🔮 Flooding the Zone?

What markets say about Trump’s expanding global ambitions

NEW MEDIA GRANTS PROGRAM: We are launching a News Grants Program. Do you have ideas for unique news content that leverages our prediction markets? Write oracle@polymarket.com with your idea or reach out on X.

SOCIAL MEDIA SURVEY: Can you help us out with a super-quick 3 question survey about your social media usage? Here’s the link.

During his first term and much of the ‘24 campaign, the big themes of Trump’s foreign policy were:

Pulling back from America’s global commitments

Getting allies to pay up for security

A personalized negotiating style

Peace through strength: High military spending and occasional strikes, but avoiding getting involved in new ground wars

Above all, things could flip fast: Trump threats of nuclear annihilation in one month could blossom into love letters by the next.

But now under 100 days into the second Trump term, we are seeing a different set of headlines:

Trump is “very serious” about taking over Greenland

Gaza will be re-developed into an American-led resort

Canada, or at least some parts of it, will join the Union as the 51st state

America will re-take the Panama Canal

And after all this, in 2029, an 82-year old Trump will begin his third term as president using the VP switch maneuver.

What Markets Say

Is Trump’s muscular isolationism giving way to a program of greatness via bolt-on acquisition? Polymarket traders are highly skeptical about any of these things happening – at least as far as the end of 2025.

Panama Canal

Of all of Trump’s mergers and acquisitions, Trump acquiring the Panama Canal before the end of 2025 is the most likely, with a 14% chance it happens.

The Trump administration has accused Panama of overcharging American ships, and expressed concern about Chinese influence over CK Hutchison, the Hong Kong-based conglomerate that operates the ports:

Trump has not ruled out military force to retake the canal, but attention has been focused on a possible deal for Blackrock to buy two strategic ports along the canal. Over the weekend, CK Hutchison reportedly backed out of the port sale, which does not seem to have affected this market’s odds.

