🔮FIRED NOT FIRED

5 Polymarkets on Trump and the Fed

Since taking office, Donald Trump has been on a crusade to get the Fed to cut interest rates.

Most of the pressure has centered on chair Jay Powell. But as Powell has proved immovable Trump has gone on to plan B: removing Fed governors.

Last night, Trump posted on Truth Social a letter terminating Biden-appointed Fed governor Lisa Cook for making conflicting statements about her state of residence on mortgage applications.

The charge was previewed two days ago by Federal Housing Finance Agency director Bill Pulte, who has been helping Trump QB the pressure campaign.

Is this the first step in Trump’s takeover of monetary policy?

Here’s where Polymarket traders think the situation is headed.

1. Lisa Cook Likely to Hang on this Year

Presidents may only remove Fed governors for cause. And Cook has signaled that she is digging in for a legal battle that could head to the Supreme Court.

There’s only an 18% chance that she leaves office by end of September and just over a one-in-three chance that she is out by end-of-year.

But OldBullTV, a prediction market veteran and author of The Super Model Substack, sees decent value in a ‘Cook out fast’ scenario, and explained how this could unfold:

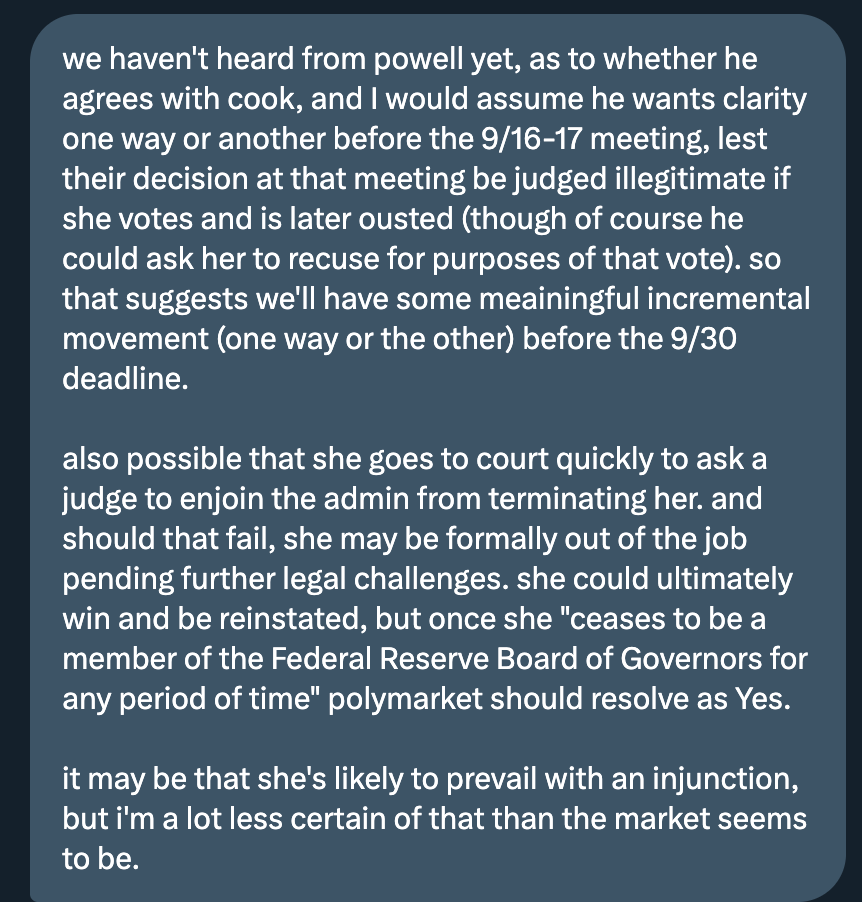

2. Powell Next?

Trump’s attempt to fire Lisa Cook seems to have made Powell's position more - not less - secure: odds the Fed Chairman is out by end of year dropped several points on the news.

Why did Trump pick Cook, rather than Powell who, as chairman, has the most sway over rates?

Fed members are appointed to 14-year terms, with Powell’s ending in January, 2028 (although his Chairmanship expires in May, 2026). Cook is slated to serve until 2038, giving Trump an opportunity to make a decision with longer-lasting consequences than axing Powell.

And targeting Fed governors, as opposed to the chair, may be a test to see how far Trump can push the situation without spooking financial markets.

3. 2025 Rate Path Unchanged

After the news broke last evening, ‘dollar plunge’ headlines spread quickly on X.

But by morning, the situation was more muted, with dollar exchange markets and the SPY basically flat.

On Polymarket, there was zero change in the overall forecast for September rate cuts (79% chance for a 25 bps cut and 16% chance of no change. And a similar story in the October (50% odds for 25bps cut) and December (51% odds for 25bps cut) polymarkets.

4. Inflation Expectations Continue to Creep Up

Why have rate cut expectations been so muted?

Powell has continued to cite inflation, and the possible inflationary effects of Trump’s tariffs, as the reason for caution on rate cuts. And this concern shows no signs of abating.

Since July, the odds for inflation to exceed 3% this year have more than doubled, from 40% to 87% today.

