🔮 MANGO MARKET

How mention market expert Mango Lassi recovered from a 100% drawdown

Mango Lassi, a former tech worker from Delhi, ran up his first deposit to $2k before losing it all on an Olympic swimming trade gone wrong.

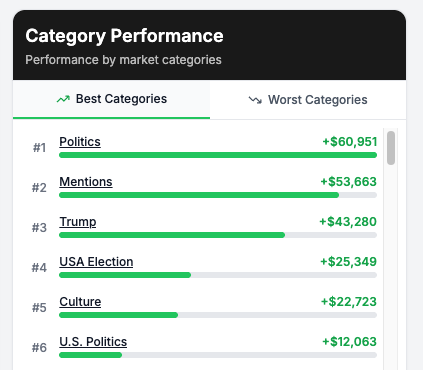

He re-deposited $4k and quickly ran his bankroll to over $130,000 in profits in less than a year, with nearly $70,000 coming from mention polymarkets. The Oracle spoke with Mango about his approach to forecasting political speeches, what Westerners miss about Indian politics, and getting an edge in Google search polymarkets.

This interview has been edited for length. All answers are his own.

How did you come up with the name Mango Lassi?

During COVID, I drank a lot of mango lassi at home. It’s a popular Indian drink, but it’s also big outside India. People are familiar with it, and they also identify you as Indian from the name.

What’s the prediction market scene in India like?

Actually, betting in India is considered unethical. We have old religious stories which guide us against gambling. But recently, the trend has shifted, especially in cricket. For a long time I wasn’t in touch with any active traders from India who were doing well. But since I started posting on X more, I connected with a few people from my city.

Most of your trading seems to be on US politics. How did you end up making that your focus?

I also need to tell you how I discovered Polymarket. It’s an interesting story. I was working as a software engineer at a big tech company in India, and then I left. I was exploring different startup ideas. Then I thought of this really interesting idea: what if I could develop an app to bet on events? Like India’s equivalent of the Fed is the RBI, so for example will the RBI cut rates next month?

But then when I searched Google, I discovered Polymarket, and was excited to see that someone had already built it. So I just signed up and deposited $10.

I follow American politics very closely. And this was in July 2024, just before the Trump assassination attempt. Then we had that first debate, the Trump-Biden debate, and Biden did very poorly. Initially I was just bonding the markets that Biden won’t resign, because I was very sure about that. But then I was looking for opportunities to make an even higher return, and I discovered mention markets.

During the campaign, Trump would do like two speeches daily, and that was very engaging. I could watch his speeches live and trade, and I could analyze his past speech data and bet accordingly. I just got very familiar with mention markets, and that is where I started doing very well. That’s where I doubled down and deposited more and kept making a lot of money. Since then, I’ve made almost $70,000 just in mention markets.

Walk me through your mention markets trading. There’s an app that analyzes old speeches. Did you make your own version of that?

Initially it was just manual. I used to just analyzed speech data. Like, suppose you have “border,” how many times did Trump mention it in the last few speeches? Since his election speeches were quite similar, it was really helpful to predict what Trump is going to say in his next speech based upon the past few speeches.

But right now it’s getting more random. You really need to see what kind of event he’s holding and where it is. So he might say one thing when he’s in the White House, but he might not say that when he’s meeting Xi in South Korea. It’s getting tougher, but I think tougher makes it better for me, maybe, because I’ve been watching his speeches for over a year. So I have a better idea of how Trump thinks, but he is still very, very unpredictable.

Like suppose during the election he mentioned “border” over 50 times in many speeches. Then suddenly in the next one, he doesn’t say it at all during the first half hour. So maybe you try to dump your shares, but then he’ll spam “border” like 20 or 30 times in the next few minutes.

He can do anything. But that is, I think, good for mention markets, because that brings volume and price fluctuation. The volatility helps good traders who can judge his behavior and extract alpha out of this unpredictability.

Right now I would say the difficulty has increased, but it’s still possible to win. If the difficulty is low, over time, alpha goes down because more and more people come into the market. Then they’ll start having the same kind of heuristics, and all the traders will start thinking the same. So alpha will definitely get squeezed. But right now it’s not been squeezed.

What are some of your best trades?

