🔮 Bond Market

New Research: Fed Odds Crystallize 26 Days Before Decisions

At 2pm this afternoon, Jay Powell will step on stage, say “good afternoon“ and explain his decision to leave the Fed Funds rate unchanged.

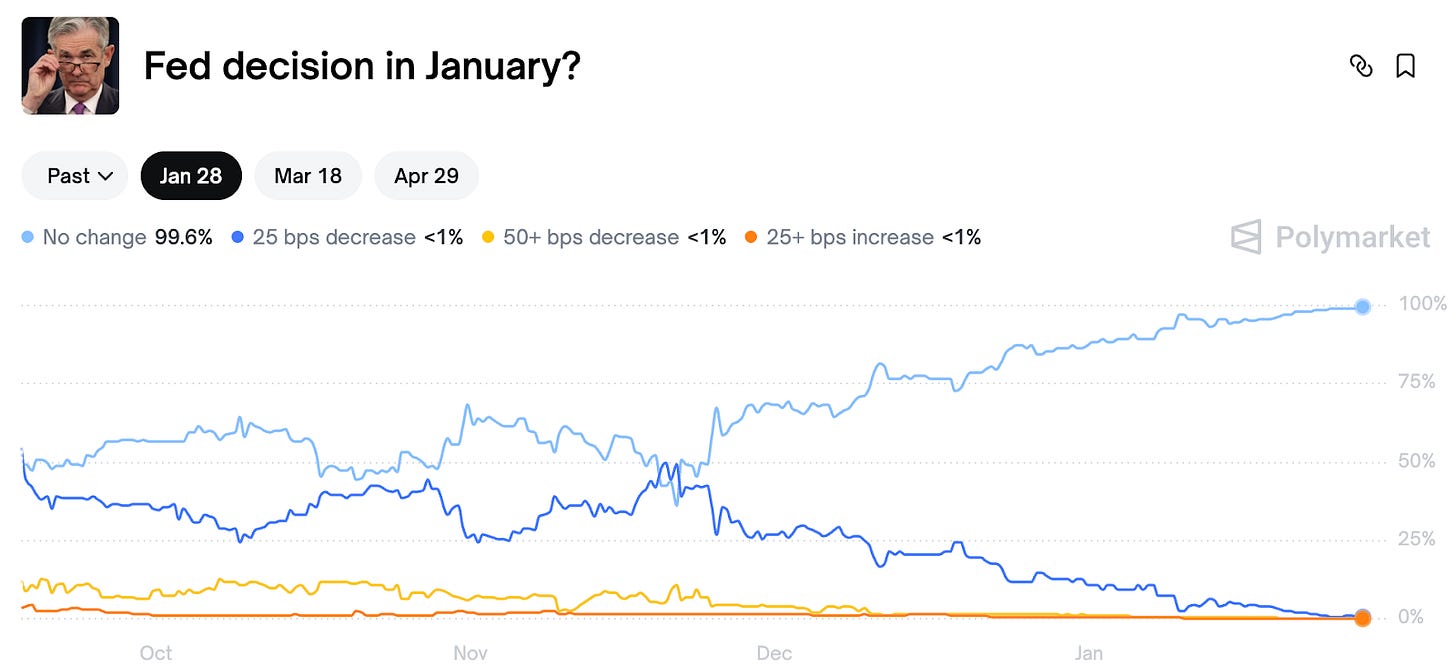

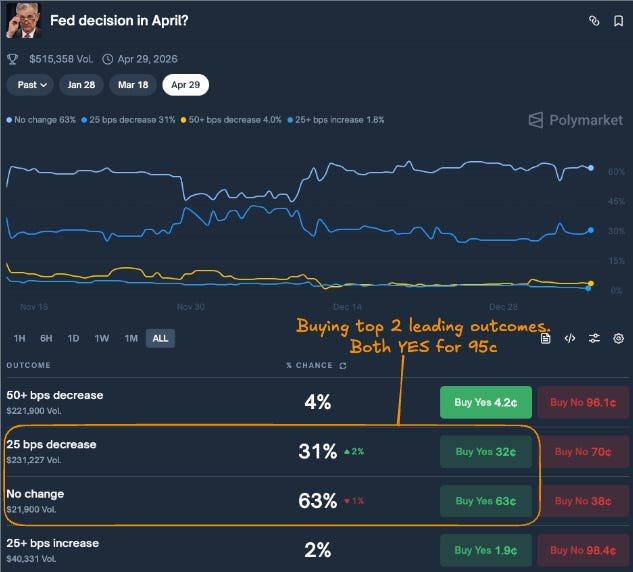

Polymarket puts odds for “No Change” at 99.6%, steadily increasing in certainty since late November.

