🔮 Meet Your Market Maker

He risks $300k every Sunday trading sports, but warns you definitely shouldn't try to copy him

The anonymous sports market maker we’re interviewing today is not your typical Polymarket whale. He doesn’t care who will win the Super Bowl. He can’t tell you which NBA team is undervalued. And he definitely won’t dox his wallet no matter how nicely I ask.

This engineer has built an automated market making operation that does millions of dollars in trading volume across NFL, NBA, and MLB games, risking up to $300k on a single Sunday. His edge, as he describes it, is a combination of tiny edges extracted from gigabytes of sports data: knowing exactly how to quote prices, handicapping injuries, how a doubleheader moves the odds, and so on.

This interview has been edited for length. All answers are his own.

Give us a sense of the size of your operation. Are you trading full time?

I got into betting with the Trump election in 2016. I just wanted to bet on him winning the primary. From there, I started betting on more politics stuff. Polymarket has that effect, it opens up a lot of doors.

I’m a software developer by day but I have a pretty light workload, so this is just a hobby for me. Someday I could probably retire from both and quit, but for now I’m able to do it while doing my regular job.

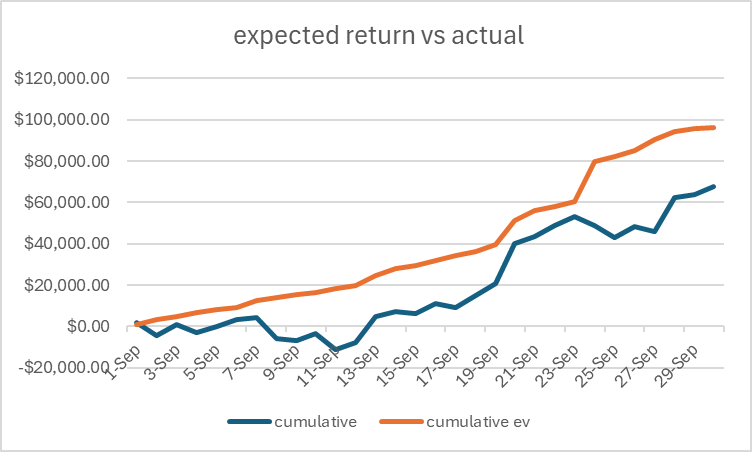

On any given NFL Sunday I might have up to $300,000 in play across various games. At the start of September I was breakeven for the whole month. I had millions of dollars in volume but had made no money. But by September 30th I was up like $60-65k. That’s just the variance you deal with.

My biggest single win was $80,000 on the Super Bowl, just getting a lot of fills for Eagles at a great price. Big events like that don’t happen very often so I’m more willing to take on exposure than I normally would be.

But I’ve also had brutal stretches. There was a time in hockey last year where I lost about $100k in the course of probably 10 days, just losing every game in a row. I was down, ready to quit. I thought I was done with this. But then the next week you win some crazy amount.

What separates a sharp sports bettor from an amateur?

It’s all about data. I’ve been doing this for five or six years. I have several hundred gigabytes of trading data I’ve collected. Every trade I do is stored, every edge I think I have is stored. Then I compare that to the outcome and create a line graph to see if my expected edge matches what I should be getting.

Some games happen a lot more frequently than others. Baseball has more games than football. There’s more NBA games than football games. So you get more data for certain sports.

Originally I was only doing NBA because football has some singular events that can completely move the price, like a pick six [interception run back for a touchdown] where odds go from 10 cents to 80 cents. Basketball doesn’t have that kind of singular event. You get a three-pointer and the odds move a little bit, but it’s a long game with lots of points. It’s easier to market make because the price moves slower.

Hockey is a game where you might only get one or two points the whole game, so one event can really move the price. That’s harder to control for.

Can you walk me through a single game from start to finish?

