🔮 IS THAT A UFO?

How Polymarket Traders Will Decide if UFOs are Real

🔮 Friends of The Oracle

What C-Suites and Wall Street are reading: Semafor Business delivers sharp, deeply sourced reporting on the forces shaping global markets. Penned by Liz Hoffman — one of Wall Street’s best sourced reporters — it offers behind-the-scenes insight, smart analysis, and the kind of scoops senior executives and market insiders rely on. Subscribe free.

On December 4, the Pentagon released a grainy 10-minute video of a speck buzzing around, captured by a military sensor somewhere over Europe. The footage was posted by AARO, a military UFO investigation office, as an “Unresolved UAP Report.”

Was this slam-dunk footage of a flying saucer? No. But did it count as Trump “declassifying UFO files”? That’s where things get interesting…

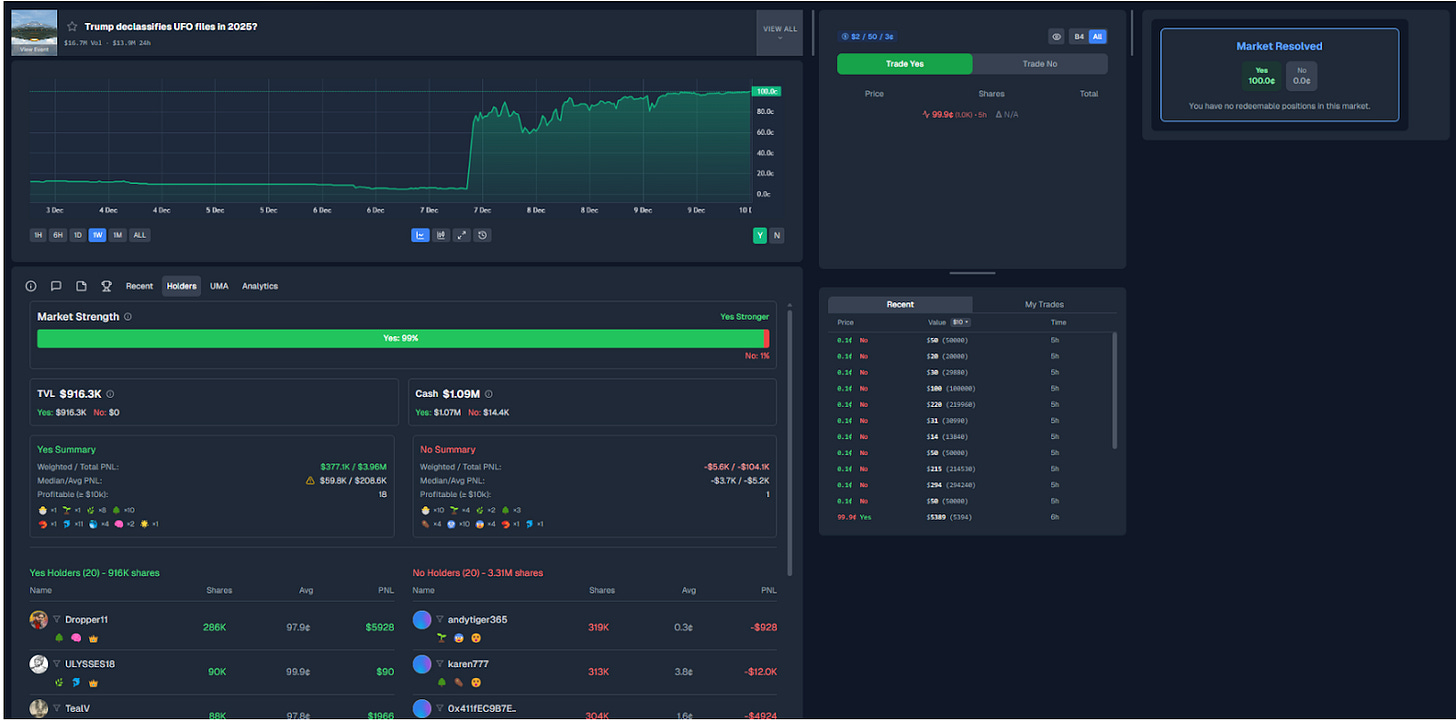

Polymarket traders were sharply divided on whether the footage satisfied rules for the “Will Trump Declassify UFO Files in 2025” market and activated Polymarket’s dispute process. This process involves a debate period, followed by a final vote by tokenholders of UMA, a third-party oracle service.