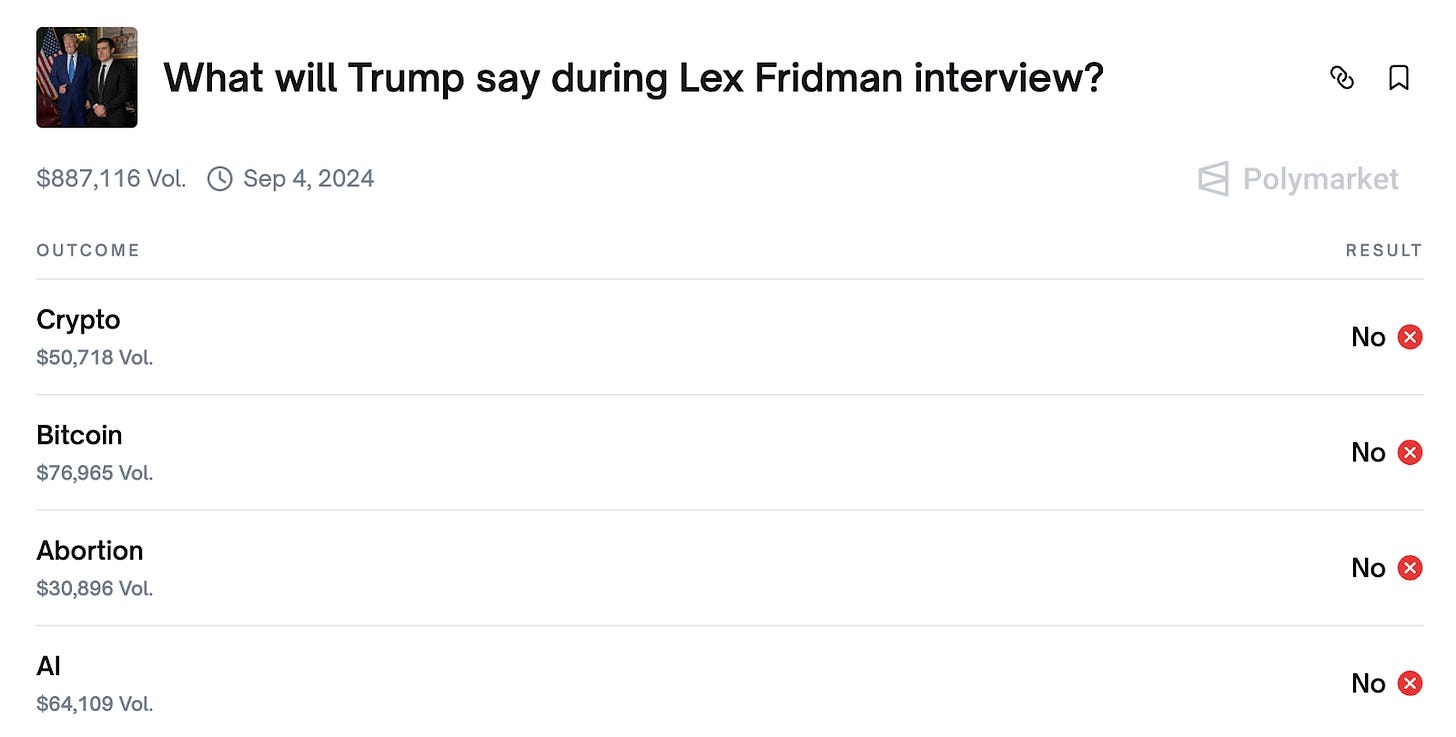

My biggest win for mention markets, was on the Trump interview on the Lex Fridman podcast. Lex Fridman was supposed to do a podcast with Trump and there was a mention market. The video was supposed to drop at around 10:30pm Indian time.

I was talking with RememberAmalek and we figured out a way to get the transcript well before. We found out the transcript one hour before the event. So we just bet all our entire portfolio and we both made over $10k.

How did you find it?

