🔮 REFUND?

A former White House trade lawyer handicaps Trump’s Supreme Court tariff case

Peter Harrell held senior positions in trade and international economics in the Biden and Obama administrations. Now at the Carnegie Endowment for International Peace, Harrell has been involved in legal challenges to Trump’s tariff policies, including filing amicus briefs on the pending cases.

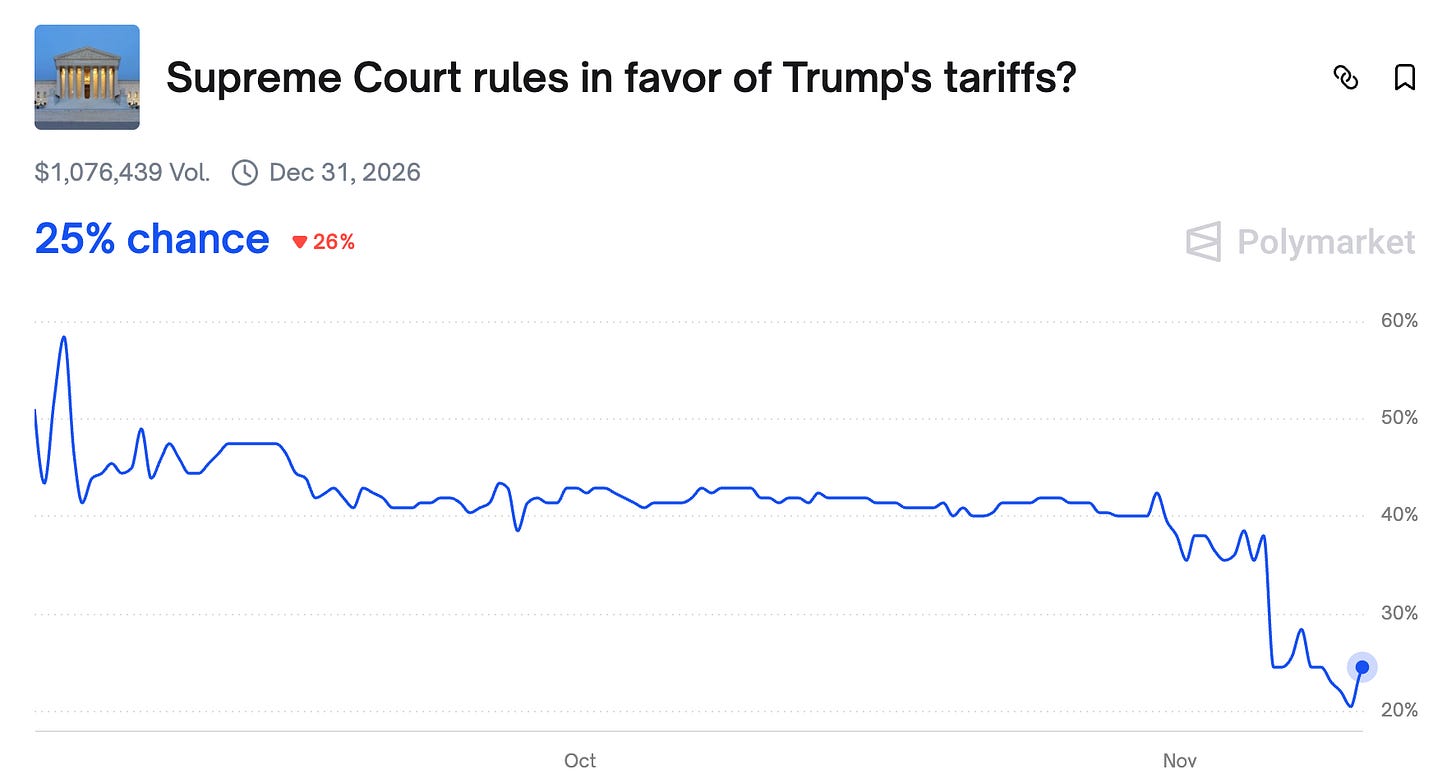

Last Wednesday, Polymarket odds for the Supreme Court to uphold Trump’s tariffs took a nosedive as the justices heard oral arguments in the case. The Oracle caught up with Harrell to debrief the hearings and where things go from here.