Well under 2% of polymarkets are ever disputed. But when it happens, disputed markets can take on a life of their own, as participants share evidence and attempt to convince UMA voters of their side.

Enter Betmoar.

With over $380m in volume, Betmoar.fun has become the largest third-party trading app for Polymarket, in large part by giving users a new reference point for navigating dispute situations.

The app tracks data relevant to Polymarket disputes, showing which traders have the best win rates in contested markets, and shows which side the sharp money is betting on.

This interview has been edited for length. All answers are Betmoar’s own.

Let’s start by familiarizing people with Polymarket’s resolution process. Can you explain how it works?

Polymarket uses an outside oracle service called UMA to resolve disputes on their markets. When a market’s conditions are met, someone “proposes” an outcome and puts up a bond, usually $750. They get this back plus a small bonus if they are correct, and lose it if they are wrong.

Then there’s a two-hour window where another user can dispute the outcome if they think it was proposed incorrectly. If no one disputes, it settles. If someone disputes, they put up their own bond and it goes to UMA token holders. There is a period where the two sides of the market debate the rules and evidence, and then the UMA token holders vote, which determines the final outcome.

This debate process is where the real alpha lives. Contentious markets might not be that many by count, but they generate massive volume. Traders pile in because, if you understand the process better than others, you can profit enormously.

Walk me through how someone can use your data to trade during disputes.

If you’re an experienced arguer and can debate your way to a market resolution, you create your own alpha. You buy shares cheap when there’s uncertainty, argue your side convincingly in the UMA Discord, win the vote, and get huge multiples on your initial investment.

The Zelensky suit market is the classic example. In July, there was a market on whether Zelensky would wear a suit. A lot of new users thought it was obviously yes. They bought ”Yes” shares and started shilling it on Discord as an easy 100x.

But experienced traders knew the exact same jacket had been ruled “not a suit” in June. The precedent was already set. But most of our superusers were not caught with their pants down. They understood the market context and history.

Let’s go through a recent case of a dispute and what info Betmoar users were able to see.

There was a recent market on whether Trump will declassify UFO files in 2025. A Pentagon office called AARO released a 10 minute video of a little speck buzzing around that was captured on some military sensor somewhere.

The video was posted as an “Unresolved UAP Report” and its description said, “the footage depicts the presence of a physical object. The object’s morphological features, performance characteristics, and behaviors are unremarkable and do not warrant further analysis.”

So here you have the basis for a classic Polymarket dispute. Was this slam dunk footage of a flying saucer? No. But does it count as releasing UFO files? Quite possibly. The market was proposed, someone disputed and it went to UMA for debate and a vote.

So now we’re trying to decide if this video counts as “UFO files” or not. What data is the app showing about the situation?

During the debate period, “Yes” shares were trading around 80 cents, which created a significant buying opportunity for anyone paying attention to our data.

