled to over 50 countries. Human beings are human beings. They don’t toe the line. You saw it with the meeting between Trump and Mamdani. Who the hell expected that? They relate to one another as human beings.

People also don’t always do what they say they’re going to do. I did really well on the Kanye coin thing because Kanye was acting like he was going to launch a coin very quickly. I’ve had a lot of experience dealing with eccentric people. Kanye clearly has some kind of mental stuff going on. My life experience is that bipolar people don’t just make a decision, especially when it comes to money, and do it. They’ll hesitate, wait, say things that don’t make any sense, then backtrack a little bit.

That was my analysis of Kanye, and it ended up being correct. That was one of the most stressful predictions I’ve ever made, but very lucrative.

Do you consider yourself a full time Polymarket trader? You mentioned you have a team. How does that work?

I think Polymarket is about 50% of my working time now. A lot of it is borrowing against crypto holdings, so how much I can have in there depends on the price of Ether. I did scale up after a few months of success. I thought, okay, I’m doing okay at this.

The team pretty much consists of one person I hired a few months ago to be the Risk Manager. The general thesis was, when I got to the million dollar mark, I made a million dollars and I don’t want to give it back.

My dad was a very kind man, passed away rich in loved ones but with little money. In addition to the love, he could’ve used a decent risk manager.

Tell me more about the risk management person. What were you doing before, and what changed?

The dynamics of Polymarket have changed. There were instances in late 2024 and early 2025, up until maybe late spring 2025, where you could ape into bets that had already been decided on UMA and other people were taking the other side. You could put $800k into something that would pay off 2% but had already been decided.

Those bets started becoming more nuanced, especially with the Zelensky suit thing. I know myself too well. If there’s something trading at 96 or 97 and the fair value should really be 99.7, I may just ape into it to the tune of $800,000 or a million dollars.

The problem is, even if the fair value is 99.5, every 200 of those you’re going to lose your ass. I’m heavy on Polymarket, so I don’t want to make it to 3 million in a year or two only to lose all of it in one funky bond.

So this guy was basically hired to make sure I don’t do that. With him on board, I don’t go more than maybe $300k to $350 max on those types of situations.

You were ripping your whole account into 2% bonds?

Sometimes, yeah, to get to the first million. I justified it because I’ve been a risk-on entrepreneur in other venues. I know that to get to the first million dollars, you have to take risk, especially if you’re trying to do it quickly. Some of those bonds had already been decided by UMA. It was crazy.

Let’s talk through some of your current trades. Will Mamdani open grocery stores, “Yes.” You’re underwater on that one…

My thinking is he’ll probably do some type of partnership. He was, after all, sponsored by billionaires. He has access to as many wealthy people as the Republican or moderate Democrat candidate did. And he’s super charismatic.

Charisma is a big thing for me. I put some serious money on Graham Platner and I think he has the charisma. There’s also a trend where people who are outside of the normal political party hierarchy are just way more successful in this era than they were 10, 20, 30 years ago. That’s a similarity between Mamdani and Platner.

I didn’t put a ton of money into the grocery store thing. Sometimes when I make money on a certain market, like I did really well with Mamdani, I’ll take a couple thousand and see if he can get the grocery stores going.

“No” on Ghislaine released from custody this year?

There’s just no way. That’s a conspiracy theory divorced from reality. Donald Trump is very media savvy. He has an amazing survival instinct.

I’m going to stay diplomatic and not call him an idiot. I don’t think he’s very bright. I don’t think he can assimilate huge amounts of data the way an Obama could. But I also think he has this incredible survival instinct and he’s very media savvy. He knows that if he released Ghislaine Maxwell, it would create an incredible disaster with his supporters. I bet on that way before he relented on the Epstein vote.

Walk me through your big Graham Platner trade for Democratic Senate in Maine. Isn’t he the guy with the alleged Nazi tattoos?

He’s a community organizer. Obama was also a community organizer. He’s got the support of Bernie Sanders. He’s able to fill stadiums. He sounds like a regular guy, not a politician. Even though he’s a regular guy, he does well in front of crowds, keeps his composure, fairly eloquent.

Even the tattoo thing. The tattoo thing isn’t an SS symbol. It’s not like a swastika or SS, it’s a skull. So to me it’s not even an overt Nazi symbol. That’s largely dirty politics by the DNC that I’m sure helped fans of his opponent put out that interpretation.

