🔮An options degen looks at TSLA earnings polymarkets

Using Polymarket + Unusual Whales to trade Wednesday’s TSLA earnings

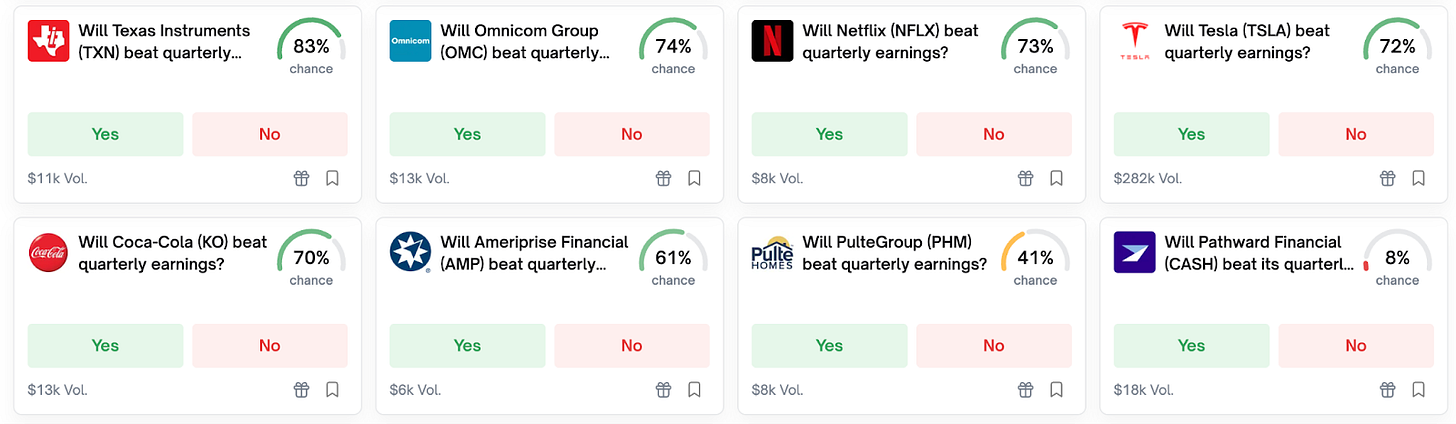

Last month, Polymarket launched markets on corporate earnings, which allow traders to forecast whether companies will beat Wall Street estimates.

Of all the earnings polymarkets so far, Tesla, which reports after market close on Wednesday, October 22, has seen the most volume and trading activity.

So we called up our friends Matt and Snorlax from Unusual Whales, an app that tracks options flow and trading activity, to help us understand how this information could help serious options traders.

What follows is a sample workflow you might use to work prediction market data into trade research around TSLA earnings this week.

Unusual Whales Dive

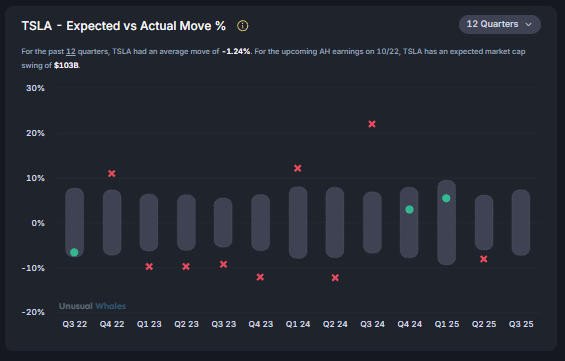

A good place to start is looking at how TSLA has traded historically a day after it reports:

This chart shows TSLA’s expected moves (based on options premiums) versus the actual move the day after earnings.

The expected move is shown as a gray bar. Green dots show when TSLA did not exceed the expected move. Red dots are when TSLA saw an outsized move, beyond what was expected by the options market.

In 9 of the last 12 quarters, shares of TSLA traded far higher (or lower!) than the options market had priced in. This suggests that shares of TSLA will see a large move, one way or another after earnings.

Next we take a look at the flow.

To my eyes, I don’t see a strong bullish or bearish lean in the pre-earnings flow. The TSLA net option premiums chart from the last seven sessions doesn’t give much of an indication as to the direction of the move.

So … will $TSLA Beat?

Next, we can check Polymarket to see the forecast for whether Tesla will beat earnings or not.