The Fed under Powell is famous for its policy of “forward guidance,” a fancy way of saying they don’t like to surprise markets about their rate decisions. At the same time, they can’t just come out and tell us the decision early. That would be too obvious.

Instead, the Fed has a widely acknowledged policy to telegraph its moves through informal channels, most notably leaks to the Wall Street Journal’s Nick Timiraos.

But how early do these decisions actually crystallize?

Polymarket traders love hunting for “bonds” or high-probability bets that rarely flip. Fed rate markets are a bond-lover’s paradise, since everyone involved hates surprises. Then the interesting question becomes: when exactly is the point of no return? What is the earliest point you can pile into the consensus trade with the best risk-reward?

Tldr:

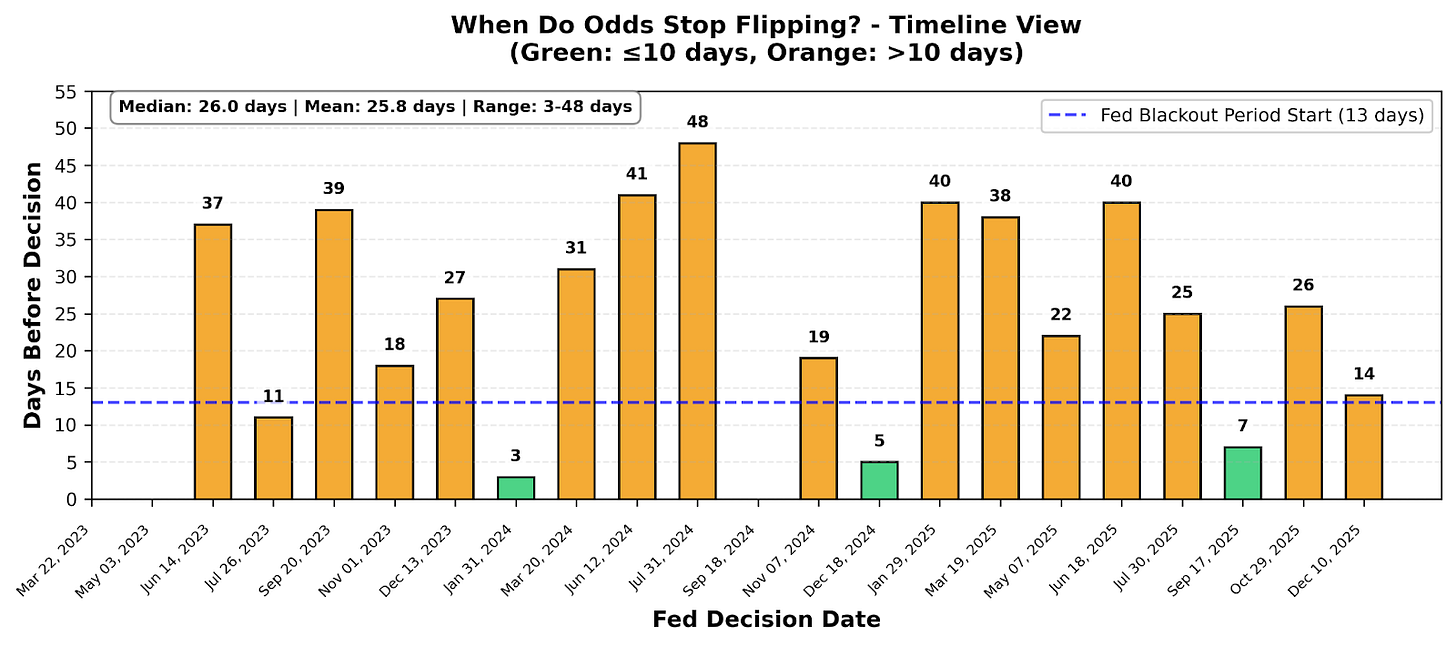

Across 22 Fed decisions from March 2023 to December 2025, I find that Polymarket odds crystallize with a median of ~26 days before the Fed meeting, which is early enough to create tradable entry points.

