🔮 Opinion: Audit the Fed

By Turd Ferguson of EndingPolitics.com

Skepticism of central banking is having a renaissance with the election of Trump and rise of DOGE.

The new administration is building on Ron Paul’s work after the Global Financial Crisis of 2009, the same year his book End The Fed was published.

Today, on Polymarket there is a 24% chance that DOGE audits the Fed by May. This puts the Fed well behind Ukraine aid (🔮 57% audit odds), Fort Knox (🔮 71% audit odds), and the IRS (🔮 77% audit odds).

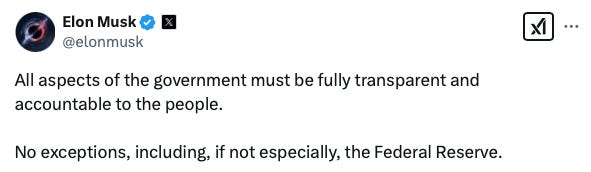

If these odds are a true reflection of Trump’s priorities, he has it backwards. Elon Musk and DOGE should prioritize a thorough audit of the Fed, which will likely uncover that the most powerful force in US financial markets has books that have been cooked longer, hotter, and more thoroughly than a Thanksgiving turkey.

Why don’t the Fed, elites, and the banking cartel want the Fed to be audited? Former Fed Chair Ben Bernanke once said the quiet part out loud in an op-ed for the far-left Brookings Institution:

God forbid the GAO would actually be able to look past page one of the Fed’s books.

What could a Fed audit uncover? Here are the most important questions to explore:

What Do Fed Dividends Get Used For?

Most people are clueless about how the Federal Reserve system works. If you were to ask an average person on the street who owns the Fed, they’d probably say either “the Federal Government” or “the American people.” Both are wrong.