With prediction markets, you are trading a contract that pays out $1 if the event occurs, and expires worthless if it doesn’t. The cost of your contract is set by the market-based odds for the event occurring.

So you get a 37% ROI if you correctly predict that TSLA beats or a 249% ROI if you buy “No” and TSLA misses its non-GAAP earnings.

Does $TSLA Usually Beat?

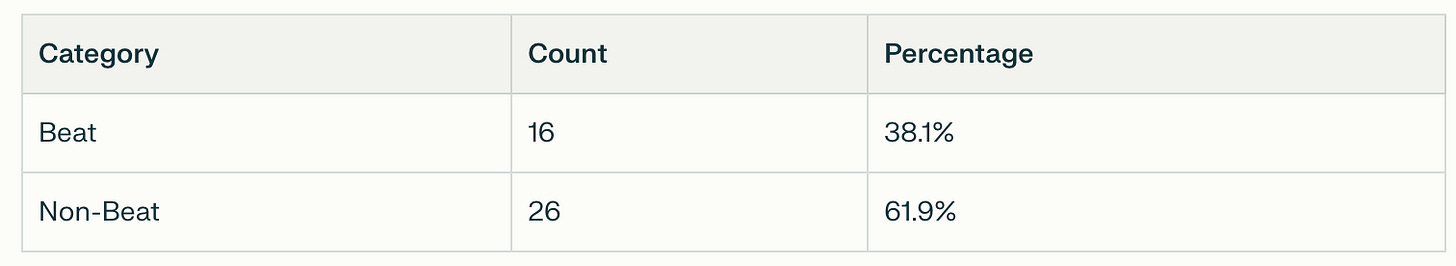

But we can get even more context on the Polymarket odds.

A query in Perplexity returns all of Tesla’s recent quarterly beats or misses.

Going back to 2014, TSLA has beaten non-GAAP earnings just over 38% of the time. Compare this to S&P companies, who tend to beat about 75% of the time (per FactSet research).

This is interesting for two reasons:

First, the polymarket is telling us that traders are expecting, with 73% odds, that TSLA will buck its trend and beat earnings.

Second, TSLA has dominated despite beating earnings at a much lower rate than other large companies.

It does this, not by always being especially profitable on its existing products, but by keeping us focused on the future.

Which brings us to:

Catalysts on the Horizon?

Here is another place where Polymarket is insanely useful.