I have a friend who I gave a tour of Paris to. His wife happens to be African American, and he got a fleur-de-lis tattoo on his arm, which is considered a white power symbol in France.

I think we live in a populist era, and that transcends both sides of the political spectrum. You saw it with Trump on the right, with Mamdani on the left. Before Mamdani, you saw it with AOC. A progressive mayor just got elected in Seattle. There’s a hardcore anti-establishment trend.

Mills [Platner’s opponent], was nominated by, of all people, Chuck Schumer. She’s 77 years old for Christ’s sake. She has a hard time putting a sentence together. She’s saying she wants to do this for her grandchildren. To me it almost sounds like Joe Biden.

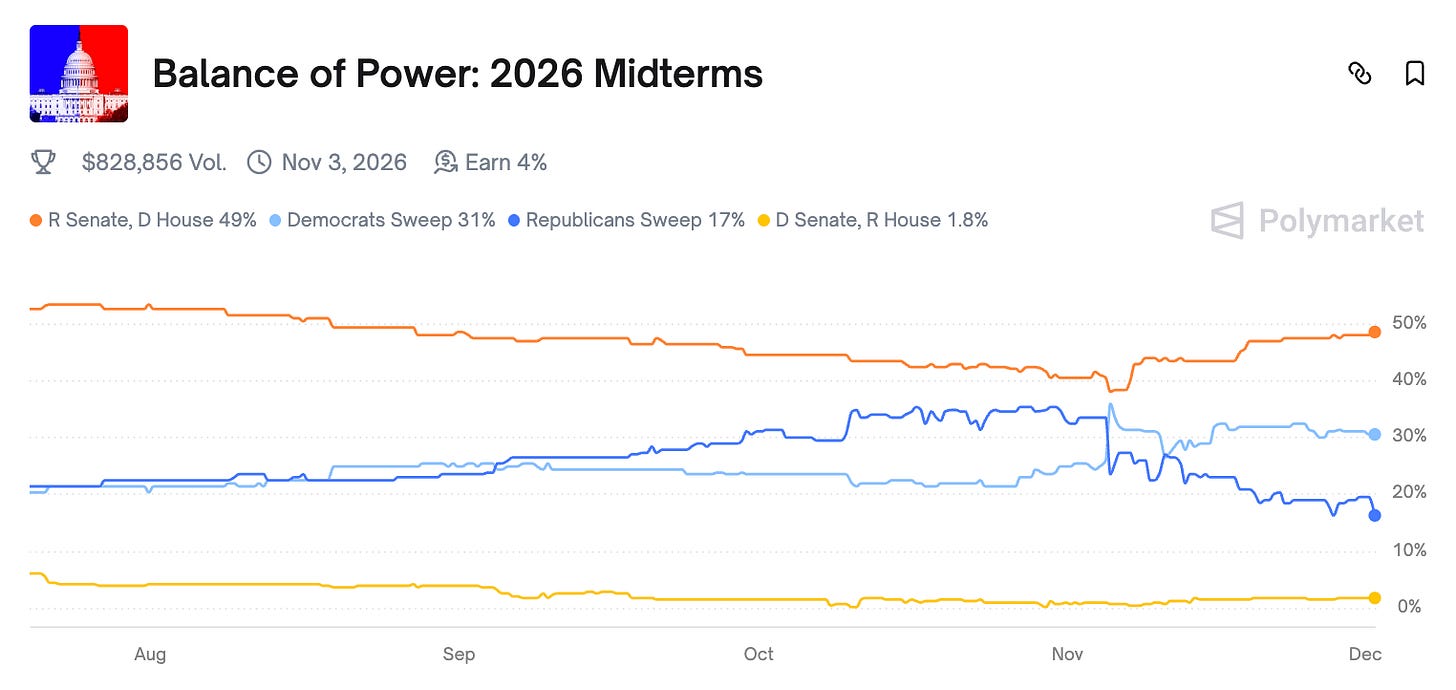

For the midterms, you have a smallish bet on Dems taking the House, Republicans keeping the Senate. Why aren’t you more sized up? Are you worried about redistricting?