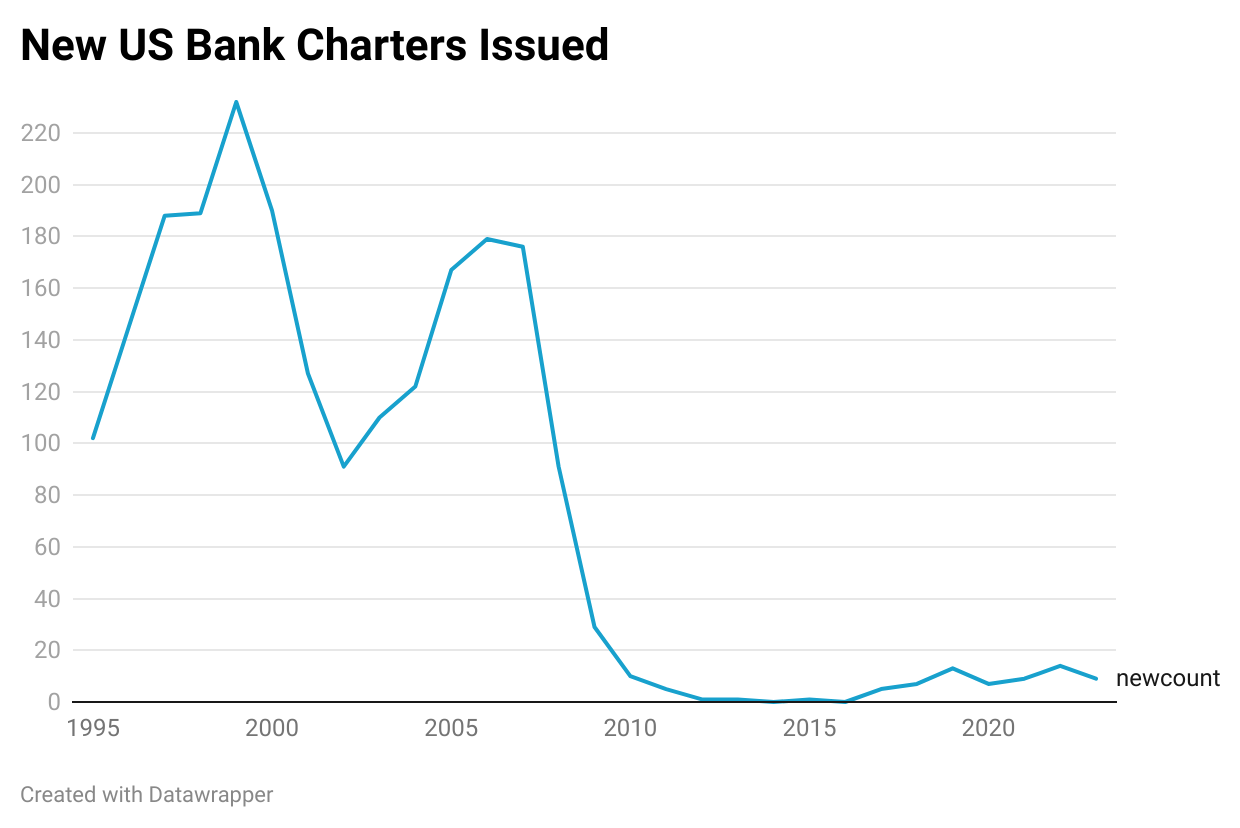

The Fed is owned by the banking cartel: incumbent commercial banks, a club which has become nearly impossible to join since the 2008 GFC. As the St. Louis Fed website states, “Federal Reserve Banks are set up like private corporations. Member banks hold stock in the Federal Reserve Banks and earn dividends.”

The Fed’s member banks are required to hold the equivalent of 6% of their capital and surplus in stock of the Fed, and the Fed pays dividends to its “shareholders” (ie, the banking cartel) annually.

But where is this money going after dividends are paid to the banks? Since the member banks are part of the Federal Reserve System, an audit of the Fed should allow DOGE to find out where - or to whom - these dividends actually go. Are they being used for marketing to grow the big banks? Stock buybacks? Bonuses for the executives?

Even if they are not used for nefarious purposes, why on earth does the central bank of the United States need to pay dividends to supposedly independent, for-profit banks?

Is the Fed Engaging in Direct Debt Monetization?

Currently, it is illegal in the US for the Fed to purchase debt directly from the Treasury (except in “emergencies”). This is known as “direct debt monetization” and is a highly risky central banking activity.

Without a doubt, the Fed did this during the Second World War.

The question is, is it buying debt from the Treasury regularly, and as a standard practice? It’s hard to say for sure, but let’s take the pandemic for example.

On July 25, 2022, the interest rate on the 2-year treasury note was 2.897%. At the time, inflation was rapidly approaching its COVID-era peak of 9.1%, and would decline to 2.9% by July 2024. The real return on a 2-year treasury note purchased on July 25, 2022 was -.306%, and this was actually one of the less bad returns on a treasury note bought during the pandemic.

Yet we’re supposed to believe there are tens of millions of savvy investors out there who are willing to invest in treasuries that will get them negative real returns on their investments. Seems unlikely, and my sense is that it’s very possible that the Fed could be regularly propping up the sovereign debt market through direct debt monetization, particularly during periods of high inflation.

Is the Fed Buying Treasuries at a Markup?

Because the Fed is only allowed to buy treasuries in normal circumstances on the secondary market, it uses a special trading platform to do so, known as “FedTrade.”

You are not allowed to sell treasuries to the Fed on this platform though. Only the beautiful people get to do that (ie, banks and large financial institutions).

During periods of “quantitative easing,” the Fed stimulates the economy by buying these treasuries in exchange for cash it creates out of thin air (a process also known as “money printing”). But how much do these institutions actually get to charge the Fed for their treasuries? As the Government Finance Officers Association notes:

“Customers” presumably includes the Fed, and as the GFOA also notes, this practice isn’t considered fraudulent until the markup exceeds 10 percent.

This becomes very problematic once you think about it. For example, if Citi wants to sell $10B worth of treasuries to the Fed, at only a 3% markup, then Citi Bank has just made an easy profit of $300,000,000 - a profit you’d never be able to make even if you had that much money to invest anyway - because you’re not allowed on FedTrade.

This presents an even bigger problem: if the Fed is in fact buying treasuries at a markup, it’s effectively creating an endless stream of passive income for the elites. They’re simply moving treasuries from one market to another, all at the cost of the value of our money. Such a practice would obviously be highly inflationary, and only a small few, very powerful people would benefit from it, while the rest of us suffer.

Potential Implications

These are not easy questions to answer. The Fed has operated in a cloud of secrecy for so long that many of its own employees, running around its corridors in a hypnotic haze, pushing buttons for some higher purpose, couldn’t answer them.

But the implications of radical Fed transparency are easier to predict. Understanding where the Fed’s dividends are going - into the pockets of privately held banks - would undoubtedly piss off the American people.

