🔮Nothing Ever Happens

A weekend full of nothing happening

There are years when nothing happens, and weekends where even more nothing happens.

This was one of those weekends.

US and China Almost Went to Trade War

After announcing a 145% tariff on China in early April, on Sunday, Trump announced a trade deal with Beijing he called a “total reset.”

Under the deal terms, ‘reciprocal tariffs’ on China will be reduced by 115% and most new tariffs suspended for 90 days.

Was it expected?

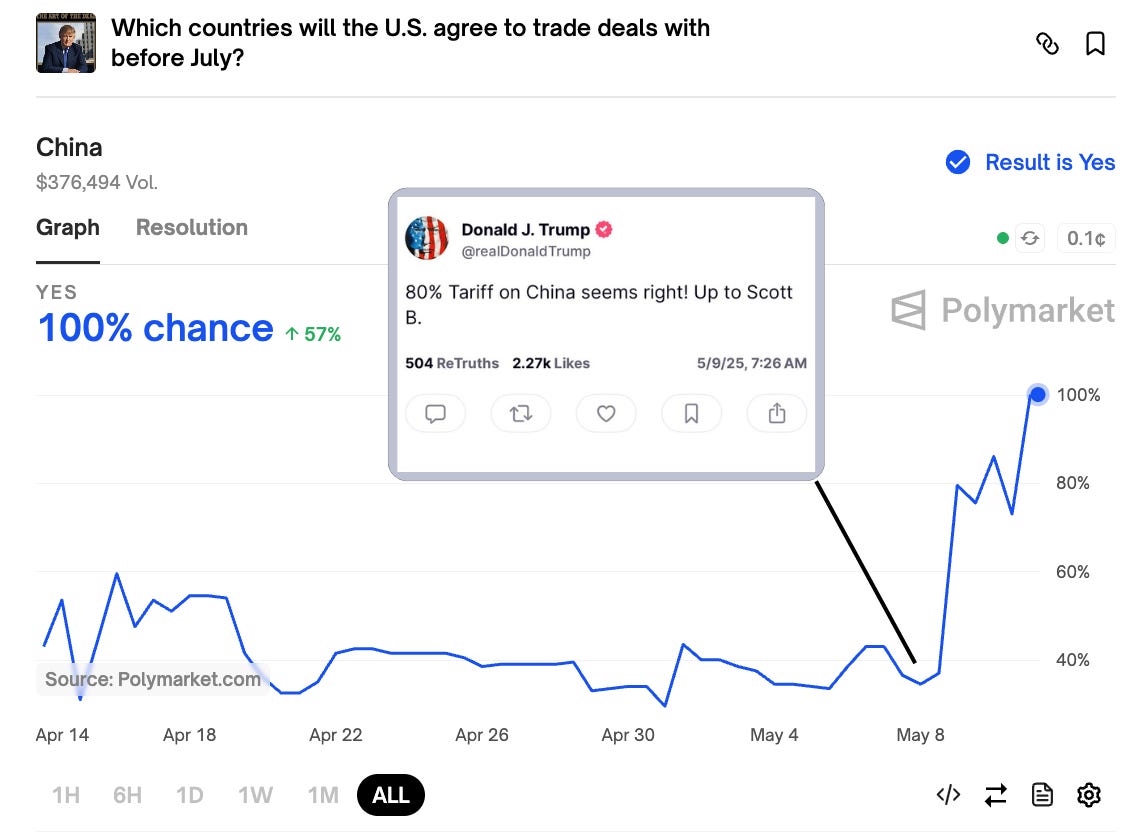

Starting on Friday, May 9, Trump began dropping some serious hints that a trade deal was in the works.

A Truth Social post from 7:26 AM that morning sent the “China Trade Deal before July” Polymarket soaring from the mid 30s to over 80%. A rules clarification issued Friday afternoon may also have contributed to the move.

Will the deal stick?

Almost certainly.

The Polymarket for US tariff rate on China for end of May is now showing a 🔮 96% chance that tariffs on China will be under 50% by then.

Recession Cancelled?

Financial markets, no surprise, loved the deal, with the S&P 500 up over 140 points on Monday.