Methodology

I analyzed using data downloaded from Polymarket directly. The objective is to quantify when odds crystallize, defined as the point at which the leading outcome becomes dominant (≥80%) and stops flipping materially (daily changes ≤5% for ≥3 consecutive days).

The 80% threshold marks the point where consensus forms. Below this level, probability remains spread across multiple outcomes. For example, let’s assume 60% at “No Change”, 25% for “ 25bps Cut”, 15% for “25bps Hike”. Above 80%, alternatives shrink below 20% in total, making reversals unlikely barring regime-level shocks.

Key Findings

Across the Fed decisions measured, Polymarket odds consistently crystallized:

Mean crystallization days: 25.8 days before decision

Median: 26 days before decision

Range: 3 to 48 days (excluding outliers)

These markets crystallize far earlier than you expect ~86% of the time (19/22 times), where consensus forms weeks before the meeting.

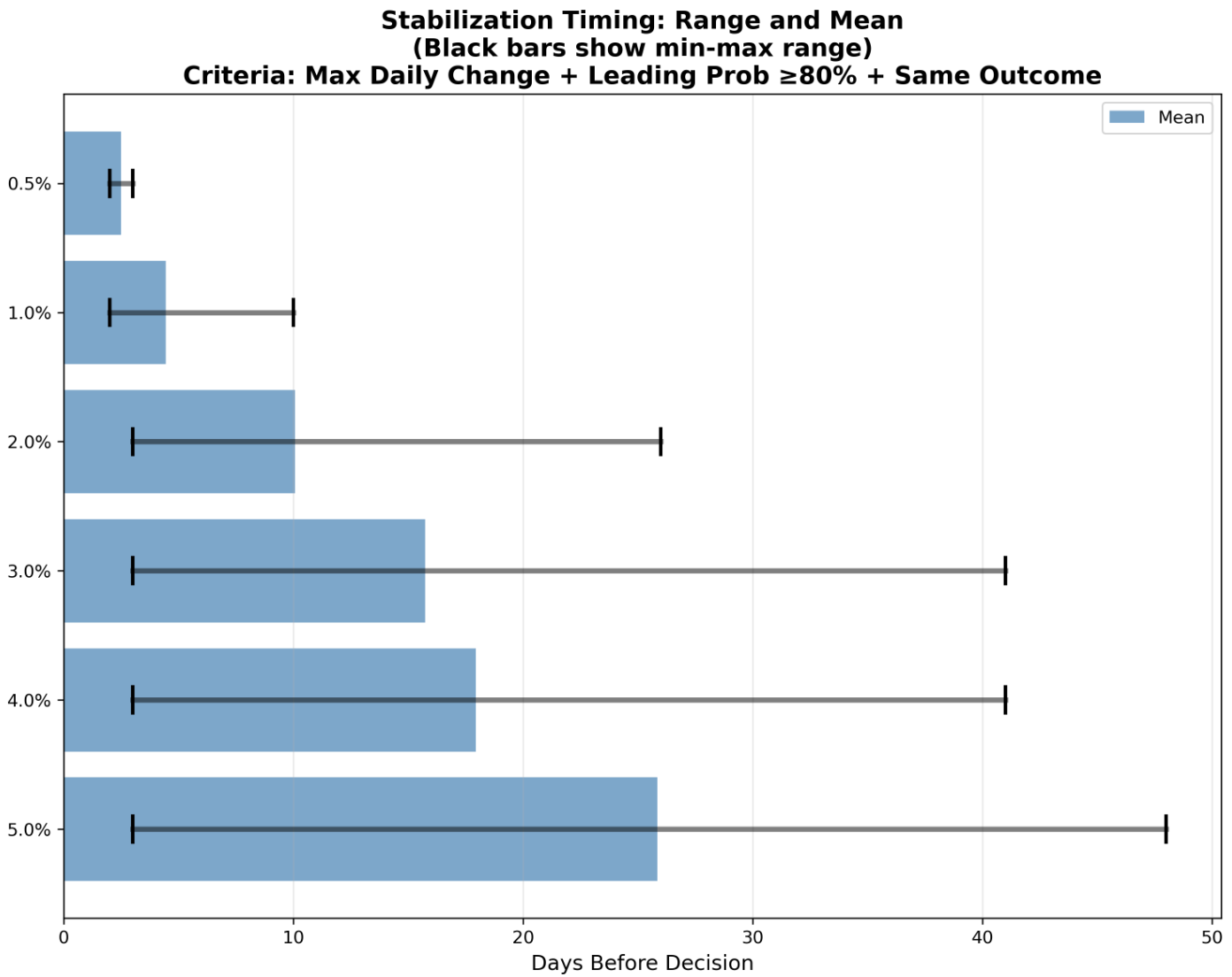

Diagram 1 shows the number of days required for odds to fulfill the crystallization criteria. The main outliers are (a) March to May 2023 (Silicon Valley Bank crisis) (b) September 2024 (first Fed rate cut after raising interest rates), both of which occurred during regime shifts. They are characterized by deep uncertainty about the Fed’s decision itself.

Also, the three meetings (highlighted in green) crystallized late (3-7 days out) due to major and surprising data releases within 10 days of the decision. For example, the hot CPI in Dec 2024, PCE in Jan 2024 and a macro surprise in Sept 2025 that broke earlier consensus. Traders should check the economic calendar close to the meeting for events that can delay or disrupt crystallization.

