🔮 Banned in Macau to Polymarket Whale

How an advantage player banned from Four Macau casinos built a million-dollar Polymarket bankroll

Under the handle RetardBoyBilly, this trader has compounded his casino winnings on Polymarket through a combination of smart bet selection, cultural knowledge, and disciplined position sizing. He spoke to The Oracle about his journey from 3 Card Poker to prediction markets.

This interview has been edited for length. All answers are his own.

How did you find Polymarket?

I always wanted to participate in political gambling. Actually in 2014, I was one of the earliest to predict that Donald Trump had a good chance of being the GOP nominee, and if he faced Clinton, he was likely to win. Even though I’m not American, I could see that the people who elected Obama were expecting big change, but nothing happened for eight years. So they were looking for someone quite different to run the country, so that meant either Bernie or Trump.

Back then the main site available was PredictIt, but they only allowed people in the US and Australia, so I never had a chance to bet. Then in the last election, when the Butler incident happened, I heard from Fox News that Trump's odds on Polymarket were skyrocketing to 70%, so I went to check the site out and saw it was exactly what I wanted in a prediction market, so I immediately started buying USDT from Binance. Yes, I didn't know the difference between USDT and USDC back then.

Were you trading stocks or betting on other things before Polymarket?

Back in 2017, I was on vacation in Macau and noticed that at the Sands, in 3-Card Poker, the dealer was doing very bad card handling. Some dealers would reveal one of their hole cards, so I started with 3 Card Poker advantage play and never looked back. Now I'm banned or somehow restricted in 4 out of the 6 casinos in Macau.

It sounds like you had a big bankroll before Polymarket. How much did you start with?

Initially I wanted to start with 1 million USDC, so I withdrew like 1 million HKD from my brokerage account each week or so, and ended up buying 1.36 million USDC as my initial fund. Because of my background as an advantage player in casinos and from poker, I calculated that my EV on Polymarket with a $2 million bankroll would be around $100k per month. That's why I started betting larger.

I also do stock and bond trading and options trading. Actually my biggest win last year was from options. The market was giving B Riley very high implied volatility, but because the owner had a $7 buyout offer out, and the company wasn't likely to go under before the 2026 Baby Bonds matured, I thought the price would likely be stable between $5-7 for a while. So I shorted both calls and puts, a short straddle. I think I was betting against some investment bank on those options. Luckily I won a few million bucks.

What's your trading philosophy on Polymarket?

I just buy on the side which I think will ultimately be the winning side. If I don't have an opinion, and it has very high rewards, I put a small bet in. If not, I just ignore that market. I don't really trade that much. I buy and hold. To make sure I don't have an oversized position in one market, if I have more than I want, I just put a limit sell order at a higher price.

But the biggest thing that I think is different about me is that I’m not looking to make the longshot 100X bets. I am looking for things where I can make a few percent at low risk and compound my bankroll. I target 50-100% gains yearly, this is much better than the stock market, and you don’t need to make any crazy longshot wins.

How do you approach position sizing? Kelly criteria?

I personally think Kelly is bullshit. You have like a 10% risk of ruin in a casino game. That's bullshit. What if you're very unlucky and lose? You start working again and build up your portfolio. I'm more conservative, more like Buffett: you just don't lose. You should never have a risk of being bankrupt.

About sizing: I buy more if I'm more confident. Unless I'm like 100% or 99.99% sure I'm winning, I would not bet more than $100k in one market. If you know you'll lose, you always sell no matter what price.

Walk me through your biggest winning trades.

