🔮CUT

Can Trump pressure Powell into slashing interest rates?

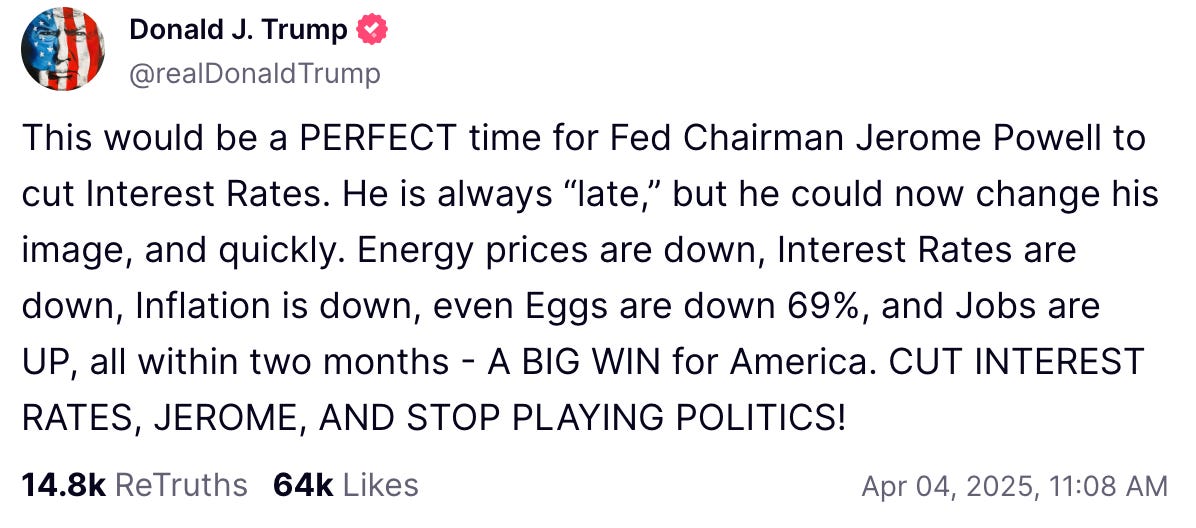

Donald Trump wants lower interest rates.

In his first term, Trump was pressuring Powell for cuts before COVID brought back zero interest rates in the blink of an eye.

The Trump theory is that lower rates will stimulate growth and weaken the dollar, and a weaker dollar would boost US exports and reduce the trade deficit.

Trump has called on Powell to cut at least four times this year, amping up the pressure after the February Fed meeting where rates stayed unchanged.

But recent reporting from Nick Timiaros paints a picture of a Fed that is concerned about the inflationary impact of tariffs.

The Bianco Question

Fed chairs are appointed to 14-year terms and not fireable by the president except “for cause.” No president has ever fired a Fed chairman or governor.

But even before Trump was inaugurated, Jim Bianco was wondering on our podcast if Trump would pressure Powell by appointing a “shadow Fed chair.” He could do this by announcing the next chair before the end of Powell’s term in May 2026, making him a lame duck.

But despite Trump’s escalation against Powell, both the “shadow Fed Chair” market, and a similar market on whether Trump will attempt to fire Powell are both pricing sub 20% odds.

Even a Supreme Court ruling on Thursday in which Roberts allowed Trump to temporarily remove two independent agency officials - seen as a test for Trump’s ability to remove Fed officials - did not move the ‘Powell out‘ markets.

The markets think he’s safe for now.

