🔮NATOLD YA SO?

John Bolton predicts Trump may exit NATO soon. Is he right?

Our last Ukraine update was February 19, where it seemed like the deal taking shape was:

US-Ukraine economic agreement for rare earth minerals (this hit 97% following news of planned deal signing)

Ceasefire along current front lines

Ukraine unlikely to recognize Russian sovereignty over captured territory

Following Friday’s dramatic Oval Office exchange between Trump, Vance, and Zelensky, the market began to discount the chances for several elements of the deal:

Staged?

The debate quickly moved to whether the fireworks were a reality show kayfabe to stir up drama, or simply the result of a bad wardrobe choice by Zelensky.

And while this isn’t the type of question that Polymarket can answer directly, another set of markets provides a hint:

Going into Friday’s meeting, multiple reports signaled that Zelensky would be pushing for Western peacekeepers in Ukraine to enforce any ceasefire. The Ukrainian president has been demanding this for months, including on the Lex Fridman podcast in January.

But the odds for both US and other Western boots on the ground in Ukraine have always been low.

Thus going into the meeting, it was pretty clear to anyone watching Polymarket that Zelensky was not going to get anywhere on his key demand.

Following the Friday meeting, multiple EU countries signaled willingness for more military support in Ukraine, but odds that any NATO or EU troops will fight there this year are just 16%

What Next?

Some new markets shed light on what may happen next:

Zelensky Out? After the Oval Office meeting Lindsey Graham, split between his Russia hawk tendencies and his support for Trump, threw in with MAGAworld by calling for Zelensky to quickly apologize or resign. The situation has put pressure on Zelensky; his odds of leaving office by July doubled to 21% in February.

NATO Exit? The day before the Oval Office drama, Trump’s former National Security Advisor John Bolton predicted Trump would soon attempt to pull the US out of NATO.

Is he right?

Over the weekend, a number of Republicans, including Elon Musk and Senator Mike Lee, called on Trump to pull out of the alliance. And, while these events certainly spiked odds for the US to leave NATO by June 30, it is still a longshot at 12%.

This market resolves “yes” if the US provides a formal notice to NATO that it intends to leave the treaty. It’s important to note, however, that the market does not cover informal steps, as suggested by Bolton, that Trump could take to weaken the alliance.

Aid Cutoff? Short of leaving NATO, Trump could cut US military support for Ukraine. But, as with the NATO question, the market thinks Trump is more bark than bite. He is likely to sic DOGE on Ukraine aid, but will stop short of cutting support.

Quick Hits

Trumpcession? The Economist ran an article this week predicting a “Trumpian economic slowdown” triggered by the tariff agenda. Does this mean ‘recession?’ The article never uses the word, but it’s interesting that there was a large spike in 2025 recession odds on Friday. In any given year the odds of a recession are about 20%, so 27% is not especially high above the historical baseline.

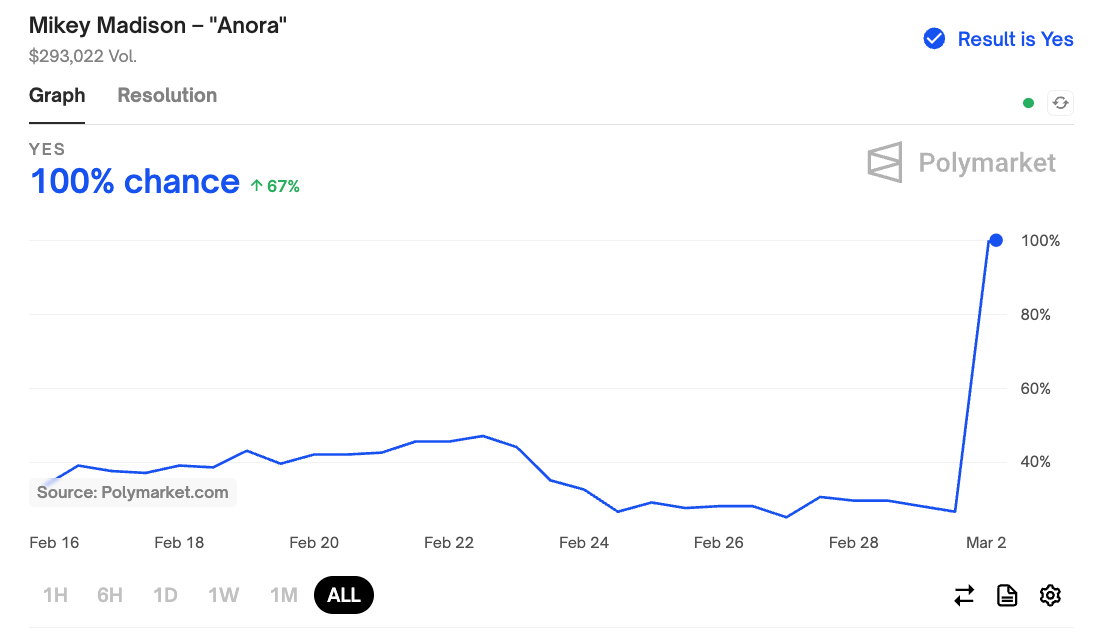

Oscar Surprise. The biggest surprise in last night’s Oscars was the Anora sweep, with Mikey Madison winning Best Actress as a 30% underdog.

