🔮 One Big Beautiful Bill

Five Things Polymarket Traders Are Saying about Trump’s Tax Bill

Trump has signed fewer bills into law than any other president in modern history at this point in his term (five so far, compared to 24 bills by the 100-day mark of his first term).

But who says quantity is more important than quality?

Trump’s legislative strategy is to pack his second term priorities into “One Big Beautiful Bill” and push it through the reconciliation process to avoid needing 60 votes in the Senate.

Here’s how Polymarket traders see the situation playing out:

1. Quick Passage Unlikely

Odds the bill is passed by end of June spiked overnight after it passed through the House Budget Committee, where it had been tied up in intra-Republican disputes. The next step is for the House Rules Committee to meet at 1AM Wednesday, with the goal of a floor vote by the weekend.

It's a coin flip if the bill is passed by the end of July, with odds rising to 76% that the final form of the reconciliation bill is passed by the end of August.

2. What’s In?

A recently-launched Polymarket sees an increase in the SALT tax cap, which would partially undo a provision of Trump's 2017 tax bill, as most likely (🔮 90% odds).

A reduction in Social Security tax (🔮 53% odds) is most likely to be removed from the bill.

3. What’s Out?

But odds for a corporate tax cut this year have fallen dramatically as Trump has shifted towards a more populist economic message. Odds of a corporate tax rate have fallen from nearly 80% on inauguration day to just 15% chance today.

4. Paid For by Tariffs?

Trump’s economic team hopes that tariffs will raise revenue to offset the planned tax cuts. But the tariffs are likely to only shave $100-200B off the $7T federal budget for 2025 (🔮 65% odds)

5. And None of this Cuts the Debt

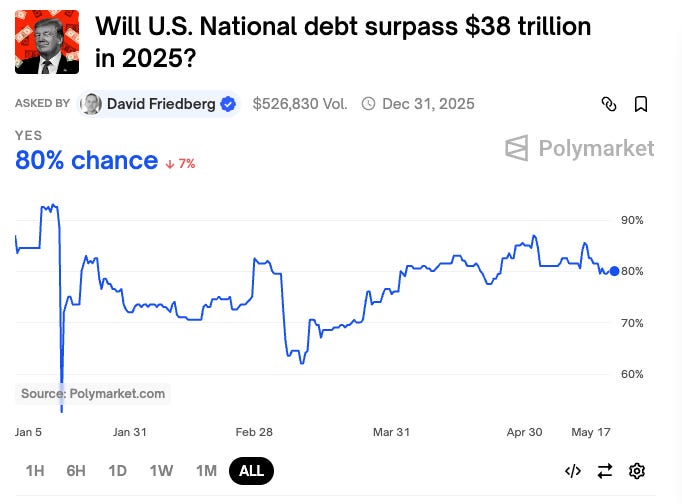

And when traders net out Trump’s planned tax cuts against the tariff revenues and DOGE savings, it’s looking less and less likely that the US government’s finances will balance this year:

🔮 80% odds the national debt surpasses $38T this year ($36.2T today)

Connect With The Oracle

Tips? Feedback? Story ideas? Write oracle@polymarket.com or @wasabiboat on X

Write for The Oracle: We’re expanding our coverage and looking to hire more writers and investigators. Details Here.

Disclaimer

Nothing in The Oracle is financial, investment, legal or any other type of professional advice. Anything provided in any newsletter is for informational purposes only and is not meant to be an endorsement of any type of activity or any particular market or product. Terms of Service on polymarket.com prohibit US persons and persons from certain other jurisdictions from using Polymarket to trade, although data and information is viewable globally.