This interview has been edited for length. All answers are his own.

You mentioned watching the hearing with Polymarket open in the other tab. Do you remember any moments where the odds began to shift?

I was mostly listening to the oral arguments with Polymarket a little bit in the background, so I wasn’t lining up each question with market movements. But there were a couple of moments where it really looked like a majority of the Court wanted to overturn these tariffs.

Early on, Chief Justice Roberts came in and criticized how the government was relying on this 1981 case, Dames & Moore v. Regan, that’s actually the only other time this particular statute has been before the Supreme Court. The government has been saying this statute is very broad, and Roberts essentially said the case itself says it’s very narrow and shouldn’t have much precedent.

Throughout the hearing, Justice Amy Coney Barrett made it very clear she doesn’t see how a law that lets the president “regulate importation” naturally means tariff. We don’t think if you’re going to regulate emissions, you’re taxing emissions, right?

And then you had Justice Gorsuch, who’s generally very strong on presidential power, asking really tough questions. He had this moment where he said, “Couldn’t a future president under your theory declare a climate emergency and tariff cars out of existence?” Seeing Gorsuch skeptical jumped out as, oh, this might not even be just a 5-4 decision. This might be 6-3 or 7-2.

Going into the hearing, we had it around 40% the tariffs would be upheld. After the hearing it dropped to around 20%. Do you agree with that recalibration?

I’ve been following this case very closely and was involved in some of the amicus filings against the tariffs. My personal view going into oral arguments was around 70% that the court would overturn the tariffs, so 30% they’d uphold. I was probably a bit more bullish on the court overturning than the market was.

20% feels about right to me coming out of the hearing. The idea that there’s a 20% chance the court might uphold the tariffs, that actually feels right after what we heard.

Have you looked at the rules for how this polymarket resolves? Are there any weird loopholes?

I have pulled the rules. It’s interesting because when you think about the rules for that case and what it resolves, you have to think through things like what happens if there’s a settlement.

I think coming out of the oral arguments, there is clearly some chance that the court will uphold limited tariffs under IEEPA, but maybe not all of them. So maybe they’d uphold the fentanyl tariffs but not the universal or reciprocal tariffs. We might get a kind of mixed ruling here.

What’s the most likely outcome? Total vindication for the challengers, a split decision, or total win for Trump?

I’d say probably 60% all the IEEPA tariffs are illegal, 20% some IEEPA tariffs are illegal but some are legal, and 20% total vindication for Trump.

The mixed outcome is interesting because the court might uphold limited tariffs under IEEPA, like maybe the fentanyl tariffs, but not the universal or reciprocal tariffs. We could get a kind of mixed ruling.

When do you expect the decision?

This is a really important question. It’s in some sense unknowable. The Supreme Court has the right to operate on its own timeline. The Supreme Court will release most of its opinions, most of the cases it’s hearing this fall, in June of next year at the end of the term.

I think it’s likely to get this case out much quicker than that. You see the Trump administration saying in filings they would like a ruling very quickly. If Trump loses, they need to come up with a plan B quick. The plaintiffs also want a short timeline ruling because if they don’t have to pay the tariffs, they want to stop paying them and start getting refunds.

I think the court understands the practical importance of this. We’re talking about tens of billions of dollars a month being collected in tariff revenue. I think they understand the need to move quickly.

That said, they are the Supreme Court. These are not people who are going to get an opinion out the Monday of next week. I think it’s plausible that we would see a decision before Christmas, right before the holidays. That seems plausible to me. Call it five or six weeks from now. I could also see January or early February being plausible, where they don’t quite get it done before Christmas but get it out early next year.

But if we get to March and there is no opinion, that is a very good sign for the government. I think the court, if they are going to rule against the government, will rule quite quickly. If they’re going to uphold these tariffs, there’s less urgency because Trump’s collecting the tariffs currently.

