🔮 Bite Of The DOGE

Special thanks to Doge-Tracker.com which combines official data sources with Polymarket forecasts for a 360° DOGE dashboard.

When we last checked in on DOGE, markets saw under $250b of Federal spending cuts (~3.7% of the 2024 budget) in Trump’s first six months as most likely, and a “boom” or “bust” scenario for government job cuts.

Almost a month into Trump’s second term, we have a clearer picture of where things are going, informed by Polymarkets thirteen plus markets on DOGE.

Federal Job Cuts

On January 28, DOGE sent all federal workers a buyout offer, the “fork in the road” Elon special, which combined warnings of future layoffs with an offer to resign and keep getting paid through the end of September.

The offer was briefly halted by a Federal judge in Massachusetts before being allowed to continue on February 11. Following the judge’s ruling, the OPM updated their website to state that the fork is now off the table.

On February 6th, reports surfaced that 60,000 workers had taken the offer, which now stands at 75,000. On Polymarket, the impact of the first report is visible, as the market quickly priced in 50-100k employees taking the deal as most likely.

The bite of the DOGE can also be seen in the Federal jobs cut in Trump’s first 6 months market, where odds have declined for the lowest bracket (< 25k jobs cut), and risen in the 100-200k bracket.

The “boom” scenario, cuts of over 200k jobs, or almost 7% of the Federal workforce, remains in play as the second most likely option at 23%.

USAID

At campaign rallies, Trump often promised to end the Department of Education, but did little to preview the blitzkrieg against USAID that culminated in its website being deleted, nearly all staff being placed on leave, and its logo being scraped off its headquarters.

The odds for Trump to shutter USAID in his first 100 days hit an all time high of 60% on February 5th, after plans were announced to merge it into the State Department (note the rules in this market consider a merger with State as a “yes”) .

But these odds were cut in half after three separate lawsuits placed holds on the action, likely pushing back the timeline beyond Trump’s first 100 days.

Another interesting market is whether Trump will cut more than $1b, just 2.5% of USAID’s $40b budget, by March 1, currently trading at 28%.

Why so low? This market uses doge-tracker.com as a resolution source, which reports savings amounts claimed on the DOGE X account. So far the account has only announced two USAID cuts for a total of $420m savings:

Audits & Prosecutions

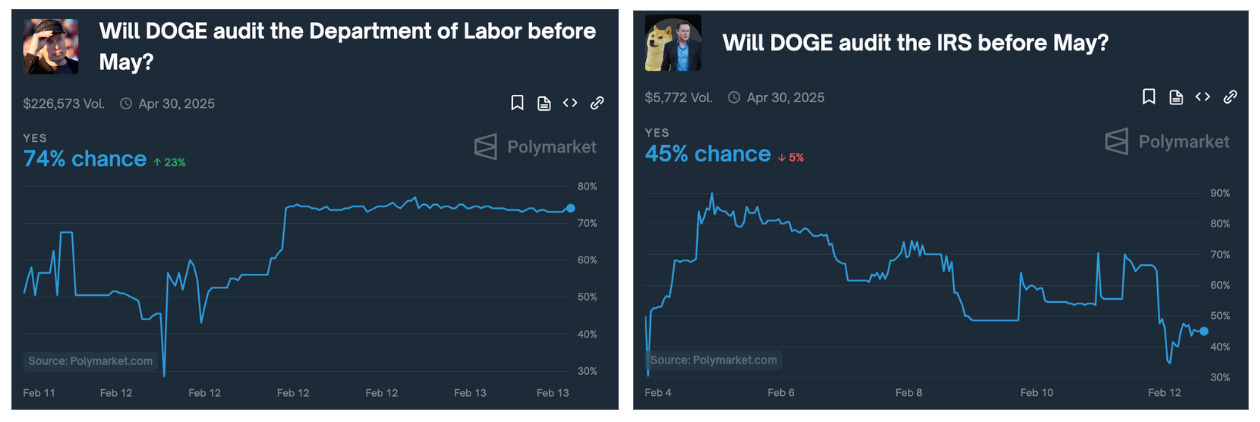

Elon kicked off the next wave of DOGE activity, rooting out abuse in government spending, with a tweet suggesting the group would soon audit the auditors - but the market currently sees a higher chance (🔮74%) that the Department of Labor will be audited before May than the IRS (🔮45%).

Over the weekend, there were reports of surging Google searches in DC for “criminal defense attorney” as well as online attacks on sitting judges perceived to be Trump enemies. What markets say:

DOGE prosecutes the Treasury (any state and Federal charges and/ or lawsuits against the department or its officials): 🔮16% odds.

House passes articles of impeachment against any US Federal judge by April: 🔮8% odds

Any Federal employee charged as a result of DOGE investigations: 🔮 59% odds

Trump Souring?

Elon has many enemies, not just on the left, but also in the anti-tech MAGA wing like Steve Bannon, Trump’s first term campaign manager who is now out of the inner circle (🔮19% pardon odds in the first 100 days).

DOGE opponents are hoping that Elon will rerun the Scaramucci playbook and piss off Trump. They point to a recent press conference where Elon appeared with Trump in the Oval Office and seemed to violate Robert Greene’s first Rule of Power: “never outshine the master.”

But anyone who thinks that Musk will be an Omarosa-tier figure in the administration should note the Elon out at DOGE in 2025 odds are the lowest they’ve ever been (🔮 31%) .

Where is this Going?

DOGE advocates make two basic arguments. The ideological wing, like Mike Benz, leader of the anti-USAID push, argues the federal bureaucracy, especially the intel and foreign aid agencies, are the enemy of Trump and his agenda.

The second is an economic one, that cutting waste will make a dent in the $36 trillion Federal debt, and by extension interest rates and sticky inflation. Elon himself set long term interest rates as a standard to measure DOGE effectiveness.

By this standard, is DOGE working yet? In the above chart, the DOGE effect does not yet show up in long term rates. However, on Polymarket the forward-looking odds for the 10-year to be above 5% by July have been trending down slightly.

There is also the suggestion that DOGE could go too far, by forcing job cuts that push the economy into a recession that has the positive byproduct of lower inflation.

This doesn’t seem to be happening either, with the odds of a US recession in 2025 falling to 21%, not much higher than the long-term base rate of 15% recession odds in any year.

On inflation, a good market to watch is Polymarket’s max inflation in 2025. With January inflation coming in hot at 3% yesterday, there is now an 83% chance it goes even higher this year, and a 35% chance we see a four-handle this year.

Connect With The Oracle

Tips? Feedback? Story ideas? Write oracle@polymarket.com or @wasabiboat on X

Write for The Oracle: We’re expanding our coverage and looking to hire more writers and investigators. Details Here.

Disclaimer

Nothing in The Oracle is financial, investment, legal or any other type of professional advice. Anything provided in any newsletter is for informational purposes only and is not meant to be an endorsement of any type of activity or any particular market or product. Terms of Service on polymarket.com prohibit US persons and persons from certain other jurisdictions from using Polymarket to trade, although data and information is viewable globally.

This was a really insightful breakdown of the Department of Government Efficiency and its potential impact. Streamlining bureaucracy and optimizing public sector performance is crucial, and it's great to see discussions around accountability and effectiveness in governance. Looking forward to more analyses like this!

Nice recap. I found this market interesting:

https://polymarket.com/event/how-much-spending-will-elon-and-doge-cut-in-2025

Two top outcomes by volume are the extremes: <50bn and >250bn. which is... not typically what you see in markets.