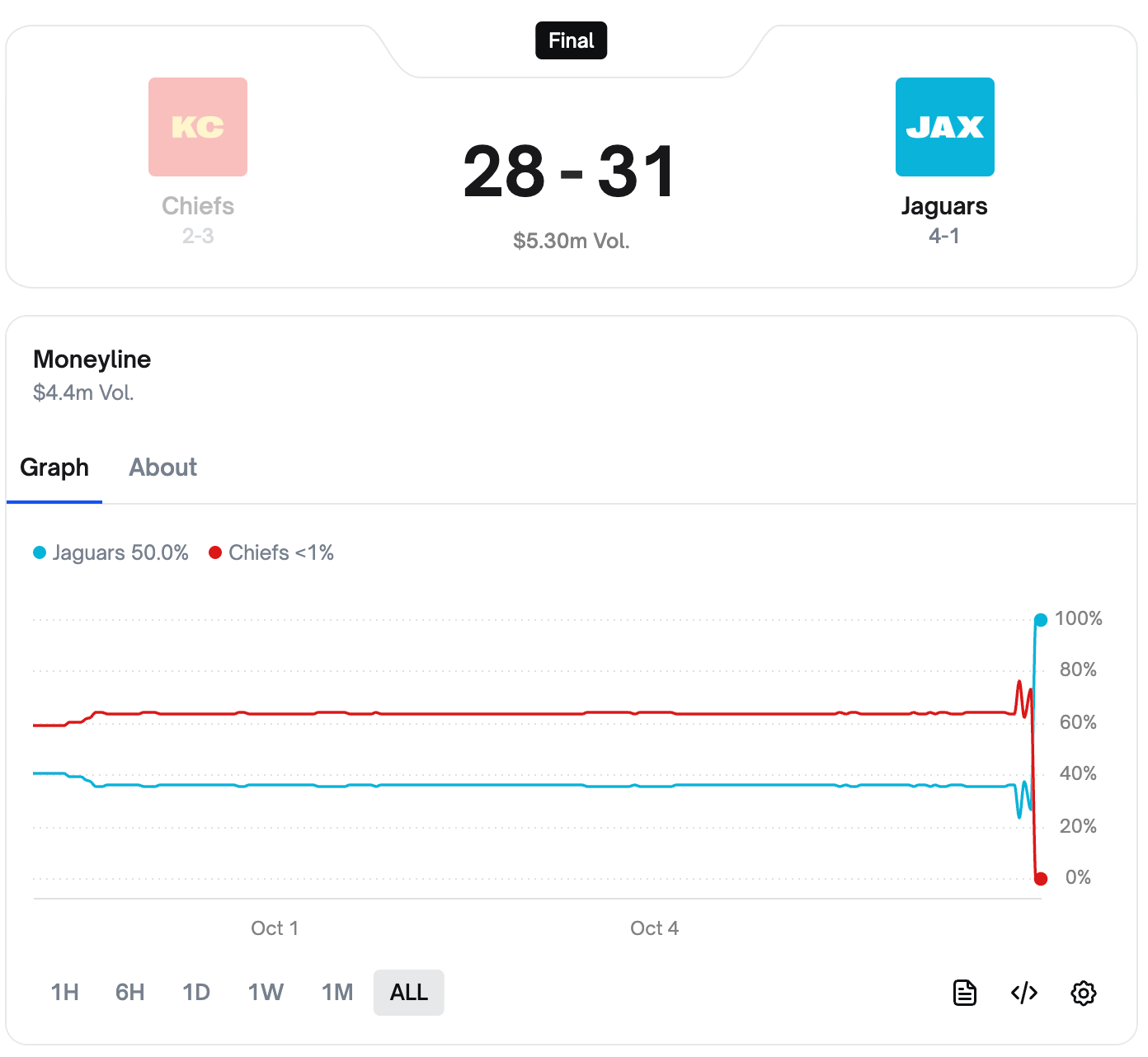

Let’s look at the Chiefs game from last week. I woke up and was getting a lot of fills at 62-63 cents. The Pinnacle line, which is what I use as my basis for pregame odds, had fair price for the Chiefs at about 64.5 cents. If you’re getting filled anything below 65 cents, that has expected positive return.

These lines move a little bit, but generally unless there’s a reason for it to move, the odds stay pretty flat. I’m getting a lot of exposure to the Chiefs at what I think is a very good price. The public was betting the Jaguars so much that they were moving the line down. The Pinnacle line was still the same, but the line on Polymarket was getting pushed down.