Let’s go through the justices - if you had to put them into three buckets, strong conviction they’ll rule with Trump, maybe, or strong against?

One thing that was striking to me listening to the oral arguments is there was no justice who literally came out as 100% sure he’s going to rule with Trump. Even Justice Thomas asked a couple of questions about the non-delegation doctrine, which is this doctrine that Congress can’t simply give the president all of Congress’s authority in one area. I don’t think Thomas was tipping his hand at all on where he came down.

Everything we’ve seen about Thomas suggests he’s historically been a pro-Republican presidential power justice. So I think you’d have to think he’s quite likely to side with Trump. But even listening to his questions, they did not come off as 100%. If you start there, you probably would have Thomas at a very high likelihood, 80-90% or more in the pro-Trump camp.

Then I think you see Alito and Kavanaugh. Alito, historically, has been very pro-presidential power. Alito had some questions suggesting he doesn’t like the breadth of the tariff power. He did suggest he thinks the president should have tariff powers in what he called “a real emergency.” That doesn’t necessarily mean he thinks in any circumstance, for any reason, the president should have tariff power. Kavanaugh was similarly grappling with the issue. I’d put them maybe 70-80% likely to support the president.

Then I think you have Gorsuch and Roberts. Gorsuch was probably a little bit more pro-Trump from the questions, but he had some tough questions for the government. Roberts was playing his cards fairly close to his vest. I actually think both of them are likely to break against Trump, above 50% likely. I think they’re probably in the 60% against the tariffs camp.

Amy Coney Barrett I think is probably in the 70% against the tariffs camp.

And then Kagan, Jackson, and Sotomayor were clearly from the questions in the 90+ percent against the tariffs camp.

