🔮 DeepSuck

Did a Chinese Startup Just Disrupt the AI Hyperscalers?

By Jeb Ory

Markets are digesting the implications of DeepSeek, a Chinese AI startup whose R1 model achieved similar performance to OpenAI’s ChatGPT with 1/20th of the training cost.

Here is how the move is playing out on Polymarket:

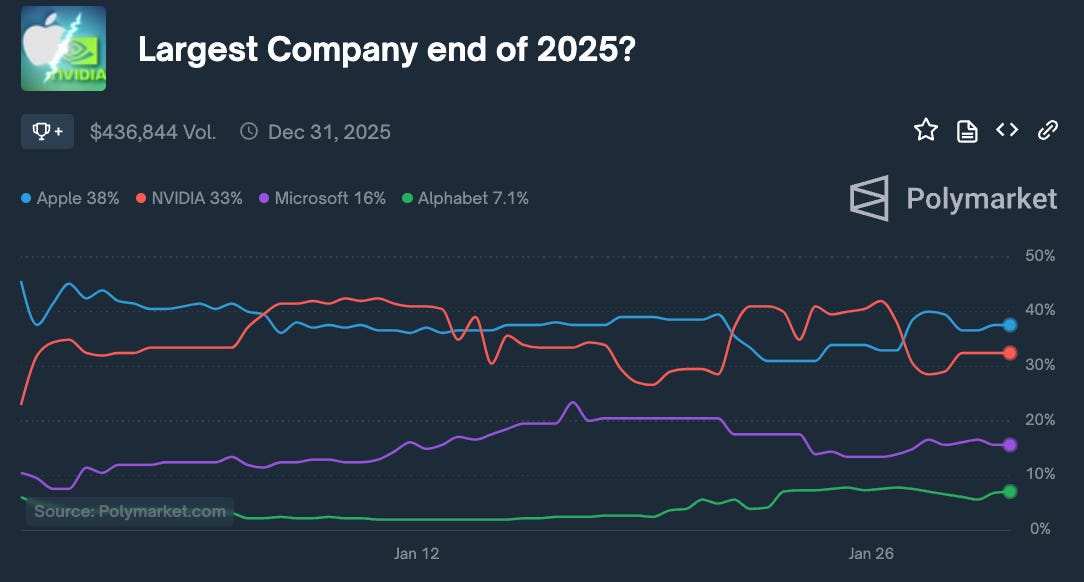

NVIDIA Dethroned For Now. Odds for NVIDIA, the company that designs the highest-powered AI chips, to be the world’s largest company by end-of-month plunged as ~$600b was wiped off the stock value over the weekend.

NVIDIA’s earnings estimates are based on projections that its customers like Google and OpenAI will need to load up on their chips as far as the eye can see. But DeepSeek’s reported ~$6m training costs (vs $100m to train GPT-4), small team, and lack of the latest chips only showed that a hardware moat in AI could be an illusion.

Longer term, the big question for NVIDIA is whether this breakthrough will hurt the market for their advanced chips or create more long term demand as cost falls (Jevons paradox). The market for the largest company at the end of 2025 shows NVIDIA is still in the running to bounce back later this year.

Who Are the Winners? Aside from China and DeepSeek itself, the biggest winners, according to a recent piece by Ben Thompson, are consumers who benefit from the collapsing cost of AI services. This means that AI could become embedded throughout tech much faster — imagine a roomba with a built-in AI navigation chip instead of one that must send data to the cloud for inference.

Apple. Apple seems to be an early winner. Their stock - which is up 6.5% over the last week - is now the 72% favorite to be the largest company through February, while the rest of the NASDAQ is down ~2%. Why does Apple win? Because they own the hardware that everyone uses, and can easily plug in better AI models as they become available.

META is also an early winner, with DeepSeek’s open source architecture validating Meta’s open source approach with Llama. "I think this will very well be the year when Llama and open source become the most advanced and widely used AI models,” Mark Zuckerberg said in Meta’s Wednesday afternoon earnings call.

Re-Thinking Export Controls. Biden put into place a series of export controls to keep the most advanced NVIDIA chips out of the hands of Chinese firms. However this backfired, and forced DeepSeek to develop ways to train models on older hardware.