I don’t want to take unlimited action on the Chiefs. Even if it is positive expected value (EV), you can get ruined trying to get too much exposure to a single game. As the game was approaching, I started adjusting my parameters. I thought these shares were worth 64.5 cents, but I’m going to let them go for 64 cents because even though I think it’s positive EV, I don’t want to get whacked with this much exposure.

My dashboard was lighting up red. Too many Chiefs shares. As it got closer to game time, I adjusted my numbers lower and lower. I was actually doing some in-game market making during quarters and halftimes because I had so much exposure. I wasn’t able to offload at 64 cents, there weren’t a lot of takers. I went into the game with about $25k on the Chiefs, which is way more than my usual parameter.

If fair value is 64.5 cents, how tight of a spread are you trying to price around that?

I have a sliding scale of liquidity. If fair is 64.5 and you get filled at 64, that’s not a huge edge, that’s half a cent above fair value. So I had about $5,000 in bids at 64 cents.

At 63 cents, now that’s 1.5 cents of edge, which is pretty significant. So I had much thicker liquidity at 63 cents. My bot was bidding basically unlimited at 63 cents because I could sell to a different sports book at 63.5 cents. Books are paying 63.5 for Chiefs shares.

I knew I could get out of this if I got too much exposure. Worst case scenario I can log onto a different sports book, bet Jaguars, and lock in a 0.5% return or whatever it was.

Your system uses the Polymarket API to trade. How much of it runs without you being in the loop?

90% of the time I’m not looking at the bot. It’s doing its own thing. I have lots of money on lots of books, and if a pricing fill comes in, it’ll only fill me in huge amounts if it’s a price I could sell somewhere else for break even or a profit.

I have alerts that go off on my phone if I’m getting crazy action. But most of the time it’s just doing its thing. I’m not watching it, just checking it occasionally to see what’s going on.

Anyone in 10 minutes can make a bot that quotes bid-ask spreads. The hard part is the risk parameters, making sure you’re not getting fast clicked, and making sure you’re not making any mistakes and quoting the wrong spread.

So what happened with the Chiefs-Jaguars game after you went into it with all that exposure?

The Chiefs started off really strong. During the quarter break I was still market making and got a ton of Jaguar shares at a really good price. My exposure to this game at this point was very low because there was a lot of baked-in profit from selling the Chiefs shares early on.

At halftime the Jags were dirt cheap. It was 14-0. I started getting some more Jag shares. Now my parameters started to look bad. I actually had huge exposure to the Jags. I had like $13k risk for the Jaguars.

The Jaguars got a huge turnaround. They got that field goal at 14-0, they got the touchdown, they got a pick. It was a crazy game. I’m getting filled left and right at crazy prices. At the end of the game I ended up getting a lot of Chiefs shares at a good price at the time.

I ended up making about $11k in that game because that’s a market maker’s dream, when a game is moving back and forth, people are buying 85-cent Jags and 85-cent Chiefs. Even though I had more Chiefs shares than Jag shares, it still worked out because there was so much trading volume in that game.

What are the differences between trading on Polymarket versus other sports books?

I have accounts on lots of books. I’ve gotten banned from lots of books. I have a pretty good system for making new wallets on new sportsbooks that pop up. On some of the sites I’ve probably burned through 50 accounts. Even if I’m hedging sharp action, they catch on quickly and ban you.

Polymarket is definitely my main squeeze. There are lots of sites out there that now offer what Polymarket has, though I think Polymarket has the best implementation.

But one thing Polymarket does differently than other sites is ties. If games tie, you have to be very careful. On a book, a tie often pushes (refunds your bet). But on Polymarket, if the Raiders tie their game, it was always 50-50. You got to factor that in.

It’s harder to be a market maker on prediction markets because you don’t have the ability to ban users like traditional sportsbooks. There’s always going to be times where people fast click and get you.

Talk to me about ‘fast clicking.’ What is it?

For me, fast clicking looks like injury reports. If a new injury report for a key player comes out, it immediately changes the odds. And if I don’t update my orders fast, someone can take advantage of my orders at the stale price and suddenly you have $10k of exposure to the other team at what’s now a very bad price. You either accept that you got filled at this bad price, take a huge loss, or just try to hold it and see if you win.

When I was first doing this, I got fast clicked a lot on injury reports and lost money. Now I’ve gotten pretty good at avoiding it.