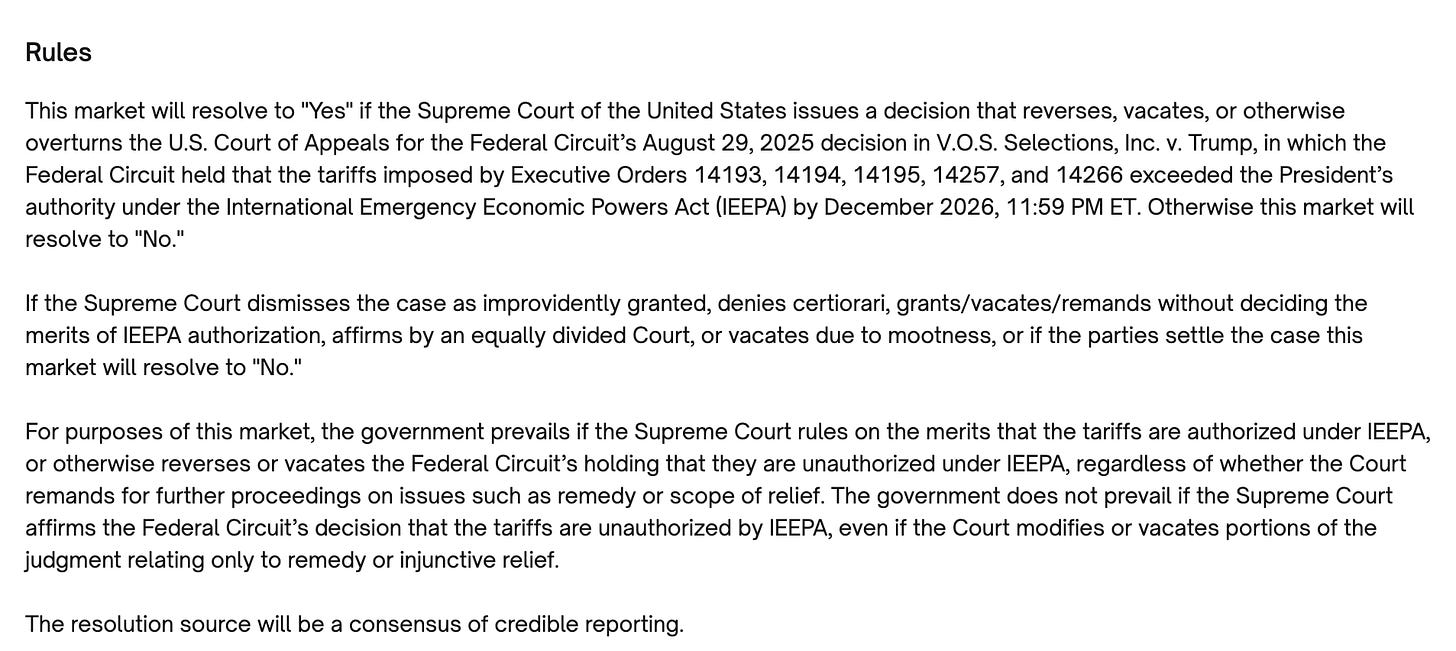

How realistic is it that the court forces Trump to issue refunds?

At the end of the day, as a legal matter, if a company paid a tariff that is illegal, that company legally will be entitled to a refund. We would all have the view that if the president comes in and confiscates 60% of your income with some new tax, and the courts conclude the president cannot legally seize your income, you’re entitled to your money back. Legally speaking, a tariff is no different from any other tax.

There’s a lot of poorly thought through thinking out there about why you wouldn’t get refunds. The starting line should be, if these tariffs are illegal, you should be entitled to a refund.

Now that’s only part of the question. Practically speaking, there are a couple of things that could happen. One is the president loses and the Supreme Court says you have to set up an administrative process to issue refunds. That would be technically feasible for Customs and Border Protection.

But maybe the Supreme Court doesn’t do that. Maybe the Supreme Court simply says these tariffs are illegal, and if you want a refund you have to file a suit against the government to get your money back. You’ll have to see lots of lawsuits by companies that want their money back. Maybe they’ll band together in some class action lawsuit. The mechanics of turning what I think would be a clear legal entitlement into actually having a check with your money, that may be complicated and messy.

