🔮 One Week to Inauguration

PLUS: We’re Hiring Writers!

Seven days from today, Donald Trump will take the oath of office to become the 47th President of the United States. Here’s what the latest Polymarket odds say about what’s in store:

Who Will Be There?

According to the latest odds:

Joe Biden (🔮 98%) He’s probably going to make it.

Javier Milei (🔮95% ) Argentina’s libertarian president is the most likely foreign head of state to attend.

Mark Zuckerberg (🔮 82%) His odds skyrocketed from 35% after ‘Based Zuck’ appeared on Joe Rogan.

Michelle Obama (🔮 71%) Her odds are down 20% after skipping Jimmy Carter’s funeral.

Benjamin Netanyahu (🔮11% ) : The Israeli PM’s odds started the month as high as 85%, but plunged after it was reported he didn’t get a formal invite.

Tesla Humanoid Robot (🔮 5%): The greatest product placement ad in history (a market suggestion from the Dumb Money podcast) probably won’t come to pass.

Ratings, Ratings, Ratings

Trump’s inauguration committee is expected to more than double its fundraising totals from the last time around, mostly due to higher corporate donations. But how many people will watch on TV?

The two most likely brackets are 26-29M (🔮 25% odds) and 29-32M (🔮 29% odds). This would put Trump somewhere between Obama second term (7ish percent of the US population) and Trump first term ratings (9ish percent of the population).

What Will Trump Say?

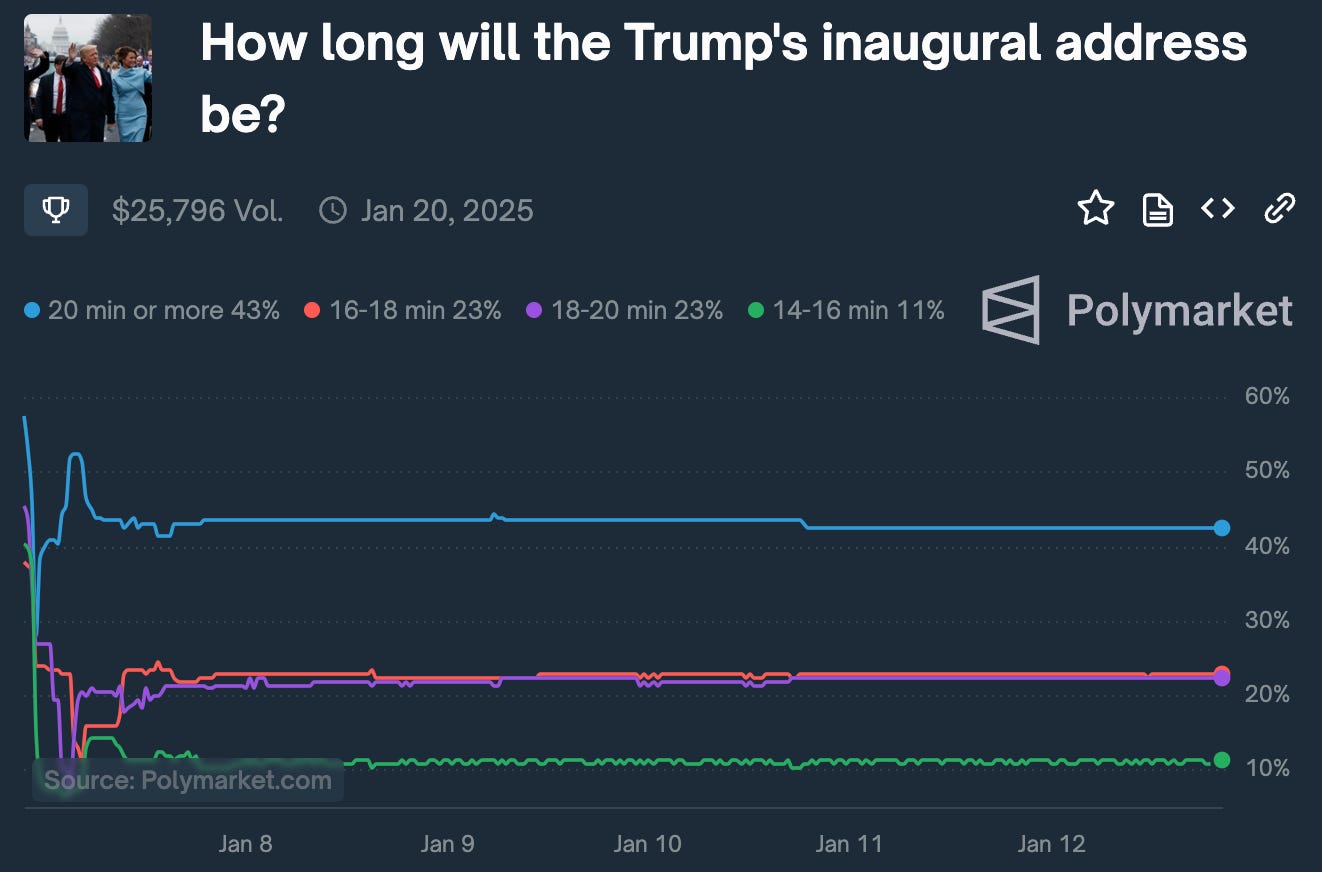

Trump’s second inaugural address is 66% likely to be longer than his first, which clocked in at 16 minutes.