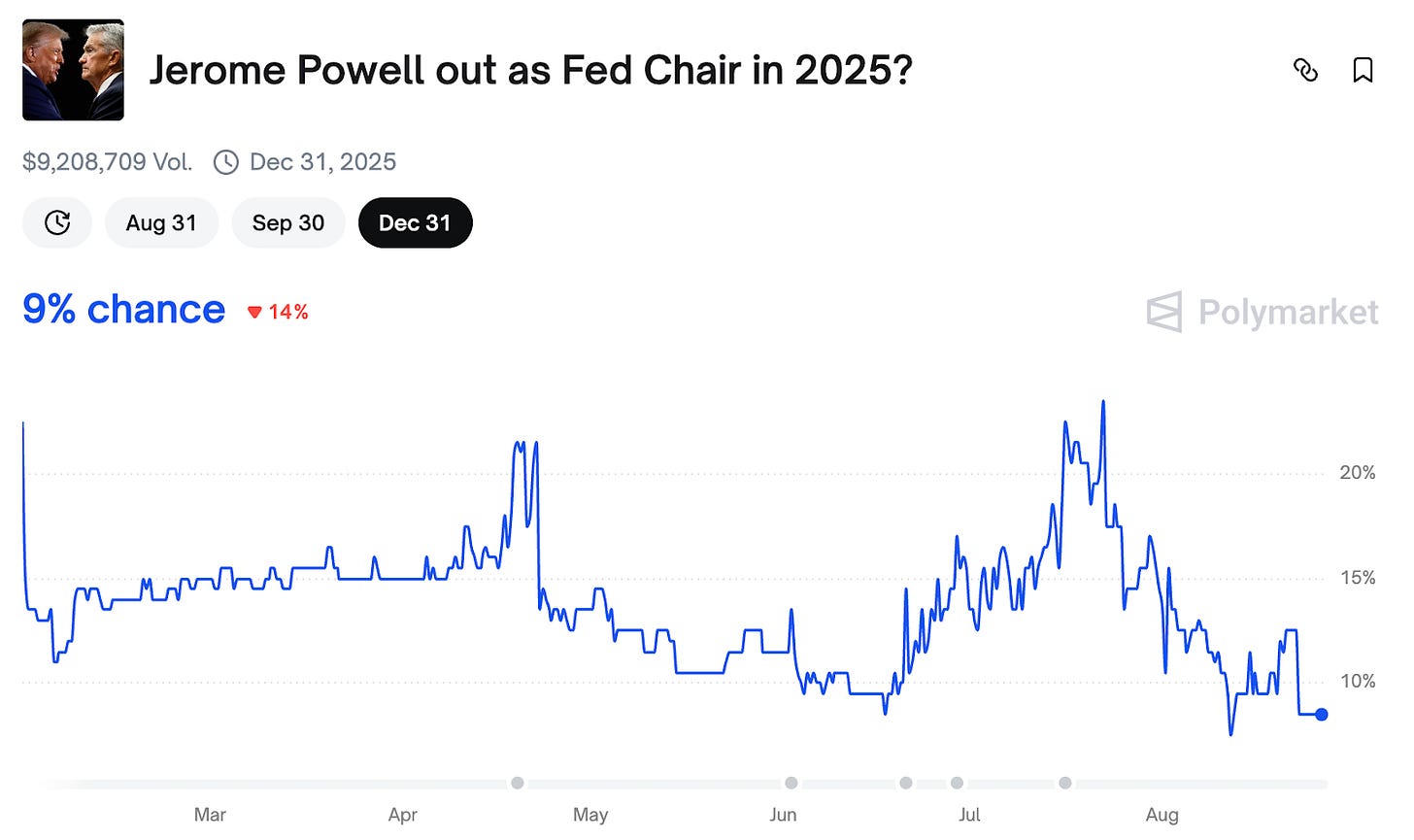

5. One-Off?

Putting this together, the sentiment reflected on Polymarket today seems to be that

1) Cook will fight a lengthy legal battle to keep her job;

2) This reduces the pressure on Powell to step down;

3) The Fed looks set to continue its path of modest rate cuts over the rest of 2025; and

4) Trump is unlikely to try this again, with only an 11% chance he attempts to remove another Fed Governor by end-October.

But, as OldBullTV points out, all this rests on the assumptions that Powell will back Cook’s attempt to stay on and / or she will win her initial legal appeal of the termination.

If either of these assumptions proves faulty, Trump could find himself in the driver’s seat of interest rates much faster than most expect.

Disclaimer

Nothing in The Oracle is financial, investment, legal or any other type of professional advice. Anything provided in any newsletter is for informational purposes only and is not meant to be an endorsement of any type of activity or any particular market or product. Terms of Service on polymarket.com prohibit US persons and persons from certain other jurisdictions from using Polymarket to trade, although data and information is viewable globally.

Words related to harassment describe behaviors and actions that are persistently annoying, threatening, or abusive, causing distress or harm to another person. Examples include terms like torment, persecution, molestation, threats, insults, slurs, and persistent criticism, which can be used in various contexts to describe situations where someone is intentionally made to feel unsafe or disrespected.