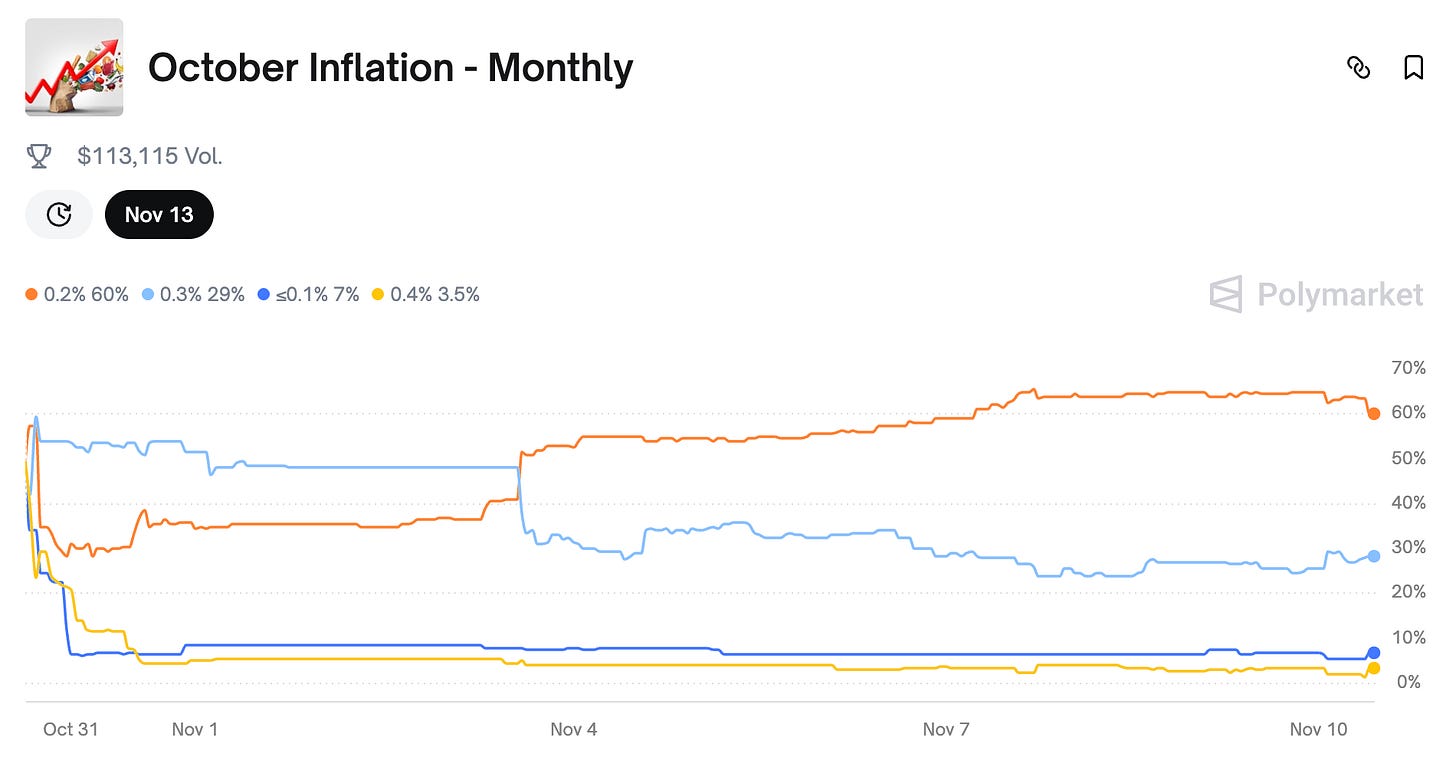

The refund market resolves “Yes” if US importers receive refunds of at least some of the tariffs invalidated by the ruling before the end of 2025.

I think that date is an easy out. If you had by end of 2026, I think it probably would resolve to “Yes.” It might not be every importer receives a refund, but at least the guys who are fighting would get their money.

Suppose we have a scenario where the Supreme Court on December 20 issues a ruling these tariffs are illegal. I’m not sure in 10 or 11 days anyone actually manages to get their money back. That’s just the practical reality of how these things work.