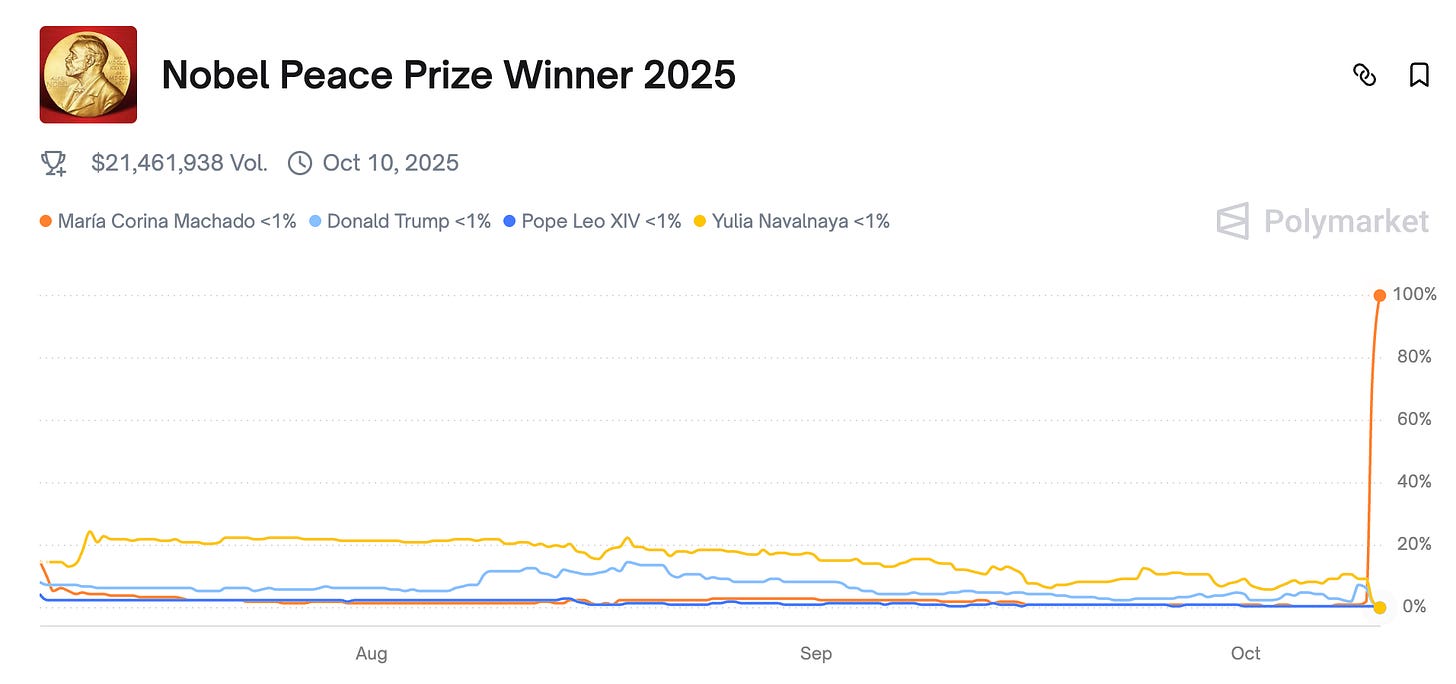

It was publicly posted, similar to the Nobel Prize market. I mean, that one was more challenging. I have no idea how he did that one, because he was involved with some other people. I have no idea, but that guy is always involved in this kind of thing.

Any other big wins?

We had the India-Pakistan conflict in May. There was a Pakistani terrorist attack that killed around 30 Indian civilians in April. There was a market, will there be a military action by India against Pakistan? The terrorist attack was on 20th April, and it was like 5th May, and everybody was thinking that India won’t do a military action, because if they were going to do it they would have done it already.

Indian markets are attractive to me because the site is filled with Westerners, and their image of India is distorted. I think they were trying to view India from the lens of Middle East conflicts, where Israel is very quick to retaliate.

But being from India, I know how the government thinks. They like to take their time, but the current government is not in a position, politically speaking, to give the opposition any opening on national security. So I was very sure that they would take military action. I think I made like $4- 5k on that bet itself.

Then the conflict was over in like three days, and there were like five or six markets for India-Pakistan, and I won all of then, I think I made like $7-8k. I was also very sure the ceasefire would be quick and sudden, but the announcement from Trump on Truth Social was a bit surprising to me.

Biggest losses?

My initial deposits were about $1,000 in total. I doubled my money in a few days with mentions, I was on a roll. But then I lost my whole portfolio, $2k, in some Olympic event, 800 meter swimming. One person was third midway, and I thought that person was going to lose. I was getting 50 cent odds for no, that she wouldn’t win. So I just put my entire portfolio on her, and then she won surprisingly.

Since then, I made two rules: no sports, and I would cap my bets at 10% of my bankroll. I recently lost $10k on the Romanian election this year, which hurt but didn’t wipe me out.

You’re also in a lot of tech markets. What’s your edge there?