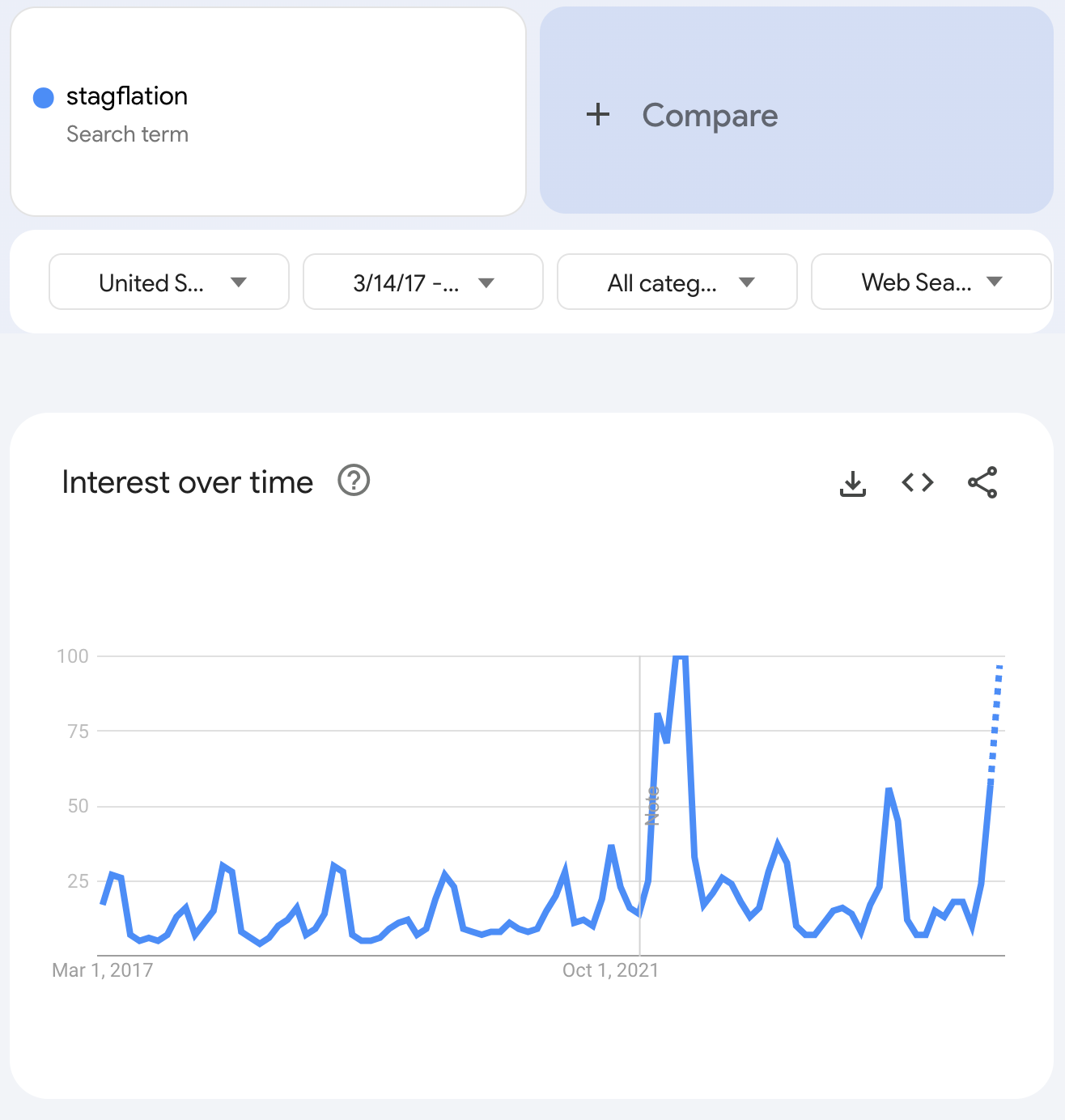

The Stagflation Parlay

For the first time since COVID, talk of stagflation is in the air.

Stagflation is tricky for the Fed because inflation is high while growth is weak. But the Fed is unable to run its usual rate cut playbook due to high inflation.