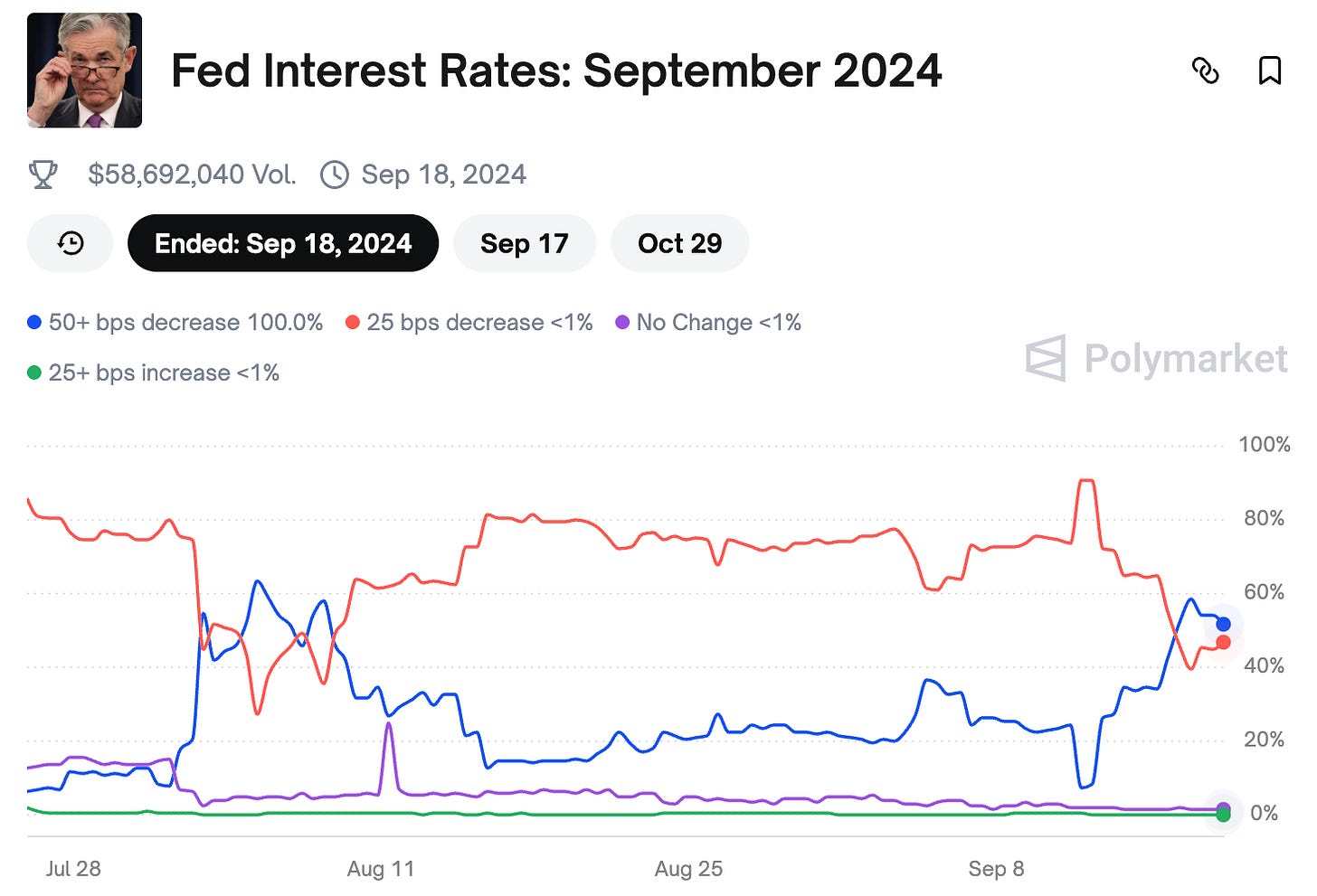

I think my biggest winning trades are probably the Fed funds trades, because I win almost each month. I lost my first bet though. I'm just very familiar with that market, and Powell seems very clear on what he wants to do. I think my only wrong Fed funds prediction over the last 10 years was the September 2024 meeting.

Fed funds are very easy markets. If you follow CNBC, you'd notice that people like Steve Liesman know for certain what the Fed decision will be 2-3 weeks before the event date, because Powell gives the market very clear signals. If the CME FedWatch interest rate tool is going in the wrong direction, Fed officials and Powell come out and say things to make sure the market is on the right track.

What went wrong with your biggest losing trades?

When I started, I lost a few big trades. One was losing to aenews on NASA hottest month markets. I didn't know what data NASA was using and was relying on Copernicus data.

And on Fed funds, I didn't know that Powell was a closet Democrat. He intentionally skipped the July 2024 meeting and cut 50 basis points in September to make the inflation data look better before the election. It would likely make early 2025 inflation data worse, but that was after the election. I think that gave the incumbent party maybe 0.5-1% more votes. That was the only time in the last decade I was wrong on what the Fed would do.

You're heavy on Xi staying in power. What's your edge there?