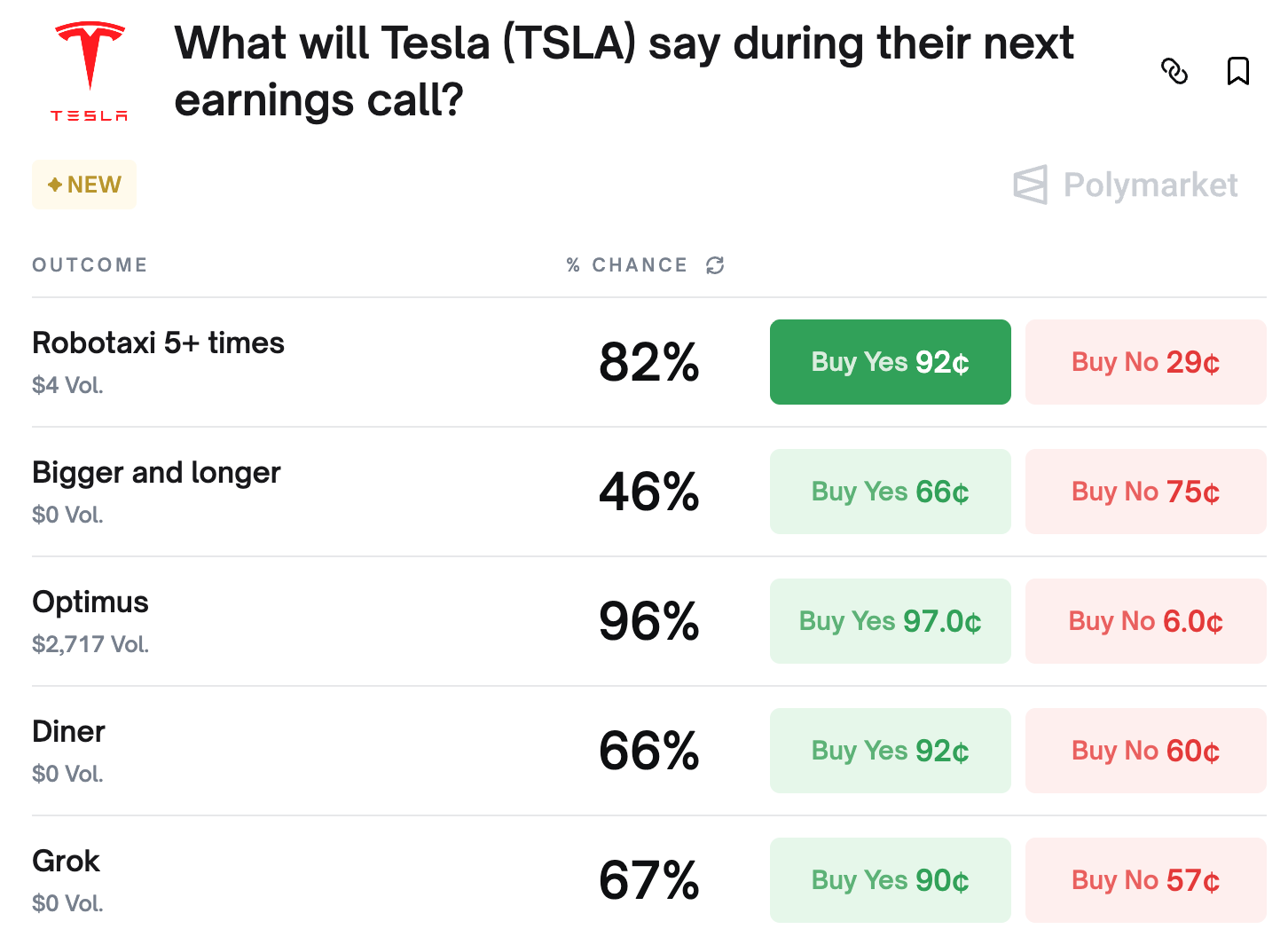

There is another type of market called a “mention market” which gives odds for terms that could be spoken on the Tesla earnings call.

This gives us clues as to what rabbits the market is expecting Elon to pull out of his hat on Wednesday afternoon.

As you can see, “Optimus” is the single most likely term to appear in the transcript.

TSLA bulls are expecting that Elon could roll out the third generation of its humanoid robot on the call or at least provide a substantive update.