For NBA there’ll be games where all the stars are out and they’re only playing the backup team. Those can move from underdog to huge favorite or vice versa. Those injury reports have an expected time they’re supposed to come out, but you can get people getting a heads up ahead of time. You’re talking 40-50 cent swings sometimes for NBA games. This makes NBA extremely hard to market make.

For NFL, if the quarterback gets hurt during practice that would move the odds a lot. But if you look at most NFL games, the starting line and finishing line aren’t too far off.

For me, if I know an injury report is coming, I just don’t want to market make that game. I don’t want to get clicked. Sometimes it’s unavoidable, but I’m not trying to be the guy that gets the first click on an injury report. I’m trying to be the guy that doesn’t get clicked.

So I’m always monitoring for injury reports. I have my Twitter feed up. I have a pretty good feed of known accounts that report on injured players. If I see news come out that a player is injured, I have a button I click on my dashboard: turn off market making for this sport, clear all orders, and stay away from this.

I’m more of a “let the dust settle, let’s see what the new line is” and then I’ll come back in with the new spread. There’s huge levels of sophistication to this endeavor that you can get into. The higher levels are way above my individual one-guy-doing-this-from-his-computer level.

How much of your bankroll are you putting on any one game?

For an NFL game I’m okay with risking up to $25k. For a college football game I try to get that down to about $5k.

At any given time on NFL Sunday I might have up to $300k in play across various games. If I need to do more than that I’m not opposed to it, I just need a good reason.

Pre-game, with half-cent edge, I’m getting $5-10k on each side. With 1.5% edge or arbitrage edge, I’m bidding basically unlimited amounts.

In-game it depends on what my exposure is. But order of magnitude: during quarter breaks I might quote a couple thousand dollars on each side. During halftime probably close to $5k each side.

Tell me about the pre-game versus in-game dynamics. Why don’t you do as much in-game trading?

Last night in the Jags-Chiefs game, the running back ran out and scored a touchdown. Everyone on the screen saw touchdown, all the odds said touchdown, it moved huge. But then wait a minute, he actually dropped the ball before he went into the end zone and it rolled out the other side, so it wasn’t a touchdown.

There was no flag for 10-15 seconds. The odds had already moved massively. If you could see that wasn’t a touchdown first, you would have gotten 40 cents of EV on that trade. You would have gotten some very cheap Jag shares that ended up being worth $1.

This is why people in stadiums have an edge. Stuff that a robot can’t really pick up, it can’t see that the announcer’s talking about a potential flag. It either sees a flag or doesn’t.

For basketball it’s less of an issue, a two-pointer or three-pointer happens all the time. But for hockey, for football, and to some extent tennis and obviously end of game for NBA, being able to see the event happen while it’s happening or knowing that the thing that happened is going to get called back, you can get some crazy trades off and make a lot of money.

That’s something market makers normally would not be able to do on a sportsbook.