China markets are very easy for me compared to foreigners, as I am Chinese. I understand how Chinese politics work.

I'll give you an example: for Trump's inauguration, he invited Xi to come, and a lot of people bet on Xi coming. But if you understand China’s politics, you know he would never go. You'd know that Han Zheng would be the one going. Why? Because ever since 2012 when Xi came to power, he lets the vice president go to those ceremonies. For Queen Elizabeth II's funeral, it was Han Zheng who went. So even when the market was created, I knew with 95%+ certainty that Han would be the one going. Like 20-30% of Chinese people would know that, but it would be very difficult for a non-Chinese person to know.

What about Xi's grip on power long-term?

After the sixth plenary session of the 18th CCP Central Committee, Xi's power became very stable. He managed to change the constitution in his first term, so he can literally be like Mao and stay in power for life. The only people spreading rumors about Xi being out of power are from Falun Gong media like Epoch Times. If you dig deep, you'd know that 80% of Chinese independent media outside mainland China are actually linked to Falun Gong, and they spread lies day in and day out.

Unless Xi has very severe health issues, like he's dead or paralyzed, there's like zero chance he steps down before the 21st National Congress CCP meeting [in 2027].

How do you see US-China relations and the Taiwan situation playing out?

Taiwan is quite difficult to analyze. It's pretty clear that if Russia hadn't done such a bad job in Ukraine, Xi might have already invaded Taiwan after the 2024 Republic of China election, and of course before Trump was elected a second time. I use the term ROC because as a Chinese, I want the unity of the country. Either PRC or ROC, I don't care, as long as it's China.

Now Xi might want to wait until Trump's out to do his thing, but he's old now and his health isn't that good. If he needs to invade, he needs to do it fast. But in the Chinese military there are a lot of people feigning compliance, so it would be difficult to actually attack. Xi wants his legacy to be better than Mao in CCP history, and the only thing that can lead to that is successfully taking Taiwan back.

Tell me about your climate betting strategy, particularly the 2025 hottest year trade.

2023 was the hottest year, and 2024 was also the hottest, both higher than previous years by a lot. It's very difficult from a math or statistics point of view to make it three in a row. Yes, there's a possibility, but it would be less than 10% of it happening. So at 60-70% price, it's clearly a +EV buy.

You can always sell at around 90% if it rises, and if 2025 is just too hot and I lose, I can still likely sell at 50% if I sell fast enough. That trade is clearly +EV. And also, aenews is pro-Democrat and always buys "yes" on hottest no matter what.

Do you use any bots or automated tools?

Currently I have a custom page being built by Betmoar for me, but it's only for placing orders faster on reward markets. I don't use any bots or automation tools. I tell a lot of people I don't use bots, but people don't seem to believe me.

Who do you consider the sharpest traders to watch?

I think 50p and Domah are very good, and aenews is also very sharp. As I mentioned, I lost to him at the beginning of my journey. I think twice before I bet against him now. Car is also very smart—he's very good at reacting to news events, and he seems to be becoming more decent nowadays because he won more money.

Final tips for new traders?

When people ask me how to become a good stock trader, advantage player, poker player, or even Amazon seller, yes, I was a full-time Amazon seller years ago. I always ask them one thing: What special talent, source, or skills do you have that others don't have, so you can be better than other people?

If you want to be successful in one area, you need to be better than at least 95% of people. A lot of people say "I think I can do it because I'm determined and work hard." That's not good enough. You need to know what your special advantage is that average competitors don't have. If you can't clearly state what your special advantage is, then it's likely you're not good enough, and I'd suggest you live a normal life. You need to understand that 95%+ of people just live an ordinary life.

So what’s your edge? Before you said you try to pick the winning side. Doesn’t everyone do that?

My edge is more mental than anything. I don’t like to gamble even though I’m gambling every day. Most traders on Polymarket are over emotional. They chase huge longshots. Or they lose money and go on tilt to try to make it back. I don’t have such feelings.

Disclaimer

Nothing in The Oracle is financial, investment, legal or any other type of professional advice. Anything provided in any newsletter is for informational purposes only and is not meant to be an endorsement of any type of activity or any particular market or product. Terms of Service on polymarket.com prohibit US persons and persons from certain other jurisdictions from using Polymarket to trade, although data and information is viewable globally.