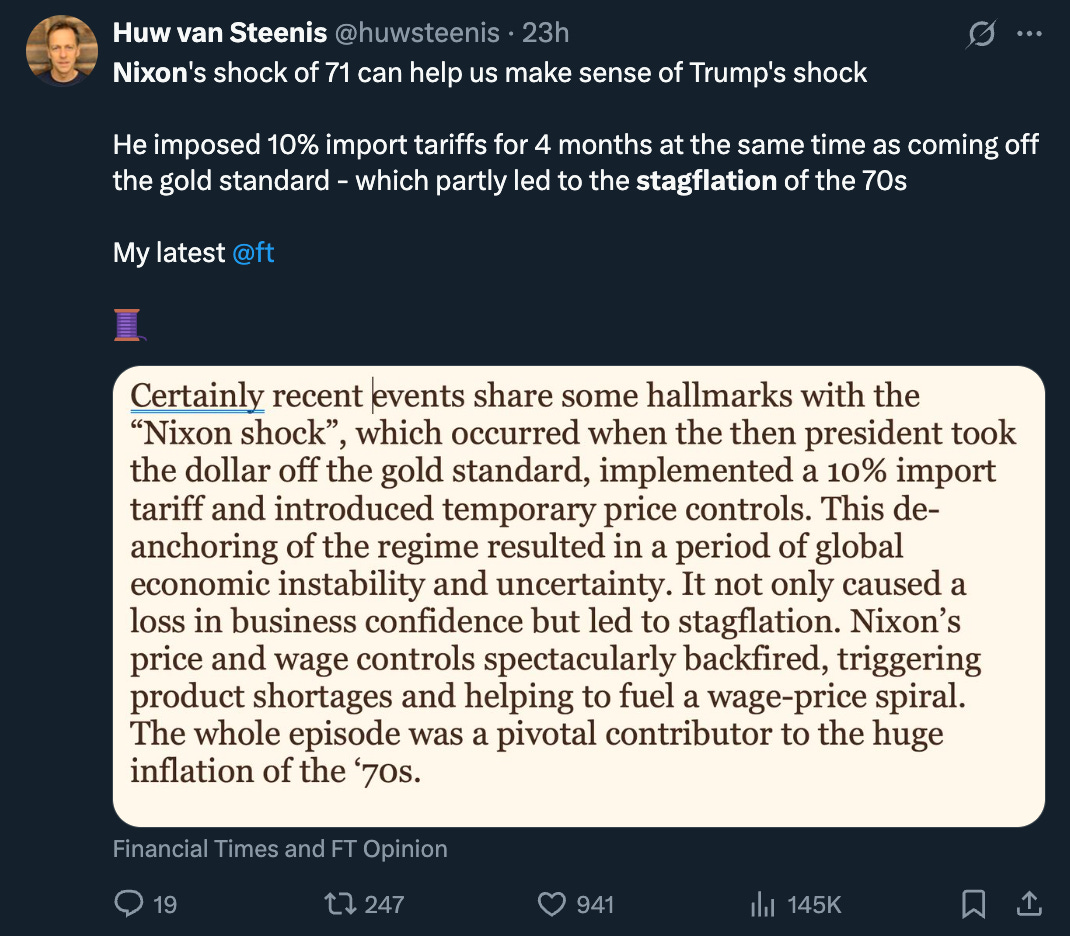

But stagflations are very rare: only ~10-15% of recessions qualify. This is because normally recessions bring price declines as demand falls; stagflations are often associated with external trade and energy shocks.

Hmmm - a stagflation kicked off by a president imposing tariffs? Sounds like a plausible scenario given the sharp market reaction to Trump’s tariff rollout.

And while there is no direct market on Polymarket for stagflation, we can back into it several ways:

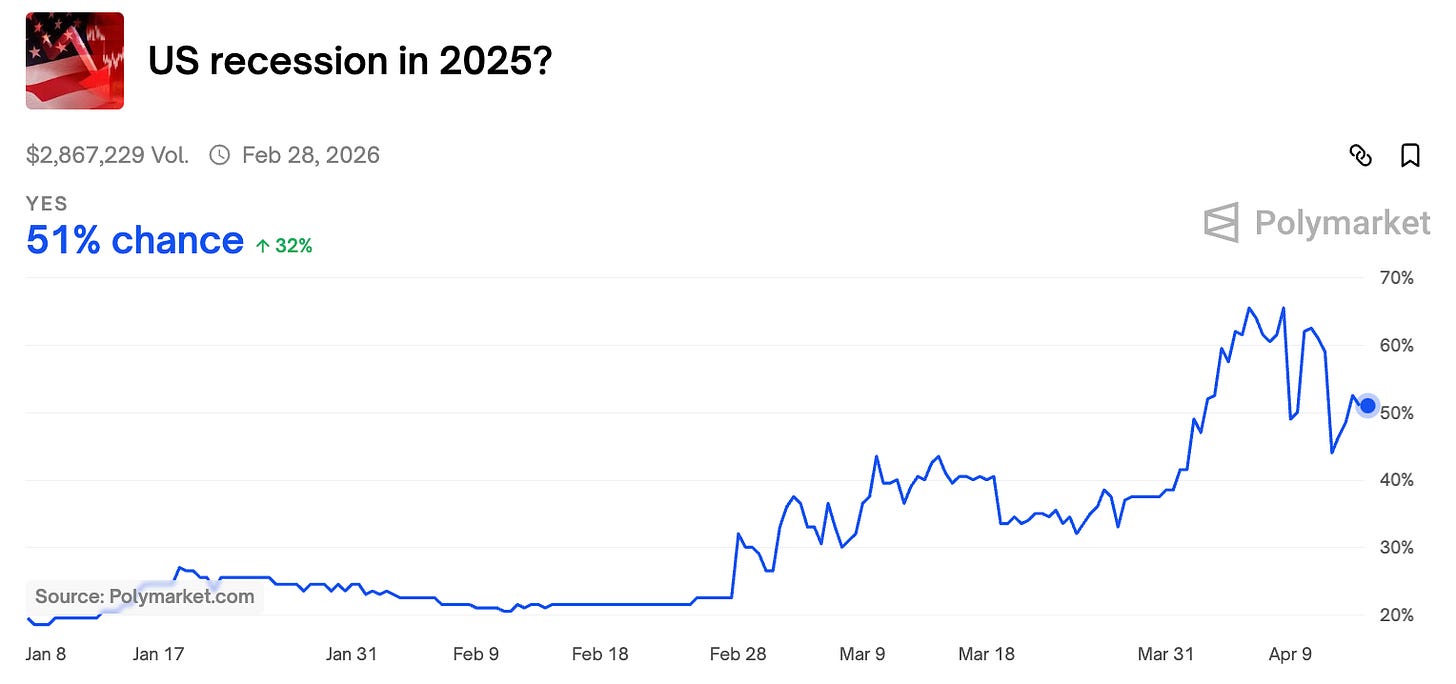

Recession. There’s a 🔮 51% chance for a recession this year, with a pretty obvious jump in odds as Trump unveiled his tariff plan. Recession odds have been cooling since Trump began rolling out the exceptions and talk of deals.

Inflation. There’s a 🔮 25% chance for inflation to hit 5% this year, which would be roughly a doubling from current levels. This has also come alongside a spike in 5-10 year inflation expectations.

Putting this together, we have a possible stagflation trigger (tariffs), combined with rising odds for inflation and recession.

The markets seem to be saying that tariffs are increasing the risk for a stagflation outcome, but this is still a sub-25% scenario.

Another way to look at it is through the lens of rate cuts:

Odds for one rate cut this year have fallen from the most likely scenario in February to the least likely today while odds for 2, 3, and 4 cuts have risen.

Whether this is due to heat from the White House, or increasing chances for a standard issue (non-stagflationary) recession is not clear.

But given the link between Trump’s tariff moves and changes to inflation and recession odds, the markets are saying that it’s Trump's tariffs, not Powell’s rate decisions, that are the bigger drivers of inflation and recession risk.

Connect With The Oracle

Tips? Feedback? Story ideas? Write oracle@polymarket.com or @wasabiboat on X

Write for The Oracle: We’re expanding our coverage and looking to hire more writers and investigators. Details Here.

Disclaimer

Nothing in The Oracle is financial, investment, legal or any other type of professional advice. Anything provided in any newsletter is for informational purposes only and is not meant to be an endorsement of any type of activity or any particular market or product. Terms of Service on polymarket.com prohibit US persons and persons from certain other jurisdictions from using Polymarket to trade, although data and information is viewable globally.