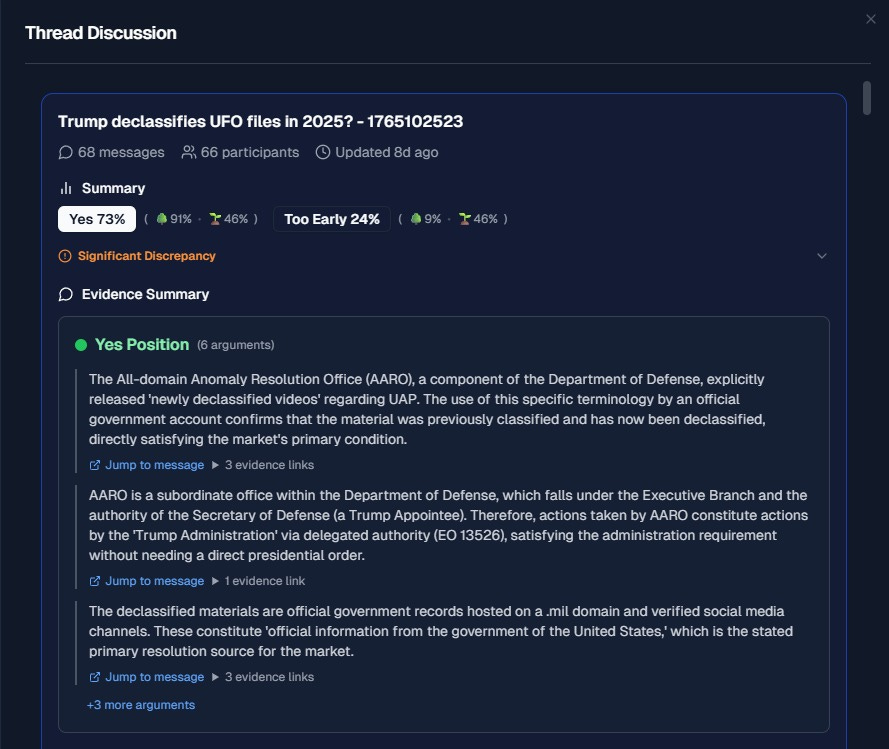

Our Thread Discussion feature made it easy to digest the conversation happening across scattered messages in the UMA Discord server where the debate happens.

And it also showed a huge split between new and experienced users. You can instantly see that all the experienced traders, like Thonker, ster, dropper, and Car were all holding and arguing forcefully for “Yes.” Their core argument was that AARO explicitly released “newly declassified videos” on official government channels, which satisfies the market’s conditions.

On the other hand, it was mostly new users who were arguing for “No.”

The market ended up resolving “Yes.” Traders who saw much of the smart money was on “Yes” had two days to buy at a significant discount while new users were arguing about the blurry speck.

AENews, for example, made over $16,000 on this single market, ranking #2 out of nearly 4,000 traders.

What else should traders be using on your platform?