If the Fed was caught regularly engaging in direct debt monetization, it would send shockwaves through the market and shake confidence in America’s central bank. Interest rates in the treasury market would blow past most upside estimates.

And Polymarket traders are already forecasting serious economic turbulence: Odds the 10-year will sink to 4.0% or lower this year are a staggering 90%, with many betting it’ll go even lower, despite the 2-yr treasury yield above 4%. Even more worrying, there was a yield curve inversion just yesterday between the 10-yr and 3-month, a strong recession indicator.

But the most explosive question is this: What would happen if during an audit, it was discovered that the Fed was buying US sovereign debt at a markup, regularly, from a select few elites, and printing money to do so?

This could cause a financial meltdown or worse. What would the American people do if they found out they were being impoverished through the devaluation of their own currency to enrich a select few?

Long dismissed as fringe, the audit the Fed movement is back with a vengeance. And, thanks to Polymarket, we now have odds on some of these extreme downside events:

As I write this, the odds that DOGE prosecutes the US Treasury stand at 14%. And there is a 15% likelihood, that while completely unprecedented, Jerome Powell is removed early as Fed Chair by President Trump.

Unlikely? Of course. But given the extreme shock that these scenarios would pose to financial markets, they can no longer be ignored.

Connect With The Oracle

Tips? Feedback? Story ideas? Write oracle@polymarket.com or @wasabiboat on X

NEW: We’re On X: Follow The Oracle for updates

Write for The Oracle: We’re expanding our coverage and looking to hire more writers and investigators. Details Here.

Disclaimer

Nothing in The Oracle is financial, investment, legal or any other type of professional advice. Anything provided in any newsletter is for informational purposes only and is not meant to be an endorsement of any type of activity or any particular market or product. Terms of Service on polymarket.com prohibit US persons and persons from certain other jurisdictions from using Polymarket to trade, although data and information is viewable globally.

This post reads more like the conspiratorial rantings of a junior college freshman “just asking questions” than someone deeply informed about monetary policy.

Not only does the author posit misleading, unsubstantiated theories about the Fed, but they make no serious attempt to research the theories in question even where obvious answers are available.

It is a series of hypotheticals with no basis in reality. It simply asserts the theories are true, then warns against the hypothetical outcomes. Does the Fed directly monetize debt? (Well, there is no evidence.) BUT if we assume it does, then that solves the problem. Are Member Banks using their legal dividends for spooky purposes? Perhaps for things I personally think are bad? Alas, there is no evidence. But don’t let reality get in the way of a good time. Why might institutions hold Treasuries with negative real yields? Could it be safety, liquidity, or regulatory purposes? Should I do an iota of research or ask someone in finance? Haha imagine? God forbid the answer isn’t alluring.

“These are not easy questions to answer.” True. Especially if you have no interest in honestly answering them.

The Fed is audited annually. The balance sheet is public. The Chair reports to Congress multiple times annually as well. At least Ron Paul was entertaining. This ain’t it.

The pattern is clear: whatever institutional forces shaped economic policy under past administrations persist under the current one. Direct debt monetization by the Fed undeniably propped up the U.S. economy during the pandemic, to the detriment of other nations, reinforcing an economic order designed to serve elite interests at the expense of everyone else. This isn't a partisan issue—it's class warfare, and it's been waged consistently regardless of which party holds power.

The idea that Trump would seriously audit the Fed is laughable, not because it wouldn’t expose corruption, but because any meaningful audit would implicate too many people, across too many sectors, and across both parties. The system is designed to protect itself. If there were real accountability, the wealth extraction machine that props up the global elite would be at risk, and that is simply not an option for those in control.

Epstein remains one of the clearest data points in all of this. The fact that his network intersected finance, media, intelligence, and politics across party lines is evidence enough that the mechanisms of power are not divided by ideology but by access and allegiance. The same is true here. The Fed is not going to be meaningfully audited because the beneficiaries of its actions are the same people who ensure that meaningful audits never happen.

This is further proof that the international community must act. The only viable response is targeted sanctions—not against abstract institutions, but against the individuals driving systemic collapse. That means CEOs, the executives and boards who sustain them, and the political and media elites who empower them. The U.S. is currently the most visible example of this rot, but the same dynamics exist globally, and any effort to hold these figures accountable must extend beyond just American leadership.

If accountability is to exist, it won’t come from within the system—it will have to be imposed upon it.