Epstein Nothingburger. True Epstein-heads, reporters who have spent years covering the legal cases of Jeffrey Epstein, were disappointed with last week’s release of the files, as there was little information not already in the public domain. It is looking less likely that any new legal accountability will happen as the result of the releases:

Government Shutdown in March? Since Trump’s inauguration revealed his scorched earth policy against Federal employees, odds for a funding lapse (which could trigger a government shutdown if not quickly ended) on March 15th have been steadily increasing.

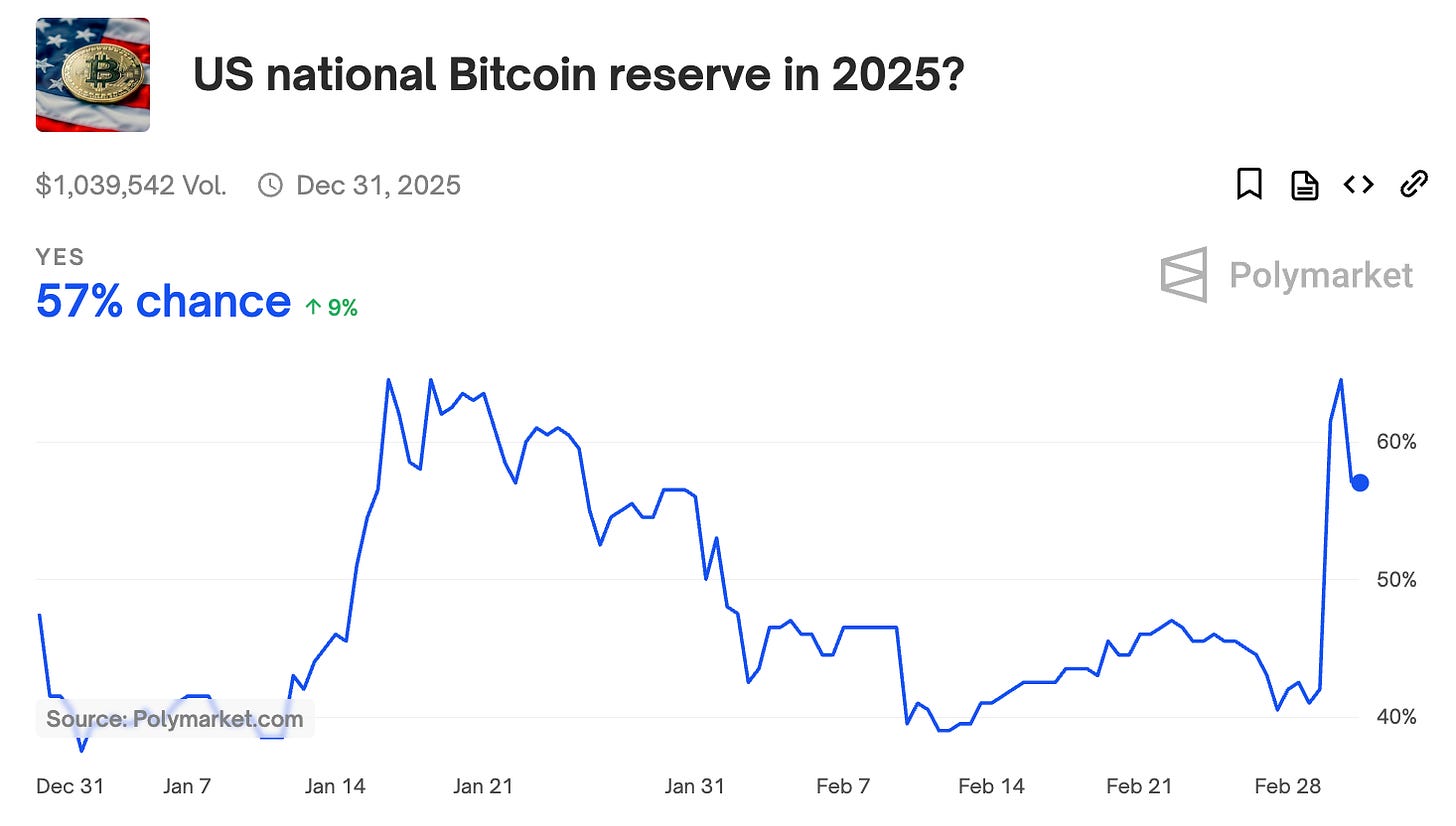

Bitcoin Strategic Reserve. Odds for a US Bitcoin Reserve spiked dramatically on Sunday after Trump announce he has directed his team to “move forward on a Crypto Strategic Reserve” that also included Bitcoin, Ether, Cardano, Ripple and Solana.

Connect With The Oracle

Tips? Feedback? Story ideas? Write oracle@polymarket.com or @wasabiboat on X

NEW: We’re On X: Follow The Oracle for updates

Write for The Oracle: We’re expanding our coverage and looking to hire more writers and investigators. Details Here.

Disclaimer

Nothing in The Oracle is financial, investment, legal or any other type of professional advice. Anything provided in any newsletter is for informational purposes only and is not meant to be an endorsement of any type of activity or any particular market or product. Terms of Service on polymarket.com prohibit US persons and persons from certain other jurisdictions from using Polymarket to trade, although data and information is viewable globally.

Bolton is an idiot.