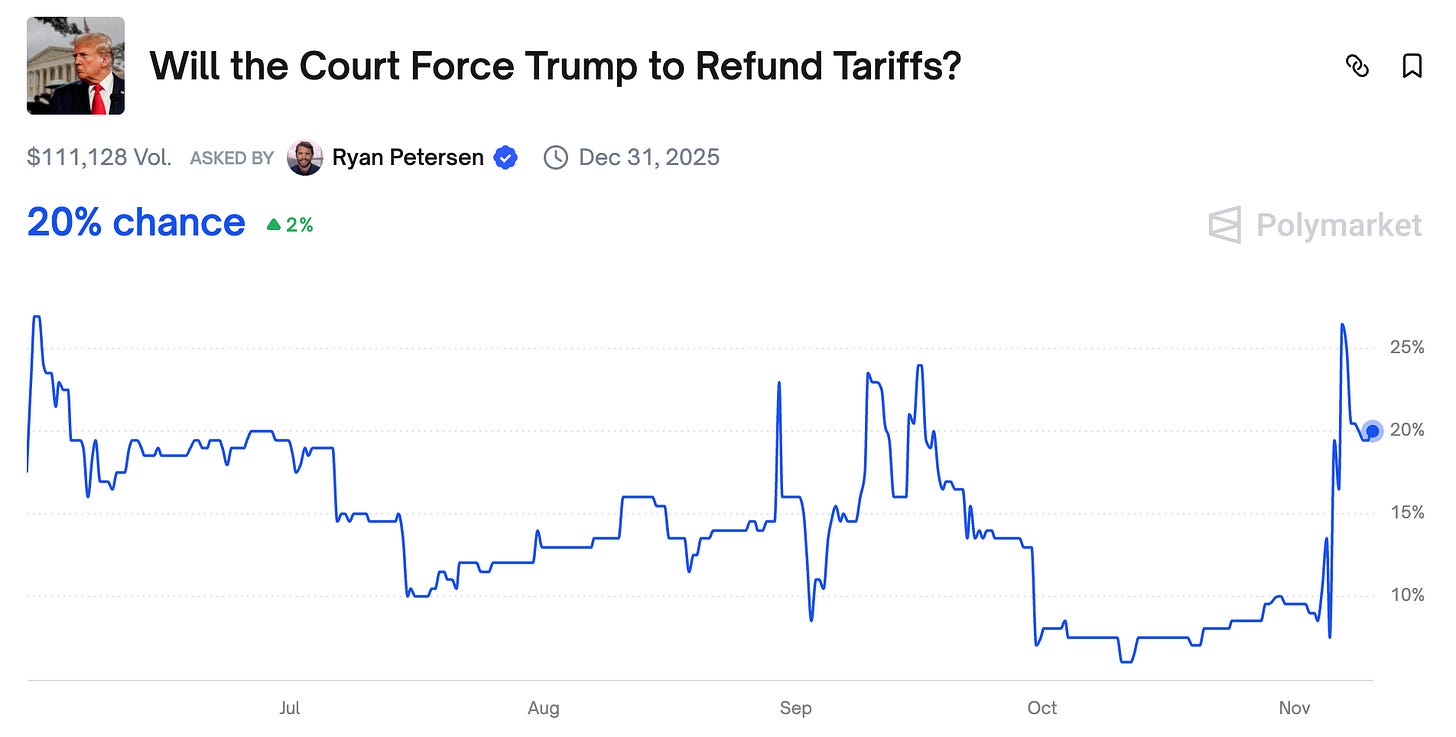

What about the macro impacts of tariffs? Would we see inflation tick up, GDP growth slow down?

I think we will see tariffs feed through next quarter into a couple tenths of a percentage point of inflation. We’ll see continued GDP growth being a little bit below where it otherwise would be. But it’s not tipping us into a recession. It’s a drag on growth, similar to how a shutdown would be a drag on growth, but it’s not actually tipping us into a recession.

What other polymarkets would you like to see on trade policy and tariffs?

Are you doing markets on export controls? Like, will Trump allow downgraded Blackwell sales to China?

As somebody who worked in government on trade policy and national security, as a policy matter I hope Trump does not authorize Blackwell sales. But as an analytic matter, having that kind of market data would be interesting.

The trade deal with China is tricky because there are so many pieces. How do you reduce that to a nice binary bet? Does it last? Does it not last? What does last mean? What we see with Trump is maybe parts of it stick but parts come unstuck. It’s hard to crystallize that into something that would make a nice Polymarket bet.

There’s good data on average applied tariff rates over time. That’s something where you can make a bet that will clearly show whether you’ve been correct or not. That would be an interesting one to have.