Greenland

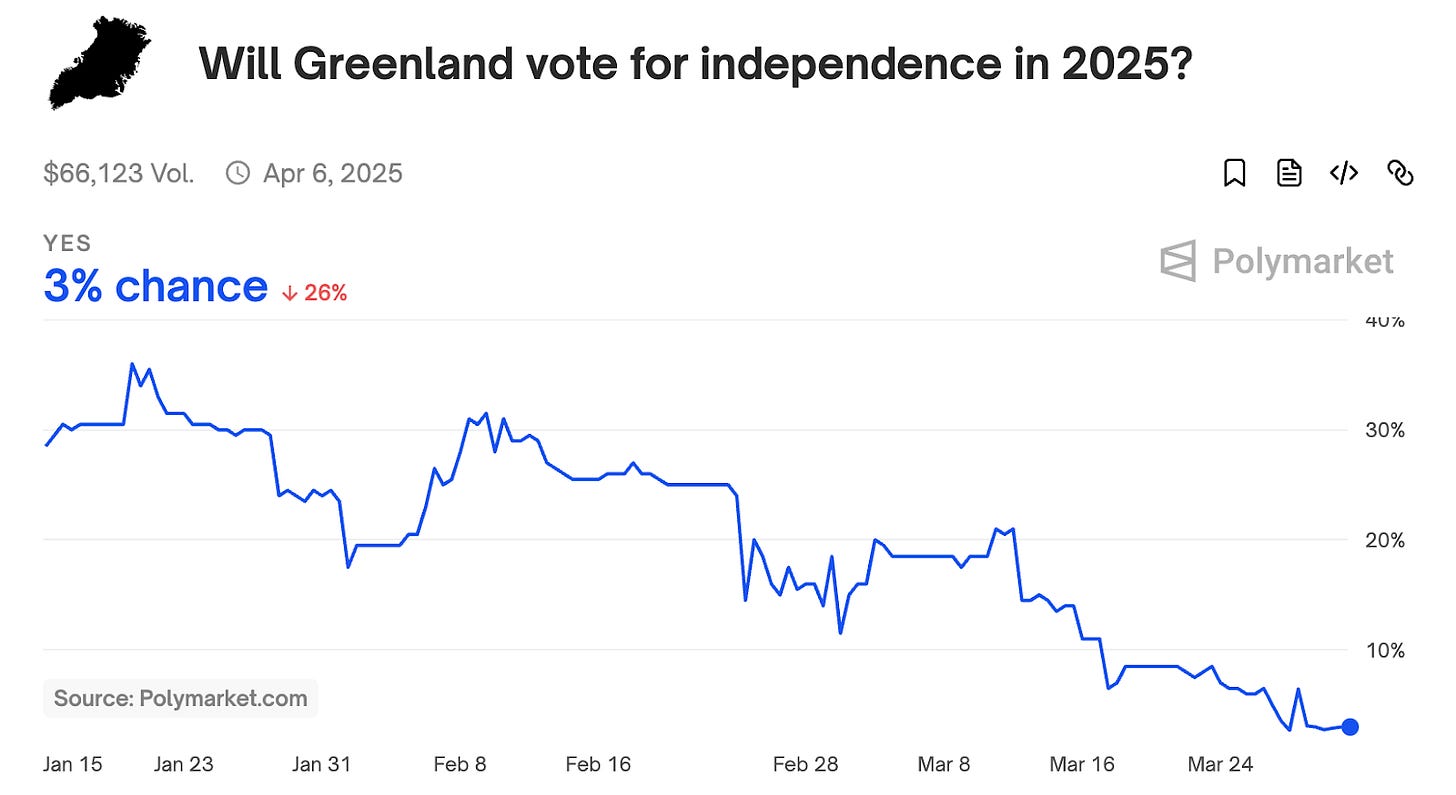

Odds for Trump to acquire Greenland in 2025 briefly hit 20% on inauguration day but have been cut in half as it became clear that Greenlanders are opposed.

Trump first expressed interest in buying Greenland in 2019, and he is reported to covet its strategic access to the Arctic, satellite downlink location, and mineral deposits (which the FT’s Javier Blas has suggested are overrated).

The recent trip by JD and Usha Vance has not moved the needle, and Trump’s pressure seems to have driven Greenlanders further into the arms of Denmark, with odds they vote for independence crashing from 30% to just 3% today.

NATO

Greenland is a territory of Denmark, which is a member of NATO. And an aggressive Trump move to take over Greenland would be a sticky situation. Would one of the countries be ejected from NATO or voluntarily leave?

Odds for any country to leave NATO this year spiked above 20% after the fiery Trump-Zelensky Oval Office meeting but have cooled since.

Gaza

Of all the possible places Trump could acquire in 2025, Gaza, where an estimated 70% of all structures were destroyed in the recent war, seems to make the least sense geopolitically.

The press likes to mock the idea of a Trump resort in Gaza, however a recent article by former diplomat Ethan Chorin floats the idea of an ambitious port and logistics deal in Gaza as a basis for ending the war and countering Chinese influence in the region.

But the market doesn't seem to be buying it, and, aside from an initial spike on February 10, when Trump seemingly gave Israel a greenlight to resume fighting there, the odds for a Trump Gaza acquisition have been steady at 10%.

The Bannon Doctrine

Steve Bannon likes to talk about a strategy called “flooding the zone” - overwhelming the opposition with a cocktail of action and bullshit that leaves them paralyzed.

The fact that all these markets (along with US acquires any Canadian territory in ‘25) are all trading like longshots, and all surfacing at the same time that Trump is moving aggressively on domestic policy with DOGE, could be a “tell” that this is what’s going on.

Any one of these moves on its own could possibly turn into a hot war, or at very least be a big shakeup to the current geopolitical order. And it’s unlikely that Trump would be able to do all of them at the same time, so perhaps this is why the market is valuing them all in the 10-15% range.

On the bright side, the 2025 geopolitical markets are still seeing a distribution of scenarios much more skewed towards peace than war:

Russia-Ukraine Peace in 2025 (🔮50%, although odds have fallen from a high of 78% in early March)

Iran nuclear deal (🔮25%, and rising slightly with Trump’s recent threats)

Gaza ceasefire (🔮70% by May)

Disclaimer

Nothing in The Oracle is financial, investment, legal or any other type of professional advice. Anything provided in any newsletter is for informational purposes only and is not meant to be an endorsement of any type of activity or any particular market or product. Terms of Service on polymarket.com prohibit US persons and persons from certain other jurisdictions from using Polymarket to trade, although data and information is viewable globally.

yeman irannext