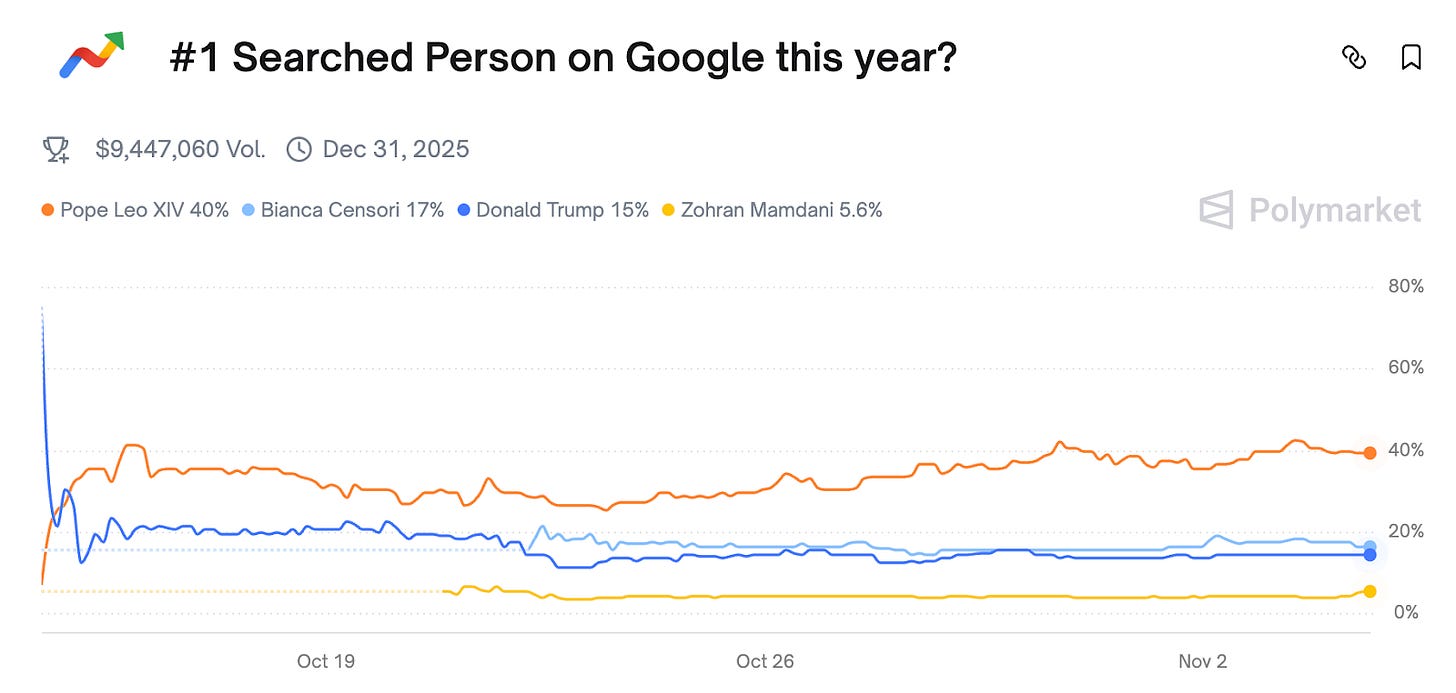

The Google search markets are really interesting because they can be predicted. This is something which is very technical and the information is public. You can just go out and look for the information and try to figure it out.

There’s one market: most searched person on Google this year. Google releases its list annually in December. I think a lot of people are betting on Trump. The price for Trump is like 13 or 14 cents. I think they believe that this market is by the search volume alone, but people need to research that Google’s list is not only by absolute search volume. It is also how trending the person is.

Donald Trump was already trending last year due to his election campaign, so I think he has a quite low chance to win it again. He was the number one search person last year, so coming it up again would be difficult. People are also betting on the new Pope, but I don’t think even he has that kind of a spike to come up number one. So I’m betting against the Pope and Trump.

So even if someone is the number one search this year and last year, they’re not going to give it to that person because they’ll look at the volatility?

Yeah, because otherwise the same people will come up on the list every year: Taylor Swift, Trump, Elon Musk, the same kind of people.

What’s your total P&L?

I think around $130,000 across a few wallets, some I keep private to avoid copytraders. And I recently cashed out a big chunk to buy a house.

Do you use the Kelly criterion to size your bets, or anything like that? Or just your max 10% rule?

Kelly is too aggressive for me. I like to be conservative in my bets, and I like to cap it at 10%. Initially, when my bankroll was very low, I could cap at 20%, but now 10% is fine. I’m okay losing 10% of my portfolio. But back then, 20% wasn’t much. Back then it was 20% because when I started, I had to be more aggressive to increase my portfolio size.

Who are the other traders that you look at? Either smart money, dumb money, specific accounts that if you see them on the other side you’re worried?

Domer is everybody’s favorite. He’s very smart.. His odds are very close to, I think, the actual odds. So whenever he’s on the other side, I tend to re-think my position.

RememberAmalek is a very sharp trader, great at elections. He’s very sharp. When his conviction is high, he sizes up huge.

Car is very inspirational. He’s very good at news trading specifically.

Dropper is another one. He’s also very good at news trading and crypto markets.

If anybody is against me in a mention market, I don’t get worried. But if I see any of these guys against me in another type of market, I’d definitely rethink.

Disclaimer

Nothing in The Oracle is financial, investment, legal or any other type of professional advice. Anything provided in any newsletter is for informational purposes only and is not meant to be an endorsement of any type of activity or any particular market or product. All odds are time sensitive. Terms of Service on polymarket.com prohibit US persons and persons from certain other jurisdictions from using Polymarket to trade, although data and information is viewable globally.

was expecting this to be an article about Avi Eisenberg

Interesting