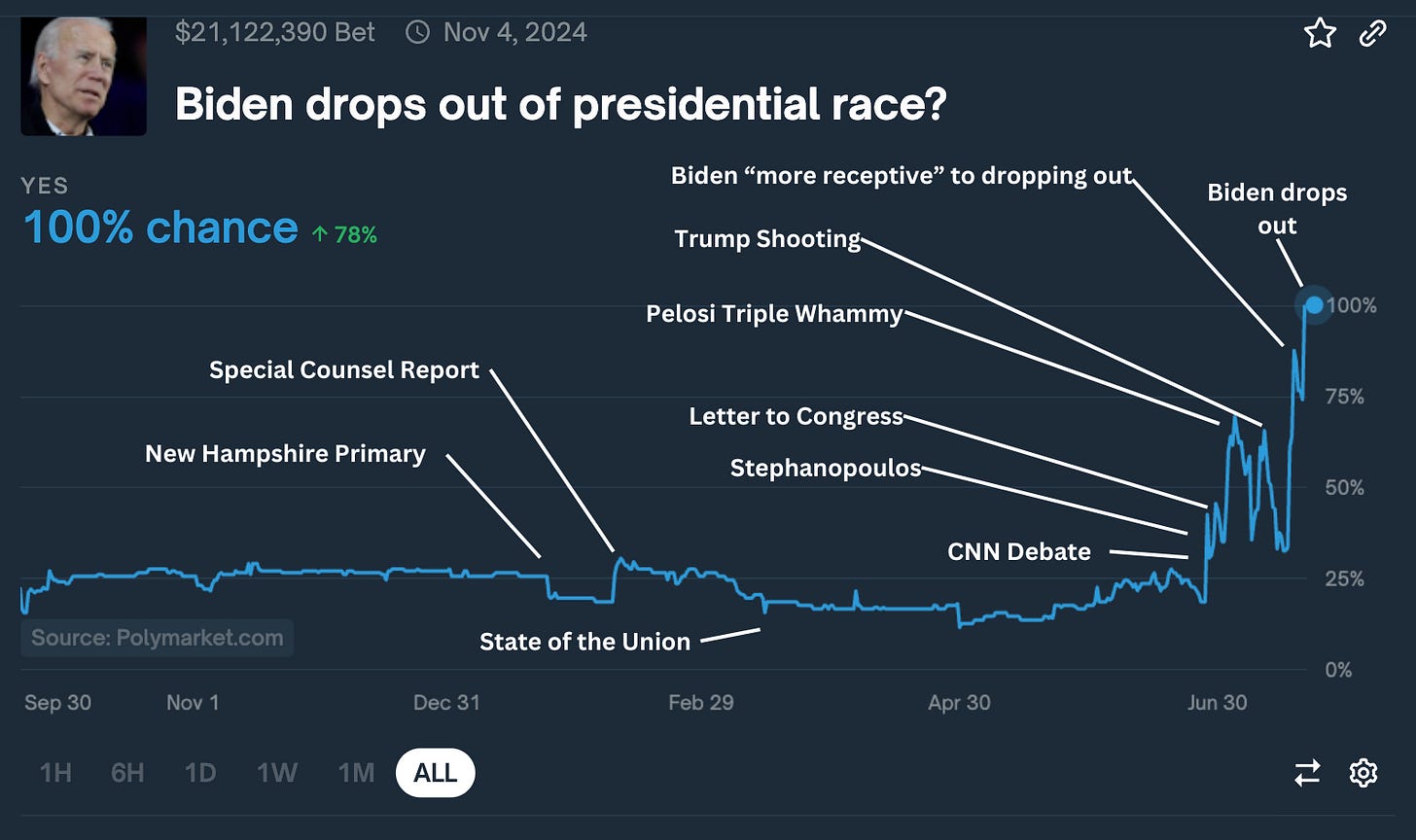

Gradually, then Suddenly: The Definitive Account of the Biden Dropout Market

How Joe Biden’s odds of ending his campaign shifted in the days after the CNN Debate

With Kamala Harris cruising uncontested to the Democratic nomination, it’s hard to remember how uncertain everything felt just a few weeks ago.

One day it seemed like everyone from George Clooney to Nancy Pelosi was calling for Biden to end his campaign. And the next, DNC bigwigs and Biden himself were scolding the press for even thinking it possible. Back and forth it went, until one Sunday afternoon, it was Joever, with a one-page letter posted to X.