In normal cycles, the question is straightforward: Will the Fed hold rates or cut by 25bps? The framework is clear, so odds settle early. During regime shifts like a banking crisis or the first rate cut in years, the question itself changes. Should the Fed prioritize financial stability over inflation? Will they cut aggressively or ease gradually? Each new data release can completely reverse market expectations, preventing odds from stabilizing. Prospectively, traders can identify regime shifts by reading more on Fed communications signaling framework uncertainty or monitoring elevated VIX for a continuous period.

A regime filter essentially separates:

Information discovery: Stable expectations result in early, reliable crystallization.

Policy uncertainty: Framework challenges lead to persistent volatility up to decision day.

Volatility compression

The pattern is clear, volatility compresses sharply as the meeting approaches.

Large daily swings (from 3% to 5%) persist more than 40 days out.

Volatility declines steadily into the final 10 days.

Close to decision day (0.5% to 1%), probabilities barely move.

The majority of information discovery and profit opportunities occur before the Fed blackout period (~10 to 13 days before announcement). By the time the blackout period begins, the volatility collapses as consensus has been priced in, leaving limited upside for new positions.

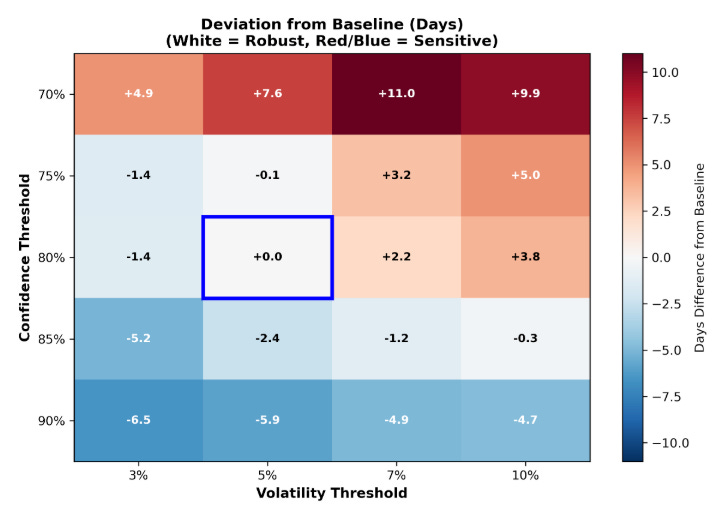

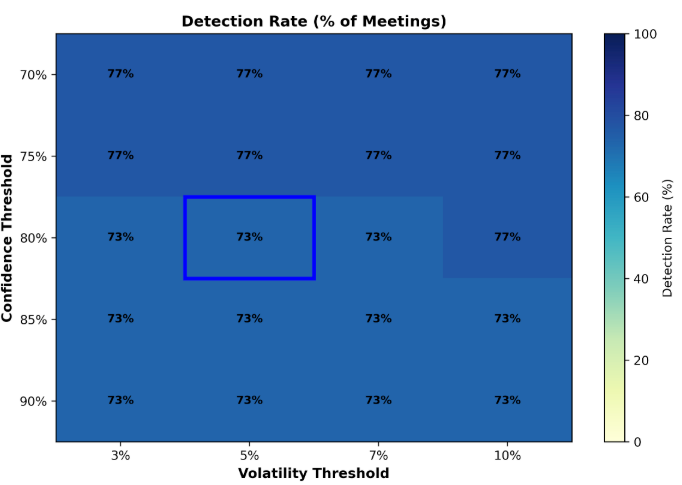

Diagram 3 shows the baseline with mean crystallization timing of 25.8 days and stabilization detected across 73% of meetings. With that being measured, the 80% confidence and 5% volatility thresholds are considered robust. Varying these parameters by ±5 percentage points shifts crystallization timing by at most 5 days, while more extreme settings either detect noise too early (prone to macro-driven reversals) or miss consensus formation.