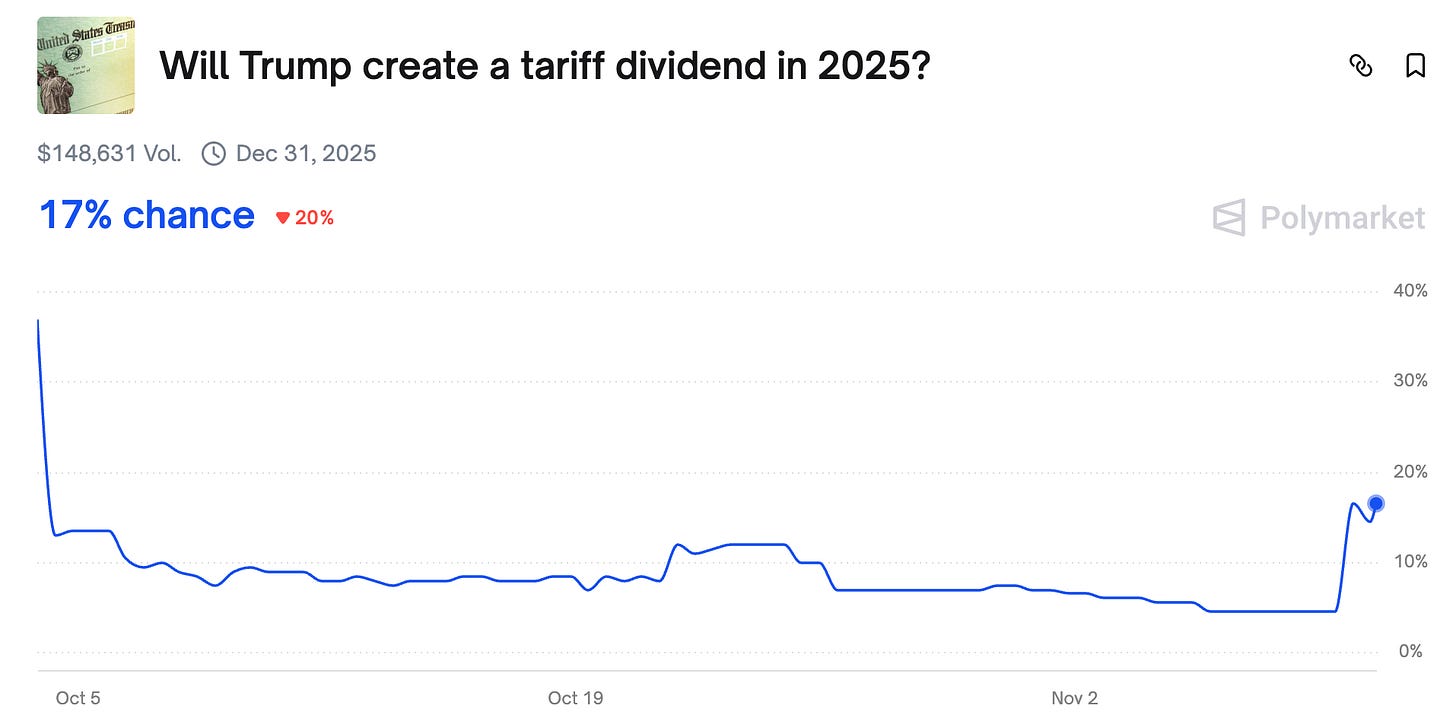

We have a polymarket on whether Trump will issue a “tariff dividend“ at 5%. Is there any precedent for this?

[Editor’s note: this interview was conducted before Trump announced $2,000 tariff rebate checks]

I think this is a bond and there’s no chance of this happening. There’s not really a precedent for it.

It’s interesting because prior to the Civil War, tariffs made up 80 to 90% of US government revenues. That’s how we raised tax money. But even in the 1930s when we all think about Smoot-Hawley, tariffs weren’t really a huge share of federal revenues. They’ve just never been meaningful enough in the modern era, the last 175 years, that you’d think about using them as the basis for a dividend.