But as early as ten months before Biden’s dropout, prediction market traders were putting millions of dollars on out-of-consensus bets on Biden’s political future. By holding these positions (and also subjecting themselves to no small amount of ridicule on social media) these traders were generating one of the most important forecasts in recent political history - one that could not be found in polls or economic data: the odds that a president would make the unprecedented decision to drop so late in the game.

Looking at how the odds of Biden’s dropout changed in the days after his CNN debate with Trump allows us to measure the relative importance of different events and participants in one of the wildest months in American political history.

Exactly how “all over” was it when the Clooney op-ed dropped? How “so back” were we when Biden sent his defiant letter to Congress? Let’s take a look at how the odds of Biden dropping out - or p(drop) to borrow a phrase from Nate Silver - shifted at critical moments in the campaign’s final days.

Early Rumblings

The Biden dropout market was launched on Polymarket on September 22, 2023, well before primary season kicked off. Between then and Biden’s eventual withdrawal, a total of $21,122,390 would flow into this market over the next ten months, making it the world’s largest single market on the topic

Since the market’s inception and into early 2024, the probability of Biden’s dropout - p(drop) - held steady in the mid 20s. For an event that had never before happened in American history, 20% is astonishingly high - evidence that some were sensing that all was not right in Bidenworld. As the primaries began, the volatility of p(drop) began to increase.

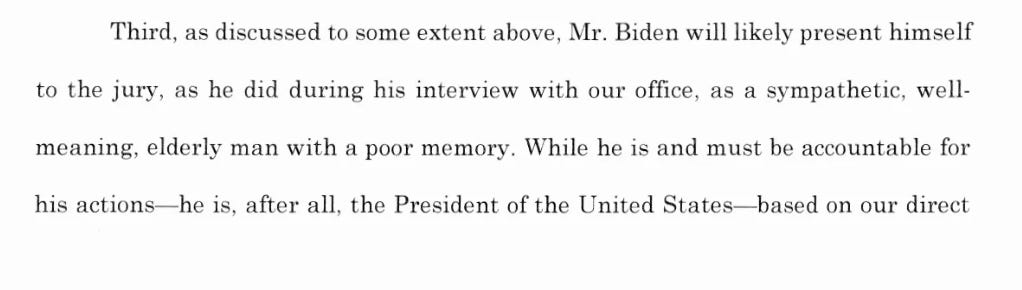

February 8 - Special Counsel Report: P(drop) doubled to 37% in the day following the release of Special Counsel Robert Hurr’s report in Biden’s classified documents probe. In explaining the decision to not prosecute Biden for document mishandling, the report called Biden a “sympathetic, well-meaning, elderly man with a poor memory.” Some Democratic-aligned commentators framed the report as a partisan hit job, but in hindsight this looks like a clear warning from the market that Biden’s mental acuity issues were a serious threat.

March 7 - State of the Union: The media narrative around Biden’s annual address to Congress was positive, with multiple commentators framing the speech as a cure for “jitters” about the president’s capacity; p(drop) fell from 26% to 16% in the hours after the event. It is interesting to note, however, that in March, Biden’s ability to get through a choreographed speech was portrayed as a major win. But, just a few months later, the perception had shifted such that a teleprompter speech was no longer seen as enough, amplifying demands for Biden to appear in unscripted and contentious settings.

Dems Declare Open Season

June 27 - CNN Debate: By 8 AM on the morning of the now infamous Biden-Trump debate, p(drop) had fallen back to 18.5%. In the 24 hours surrounding the debate, Biden’s drop odds more than doubled to 42%, the biggest spike coming the following morning as the New York Times ran an editorial: “To Serve His Country, President Biden Should Leave the Race.“ This created a permission structure for other Democrats to shift from expressing doubts to openly calling for Biden to get out.

July 2 - First Lawmaker Calls on Biden to Exit: Biden’s drop odds surged to a new high of 82% after Rep. Lloyd Doggett of Texas became the first Democratic representative to call on Biden to quit.

Biden Strikes Back

July 5 - Stephanopoulos: After the July 4th holiday weekend, the Biden campaign began to signal that they weren’t going down without a fight. The president gave a taped interview to ABC’s George Stephanopoulos where he unconvincingly responded to questions such as, “Are you more frail?... Have there been more lapses?” P(drop) hovered around 65% as clips from the interview were teased on social media throughout the day.