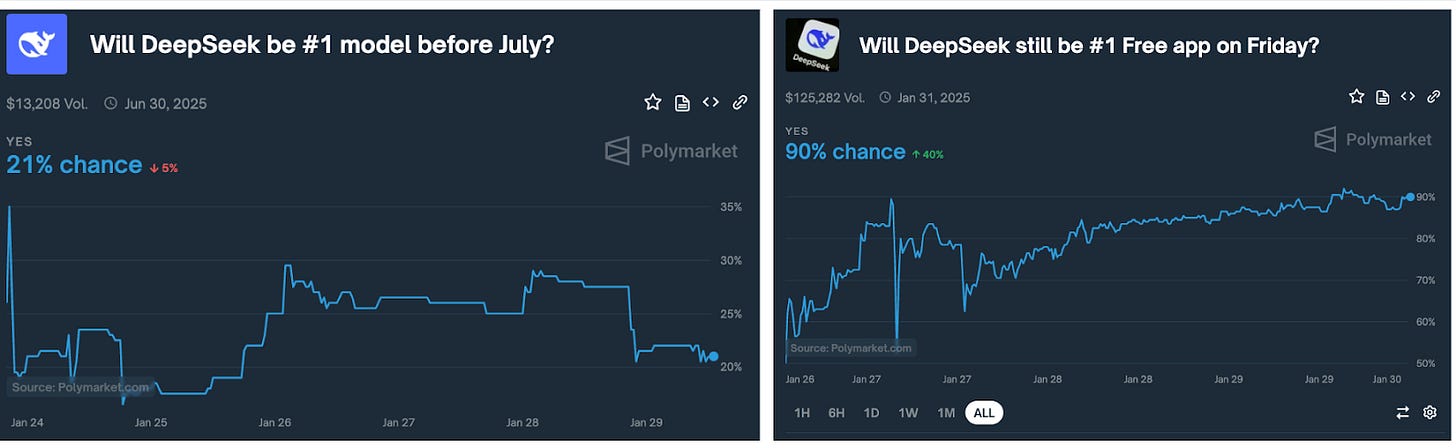

If the US truly wants to limit DeepSeek to protect domestic AI companies, it would likely have to resort to bans at the app store level, as was attempted with TikTok. There is a 20% chance that DeepSeek is banned in the US before July.

But DeepSeek Could Pull Ahead. DeepSeek has been accused of using OpenAI models to train its own, essentially stealing OpenAI’s intellectual property. The implication is that OpenAI is the innovator and the Chinese model is the copycat.

But the market sees a 21% chance that DeepSeek will surpass the US labs to become a top-performing AI model by July, (based on lmarena.ai score) and a 90% chance that DeepSeek will continue to be the top free app by Friday. With a combination of high performance and extremely low cost, there is a real chance that Deepseek achieves a strong market position.

Marc Benioff of Salesforce hinted that DeepSeek’s dominant position in app stores creates a customer data moat which could reinforce their market position and their model’s success.

QQQ Damage Contained? If the same level of investment in chips isn’t necessary, does this spell trouble for other tech stocks with AI businesses? For now, the prospect of the Mag 7 shrinking below 30% of the S&P 500 has not been affected by the DeepSeek launch. So it’s more about winners and losers within tech rather than a total sector risk.

Stargate Off? If DeepSeek marks a new era of more efficient model training, it could throw into question the OpenAI-Softbank-Oracle “Stargate” project, which plans huge investments in data centers and power generation for next-gen AI. Why would companies need to spend $500 billion to build something that can be done for a fraction of the cost?

But Wait. Is it possible that the “DeepSeek built all of this on $6m” narrative is a psyop, and that somehow, DeepSeek has access to 50,000 top of the line NVIDIA Chips, worth ~$1.25 billion? This is what Alexandr Wang of Scale AI, suggested on CNBC the other day.

Wang implied that the Chinese company can’t admit to using its H100s because this would confirm it violated export control laws. On Polymarket, there’s only an 8% chance this is confirmed. But of course, DeepSeek would have every incentive to not admit using the advanced chips if it has them.

Open Questions

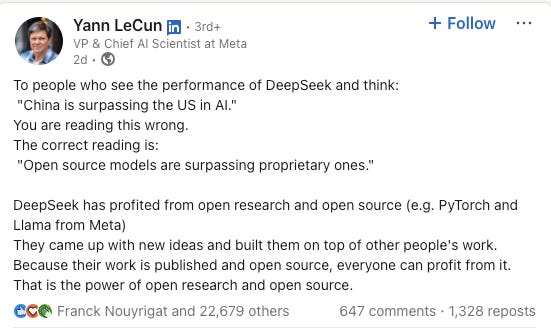

Open vs Closed Models. Yann LeCun, Chief AI Scientist at Meta, views DeepSeek as validation of open source models, such as Meta’s Llama, over closed models (such as ChatGPT).

Propaganda Value. Palmer Luckey of Anduril thinks that claims about DeepSeek’s ~$6m investment was a “CCP propaganda" job to hurt American tech. He noted in an interview that they didn’t release complete training costs, which could be much higher.

Overstated Leap? In a paper released this week, Dario Amodei of Anthropic also downplayed the $6m vs $100m training cost comparisons, but also said that DeepSeek makes export controls “even more existentially important than they were a week ago.”

The implications of DeepSeek are huge. It’s a body blow for NVIDIA’s business, a shot over the bow for US-based AI models, and an example of a Chinese startup making waves by thwarting efforts of the US labs to protect their tech.

It is highly likely that OpenAI is forced to respond - likely a combination of increasing their model security while accelerating the release of their advanced models.

Is AGI right around the corner?

Connect With The Oracle

Tips? Feedback? Story ideas? Write oracle@polymarket.com or @wasabiboat on X

NEW: We’re On X: Follow The Oracle for updates

Write for The Oracle: We’re expanding our coverage and looking to hire more writers and investigators. Details Here.

Disclaimer

Nothing in The Oracle is financial, investment, legal or any other type of professional advice. Anything provided in any newsletter is for informational purposes only and is not meant to be an endorsement of any type of activity or any particular market or product. Terms of Service on polymarket.com prohibit US persons and persons from certain other jurisdictions from using Polymarket to trade, although data and information is viewable globally.