The 80% level effectively identifies the point where a dominant outcome emerges and reversal risk sharply declines, while the ±5% volatility filter reliably separates sustained consensus from temporary fluctuations.

What Causes Odds to Shift?

Polymarket odds respond to the same forces that move the institutional rates markets. The primary catalysts include:

Macro data releases: CPI, NFP and PCE prints that shift Fed’s inflation/employment dual mandate.

Fed communications: FOMC minutes, speeches by Chair Powell and voting members and Beige Book release.

Market-moving events: Financial stress (e.g., global financial crisis), extreme shocks (e.g; Covid 2020).

Once the blackout period begins, new information flow slows sharply. As shown earlier, odds movements during this phase are driven more by positioning than fundamentals, reinforcing why crystallization typically occurs ~26 days before the decision.

Polymarket vs CME FedWatch: Why compare them?

To ground the analysis in institutional expectations, I compared Polymarket probabilities against CME FedWatch, a proxy of Fed Funds futures.

The comparison serves two purposes:

Credibility: to validate if prediction markets align with institutional pricing.

Signal discovery: to identify when one market adjusts faster than the other.

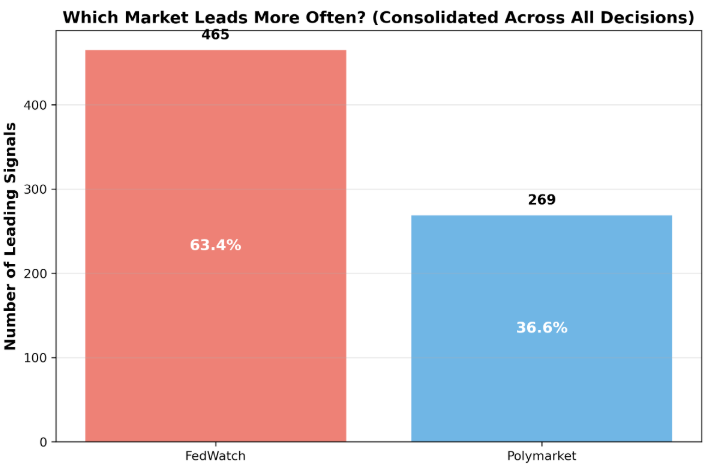

The idea is not to declare a “better” market per se, but to understand who leads, who follows and when divergences matter.

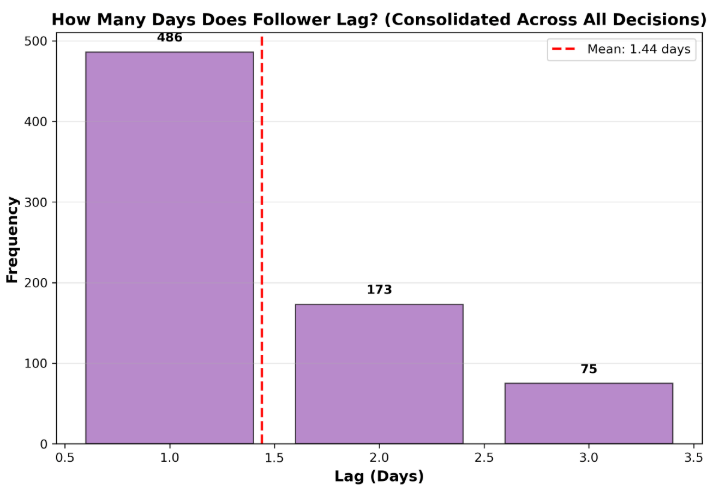

Per diagram 5 and 6, across four recent Fed meetings (Jul to Dec 2025), CME FedWatch led Polymarket 63.4% of the time, with Polymarket adjusting on average 1.44 days later. Early-cycle gaps are largest 40-60 days before a decision but these differences compress sharply as the meeting approaches. By the final few weeks, probability gaps typically narrow massively, indicating convergence toward a shared consensus. This pattern suggests that institutional pricing often pulls retail odds, rather than the other way around.