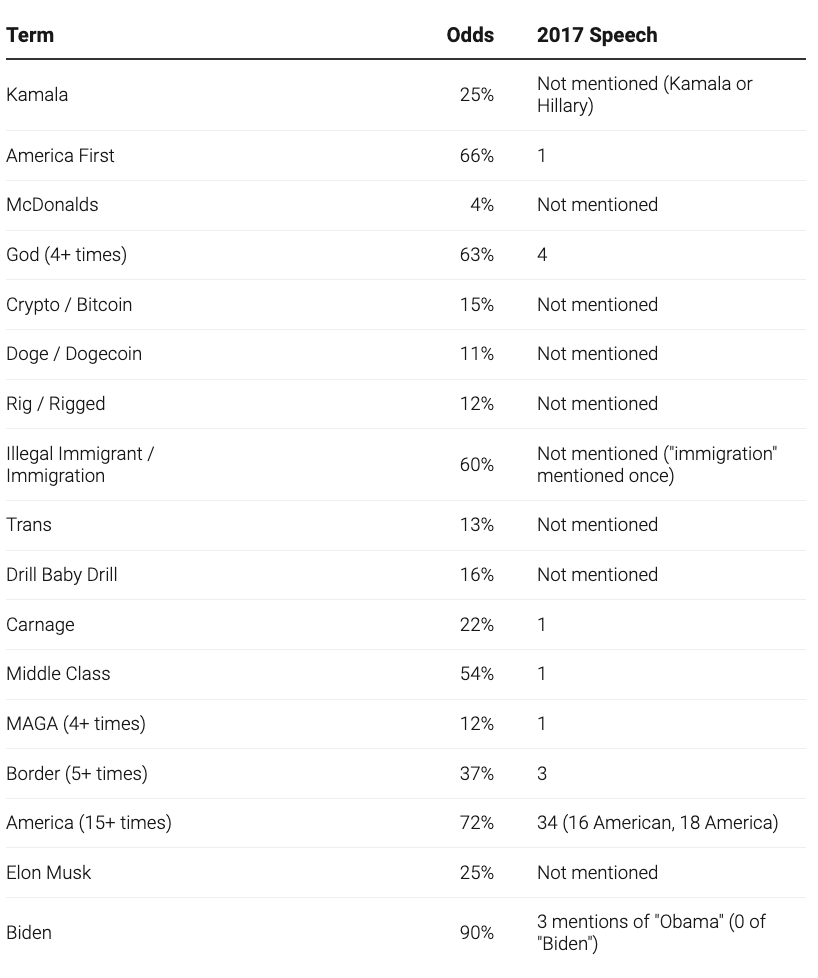

Unfortunately for the tampon bros, the mention market for Trump’s inaugural address – where users predict what words will be said during an event – is forecasting a fairly dull speech. Here’s what’s in store, benchmarked against Trump’s first inaugural speech:

Pre-Inauguration BTC Dump?

On Wednesday, crypto markets were rattled by a headline that the Biden administration was “given the green light” to sell $6.5b of seized Bitcoin onto the market in its final days. The coins, seized from the Silk Road online marketplace in 2013 were the largest crypto asset seizure in history.

The 69,370 seized coins, which are still sitting unsold in the FBI’s wallet, are envisioned to be a core part of Trump’s proposed Strategic Bitcoin Reserve. And a last minute open-market dump by the Biden administration could send the price of Bitcoin tumbling and make it harder for Trump to bootstrap the reserve, forcing the government to re-buy the coins, rather than simply hodling the seized coins.

On Polymarket, the headline was quickly priced into, and then out of the market as additional reports circulated suggesting additional appeals and administrative steps are likely that will delay the sale further. Currently there’s just an 8% chance the DOJ will sell any portion of its BTC holdings before Inauguration.

Nevertheless, the price of Bitcoin ( $91k this morning) continues to dump on macro fears connected with increasing government borrowing costs. Odds that the 10-year bond yield hits 5% by July (🔮 61% chance and rising) have more than tripled since last Monday’s newsletter.

Will Trump Save Tiktok?

On Friday, the Supreme Court heard oral arguments on the Protecting Americans from Foreign Controlled Applications Act, which would effectively ban TikTok in the US unless its parent company ByteDance sells the service.

Here’s the current state of play on this law which is set to go into effect on January 19:

Tiktok is Banned by May (🔮 68% chance): Justices’ skepticism of claims during the arguments caused these odds to shoot up from ~25% to their current level.

Will ByteDance Sell by April? (🔮 17% chance): One way for TikTok to keep operating in the US is if its Chinese parent company sells the app to a US company. The company has strongly denied that they will sell, however, stating that it can’t let its addiction algorithm fall into the wrong hands.

Trump Saves Tiktok in First 100 Days? (🔮 52% chance and rising): Trump has an ambiguous policy towards the service. He issued an executive order in 2020 critical of the app’s Chinese influence, but vowed to save it during the campaign and has recently posted approvingly of it on Truth Social. As president, Trump would have a number of options to keep TikTok running, from simply not enforcing the ban, to negotiating a sale.

If TikTok gets booted, the biggest beneficiary would be Meta, which owns Facebook and Instagram. With TikTok’s crown jewel algo and 170 million pairs of American eyeballs at stake, perhaps there’s more going on with Zuck’s recent anti DEI blitz than meets the eye?

Connect With The Oracle

Tips? Feedback? Write oracle@polymarket.com or @wasabiboat on X

NEW: We’re On X: Follow The Oracle for updates

Write for The Oracle: We’re looking to hire more prediction market- fueled writers and investigators. Details Here.

Disclaimer

Nothing in The Oracle is financial, investment, legal or any other type of professional advice. Anything provided in any newsletter is for informational purposes only and is not meant to be an endorsement of any type of activity or any particular market or product. Terms of Service on polymarket.com prohibit US persons and persons from certain other jurisdictions from using Polymarket to trade, although data and information is viewable globally.

Why would the us capital need to be locked down … I mean no one has ever attacted it right?