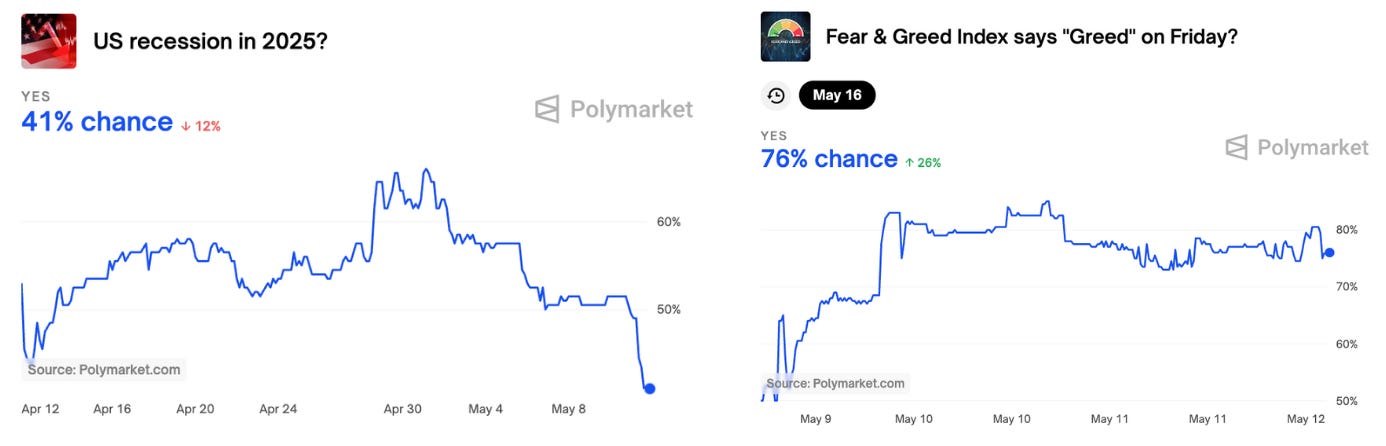

The US Recession 2025 market tanked 10% over the weekend to 🔮 41% and the “Fear & Greed Index on Friday” Polymarket swung sharply towards greed.

But that’s not the only major crisis that was averted this weekend…

India and Pakistan War Risk Spiked

On Friday night, the odds of the India-Pakistan conflict spiraling into a full-blown war touched as high as 24% as the two sides began striking strategic bases.

On Saturday, May 10, a ceasefire went into effect following intervention spearheaded by JD Vance.

Could the “dramatic escalation” have been nuclear in nature? This is what Trump hinted in a Truth Social post announcing the ceasefire. Over the weekend, the “Nuclear Detonation in 2025” Polymarket spiked two points to 19%, and now sits at 16% following the ceasefire.

For more on the India-Pakistan situation, our friends at Sentinel Global Risks Watch just released a podcast on the risk of nuclear escalation.

Gaza Re-Invasion Stalled?

In the Middle East, too, tensions fell over the weekend.

Odds spiked to over 80% for a renewed Israeli ground invasion of Gaza in May following reports that Israel was preparing to invade and fully retake Gaza.

But, here again, the Trump administration intervened. Trump’s everything envoy Steve Witkoff (with some help from Sir Tony Blair) announced a hostage deal on Sunday, which cooled invasion odds significantly.

More Nothing Likely

In observance of the high levels of nothingness that prevail, there is a “Nothing Ever Happens” May parlay market.

The market will resolve to “yes” if none of the following events happen this month:

Russia and Ukraine agree to a ceasefire

The next Pope is Black

The Fed cuts rates

India invades Pakistan

Israel or US military action against Iran

With two of these five having already hit (no Black Pope, no rate cut at the May Fed meeting), the market seems bullish on current nothingness levels to persist.

Connect With The Oracle

Tips? Feedback? Story ideas? Write oracle@polymarket.com or @wasabiboat on X

Write for The Oracle: We’re expanding our coverage and looking to hire more writers and investigators. Details Here.

Disclaimer

Nothing in The Oracle is financial, investment, legal or any other type of professional advice. Anything provided in any newsletter is for informational purposes only and is not meant to be an endorsement of any type of activity or any particular market or product. Terms of Service on polymarket.com prohibit US persons and persons from certain other jurisdictions from using Polymarket to trade, although data and information is viewable globally.