Five Questions Shaping the Middle East in 2024

🔮 How the Gaza Conflict is Reverberating around the Region and Beyond

Will Israel Get Sinwar?

The market is not confident that Israeli Prime Minister Benjamin Netanyahu will outlast Yahya Sinwar, the Hamas leader who orchestrated the October 7 attack on Israel. Sinwar is public enemy number one in Israel. His whereabouts are top secret; many believe he is hiding in the tunnel network under Gaza.

What Markets Say. “Who’s Out First: Netanyahu or Sinwar” is one of the steadiest charts on Polymarket, indicating that the market doubts Israel is getting closer to capturing or killing Sinwar - despite public statements to the contrary.

Why it Matters: Getting Sinwar is not just important symbolically; it would be a sign that Israel has achieved full control of Gaza. The inability to fully control Gaza also explains how Israel has not been able to secure the return of over 100 remaining hostages, nor to fully suppress the ongoing guerilla warfare against its troops in Gaza.

Go Deeper: Dr. Nimrod Goren, a senior fellow at the Middle East Institute in Washington, points to a gap in the strategic aims of the Netanyahu government and the Israeli public over what happens next in Gaza:

“Netanyahu envisions continued Israeli control in strategic locations within the Gaza Strip, and civilian management of daily affairs in Gaza by non-Hamas – but also non Palestinian Authority – Palestinians. This would serve his strategic goal of blocking prospects for a 2-state solution. Prolonging the war also serves his domestic political goals, but runs in contrast to what the majority of Israelis want. For them, ‘total victory,’ now that Hamas has already been significantly weakened, will be first and foremost – the return home of the Israeli hostages.”

Gaza Ceasefire this Year?

Hamas representatives are absent from another round of ceasefire talks beginning today in Doha.

What Markets Say: The Polymarket odds of a ceasefire in 2024 declined to 56% from a high of 87% during the last round of talks in July.

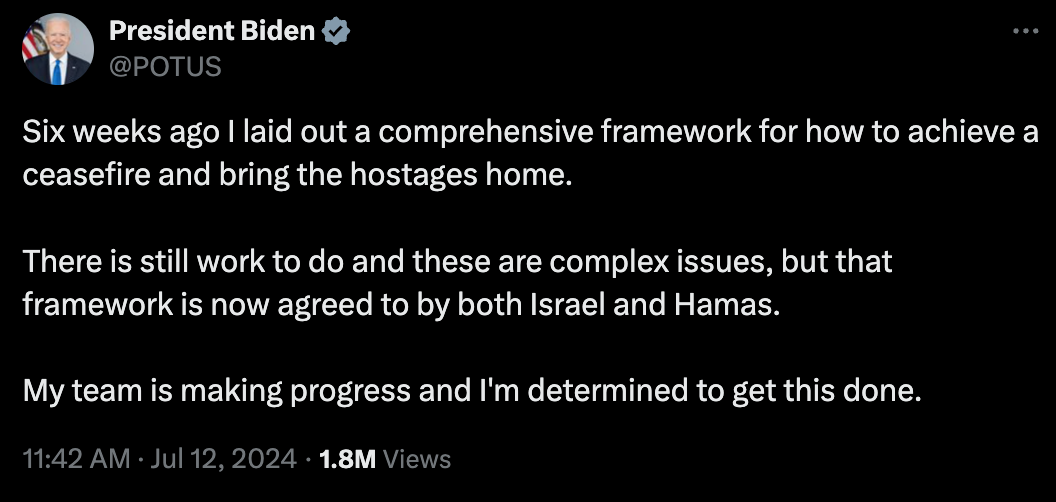

The Big Picture. Mid-July marked the height of optimism for a ceasefire, with talks based on Biden’s 3-phase peace plan announced on May 31.

Recent actions taken by the Israeli government on foreign soil and condemnations from right-wing members of Netanyahu’s coalition have cast doubt on Israel’s willingness and ability to reach a ceasefire deal. Nonetheless, the market sees September as the best chance for a ceasefire before year end.

The Saudi Factor

The question of Israel-Saudi normalization is another lens through which to view the Gaza conflict.

What Markets Say: Even during a burst of optimism earlier this year, the odds for an Israel-Saudi normalization deal before November never surpassed 25%, and are now down to 3%.

The Big Picture: A grand bargain between Israel and Saudi Arabia, sweetened with security guarantees from the US, has been a goal of both Republican and Democratic administrations. But the Gaza situation is just one of many obstacles to a deal, which also include:

Dim prospects for a two-state solution in Israel/Palestine

Opposition in the Senate to the human rights situation in Saudi Arabia

Saudi requests for nuclear technology and security guarantees

Will Israel Invade Lebanon?

Hezbollah has stepped up rocket and drone attacks against Israel in recent months. This increased rocket fire has caused evacuations of up to 80,000 Israeli residents living near the border with Lebanon.

What Markets Say. Did Netanyahu’s US trip diffuse invasion plans? In June fears of an imminent Israeli invasion reached a peak of 65%.

The IDF announced that operational plans for a Lebanon offensive had been approved.

Netanyahu gave an interview suggesting that attention was shifting from Gaza to Lebanon.

Western and Arab governments recommended citizens leave Lebanon and announced plans for evacuations.

But the Polymarket odds of an Israeli invasion fell sharply starting on June 30, the day before Netanyahu accepted an invitation to address the US Congress later in the month.

Not Over Yet. Dr. Goren of the Middle East Institute cautions that Israel still has the capability and desire to strike hard at Hezbollah if provoked:

“The Israeli leadership has been publicly threatening to take more fierce action against Hezbollah for multiple months, but so far has been reluctant to engage in a full-fledged war, hoping for achievements via US mediation efforts, but refusing to reach the deal in Gaza that is a prerequisite for an arrangement with Hezbollah. If things escalate – e.g. following an upcoming Hezbollah retaliation – Israel will be able to take wider actions against Hezbollah, and has the military capacity to do so, but that will probably come at a heavy price to Israel's home front.”

Prospects for Iran-Israel War?

What Markets Say. Markets continue to see a high chance of direct military confrontation between Iran and Israel through the end of the year.

On August 5, markets assessed a 77% chance of imminent Iranian strikes on Israel in retaliation for the assassination of Hamas leader Ismail Haniyeh in Tehran on July 31.

There is a 15% chance that a direct Iranian retaliation against Israel will occur by tomorrow, Friday, and a 75% chance that Israel directly attacks Iran by year end.

The Big Picture.

US and Israeli sources assess that Iran is preparing to strike back at Israel this week.

The April rocket and drone barrage that Iran fired at Israel was 99% neutralized by a combined air defense effort from Israel, the US, Great Britain, and Jordan.

The April attack came 12 days after Israel attacked the Iranian consulate in Damascus, killing 16, and was preceded by a few hours by the closure of airspace of several neighboring countries.

Disclaimer

Nothing in The Oracle is financial, investment, legal or any other type of professional advice. Anything provided in any newsletter is for informational purposes only and is not meant to be an endorsement of any type of activity or any particular market or product. Terms of Service on polymarket.com prohibit US persons and persons from certain other jurisdictions from using Polymarket to trade, although data and information is viewable globally.

Careful drawing insights from markets with $20k bet. They are not efficient and won't have much predictive power!