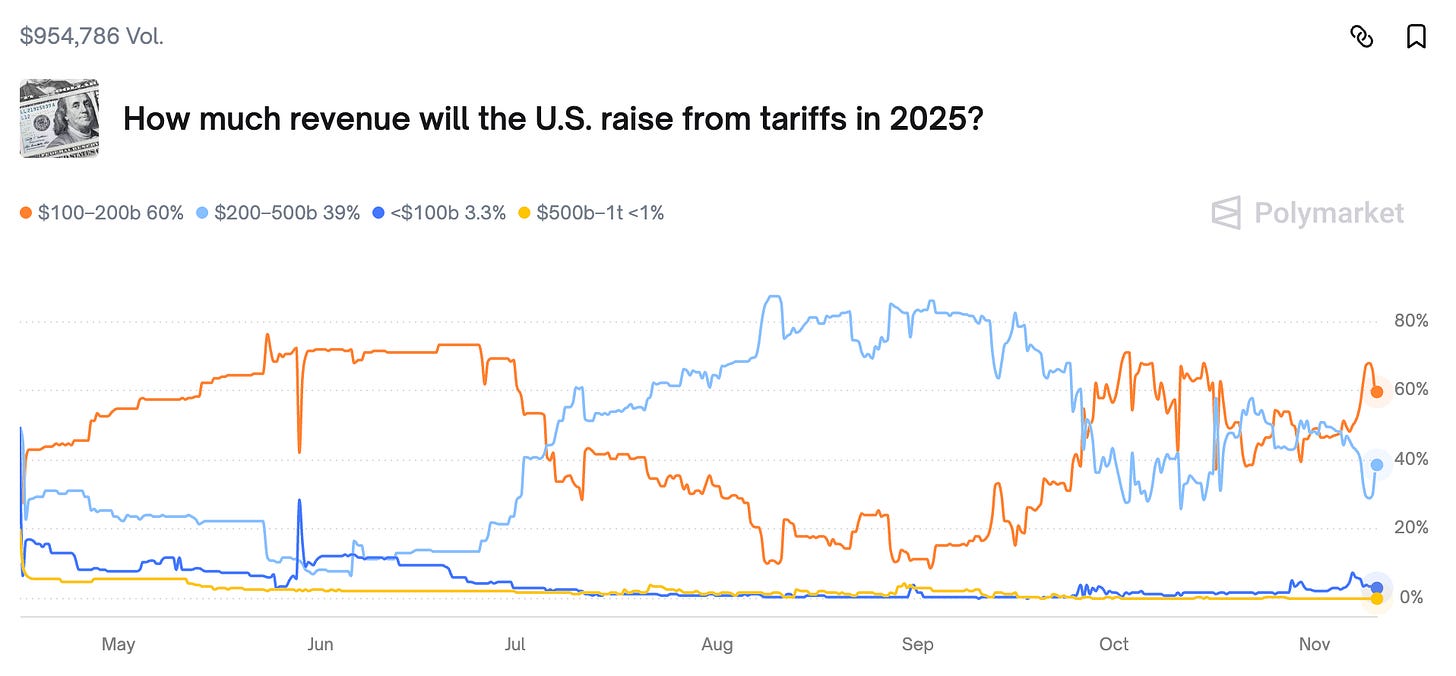

There’s a polymarket on how much tariff revenue the US will collect in 2025 that has fallen in recent weeks. What’s driving that?

There are a couple of factors beyond just the rates going up or down that affect tariff revenues, and I think this is an under-told story.

First is what products are exempt. We all focus on the very high headline rates, but Trump has over the last couple of months actually been exempting more and more products from them. High headline rates, but a slightly smaller base of products that the tariffs apply to. That brings revenues down.

The second factor is valuation, and this is really interesting. Back when tariffs didn’t matter much, when rates were low pre-Trump, if you’re importing 1,000 TVs worth a million dollars and the tariff was 0-2%, you’d just pay between $0 and $20,000. You’d declare it’s worth a million dollars and move on.

But now that tariffs matter, companies start thinking creatively. Maybe instead of paying the Vietnamese company a million dollars for the TVs, I pay them $700,000 for the TVs, $100,000 for shipping and handling, and $200,000 for warranty services. All of a sudden, you’ve reduced the tariff value from a million dollars down to $700,000. You have to justify the valuation, but it can be done lawfully.

Going into Trump’s second term, we heard about massive tariffs, American re-industrialization, forcing countries to buy 100-year bonds, reshaping the global economy. What’s your base case now for how this plays out?

I wouldn’t say a slow reversion to the mean. If you oversimplify and think about the average US tariff rate pre-Trump being around 3.5% putting aside China, and now it’s around 15%, obviously there’s a lot of variation by goods and countries. But if the average is 15%, I bet the average comes down to more like 8-10% two years from now.

It comes down, but it doesn’t go back to the pre-Trump era. You’re seeing increased pushback at the Supreme Court, manufacturers finding lawful but loophole-y ways to reduce the tariff burden, increasing exemptions for politically connected products or sensitive components. You keep the dramatic headlines and Trumpian rhetoric, but land somewhere in between.

Disclaimer

Nothing in The Oracle is financial, investment, legal or any other type of professional advice. Odds are time sensitive and subject to change. Anything provided in any newsletter is for informational purposes only and is not meant to be an endorsement of any type of activity or any particular market or product. Terms of Service on polymarket.com prohibit US persons and persons from certain other jurisdictions from using Polymarket to trade, although data and information is viewable globally.

Does this lawyer work for Communist China? Or does he just hate the US - but live there?