🔮 RFK HIDDEN GEM?

Top 2024 GOP Pollster Patrick Ruffini Handicaps the 2028 Field

Patrick Ruffini is a partner at polling and market research firm Echelon Insights. His book Party of the People forecast the shift of non-white working-class voters toward Trump a year before it happened.

While Ruffini doesn’t trade prediction markets himself, his firm conducts hundreds of private polls for campaigns and corporations, giving him a unique view into what moves voters. The Oracle spoke with Ruffini to discuss how the electorate is changing, trends in Trump’s approval numbers, and preview the 2028 field.

This interview has been edited for length. All answers are his own.

What did we learn about the US electorate in the 2024 election?

The 2024 election validated what we saw a year out. That big New York Times - Siena poll basically forecasted what ended up happening. The Democratic margin with non-white working-class voters has completely eroded. Obama won this group by 67 points, Biden by 45 points, and now Democrats are down to maybe a 20 to 30 point advantage with non-white voters. This used to be one of the main pillars of the Democratic coalition.

We saw it in focus groups throughout 2024. These voters were fed up with inflation and the direction of the country under Democrats. Surprisingly to some folks, they were also upset about immigration and the southern border. The thesis about an emerging Democratic majority didn’t bear fruit. Turns out Hispanic voters were almost as concerned about the immigration issue as the rest of the country.

Was there actually a problem with partisan pollsters polluting the averages in 2024?

I think that narrative is overblown for 2024. It was more of an issue in 2022. Trafalgar was flagged as one of the worst offenders in 2022, but their 2024 polls were within reason and pretty accurate.

The real issue is that polling averages aren’t as objective as people think. It’s dealer’s choice when it comes to what polls you include and what factors you count. The Nate Silver model versus the Elliot Morris 538 model can say different things because the forecaster decides the inputs.

Did anything surprise you about the 2024 results?

It was the non-battleground states. The battlegrounds get polled to death, but look at New Jersey coming into single digits, almost more competitive than Arizona which was a battleground.

The moment I knew Trump won on election night was the Loudoun County, Virginia result. It swung to Trump by nine points. That should not happen if Harris’s path to victory rested on wealthy suburban voters swinging further left. That was not a good sign.

2024 was the first election where Polymarket traders reportedly commissioned private polls to trade on. What do you make of the French Whale story?

We’ve tried that method [asking “Who are your neighbors voting for?”] and came up with similar results. But I’m careful about what we’re measuring. Are people simply repeating back the conventional wisdom that there’s a hidden Trump vote? I live in a blue suburb and don’t think my neighbors talk to each other much. Is this measuring something real, or is it just that the conventional wisdom happens to be true? I wouldn’t take it entirely on face value.

How much would it cost to commission a private poll? And would it be worth it?

If you’re just getting a horse race number, asking similar questions to what media polls are asking, particularly nationally or in heavily polled states, your one-off Pennsylvania poll probably won’t beat the average of the five Pennsylvania polls released publicly in the last 48 hours.

Now, if you have a unique thesis like the Polymarket whale did, if you have a question you think is better than the horse race question that no one is asking, sure it’s worth doing. But if you’re just gathering a sample from online panel companies without correcting for biases, you’ll have a garbage in, garbage out problem.

Why would anyone commission a poll in the first place if any one poll isn’t going to move the needle?

The reason the industry still exists is that clients aren’t coming to us in the final month of the election. They’re coming long before to figure out viability. They’re at 2% in the polls and need to get to 48%. How do I get there? That’s a fundamentally different model than what public polls are measuring. We’re charting a path to victory, not just measuring who’s ahead.