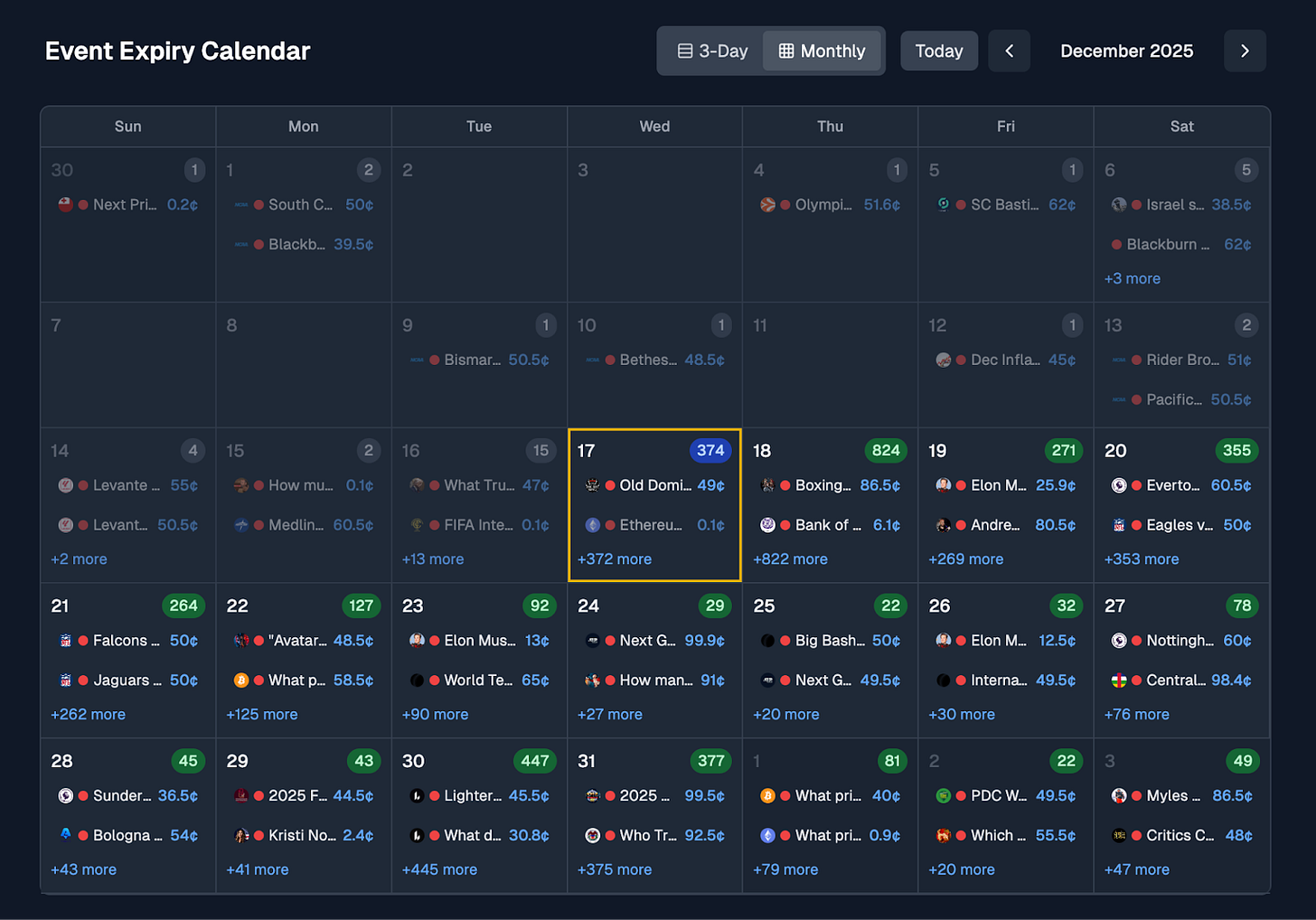

The calendar view shows what’s resolving soon and bonding opportunities. Bonding markets are still giving insane APYs, easily 200 to 400% on what are essentially risk-free positions. Compare that to AAVE giving 4-6% on USDC. It shows how capital inefficient our space still is.

The news terminal maps breaking news directly to relevant markets so you can trade without switching tabs. You can track specific traders and get alerts when they enter positions.

Final wisdom for people entering the space?

You don’t need to trade fast. This isn’t Solana memecoin sniping. You get better entries being patient and understanding the market well. The people who actually do the research, look into profiles, study the data, build qualitative reasoning about market context, they’re the ones who make real money.

Be especially careful when you see cults form around a market, and pay attention to the track records of users who are trying too hard to convince you to buy something. If it was such a good price, why wouldn’t they just be buying the shares themselves? In the Zelensky suit situation, people were buying Yes at sub-cent per share and shilling it as an easy 100x. That’s a trap.

The trenches are in the UMA Discord. That’s where the actual trading happens. Twitter is for dopamine hits. Discord is where you make or lose money.

Disclaimer

Nothing in The Oracle is financial, investment, legal or any other type of professional advice. All odds are time sensitive. Anything provided is for informational purposes only and is not meant to be an endorsement of any activity or market. Terms of Service on polymarket.com prohibit US persons and certain other jurisdictions from using Polymarket to trade, although data and information is viewable globally.