This lead-lag relationship matters because it reveals that Polymarket is reacting rather than discovering. The ~1.44 day lag likely reflects an information and liquidity gap. Potentially, institutional traders in Fed Funds futures have direct access to comprehensive sell-side research, proprietary macro models and deeper liquidity, allowing immediate position adjustments.

When odds move in CME FedWatch first:

it signals new information is being priced by the Rates markets.

Polymarket odds follow with a short delay, creating a temporary mispricing window. The mispricing windows are the largest 40+ days out before the decision.

For traders, this means divergences are not a noise, but often transitional states before convergence. It is worth noting that traders should view this on a relative-value basis rather than solely believing one is correct while the other is wrong as odds could flip quickly with new emerging data.

Execution Considerations

Relative-value positioning within Polymarket

Before crystallization (40+ days out): When probability remains dispersed across multiple outcomes (e.g., 63% “No Change”, 31% “Cut 25 bps”), traders can allocate exposure across the two leading scenarios at a combined cost below $1. As odds compress toward the crystallization point, one outcome typically dominates, allowing profitable exit before full crystallization.

After crystallization (26 days out): Once odds stabilize at ≥80%, the directional trade becomes clear but the edge diminishes. The relative-value approach works best in the early, high-uncertainty phase.

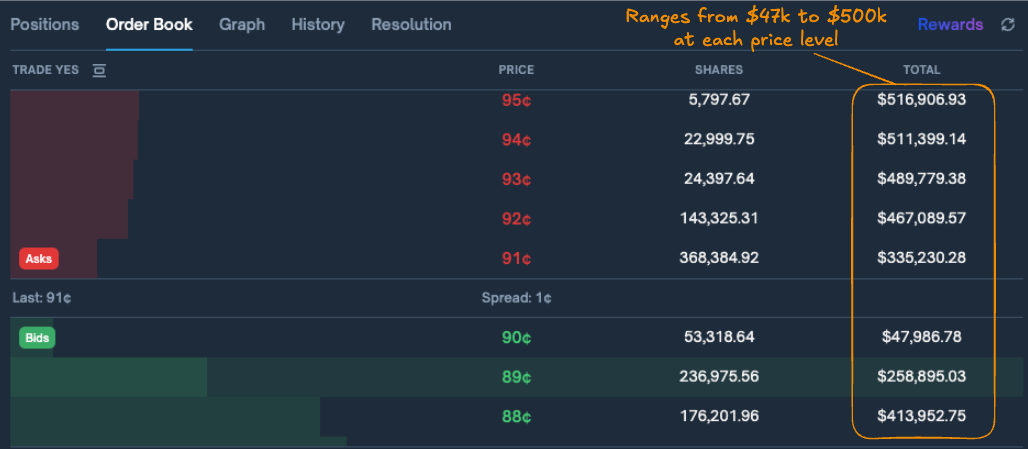

Liquidity

An interesting discovery is that polymarkets for upcoming Fed decisions can support position sizes of several hundred thousands dollars without causing a significant price impact. Larger trades, however, can quickly consume the available liquidity and move prices, limiting scalability.

Conclusions

Polymarket Fed odds crystallize in 86% of meetings analyzed (19/22), typically 26 days before decisions.

The trading framework:

(1) enter when the leading outcome hits ≥80% with <5% daily volatility for 3+ days,

(2) monitor CME FedWatch for early signals as it leads Polymarket by ~1.4 days

(3) before crystallization, buy both leading outcomes if they sum to <$1 and

(4) avoid regime shifts flagged by VIX >40 (during Covid-19 crisis, global financial crisis).

One wild card in this strategy is that Powell’s tenure ends May 2026. A new Fed chair could abandon forward guidance entirely, turning the succession decision itself into the ultimate regime shift test for this framework.

Connect with Terry:

Disclaimer

Nothing in The Oracle is financial, investment, legal or any other type of professional advice. All odds and forecasts are time sensitive and subject to change. Anything provided in any newsletter is for informational purposes only and is not meant to be an endorsement of any type of activity or any particular market or product. Terms of Service on polymarket.com prohibit US persons and persons from certain other jurisdictions from using Polymarket to trade, although data and information is viewable globally.

great analysis!