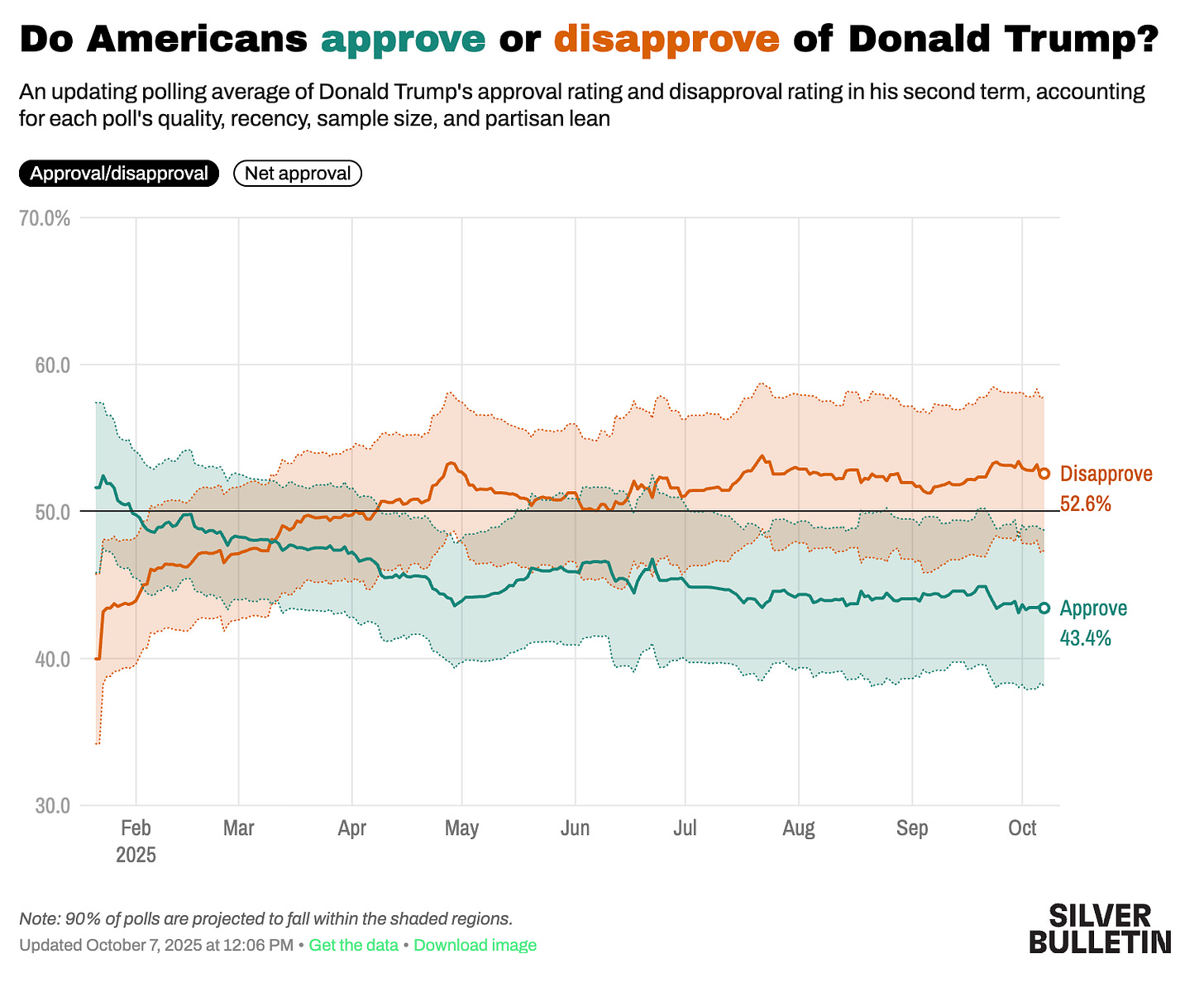

What’s driving Trump’s approval trends?

Trump is as known a quantity as we’ve ever had in American political history. It’s very difficult for anything to move him off his long term trajectory. He’s higher now than in his first term. A segment of Republicans has come around to him that wasn’t with him in 2016 or 2020.

We’re seeing much more stability across all presidents. In the modern era, going back to Obama, approval ratings have gotten more immune to shifts in the news cycle. Nixon could give a speech and his approval would increase 18 points overnight. That doesn’t happen anymore. But a two to three point shift can still matter a lot, probably the difference between a Republican House and Democratic House.

We’ve seen Trump’s approval slip since the start of his second term. Based on your research, what could he do to reverse this?

To be clear, I don’t think he’s making decisions based on polls. He says what he thinks, which is both his superpower and his Achilles heel.