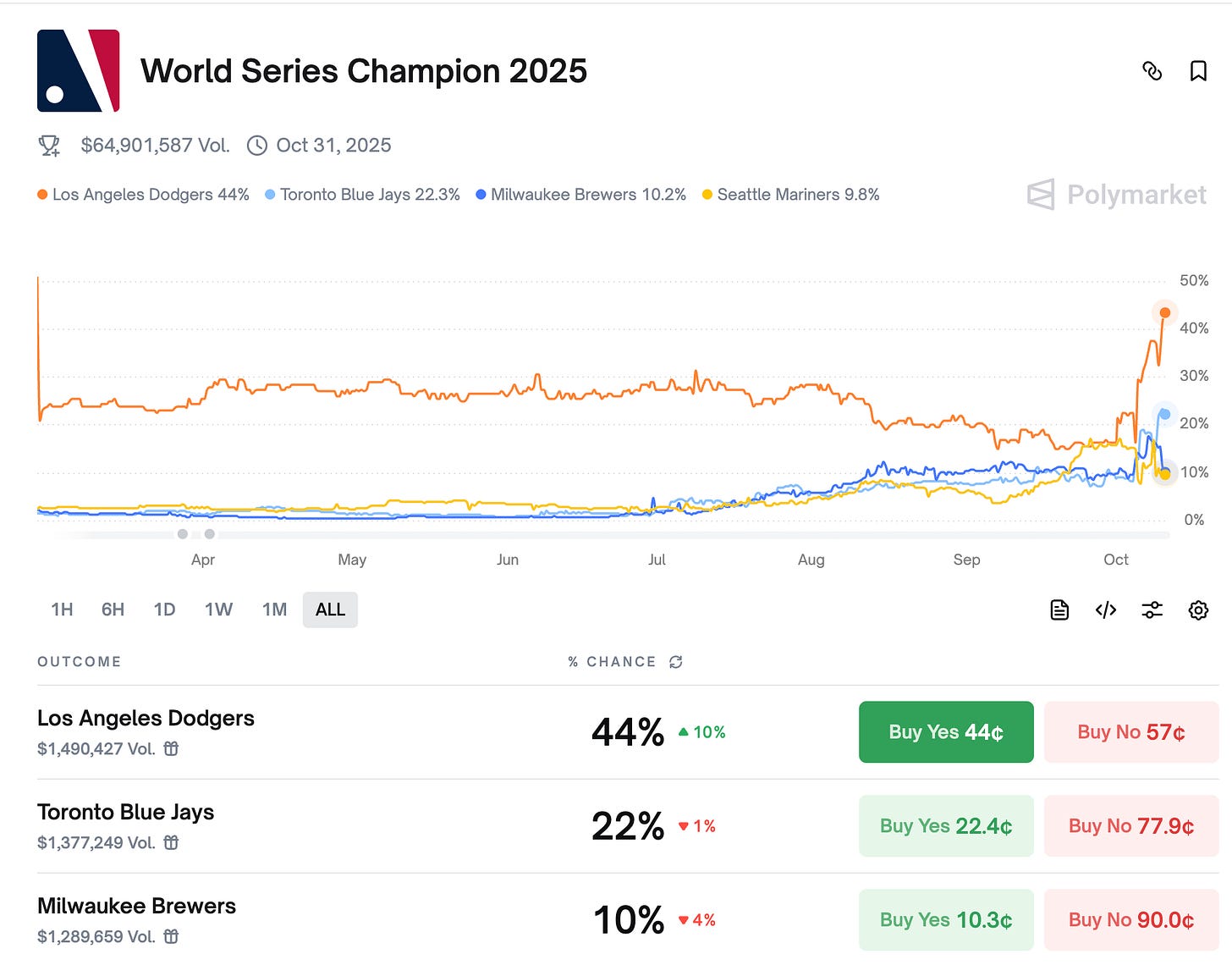

What about longer term sports markets, like the Super Bowl or World Series. Do you trade them at all?

People on Polymarket hate holding exposure to things that happen months from now because you need a return on your investment. So futures markets often have teams trading 40% below fair value compared to sharp sportsbooks.

There’s no limit, so whales can move lines. There’s no shorting, so mispricing persists. I got very cheap Cubs World Series shares just by comparing the sharp lines to Polymarket.

I’m also in a few Discords that sell picks, not to follow them but to see when there’s going to be a big line movement. When a tout service pumps a team, suddenly I see a lot of trades come in and take the other side. This allows me to get pretty good prices on the fade.

Are there any other Polymarket traders you respect and follow? Or resources you can think of for trading in this style?