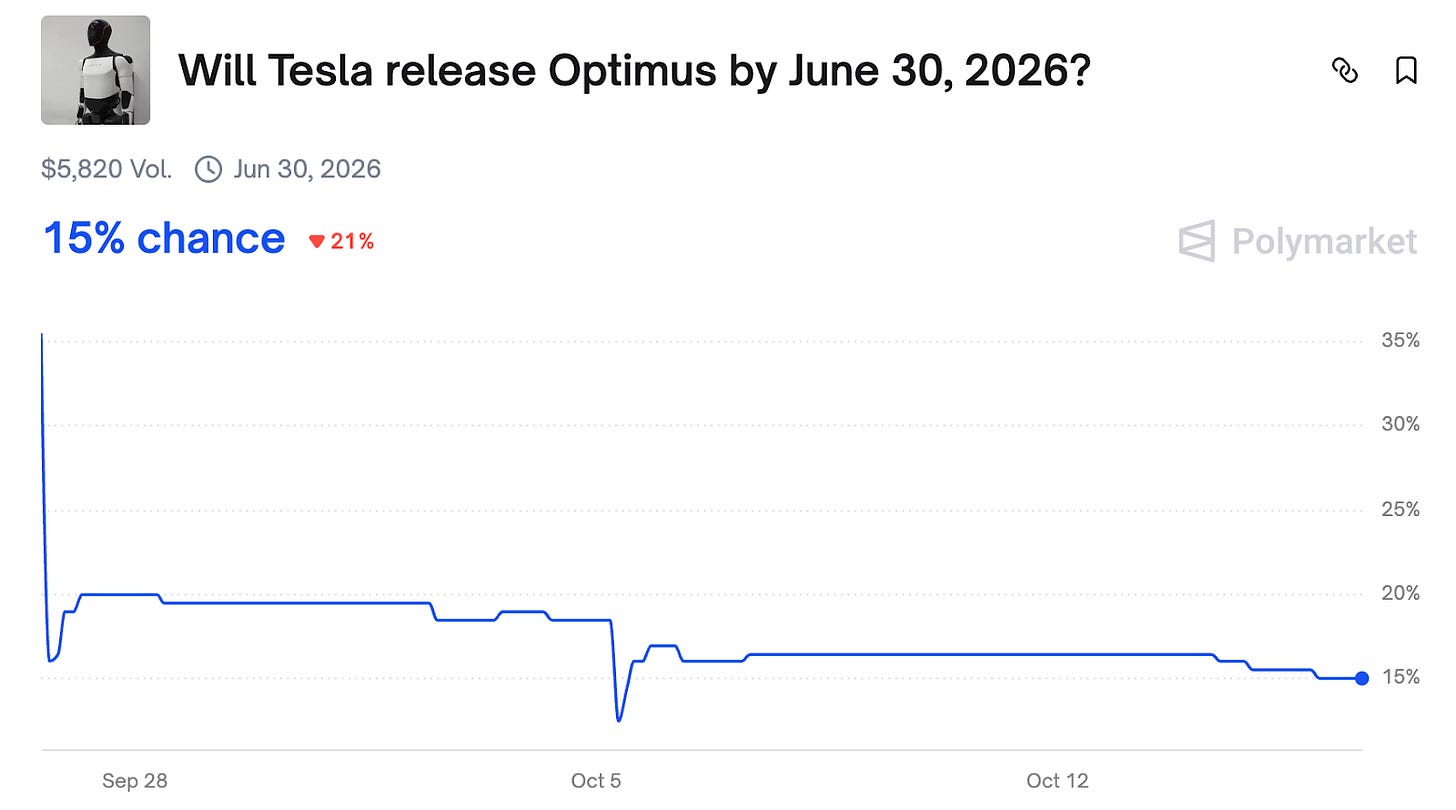

But, as you can see in another polymarket, there is a large gap between expectations and reality.

Polymarket traders think that Elon’s “production hell” (manufacturing delays that plague Tesla products) will push Optimus well into Q3 of next year or beyond.

Possible Trading Gameplans

Putting this all together, we know that:

TSLA historically moves more than expected on earnings (9 of last 12 quarters)

Polymarket says 73% chance of beat (vs 38% historical rate)

Recent options flow is mixed (no slam dunk bullish or bearish flow)

This leaves us with several possible plays:

Straddle. Buy offsetting calls and puts expiring after earnings. Since TSLA exceeded expected moves 9 of the last 12 quarters, you could buy volatility that’s been historically cheap.

Follow the Flow. If there’s no signal sometimes the best move is to just monitor the flow around market close, looking for outsized bets. I’d set a screen for large block orders (1,000+ contracts, Vol/OI > 2). Look for aggressive call buying at $450+.

Trade Polymarket Directly. Polymarket’s forecasts are historically 90%+ accurate in the hours before event resolution, and this only increases as you get closer to the market’s close and more money is traded. If you just want to make a clean trade on the earnings beat, Optimus production, or many other corporate events, there’s now a way to do it without worrying about greeks, Trump tariff headlines, or other outside factors that can mess up your beautiful stonk trades.

Thread the Needle: Or you could get even more creative. Armed with the knowledge that TSLA tends to miss its numbers, you could buy Poly “No” shares on earnings beat, to capture that 250% upside while also going long some cheap calls, betting that TSLA will miss earnings but Elon will hype up the market by announcing robot sex taxis or some other crazy headline.

Disclaimer

Nothing in The Oracle is financial, investment, legal or any other type of professional advice. All data and prices mentioned are time sensitive. Anything provided in any newsletter is for informational purposes only and is not meant to be an endorsement of any type of activity or any particular market or product. Terms of Service on polymarket.com prohibit US persons and persons from certain other jurisdictions from using Polymarket to trade, although data and information is viewable globally.

This was a great read. Please keep publishing more articles/analysis like this.

TSLA 🚀: 76.2% — recent positive divergences.

Last Bull% Signal: Oct 15 📊 P&L 1.8% — modest continuation potential.

📊 $TSLA #OptionsFlow #Sentiment #Positioning #Markets

Get full free access to our Bull% Framework — data-driven market insights 👇 🔗 https://reflectionsofreality.substack.com/subscribe