If he were open to advice, I’d say focus on the part of the electorate that surged to him in 2024 who are still worried about cost of living. They’re the swing voters, who are also on the fence about voting or not voting in 2026. Greater emphasis on things in the Big Beautiful Bill like no tax on tips, no tax on overtime, those policies that reach voters not certain to turn out in midterms.

Looking at the 2028 Republicans, JD Vance is at 53% on Polymarket. Does that seem right to you?

Sitting vice presidents who maintain popularity with the base and are aligned with a popular president almost never lose the nomination. When they don’t run, it’s because they’re not perceived as viable enough, like Dick Cheney or even Joe Biden in 2016 who was seen as too old, even then.

The 53% accounts for the factor of time. There’s a long way to go until the primaries. If Trump becomes as unpopular as Bush after Katrina and Iraq, that creates space. But I don’t think that signals any fundamental weakness with Vance. No one at this stage could be an 80 to 90% favorite unless they were the literal incumbent running.

Do any of the other Republican candidates seem overvalued or undervalued? Tucker at 4%, Tulsi at 3%?

There seems to be a bias toward certain types of candidates. Vivek was much stronger on betting markets than in polling. I’d put Tucker and Tulsi in that camp of systematically overvalued.

RFK gets about 8% when we include him in our polls, usually second or third. He’s at 1% on Polymarket. There seems to be some base of support there that’s not reflected in the markets. I’d rank him higher than Tucker.

On the Democratic side, Newsom is at 36%, AOC at 11%. Thoughts?

I put out a model with Newsom at 30% and AOC at 20%. She has the ability to dominate progressive voters and raise a lot of money from small dollar donors. The problem is if she gets into a one-on-one with Newsom on Super Tuesday, it’s hard for her to win. She needs a fragmented field throughout.

I don’t think Newsom is six times stronger than Pete Buttigieg at 6%. He’s pretty strong with good name recognition, and he’s seized on the redistricting issue to establish himself as a tribal leader among Democrats. But does that last? I don’t think he’s been that stress tested yet.

Could we see an AOC vs. Newsom scenario like Bernie vs. Biden?

Absolutely. AOC has every reason to stay in late because she’ll have the ability to raise money. Look at her House account right now. No one else seems poised to step in with that kind of fundraising base from the progressive side. Bernie’s not running, Warren probably not. It’s not necessarily a bet on her winning. It’s a bet on her being in the top two. She may peak at 20 to 40%. That’s the value trade.

On the midterms, Republicans are 72% to win Senate, Democrats 70% to win the House. Does that track with what you’re seeing in the polling?

Despite redistricting giving Republicans three to seven seats, it still seems possible Democrats could win the House with a normal midterm. The Senate is a very tall hill to climb. They have to win states that are Trump plus 10 or plus 12, which is very uncommon in our environment where people aren’t splitting their tickets much.

Republicans are strong favorites to retain the Senate. The edge case to consider is what redistricting does to the playing field. In 2022, a lot of competitive seats became safe seats in redistricting. Republicans did well in those safe seats while Democrats held a smaller set of competitive seats with concentrated resources. If Republicans can do the same, focusing the playing field on a handful of seats, that can limit their losses.

Which states are crucial for redistricting?

Florida could redistrict four seats, a shift of about four seats total. Missouri and Indiana are also on the table. Maryland is considering it from the Democratic side but has more constitutional barriers. Florida is relatively easy because you can draw geographically compact districts where Republicans do quite well without it looking like a complete partisan gerrymander.

Are there other markets you’d like to see on Polymarket?

It would be interesting to see more action around House and Senate races. Primary markets would be particularly valuable because that matters a lot to the general election outcome. States like Maine or Michigan where progressive primary challenges could produce less electable general election candidates.

Having a market incentivizes people to be more rigorous in their analysis because there’s real money on the line. People aren’t incentivized to just cheerlead for a candidate when they have to put money down.

Disclaimer

Nothing in The Oracle is financial, investment, legal or any other type of professional advice. Anything provided in any newsletter is for informational purposes only and is not meant to be an endorsement of any type of activity or any particular market or product. Terms of Service on polymarket.com prohibit US persons and persons from certain other jurisdictions from using Polymarket to trade, although data and information is viewable globally.