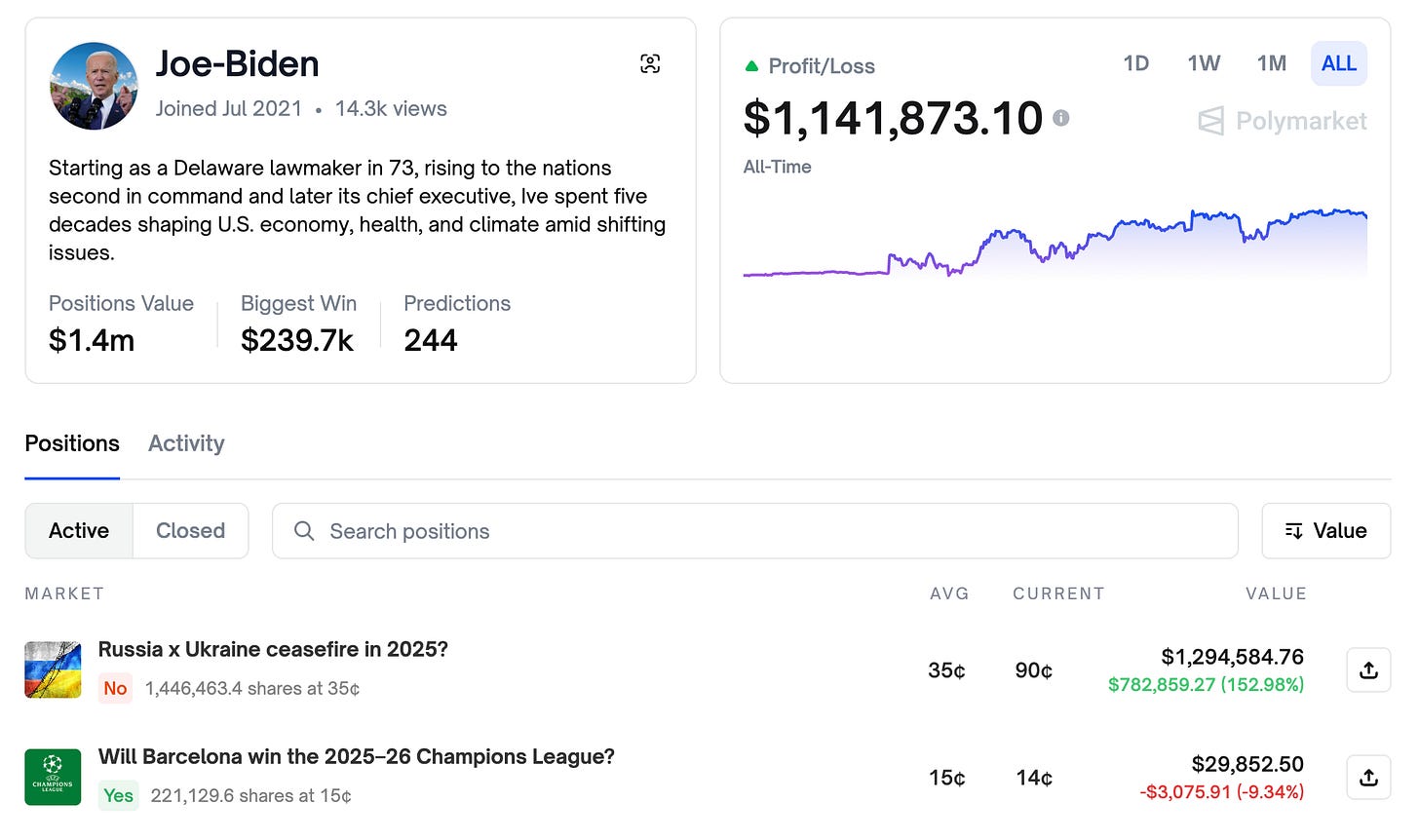

One guy, Taras, he’s a professional poker player who also likes to bet on things. He has a very clear edge on World Cup games. You might know him on Polymarket as ‘President Biden.’

But many sharps constantly create new wallets. They don’t want people to know they’re sharp. You gotta trace the money and see what wallets they have.

If you’re thinking about doing what I do, I would say don’t. You need a pretty big bankroll to ride out the swings, you need a pretty sophisticated model, you need to be very quick.

But if despite that you want to get into it, I would say Nate Silver’s book On the Edge. He published an interesting section on sports betting, about risk taking in general.

In a lot of ways poker and sports betting aren’t that different. You just have an edge, you have your EV, you’re basing things off information that you don’t know is going to happen. So a lot of those lessons from talking about poker do also apply for sports.

Disclaimer

Nothing in The Oracle is financial, investment, legal or any other type of professional advice. Anything provided in any newsletter is for informational purposes only and is not meant to be an endorsement of any type of activity or any particular market or product. Terms of Service on polymarket.com prohibit US persons and persons from certain other jurisdictions from using Polymarket to trade, although data and information is viewable globally.

Fascinating!

Did this individual provide proof of their profitability on Polymarket? Some of this article seems questionable to me.