July 8 - Letter to Congress: The strongest arrow in Biden’s quiver came in his letter to Congress in which he declared he was “firmly committed” to staying in the race, and challenged would-be candidates to oppose him at the convention. The letter was aimed at stopping defections on Capitol Hill, where a trickle of elected officials were coming out in opposition to his candidacy. In the days immediately after the letter, p(drop) traded as low as 34%, but this dip would not last long.

The Pelosi Factor

July 10 - Triple Whammy: Nancy Pelosi appeared on Morning Joe and ignored Biden’s multiple protests that he wasn’t going anywhere: “It’s up to the president to decide if he is going to run. We’re all encouraging him to make that decision because time is running short.” Not exactly a ringing endorsement. The same day, Peter Welch of Vermont became the first Democratic senator to call for Biden’s removal, and George Clooney spoke for the Obama-aligned Hollywood donor class, writing “I Love Joe Biden. But We Need a New Nominee." Over the next 48 hours, p(drop) surged to as high as 69%.

July 13 - Shots Fired: The attempted assassination of Donald Trump boosted his odds in the general election from 60% to the low 70s in the day following. Some on Twitter touted the event as a lifeline for Biden, and the odds did move down from the mid 40s to as low as 32% on the day after the attempt. However this dip proved to be short lived, and 32% marked the low water mark for p(drop) going forward.

July 17 - Walls Closing In: As the shooting started to move out of the headlines, it quickly became clear that Biden’s position was as perilous as ever. An AP-NORC poll found that two-thirds of Democrats wanted Biden out, Adam Schiff became the highest-profile House Dem to call on Biden to exit, and - crucially - CNN reported that the president was “more receptive” to dropping out. Over the course of the afternoon p(drop) almost doubled from 36% at 1pm to nearly 70% by 8:30 p.m.

July 20 - Decision Day: Reports indicate that Biden ultimately made up his mind to exit the race over Saturday the 20th while meeting with close staff and family. Assuming the reports are accurate, the drop was basically certain at this point, however p(drop) continued to trade in the low 70s, indicating that the information was successfully kept secret.

July 21 - Announcement Day: Biden’s decision came without warning on a Sunday afternoon. Just hours earlier, Biden campaign co-chair Cedric Richmond had appeared on TV denying any plans to leave the race. The following is a timeline of the minutes surrounding the announcement, reconstructed from Polymarket data and public sources.

1:40 PM: Polymarket indicates p(drop) of 71.5%

1:46 PM: Biden exits the race via a letter posted to X

1:50 PM: P(drop) rises to 93.5% on Polymarket

1:56 PM: P(drop) passes 99% on Polymarket

2:02 PM: CBS News reports

2:02:30 PM: NBC News reports

2:04 PM: ABC News reports

The fact that the market surged nearly 30% in the final few minutes is a testament to the opsec of the Biden inner circle. Subsequent reporting confirms this, with most of Biden’s campaign staff saying they learned of his decision from the post itself or media reporting on it.

On that day, Polymarket saw $28m in total volume, its highest 24-hour volume to date, making this also the heaviest trading day for prediction markets. The largest moves took place in the general election, Democratic nomination, Democratic VP, and Biden resignation markets.

Three Takeaways

Leak-Resistant White House: A recurring debate over prediction markets is whether they attract insiders to price in new information before it hits the headlines. With over $21m in volume, the Biden drop out market offered a juicy prize to anyone who could close the information gap between ~70% and 100% on that final Sunday. But that didn’t seem to happen here, as the market gapped up on Biden’s official announcement.

News Flow: Instead, the market seemed to react fairly predictably to news flow, usually taking several hours to a day to stabilize after a major development. Ambiguous new information, like the impact of Trump’s assassination attempt on Biden’s odds took longer to price in, while obvious major developments, like the CNN report that Biden was “more receptive” to exiting was priced in faster. Biden’s post ending his campaign was reflected in Polymarket prices a full six minutes before the first legacy network.

Biden Got Outplayed: Looking back over the timeline, it is apparent how big of an impact the July 10 triple whammy of Pelosi / Clooney / Welch had on the course of events. Even though p(drop) was temporarily pushed down by the reaction to Trump’s shooting, this seems like the “point of no return” for Biden. He was now facing a coordinated effort run by one of his own party’s most ruthlessly effective operators.

Disclaimer

Nothing in The Oracle is financial, investment, legal or any other type of professional advice. Anything provided in any newsletter is for informational purposes only and is not meant to be an endorsement of any type of activity or any particular market or product. Terms of Service on polymarket.com prohibit US persons and persons from certain other jurisdictions from using Polymarket to trade, although data and information is viewable globally.