At this point I think the Democrats could actually win the Senate. So I wouldn’t upsize that bet. I have a few brilliant people in my life — Pamela, Hillary, and Uri — who are not traders but I really trust their opinion and like to discuss these things with. Sometimes I’ll make a small bet on a market I want to keep an eye on. That’s the case with that market. I don’t have super high conviction on that.

I’m waiting to scale up on this though. A month before is really the sweet spot. You have values that are still fairly high, but you can kind of get a sense of where things are headed. I would say four to six weeks before is the real sweet spot.

Gavin Newsom for president is the one presidential candidate I see in your portfolio. Why don’t you have a Vance position?

I think Newsom will probably get to the mid 40s, and I can sell in the mid 40s. I don’t think he’s necessarily going to get it. I don’t think JD Vance is going to be the next president. He lacks the charisma Trump has, even the charisma Newsom has. He comes off as inauthentic. You said the guy was like Hitler, then a year or two later you’re working for him and you’re his VP. All these politicians can be accused of being inauthentic.

Where is the Gavin Newsom video that makes you think, damn, this guy is charismatic?

He was somewhat charismatic in the debate against DeSantis. I get what you’re saying, he’s not. But the charisma doesn’t necessarily have to come from him individually. He’s leveraged, I don’t know where he’s getting all the Trump trolling from. It sounds like Hollywood writers. He’s leveraged these Hollywood writers to say really funny things and getting some good social media traction. I somehow put that under the charisma banner, even though that’s not the proper word for it.

Maduro in Venezuela. Are you not confident he’ll stay around through the end of the year?

I did a good amount of research on Venezuela. I think he probably will stick around till the end of the year. It’s just too fucking stressful for me. I don’t know if I can handle that level of stress through the holidays for another five weeks.

I think he’ll probably stick around through the end of the year. He’ll definitely stick around through the end of the month. Goodness knows we’ve tried to do regime change in Cuba for 70 years. I think he could get knocked out of there.

The chances are not impossible for something to happen in December. But I think the fair value is probably more like 92 to 95%, which means it could still happen, which means it’s going to stress me out over an extended period of time. I’d rather not deal with that stress.

Are there any other traders you respect? If you see them on the other side, do you reconsider?

I like aenews. I think he’s very bright. I actually met him in person recently. He’s very sharp.

I don’t even know how to pronounce it, but Jabvek is very good. He has a really incredible quant methodology but he is overconfident sometimes.

I beat most of the quants in Romania [presidential election] by just staying out of that bet. They were all so confident. I was just like, you know what, this isn’t it. If you’re applying your quantitative methodology to Norway or Sweden, a country that’s really super developed where people are generally honest, a high earning economy, that’s one thing. But Romania is not that.

Romania is also on the forefront of what some people have termed the beginnings of World War III, with great power influence between the United States and Russia and NATO. God knows what their intelligence agencies are doing over there.

Those quant guys like him, I respect them tremendously, but sometimes they don’t incorporate enough outside variables that could influence things.

Final words of wisdom for someone joining the space?

It depends on their tolerance for risk. Every case is specific. If they’re the entrepreneur type, they should be risk on. If they have something to fall back on.

If you’re fairly intelligent and 25 years old, it shouldn’t even really matter if you have something to fall back on, because what you have to fall back on is your intelligence and your age.

If you’re 55 years old or 45 years old, intelligent but you don’t have a ton to fall back on, you should be a lot more careful. If you managed to save up $100,000 working as a waiter for 20 years and you have a knack for certain markets, you don’t want to lose that $100,000.

But if you’re 25 and you’ve saved up $50,000, you have a lot more time to make that back if you lose. It depends on the person’s age and general life circumstances.

Follow Scottilicious on X @scottonPoly.

Disclaimer

Nothing in The Oracle is financial, investment, legal or any other type of professional advice. All odds are time sensitive. Anything provided in any newsletter is for informational purposes only and is not meant to be an endorsement of any type of activity or any particular market or product. Terms of Service on polymarket.com prohibit US persons and persons from certain other jurisdictions from using Polymarket to trade, although data and information is viewable globally.

That line where he says that there's a lot of profit to be had in 70 to 90% bets. That's one of those things that, as soon as I read it, just felt extremely true. Not obvious on its face, but obvious once someone says it. Like this is the range a lot of the retail guessers aren't going to go for and that's where you can get a lot of easy wins and stack up serious gains.

Thank You for another

Excellent

Read.